1095a Form 2016

What is the 1095a Form

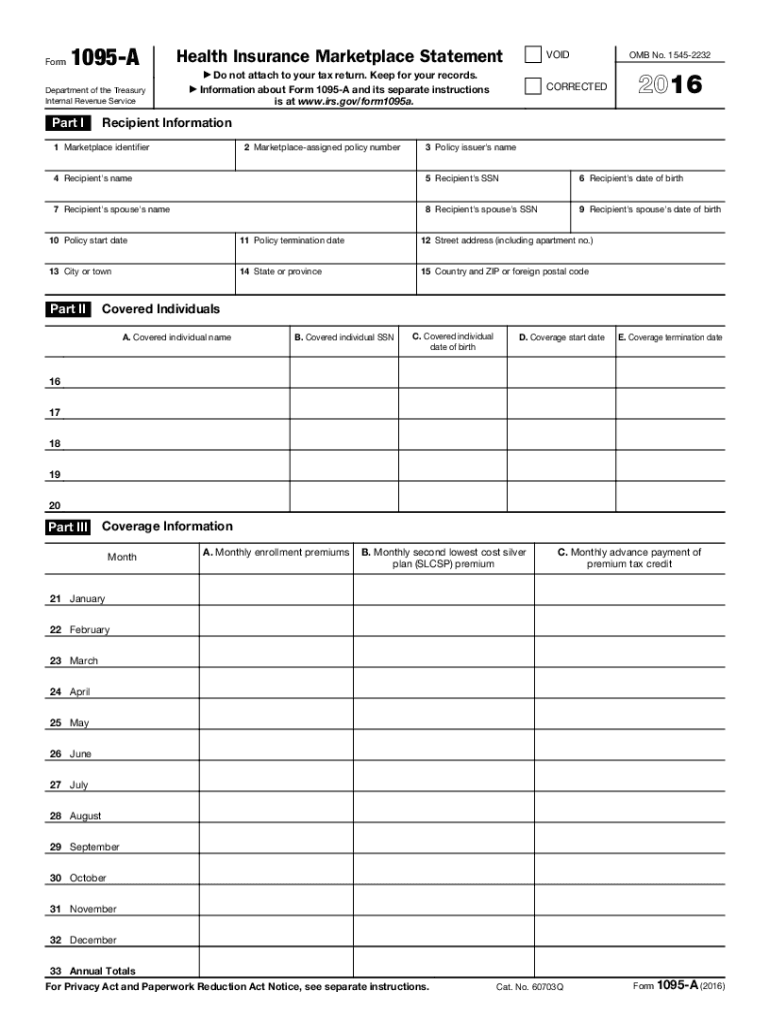

The 1095a form, officially known as Form 1095-A, Health Insurance Marketplace Statement, is a crucial document for individuals who have obtained health insurance coverage through the Health Insurance Marketplace. This form provides essential information about the coverage, including the months of coverage, the amount of premium tax credit received, and details about the insurance provider. It is necessary for taxpayers to accurately complete their federal tax returns, particularly when claiming premium tax credits or reconciling any advance payments of the premium tax credit.

Steps to complete the 1095a Form

Filling out the 1095a form involves several steps to ensure accuracy and compliance with IRS guidelines. First, gather all necessary information, including your health insurance policy details and any premium tax credits received. Next, fill in the required fields, such as your name, Social Security number, and the details of your coverage. Be sure to accurately report the months you had coverage and the amount of premium tax credits. After completing the form, review it for any errors before submitting it with your tax return. It is advisable to keep a copy for your records.

How to obtain the 1095a Form

To obtain the 1095a form, individuals can access it through their Health Insurance Marketplace account. If you enrolled in coverage through the Marketplace, you should receive a copy of the form by mail or electronically. If you do not receive it, you can log in to your account on the Marketplace website to download a copy. Additionally, you can contact your insurance provider for assistance in obtaining the form if needed.

Legal use of the 1095a Form

The 1095a form serves as an official document required by the IRS for tax reporting purposes. It is legally binding and must be accurately completed to ensure compliance with federal tax laws. Taxpayers must use the information provided in the 1095a form to reconcile any premium tax credits received during the tax year. Failure to accurately report this information can lead to penalties or delays in processing tax returns.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the 1095a form is essential for compliance. The IRS typically requires that taxpayers receive their 1095a forms by January 31 of the year following the tax year. When filing your federal tax return, it is crucial to include the 1095a form by the tax filing deadline, which is usually April 15. If you need additional time, you may apply for an extension, but ensure that you still file the 1095a form by the final deadline to avoid penalties.

