EXONERATION FORM for PROPERTY TAX REFUND Kentucky

What is the exoneration form for property tax refund in Kentucky?

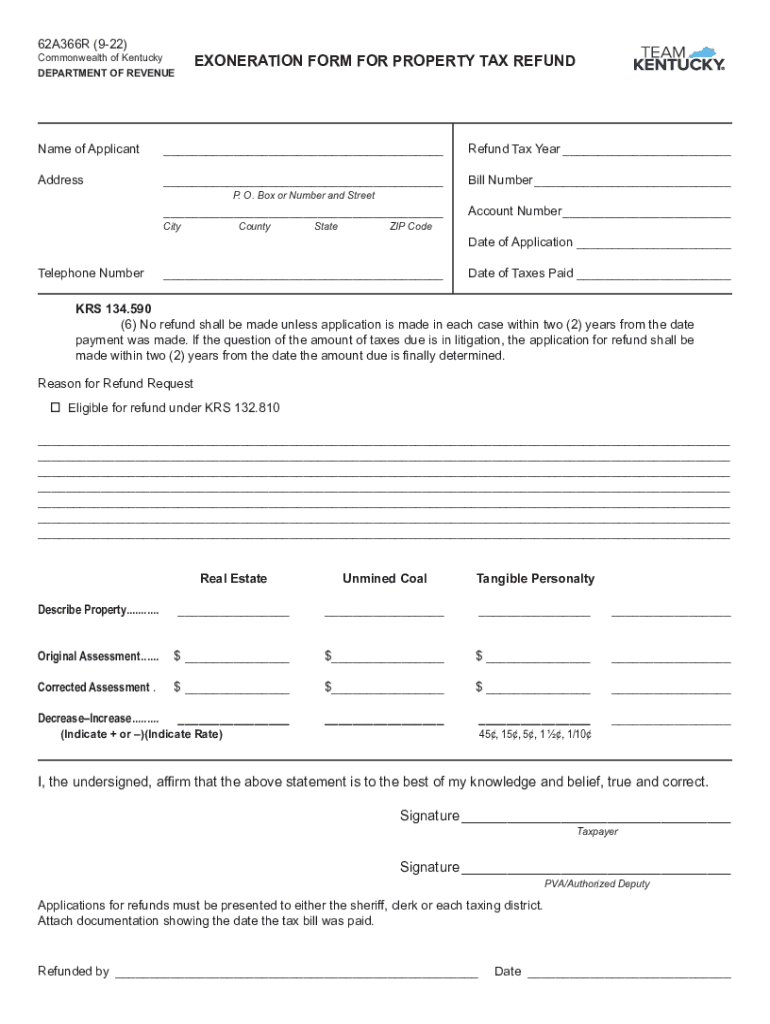

The exoneration form for property tax refund in Kentucky is a legal document that allows property owners to request a refund for overpaid property taxes. This form is specifically designed for individuals who believe they have been incorrectly assessed or have experienced a change in property status that warrants a tax refund. The form ensures that taxpayers can formally communicate their request to the relevant tax authorities, facilitating the review and potential reimbursement of excess taxes paid.

How to use the exoneration form for property tax refund in Kentucky

Using the exoneration form for property tax refund in Kentucky involves several straightforward steps. First, obtain the correct version of the form, typically available through the Kentucky Department of Revenue or local tax offices. Next, fill out the form accurately, providing all required information, including property details and the reason for the refund request. Once completed, submit the form according to the instructions provided, ensuring that you keep a copy for your records. It is essential to follow any specific guidelines regarding submission methods to ensure your request is processed efficiently.

Steps to complete the exoneration form for property tax refund in Kentucky

Completing the exoneration form for property tax refund in Kentucky requires careful attention to detail. Here are the key steps:

- Obtain the exoneration form from the appropriate source.

- Fill in your personal information, including name and address.

- Provide property details, such as the parcel number and property description.

- Clearly state the reason for the refund request, citing any relevant changes or errors.

- Sign and date the form to validate your request.

Ensure that all information is accurate to avoid delays in processing.

Eligibility criteria for the exoneration form for property tax refund in Kentucky

To be eligible for a refund using the exoneration form in Kentucky, property owners must meet specific criteria. Generally, eligibility includes situations such as having overpaid property taxes due to an incorrect assessment, changes in property ownership, or qualifying for exemptions that were not applied. Additionally, the request must be made within the designated timeframe set by the Kentucky Department of Revenue. It is essential to review these criteria carefully to ensure that your request is valid and can be processed without complications.

Form submission methods for the exoneration form for property tax refund in Kentucky

The exoneration form for property tax refund in Kentucky can typically be submitted through various methods to accommodate different preferences. Common submission options include:

- Online submission through the Kentucky Department of Revenue's official website.

- Mailing the completed form to the designated tax office.

- In-person submission at local tax offices or county clerks' offices.

Each method may have specific requirements regarding documentation and deadlines, so it is advisable to verify the preferred submission method for your locality.

Key elements of the exoneration form for property tax refund in Kentucky

The exoneration form for property tax refund in Kentucky includes several key elements that must be addressed for a successful submission. These elements typically consist of:

- Taxpayer's name and contact information.

