1095 a Form 2014

What is the 1095 A Form

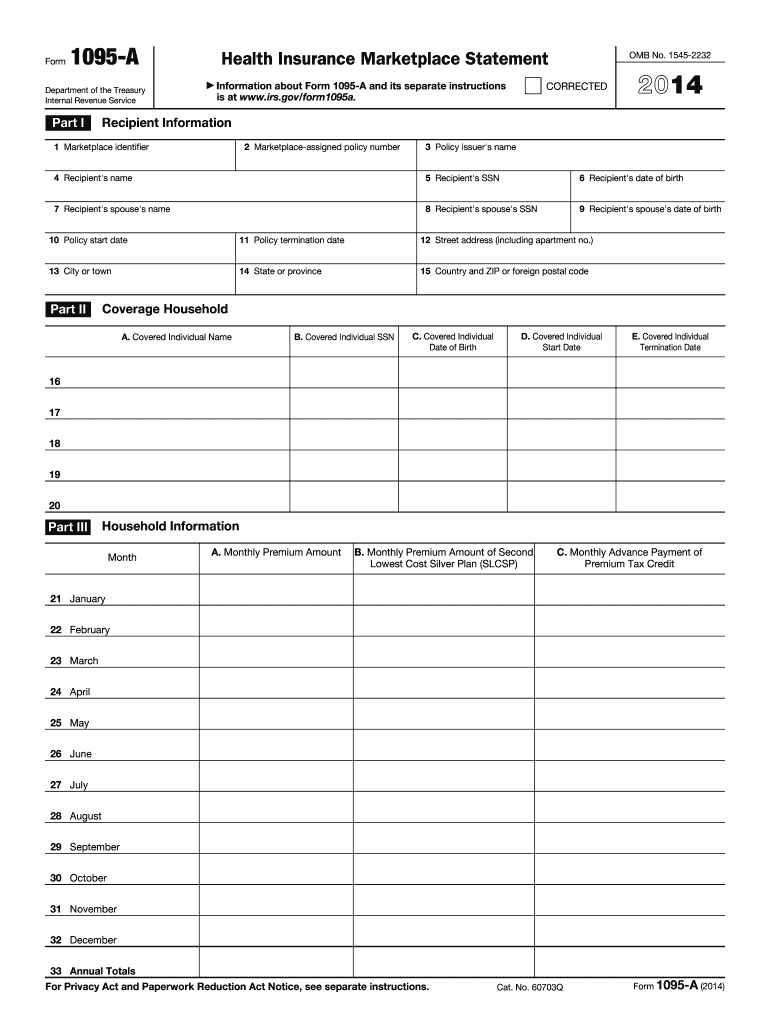

The 1095 A form, also known as the Health Insurance Marketplace Statement, is a tax document provided by the Health Insurance Marketplace. It is crucial for individuals who have enrolled in a health plan through the Marketplace. This form includes essential information about the coverage, such as the months of coverage, the premium amount, and the number of individuals covered. It is necessary for completing the federal income tax return, as it helps determine eligibility for premium tax credits and the amount of any tax penalties for not having health coverage.

How to use the 1095 A Form

To effectively use the 1095 A form, taxpayers should first ensure they have received it from the Health Insurance Marketplace. The form must be reviewed carefully for accuracy, as any discrepancies can affect tax filings. Taxpayers will need to use the information from the 1095 A when filling out IRS Form 8962, which calculates the premium tax credit. This credit can help lower the cost of health insurance premiums. It is important to keep the 1095 A form with tax records for at least three years, as it may be required for future reference or audits.

Steps to complete the 1095 A Form

Completing the 1095 A form involves several key steps. First, gather all necessary information, including personal details and health coverage data. Next, accurately fill out the form by entering the required details, such as the names of covered individuals and the coverage months. After completing the form, review it for any errors or omissions. Finally, submit the form along with your tax return to the IRS. If using tax software, the 1095 A information can often be entered directly into the program, streamlining the process.

Legal use of the 1095 A Form

The 1095 A form is legally required for individuals who have health coverage through the Marketplace. It serves as proof of insurance and is necessary for compliance with federal health care laws. Failure to provide accurate information from the 1095 A can result in penalties or delays in processing tax returns. It is essential to ensure that the form is completed correctly and submitted on time to avoid any legal issues related to health insurance coverage.

Filing Deadlines / Important Dates

Filing deadlines for the 1095 A form align with the general tax filing schedule. Typically, taxpayers must submit their federal income tax returns by April fifteenth each year. However, if additional time is needed, an extension can be requested, allowing for a six-month extension to file. It is crucial to keep in mind that any taxes owed must still be paid by the original deadline to avoid penalties and interest. Additionally, the Health Insurance Marketplace usually sends out the 1095 A forms by the end of January, allowing taxpayers time to prepare their tax returns.

