Form 1095 a Health Insurance Marketplace Statement 2022-2026

What is the Form 1095 A Health Insurance Marketplace Statement

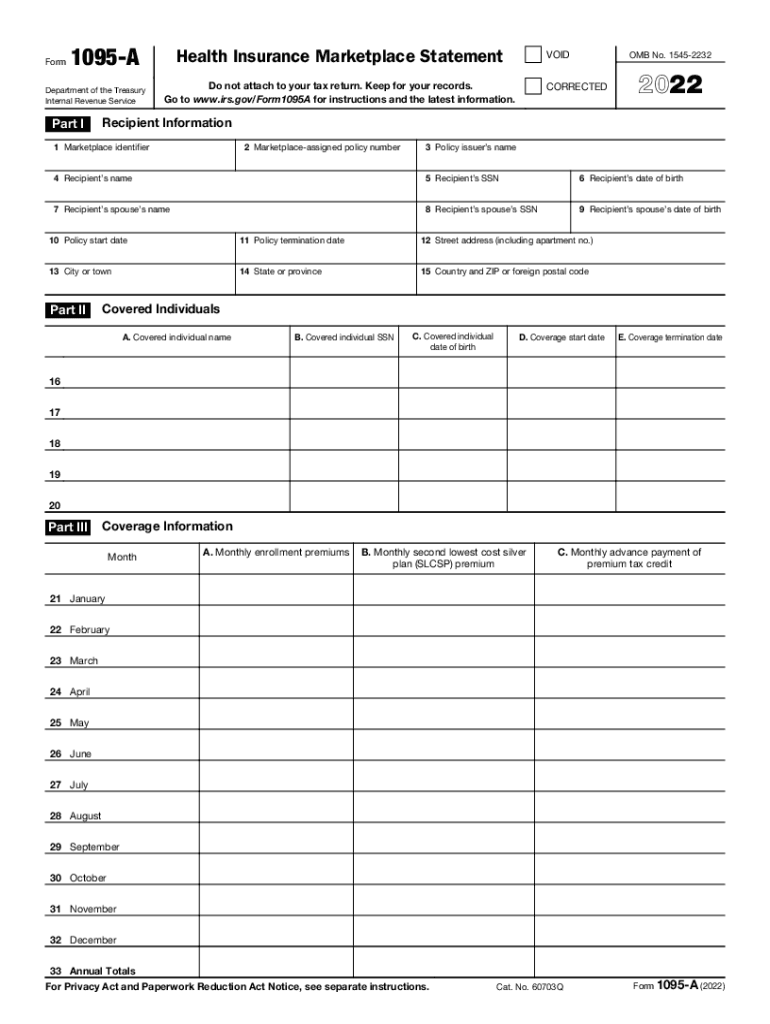

The Form 1095 A is a crucial document provided to individuals who enroll in a health insurance plan through the Health Insurance Marketplace. This form contains essential information about the coverage you received, including the months you were enrolled and the premium amounts. It serves as proof of health insurance coverage, which is necessary for filing your federal tax return. The information on the 1095 A helps determine eligibility for premium tax credits and other benefits under the Affordable Care Act.

How to use the Form 1095 A Health Insurance Marketplace Statement

Using the Form 1095 A is straightforward. First, ensure you receive the form from the Health Insurance Marketplace by the end of January each year. Once you have it, review the details carefully to confirm that the information is accurate. You will need to use the data from this form to complete your federal tax return, specifically when filling out Form 8962, which calculates your premium tax credit. If there are discrepancies, contact the Marketplace for corrections before filing your taxes.

Steps to complete the Form 1095 A Health Insurance Marketplace Statement

Completing the Form 1095 A involves several steps:

- Gather your personal information, including Social Security numbers for all covered individuals.

- Access the Form 1095 A from the Health Insurance Marketplace, either online or via mail.

- Review the coverage months and premium amounts listed on the form.

- Use the information to fill out Form 8962 for your tax return.

- Keep a copy of the 1095 A for your records, as you may need it for future reference.

Legal use of the Form 1095 A Health Insurance Marketplace Statement

The Form 1095 A is legally recognized as proof of health insurance coverage under the Affordable Care Act. It is essential for fulfilling tax obligations and ensuring compliance with health insurance mandates. The IRS requires taxpayers to report their health coverage status, and the 1095 A provides the necessary documentation to support claims for premium tax credits. Failure to report this information accurately may result in penalties or the loss of tax credits.

Key elements of the Form 1095 A Health Insurance Marketplace Statement

Several key elements are included in the Form 1095 A that are important for taxpayers:

- Monthly premium amounts: Indicates the total premium for each month of coverage.