- Property details, including the address and parcel number.

- Reason for the refund request, clearly articulated.

- Signature of the taxpayer, affirming the accuracy of the information provided.

Completing these elements accurately is crucial for the processing of the refund request.

Quick guide on how to complete exoneration form for property tax refund kentucky

Complete EXONERATION FORM FOR PROPERTY TAX REFUND Kentucky effortlessly on any device

Web-based document management has become increasingly popular among companies and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed papers, allowing you to obtain the necessary form and securely save it online. airSlate SignNow provides you with all the resources required to create, modify, and electronically sign your documents promptly without delays. Manage EXONERATION FORM FOR PROPERTY TAX REFUND Kentucky on any device with airSlate SignNow Android or iOS applications and enhance any document-focused operation today.

How to modify and electronically sign EXONERATION FORM FOR PROPERTY TAX REFUND Kentucky with ease

- Locate EXONERATION FORM FOR PROPERTY TAX REFUND Kentucky and click Obtain Form to begin.

- Utilize the features we provide to complete your form.

- Identify important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Finish button to save your modifications.

- Select your preferred method for sending your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow manages all your document management needs in just a few clicks from any device of your choosing. Modify and electronically sign EXONERATION FORM FOR PROPERTY TAX REFUND Kentucky and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an exoneration form?

An exoneration form is a legal document used to release a party from liability or obligation. In the context of airSlate SignNow, it serves as a powerful tool to manage and streamline the signing process of such critical documents. Users can easily create, send, and eSign exoneration forms, ensuring compliance and efficiency.

-

How does airSlate SignNow facilitate the use of exoneration forms?

airSlate SignNow offers a user-friendly platform for creating and managing exoneration forms. With features like customizable templates and automated workflows, users can generate and send forms quickly, ensuring that the signing process is both seamless and legally binding.

-

What are the pricing plans for using airSlate SignNow for exoneration forms?

airSlate SignNow provides a variety of pricing plans to suit different business needs, starting with an affordable option for new users. Each plan includes essential features such as unlimited eSigning, access to templates for exoneration forms, and integrations with other applications. Users can choose the plan that best fits their requirements without sacrificing quality.

-

Are there any benefits to using airSlate SignNow for exoneration forms?

Yes, using airSlate SignNow for exoneration forms offers numerous benefits, including enhanced document security, faster turnaround times, and improved compliance. The platform allows teams to efficiently handle legal documents, reducing the risk of errors while ensuring all parties can sign conveniently from anywhere.

-

Can I integrate airSlate SignNow with other applications for managing exoneration forms?

Absolutely! airSlate SignNow supports integrations with various business applications like CRM and project management tools. This capability enhances the overall workflow, allowing users to manage their exoneration forms alongside other critical documents and processes seamlessly.

-

Is it easy to eSign an exoneration form using airSlate SignNow?

Yes, eSigning an exoneration form with airSlate SignNow is straightforward and user-friendly. Recipients can receive the document via email and sign it electronically on any device without needing to download additional software, making the process efficient and convenient.

-

Does airSlate SignNow provide templates for exoneration forms?

Yes, airSlate SignNow offers a library of customizable templates specifically designed for exoneration forms. This feature saves time and ensures users can easily create legally compliant documents that meet their specific needs, enhancing productivity and accuracy.

Get more for EXONERATION FORM FOR PROPERTY TAX REFUND Kentucky

- Essential legal life documents for new parents oklahoma form

- General power of attorney for the delegation of parental or legal authority over child oklahoma form

- Ok small form

- Oklahoma procedures form

- Ok attorney form

- Newly divorced individuals package oklahoma form

- Ok statutory form

- Contractors forms package oklahoma

Find out other EXONERATION FORM FOR PROPERTY TAX REFUND Kentucky

- Sign Colorado Plumbing Emergency Contact Form Now

- Sign Colorado Plumbing Emergency Contact Form Free

- How Can I Sign Connecticut Plumbing LLC Operating Agreement

- Sign Illinois Plumbing Business Plan Template Fast

- Sign Plumbing PPT Idaho Free

- How Do I Sign Wyoming Life Sciences Confidentiality Agreement

- Sign Iowa Plumbing Contract Safe

- Sign Iowa Plumbing Quitclaim Deed Computer

- Sign Maine Plumbing LLC Operating Agreement Secure

- How To Sign Maine Plumbing POA

- Sign Maryland Plumbing Letter Of Intent Myself

- Sign Hawaii Orthodontists Claim Free

- Sign Nevada Plumbing Job Offer Easy

- Sign Nevada Plumbing Job Offer Safe

- Sign New Jersey Plumbing Resignation Letter Online

- Sign New York Plumbing Cease And Desist Letter Free

- Sign Alabama Real Estate Quitclaim Deed Free

- How Can I Sign Alabama Real Estate Affidavit Of Heirship

- Can I Sign Arizona Real Estate Confidentiality Agreement

- How Do I Sign Arizona Real Estate Memorandum Of Understanding