IRS CT 1 Fill Out Tax Template OnlineUS Legal Forms 2020

Understanding the IRS CT 1 Tax Form

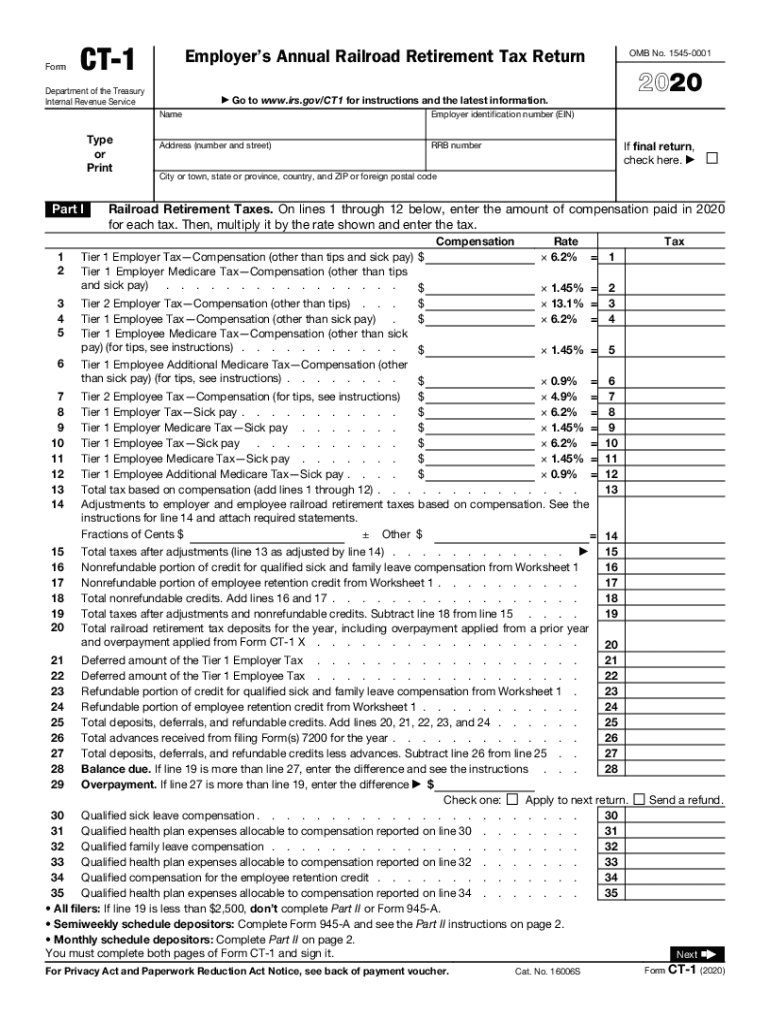

The IRS CT 1 tax form is essential for businesses and individuals who need to report specific tax information to the Internal Revenue Service. This form is primarily used for reporting certain types of income, deductions, and credits. Understanding its purpose and requirements is crucial for compliance with U.S. tax laws. The CT 1 form can be accessed online, allowing users to fill it out digitally, which streamlines the process and enhances accuracy.

Steps to Complete the IRS CT 1 Tax Form Online

Filling out the IRS CT 1 tax form online involves several straightforward steps. First, access the digital version of the form on a reliable platform. Begin by entering your personal information, including your name, address, and Social Security number. Next, accurately report your income, deductions, and any applicable credits. Review your entries for accuracy before submitting the form. Utilizing an electronic signature solution can further ensure that your submission is legally binding and secure.

Legal Use of the IRS CT 1 Tax Form

The IRS CT 1 tax form is legally recognized when filled out correctly and submitted on time. Compliance with eSignature laws is vital to ensure that the form holds legal weight. By using a trusted electronic signature platform, users can be confident that their submissions meet the necessary legal standards. This is particularly important for businesses that must adhere to strict regulatory requirements.

Filing Deadlines for the IRS CT 1 Tax Form

Timely filing of the IRS CT 1 tax form is crucial to avoid penalties. The deadline for submission typically aligns with the annual tax filing date, which is usually April fifteenth for most taxpayers. However, specific circumstances may allow for extensions. It is important to stay informed about any changes in deadlines to ensure compliance and avoid potential fines.

Required Documents for the IRS CT 1 Tax Form

When preparing to fill out the IRS CT 1 tax form, certain documents are necessary to ensure accurate reporting. These may include income statements, previous tax returns, and documentation for any deductions or credits claimed. Having these documents readily available can facilitate a smoother and more efficient filing process.

Form Submission Methods for the IRS CT 1 Tax Form

The IRS CT 1 tax form can be submitted through various methods, including online, by mail, or in person at designated IRS offices. Online submission is often the most efficient option, as it allows for immediate processing and confirmation. For those who prefer traditional methods, mailing the form requires careful attention to ensure it is sent to the correct address and postmarked by the deadline.

Penalties for Non-Compliance with the IRS CT 1 Tax Form

Failure to file the IRS CT 1 tax form on time or inaccuracies in reporting can result in significant penalties. These may include fines, interest on unpaid taxes, and potential legal repercussions. It is essential to understand the importance of compliance and take proactive measures to ensure that all submissions are accurate and timely.

