Technology Jobs and Research and Development Tax Bb New Mexico Form

What is the Technology Jobs And Research And Development Tax Bb New Mexico

The Technology Jobs and Research and Development Tax BB New Mexico is a tax incentive designed to promote job creation and investment in technology and research sectors within the state. This program provides tax credits to businesses that engage in qualified research activities and hire eligible employees in technology-related fields. It aims to stimulate economic growth by encouraging innovation and the development of new technologies in New Mexico.

Eligibility Criteria

To qualify for the Technology Jobs and Research and Development Tax BB New Mexico, businesses must meet specific criteria. Eligible companies typically include those engaged in research and development activities in fields such as software development, biotechnology, and engineering. Additionally, the business must hire employees whose roles are directly related to these activities. It is essential to review the detailed eligibility requirements outlined by the state to ensure compliance.

Steps to Complete the Technology Jobs And Research And Development Tax Bb New Mexico

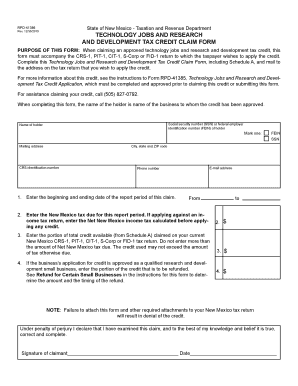

Completing the Technology Jobs and Research and Development Tax BB New Mexico form involves several key steps:

- Gather necessary documentation, including financial records and employee information.

- Complete the form accurately, ensuring all required fields are filled out.

- Review the completed form for any errors or omissions.

- Submit the form electronically or via mail, depending on your preference.

Legal Use of the Technology Jobs And Research And Development Tax Bb New Mexico

The legal use of the Technology Jobs and Research and Development Tax BB New Mexico form is governed by state tax laws. To ensure that your submission is legally binding, it is crucial to comply with the requirements set forth by the New Mexico Taxation and Revenue Department. This includes obtaining necessary signatures and maintaining accurate records of your research activities and employee qualifications.

Form Submission Methods

The Technology Jobs and Research and Development Tax BB New Mexico form can be submitted through various methods. Businesses have the option to file electronically using approved e-filing systems or submit a paper form via mail. Each method has its own set of guidelines and deadlines, so it is important to choose the method that best suits your business needs.

Required Documents

When applying for the Technology Jobs and Research and Development Tax BB New Mexico, specific documents are required to support your application. These may include:

- Proof of research and development activities.

- Employee payroll records.

- Financial statements demonstrating eligible expenses.

Ensuring that all required documentation is complete and accurate will facilitate a smoother application process.

Quick guide on how to complete technology jobs and research and development tax bb new mexico

Complete Technology Jobs And Research And Development Tax Bb New Mexico effortlessly on any device

Online document management has gained traction among companies and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to easily locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Handle Technology Jobs And Research And Development Tax Bb New Mexico on any device with the airSlate SignNow applications for Android or iOS and streamline any document-related process today.

The easiest way to modify and eSign Technology Jobs And Research And Development Tax Bb New Mexico effortlessly

- Locate Technology Jobs And Research And Development Tax Bb New Mexico and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Mark important sections of your documents or redact sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs with just a few clicks from any device you prefer. Modify and eSign Technology Jobs And Research And Development Tax Bb New Mexico and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are Technology Jobs And Research And Development Tax Bb New Mexico?

Technology Jobs And Research And Development Tax Bb New Mexico refers to specific tax incentives designed to encourage businesses to engage in research and development activities. These programs aim to foster innovation within the technology sector, signNowly benefiting companies that invest in developing new technologies and processes. Understanding these incentives can greatly enhance financial planning for businesses operating in New Mexico.

-

How can airSlate SignNow support my Technology Jobs And Research And Development Tax Bb New Mexico applications?

airSlate SignNow offers a streamlined document preparation and signing solution that simplifies the application process for Technology Jobs And Research And Development Tax Bb New Mexico. With our easy-to-use platform, businesses can quickly prepare and electronically sign necessary documents, ensuring compliance and expediting submissions. This efficiency can save time and resources when applying for tax incentives.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow provides essential features such as customizable templates, cloud storage integration, and secure electronic signatures. These features enhance document management for businesses exploring Technology Jobs And Research And Development Tax Bb New Mexico. By utilizing SignNow, companies can ensure all their documents are organized, easily accessible, and legally compliant.

-

What benefits does airSlate SignNow provide for businesses in the tech industry?

Businesses in the tech industry can benefit from airSlate SignNow through its cost-effective eSignature solution that reduces document turnaround time. By integrating eSigning into the workflow, companies can focus on innovation and research, especially when navigating Technology Jobs And Research And Development Tax Bb New Mexico. Our platform enhances collaboration and minimizes administrative overhead.

-

How does airSlate SignNow integrate with other software?

airSlate SignNow seamlessly integrates with various software applications, enabling users to enhance their existing workflows. This compatibility is especially beneficial for businesses looking to manage their Technology Jobs And Research And Development Tax Bb New Mexico documentation alongside existing tools. Our integrations allow for a smoother transition and better utilization of resources.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans that cater to different business needs, making it accessible for companies dealing with Technology Jobs And Research And Development Tax Bb New Mexico. Our pricing options include monthly subscriptions or annual plans, providing savings for long-term users. Additionally, the potential savings from tax incentives can offset the cost of our services.

-

How secure is airSlate SignNow for sensitive documents?

Security is a top priority at airSlate SignNow, as we use advanced encryption methods to protect sensitive documents. This is crucial for companies involved in Technology Jobs And Research And Development Tax Bb New Mexico, as they often handle proprietary information. Our platform complies with industry standards, ensuring that your data remains confidential and secure.

Get more for Technology Jobs And Research And Development Tax Bb New Mexico

- Oregon notice closure form

- Oregon notice 497323763 form

- Workers compensation surety rider oregon form

- Oregon entity form

- Oregon assistance form

- Preferred worker worksite modification agreement limited to 2500 oregon form

- Job analysis for worksite modification attachment a oregon form

- Reopened claims form

Find out other Technology Jobs And Research And Development Tax Bb New Mexico

- How Can I eSignature Kentucky Co-Branding Agreement

- How Can I Electronic signature Alabama Declaration of Trust Template

- How Do I Electronic signature Illinois Declaration of Trust Template

- Electronic signature Maryland Declaration of Trust Template Later

- How Can I Electronic signature Oklahoma Declaration of Trust Template

- Electronic signature Nevada Shareholder Agreement Template Easy

- Electronic signature Texas Shareholder Agreement Template Free

- Electronic signature Mississippi Redemption Agreement Online

- eSignature West Virginia Distribution Agreement Safe

- Electronic signature Nevada Equipment Rental Agreement Template Myself

- Can I Electronic signature Louisiana Construction Contract Template

- Can I eSignature Washington Engineering Proposal Template

- eSignature California Proforma Invoice Template Simple

- eSignature Georgia Proforma Invoice Template Myself

- eSignature Mississippi Proforma Invoice Template Safe

- eSignature Missouri Proforma Invoice Template Free

- Can I eSignature Mississippi Proforma Invoice Template

- eSignature Missouri Proforma Invoice Template Simple

- eSignature Missouri Proforma Invoice Template Safe

- eSignature New Hampshire Proforma Invoice Template Mobile