- Coverage start and end dates: Shows the duration of your health insurance coverage.

- Policy number: Identifies your specific health insurance policy.

- Individuals covered: Lists the names and Social Security numbers of all covered individuals.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines associated with the Form 1095 A. The Health Insurance Marketplace typically issues the form by January 31 each year. Taxpayers must include the information from the 1095 A when filing their federal tax returns, which are generally due by April 15. If you need additional time, you may file for an extension, but ensure you still report your coverage accurately to avoid penalties.

Quick guide on how to complete 2022 form 1095 a health insurance marketplace statement

Complete Form 1095 A Health Insurance Marketplace Statement effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents promptly and without issues. Handle Form 1095 A Health Insurance Marketplace Statement on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

The easiest way to modify and electronically sign Form 1095 A Health Insurance Marketplace Statement effortlessly

- Obtain Form 1095 A Health Insurance Marketplace Statement and click Get Form to begin.

- Make use of the tools we provide to finalize your document.

- Emphasize relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your electronic signature using the Sign feature, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Put aside concerns about lost or misplaced documents, time-consuming form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device of your choice. Edit and electronically sign Form 1095 A Health Insurance Marketplace Statement and ensure effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2022 form 1095 a health insurance marketplace statement

Create this form in 5 minutes!

People also ask

-

What is the 1095 a 2022 form and why do I need it?

The 1095 a 2022 form is a tax document that provides information about the health insurance coverage provided to individuals. It is essential for filing taxes as it helps determine your eligibility for premium tax credits and your status under the Affordable Care Act.

-

How can airSlate SignNow assist with the 1095 a 2022 form?

airSlate SignNow streamlines the process of sending and eSigning the 1095 a 2022 form. With our user-friendly platform, you can easily send this document for signatures, ensuring compliance and accuracy while saving time and resources.

-

Is there a cost associated with using airSlate SignNow for the 1095 a 2022 form?

airSlate SignNow offers competitive pricing plans that cater to businesses of all sizes. By using our platform for the 1095 a 2022 form, you can benefit from a cost-effective solution that simplifies document management and eSigning without hidden fees.

-

What features does airSlate SignNow provide for managing the 1095 a 2022 form?

Some key features include customizable templates, automated workflows, and secure document storage. These features not only help in managing the 1095 a 2022 form efficiently but also enhance collaboration and track the status of document signatures.

-

Can I integrate airSlate SignNow with other software for processing the 1095 a 2022 form?

Yes, airSlate SignNow offers seamless integration with various software like CRM systems and accounting tools. This integration simplifies the process of managing the 1095 a 2022 form, allowing you to streamline your workflow across different applications.

-

What benefits will I gain by using airSlate SignNow for my 1095 a 2022 form?

Using airSlate SignNow for your 1095 a 2022 form provides numerous benefits, including reduced paperwork, increased efficiency, and enhanced security for sensitive data. Additionally, you can easily track changes and access your documents from anywhere.

-

Is airSlate SignNow secure for handling the 1095 a 2022 form?

Absolutely! airSlate SignNow employs industry-leading security measures to protect your data, including encryption and secure cloud storage. You can trust us to safeguard the information on your 1095 a 2022 form and ensure compliance with regulations.

Get more for Form 1095 A Health Insurance Marketplace Statement

- Criminal sheet form

- Oklahoma domestic cover sheet form

- Oklahoma probate form

- Order income child support form

- Instructions to complete order notice to withhold income for child support oklahoma form

- Oklahoma contractors release and waiver of lien form

- Oklahoma state lien law summary levyvon beck form

- Quitclaim deed from individual to corporation oklahoma form

Find out other Form 1095 A Health Insurance Marketplace Statement

- Sign Idaho Basic rental agreement or residential lease Online

- How To Sign Oregon Business agreements

- Sign Colorado Generic lease agreement Safe

- How Can I Sign Vermont Credit agreement

- Sign New York Generic lease agreement Myself

- How Can I Sign Utah House rent agreement format

- Sign Alabama House rental lease agreement Online

- Sign Arkansas House rental lease agreement Free

- Sign Alaska Land lease agreement Computer

- How Do I Sign Texas Land lease agreement

- Sign Vermont Land lease agreement Free

- Sign Texas House rental lease Now

- How Can I Sign Arizona Lease agreement contract

- Help Me With Sign New Hampshire lease agreement

- How To Sign Kentucky Lease agreement form

- Can I Sign Michigan Lease agreement sample

- How Do I Sign Oregon Lease agreement sample

- How Can I Sign Oregon Lease agreement sample

- Can I Sign Oregon Lease agreement sample

- How To Sign West Virginia Lease agreement contract