Quick guide on how to complete irs ct 1 2019 fill out tax template onlineus legal forms

Effortlessly prepare IRS CT 1 Fill Out Tax Template OnlineUS Legal Forms on any device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an excellent eco-friendly alternative to conventional printed and signed documents, allowing you to locate the necessary form and securely keep it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents promptly without holdups. Manage IRS CT 1 Fill Out Tax Template OnlineUS Legal Forms on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to edit and eSign IRS CT 1 Fill Out Tax Template OnlineUS Legal Forms with ease

- Obtain IRS CT 1 Fill Out Tax Template OnlineUS Legal Forms and click Get Form to begin.

- Make use of the tools provided to complete your form.

- Highlight pertinent sections of your documents or mask sensitive information with tools that airSlate SignNow supplies explicitly for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal significance as a traditional wet ink signature.

- Review the information and click the Done button to save your changes.

- Choose your preferred method for delivering your form: via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate generating new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign IRS CT 1 Fill Out Tax Template OnlineUS Legal Forms and guarantee effective communication at any phase of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irs ct 1 2019 fill out tax template onlineus legal forms

Create this form in 5 minutes!

How to create an eSignature for the irs ct 1 2019 fill out tax template onlineus legal forms

How to make an eSignature for your PDF file in the online mode

How to make an eSignature for your PDF file in Chrome

The way to make an eSignature for putting it on PDFs in Gmail

The way to create an electronic signature straight from your smartphone

The best way to make an electronic signature for a PDF file on iOS devices

The way to create an electronic signature for a PDF document on Android

People also ask

-

What is airSlate SignNow and how does it relate to ct 1?

airSlate SignNow is an innovative platform designed to streamline the process of sending and eSigning documents. The term 'ct 1' may refer to a specific feature or integration within the service that enhances its functionality for businesses looking to simplify their document management.

-

How much does airSlate SignNow cost when using ct 1?

Pricing for airSlate SignNow varies based on the plan selected, with options available to suit different budgets. Utilizing features allowed by ct 1, businesses can achieve a cost-effective solution for eSigning, ensuring they only pay for what they need.

-

What features does airSlate SignNow offer with ct 1 integration?

With the ct 1 integration, airSlate SignNow provides a robust set of features including document tracking, customizable templates, and automated workflows. This enhances user experience by allowing organizations to manage their signing processes more efficiently.

-

Can I integrate airSlate SignNow with other tools using ct 1?

Yes, airSlate SignNow supports integration with a variety of other tools and platforms. The ct 1 feature specifically allows for seamless connectivity with popular applications, making it easier to incorporate eSigning into your existing business processes.

-

What are the benefits of using airSlate SignNow with ct 1?

The benefits of using airSlate SignNow with ct 1 include increased efficiency, reduced turnaround time for document signing, and enhanced team collaboration. Additionally, businesses gain a competitive edge by leveraging advanced technology for document management.

-

Is airSlate SignNow secure when using ct 1?

Yes, airSlate SignNow prioritizes security, employing advanced encryption and compliance protocols. When using ct 1, you can be assured that your documents are protected, safeguarding sensitive information during the signing process.

-

How does airSlate SignNow support mobile signing with ct 1?

airSlate SignNow is designed for mobile compatibility, allowing users to sign documents on the go with ct 1 features. This mobile functionality is essential for businesses that require flexibility and quick access to documents anytime, anywhere.

Get more for IRS CT 1 Fill Out Tax Template OnlineUS Legal Forms

- Vodafone change of ownership request form

- Fusd declaration form

- Application for direct transfer of an austrian pension to abroad form

- The sun understanding main ideas form

- Flower parts amp pollination worksheet form

- Young persons risk assessment form

- Esic form 7

- Untitled midwest operating engineers fringe benefit funds form

Find out other IRS CT 1 Fill Out Tax Template OnlineUS Legal Forms

- Help Me With Electronic signature Montana Police Word

- How To Electronic signature Tennessee Real Estate Document

- How Do I Electronic signature Utah Real Estate Form

- How To Electronic signature Utah Real Estate PPT

- How Can I Electronic signature Virginia Real Estate PPT

- How Can I Electronic signature Massachusetts Sports Presentation

- How To Electronic signature Colorado Courts PDF

- How To Electronic signature Nebraska Sports Form

- How To Electronic signature Colorado Courts Word

- How To Electronic signature Colorado Courts Form

- How To Electronic signature Colorado Courts Presentation

- Can I Electronic signature Connecticut Courts PPT

- Can I Electronic signature Delaware Courts Document

- How Do I Electronic signature Illinois Courts Document

- How To Electronic signature Missouri Courts Word

- How Can I Electronic signature New Jersey Courts Document

- How Can I Electronic signature New Jersey Courts Document

- Can I Electronic signature Oregon Sports Form

- How To Electronic signature New York Courts Document

- How Can I Electronic signature Oklahoma Courts PDF