Who Issues the Form

The 1095 A form is issued by the Health Insurance Marketplace, which is operated by either the federal government or individual states. Taxpayers who enrolled in a health plan through the Marketplace will receive this form directly from the Marketplace. It is important for individuals to ensure that they have the correct form, as there are different versions for various types of coverage. If a taxpayer does not receive their 1095 A form, they should contact the Marketplace for assistance.

Quick guide on how to complete 2014 1095 a form

Effortlessly Prepare 1095 A Form on Any Device

Online document management has become increasingly popular among businesses and individuals. It offers a fantastic eco-friendly substitute for traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, edit, and electronically sign your documents efficiently without delays. Manage 1095 A Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The Easiest Way to Edit and eSign 1095 A Form with Ease

- Find 1095 A Form and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information with the tools that airSlate SignNow specifically offers for this purpose.

- Generate your eSignature using the Sign feature, which takes seconds and has the same legal validity as a conventional wet ink signature.

- Verify all the details and then click on the Done button to save your changes.

- Choose how you would like to share your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow caters to your document management needs in just a few clicks from your preferred device. Modify and electronically sign 1095 A Form and guarantee effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2014 1095 a form

Create this form in 5 minutes!

How to create an eSignature for the 2014 1095 a form

How to generate an electronic signature for your PDF online

How to generate an electronic signature for your PDF in Google Chrome

The way to generate an electronic signature for signing PDFs in Gmail

How to generate an electronic signature from your smartphone

How to make an electronic signature for a PDF on iOS

How to generate an electronic signature for a PDF file on Android

People also ask

-

What is the significance of the 2014 a 1095 form?

The 2014 a 1095 form is crucial for reporting health coverage under the Affordable Care Act. It provides essential information to both taxpayers and the IRS about the health insurance coverage individuals had during the year. Understanding this form can help you ensure compliance with health insurance requirements.

-

How can airSlate SignNow assist with the 2014 a 1095 process?

airSlate SignNow streamlines the process of managing the 2014 a 1095 documentation. Our platform allows you to easily send, sign, and store these essential forms electronically, ensuring that all parties have access to the necessary documentation quickly and efficiently. This saves time and reduces the hassle of paper-based processes.

-

What are the pricing options for using airSlate SignNow for 2014 a 1095 transactions?

AirSlate SignNow offers competitive pricing plans that cater to businesses of all sizes. Whether you're a small business or a large organization dealing with multiple 2014 a 1095 forms, our pricing is designed to be affordable and flexible. You can explore various plans to find the best fit for your needs.

-

Are there any features in airSlate SignNow specifically for handling 2014 a 1095 forms?

Yes, airSlate SignNow includes features tailored for the efficient handling of 2014 a 1095 forms. You can utilize customizable templates, secure eSigning capabilities, and automated reminders to ensure timely submission of these forms. This makes the entire process smoother and more organized.

-

Can airSlate SignNow integrate with other tools for managing 2014 a 1095 documents?

Absolutely! airSlate SignNow offers seamless integration with various third-party tools, making it easier to manage your 2014 a 1095 documents alongside other business applications. Whether you're using accounting software or HR systems, our platform ensures compatibility for your convenience.

-

What are the benefits of using airSlate SignNow for 2014 a 1095 document management?

Using airSlate SignNow for 2014 a 1095 document management offers signNow benefits like increased efficiency, enhanced security, and improved compliance. With our platform, you can quickly prepare and send forms while maintaining a secure audit trail and ensuring that all necessary data is accurately recorded.

-

Is airSlate SignNow secure for handling sensitive 2014 a 1095 information?

Yes, security is a top priority at airSlate SignNow. We employ robust encryption and security protocols to protect sensitive data, including 2014 a 1095 information. This ensures that your documents are safely stored and shared, giving you peace of mind during the eSigning process.

Get more for 1095 A Form

- State your reasons for not appearing in court on the day default judgment was given form

- 5113 1 312 in the district court of kansas judicial council kansasjudicialcouncil form

- Rev 072016 ksjc 1 329 in the district court of county kansasjudicialcouncil form

- 5113 185 in the district court of county kansas in the interest of name year of birth a male female case no form

- We care online kansas form

- Oath of court appointed special advocate kansasjudicialcouncil form

- Cdocuments and settingsnataliemy documentsksjc websitewebsite files 2008related linksstudies and reportsprevious judic form

- Cdocuments and settingsptulllocal settingstemporary internet filesolk2judicial performance reportwpd kansasjudicialcouncil

Find out other 1095 A Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors