Form CT 1 IRS 2022

What is the Form CT 1 IRS

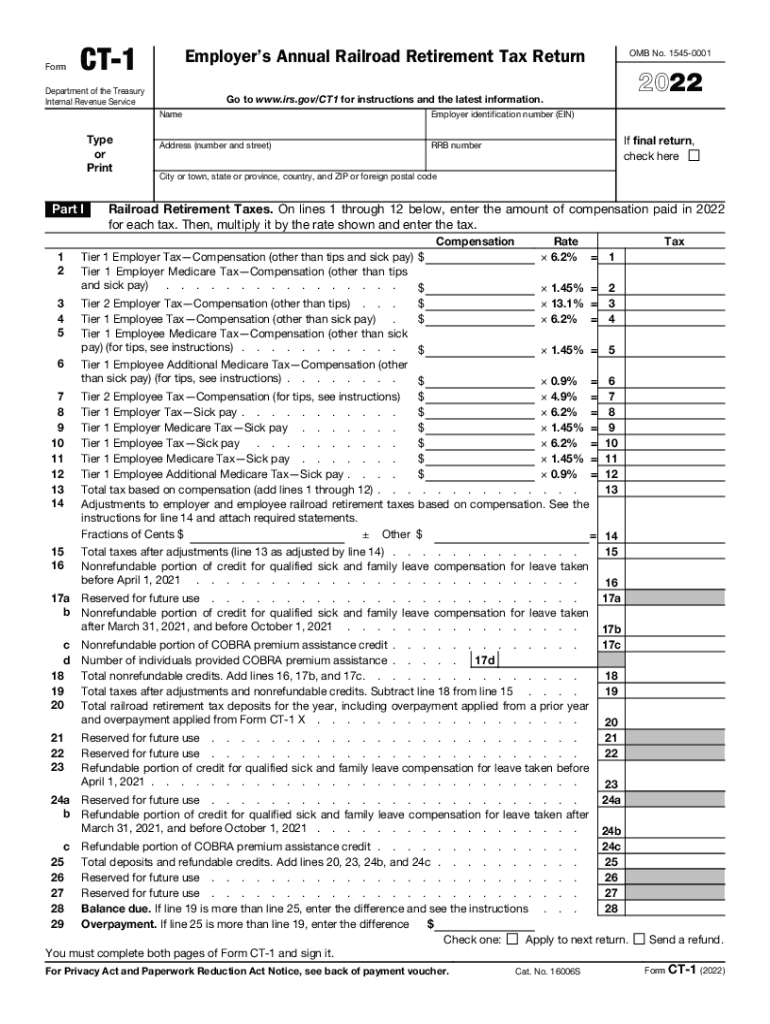

The Form CT 1 is an essential tax document used by employers in the United States to report and pay the railroad retirement taxes. This form is specifically designed for employers who have employees working in the railroad industry. The IRS requires this form to ensure compliance with federal tax laws related to railroad retirement benefits. The CT 1 form includes information about the employer, the number of employees, and the total wages subject to railroad retirement taxes.

How to use the Form CT 1 IRS

Using the Form CT 1 involves several steps to ensure accurate reporting and compliance. Employers must first gather necessary information about their employees and wages. Once the data is compiled, the employer fills out the form, ensuring all sections are completed accurately. After completing the form, it must be submitted to the IRS, along with any required payments. It is crucial for employers to keep a copy of the submitted form for their records, as it serves as proof of compliance with tax obligations.

Steps to complete the Form CT 1 IRS

Completing the Form CT 1 involves a systematic approach:

- Gather all employee information, including names, Social Security numbers, and total wages paid.

- Fill out the employer's details, including the employer identification number (EIN).

- Report the total taxable wages and calculate the railroad retirement taxes owed.

- Review the completed form for accuracy and ensure all required fields are filled.

- Submit the form to the IRS by the specified deadline, along with any payments due.

Legal use of the Form CT 1 IRS

The Form CT 1 is legally binding when completed and submitted according to IRS regulations. Employers must adhere to the guidelines set forth by the IRS to ensure that the form is valid. This includes accurate reporting of employee wages and timely submission of the form. Failure to comply with these regulations can result in penalties and interest on unpaid taxes. Therefore, understanding the legal implications of the CT 1 form is essential for employers in the railroad industry.

Filing Deadlines / Important Dates

Filing deadlines for the Form CT 1 are critical for compliance. Employers must submit the form annually, typically by the end of January for the previous tax year. It is important to stay informed about any changes in deadlines, as the IRS may adjust them. Additionally, employers should be aware of quarterly payment deadlines for railroad retirement taxes to avoid penalties.

Penalties for Non-Compliance

Non-compliance with the requirements of the Form CT 1 can lead to significant penalties. Employers may face fines for late submissions, inaccuracies, or failure to file altogether. The IRS may impose interest on unpaid taxes, further increasing the financial burden on employers. Understanding these penalties can motivate timely and accurate filing, ensuring that employers remain compliant with federal tax laws.

Quick guide on how to complete 2022 form ct 1 irs

Prepare Form CT 1 IRS effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly and without delays. Manage Form CT 1 IRS on any platform using airSlate SignNow Android or iOS applications and streamline any document-related task today.

How to modify and electronically sign Form CT 1 IRS with ease

- Locate Form CT 1 IRS and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight pertinent sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which only takes seconds and has the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to finalize your changes.

- Choose your preferred method for sending your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate the worry of lost or misfiled documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs within a few clicks from any device you prefer. Modify and electronically sign Form CT 1 IRS while ensuring effective communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2022 form ct 1 irs

Create this form in 5 minutes!

How to create an eSignature for the 2022 form ct 1 irs

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is ct 1 and how does it work with airSlate SignNow?

ct 1 is a critical component of airSlate SignNow that facilitates seamless document signing and management. It allows users to create, send, and track documents effortlessly, ensuring a speedy and efficient workflow. By leveraging ct 1, businesses can enhance their document processes while maintaining security and compliance.

-

How much does ct 1 cost with airSlate SignNow?

The pricing for ct 1 within airSlate SignNow varies based on the plan you choose. Customers can opt for monthly or annual subscriptions, with discounts available for annual payments. It's essential to evaluate your business needs to select the most cost-effective solution.

-

What features are included in the ct 1 package?

The ct 1 package offers various features such as customizable document templates, real-time tracking of signatures, and secure cloud storage. These functionalities empower users to manage their document workflows efficiently. Additionally, ct 1 supports multiple file formats for versatile document handling.

-

Can I integrate ct 1 with other applications?

Yes, airSlate SignNow and ct 1 offer integrations with numerous applications like Google Workspace, Salesforce, and Microsoft Teams. This compatibility enhances your existing workflows, allowing for seamless collaboration within your team and across platforms. Integration with ct 1 simplifies the document handling process signNowly.

-

What are the benefits of using ct 1 for eSigning documents?

Using ct 1 for eSigning offers numerous benefits, including improved efficiency, reduced turnaround time, and enhanced security. Businesses can eliminate the hassles of paper-based signing, streamlining operations while keeping documents secure. With ct 1, you can confidently manage your document signing needs.

-

Is ct 1 suitable for small businesses?

Absolutely, ct 1 is an excellent solution for small businesses seeking cost-effective document management. Its user-friendly interface and flexible pricing plans make it accessible for various business sizes. AirSlate SignNow tailors its features to empower small businesses to thrive in their documentation processes.

-

How does ct 1 ensure the security of signed documents?

ct 1 prioritizes document security through advanced encryption and robust authentication measures. Document integrity is maintained with audit trails, ensuring that every signature is tracked and verified. This focus on security makes ct 1 a trustworthy choice for sensitive business documents.

Get more for Form CT 1 IRS

Find out other Form CT 1 IRS

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will

- Electronic signature Insurance Document Kentucky Myself

- Electronic signature Delaware High Tech Quitclaim Deed Online

- Electronic signature Maine Insurance Quitclaim Deed Later

- Electronic signature Louisiana Insurance LLC Operating Agreement Easy

- Electronic signature West Virginia Education Contract Safe

- Help Me With Electronic signature West Virginia Education Business Letter Template

- Electronic signature West Virginia Education Cease And Desist Letter Easy

- Electronic signature Missouri Insurance Stock Certificate Free

- Electronic signature Idaho High Tech Profit And Loss Statement Computer

- How Do I Electronic signature Nevada Insurance Executive Summary Template

- Electronic signature Wisconsin Education POA Free

- Electronic signature Wyoming Education Moving Checklist Secure