Key elements of the 1095a Form

The 1095a form contains several key elements that are vital for accurate tax reporting. These include the name and Social Security number of the insured, the details of the health coverage provider, the months during which coverage was active, and the total premium amounts. Additionally, the form outlines any premium tax credits received, which are essential for reconciling with your tax return. Each section must be carefully filled out to ensure compliance with IRS regulations.

Quick guide on how to complete 2016 1095a form

Complete 1095a Form seamlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to generate, modify, and eSign your documents swiftly without delays. Manage 1095a Form on any device with airSlate SignNow's Android or iOS applications and streamline any document-related procedure today.

How to modify and eSign 1095a Form with ease

- Locate 1095a Form and click Get Form to begin.

- Utilize the tools we provide to finish your document.

- Emphasize important sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to share your form, whether via email, SMS, or an invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device of your choice. Modify and eSign 1095a Form and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2016 1095a form

Create this form in 5 minutes!

How to create an eSignature for the 2016 1095a form

How to create an electronic signature for the 2016 1095a Form online

How to generate an electronic signature for your 2016 1095a Form in Google Chrome

How to make an electronic signature for putting it on the 2016 1095a Form in Gmail

How to generate an eSignature for the 2016 1095a Form right from your smart phone

How to create an electronic signature for the 2016 1095a Form on iOS devices

How to make an eSignature for the 2016 1095a Form on Android OS

People also ask

-

What is a 1095a Form and why is it important?

The 1095a Form is a tax document that provides information about health insurance coverage under the Affordable Care Act. It is essential for individuals to receive this form to complete their tax returns accurately and report their health coverage status.

-

How can airSlate SignNow help with the 1095a Form?

airSlate SignNow simplifies the process of sending and eSigning the 1095a Form by providing a user-friendly platform. With our solution, you can easily share the form with clients or employees, ensuring they receive it quickly and securely.

-

What features does airSlate SignNow offer for handling the 1095a Form?

airSlate SignNow offers features like customizable templates, secure eSignature capabilities, and document tracking specifically for forms like the 1095a Form. These tools help ensure that your documents are completed accurately and efficiently.

-

Is airSlate SignNow cost-effective for managing the 1095a Form?

Yes, airSlate SignNow is a cost-effective solution for businesses that need to manage the 1095a Form. Our pricing plans are designed to fit various budgets, making it accessible for small and large companies alike.

-

Can I integrate airSlate SignNow with other software for managing the 1095a Form?

Absolutely! airSlate SignNow offers seamless integrations with popular software like Google Drive, Dropbox, and CRM systems. This allows you to easily manage the 1095a Form alongside your other business processes.

-

What are the benefits of using airSlate SignNow for the 1095a Form?

Using airSlate SignNow for the 1095a Form provides benefits such as increased efficiency, enhanced security, and better compliance with tax regulations. Our platform streamlines the eSigning process, saving you time and reducing the risk of errors.

-

How does airSlate SignNow ensure the security of the 1095a Form?

airSlate SignNow prioritizes security with advanced encryption and compliance with industry standards. When handling sensitive documents like the 1095a Form, you can trust that your data is safe and protected.

Get more for 1095a Form

Find out other 1095a Form

- Can I eSign Alaska Equipment Rental Agreement Template

- eSign Michigan Equipment Rental Agreement Template Later

- Help Me With eSignature Washington IOU

- eSign Indiana Home Improvement Contract Myself

- eSign North Dakota Architectural Proposal Template Online

- How To eSignature Alabama Mechanic's Lien

- Can I eSign Alabama Car Insurance Quotation Form

- eSign Florida Car Insurance Quotation Form Mobile

- eSign Louisiana Car Insurance Quotation Form Online

- Can I eSign Massachusetts Car Insurance Quotation Form

- eSign Michigan Car Insurance Quotation Form Online

- eSign Michigan Car Insurance Quotation Form Mobile

- eSignature Massachusetts Mechanic's Lien Online

- eSignature Massachusetts Mechanic's Lien Free

- eSign Ohio Car Insurance Quotation Form Mobile

- eSign North Dakota Car Insurance Quotation Form Online

- eSign Pennsylvania Car Insurance Quotation Form Mobile

- eSignature Nevada Mechanic's Lien Myself

- eSign California Life-Insurance Quote Form Online

- How To eSignature Ohio Mechanic's Lien