Form 1099 R Form 1099 R 2021

What is the Form 1099 R

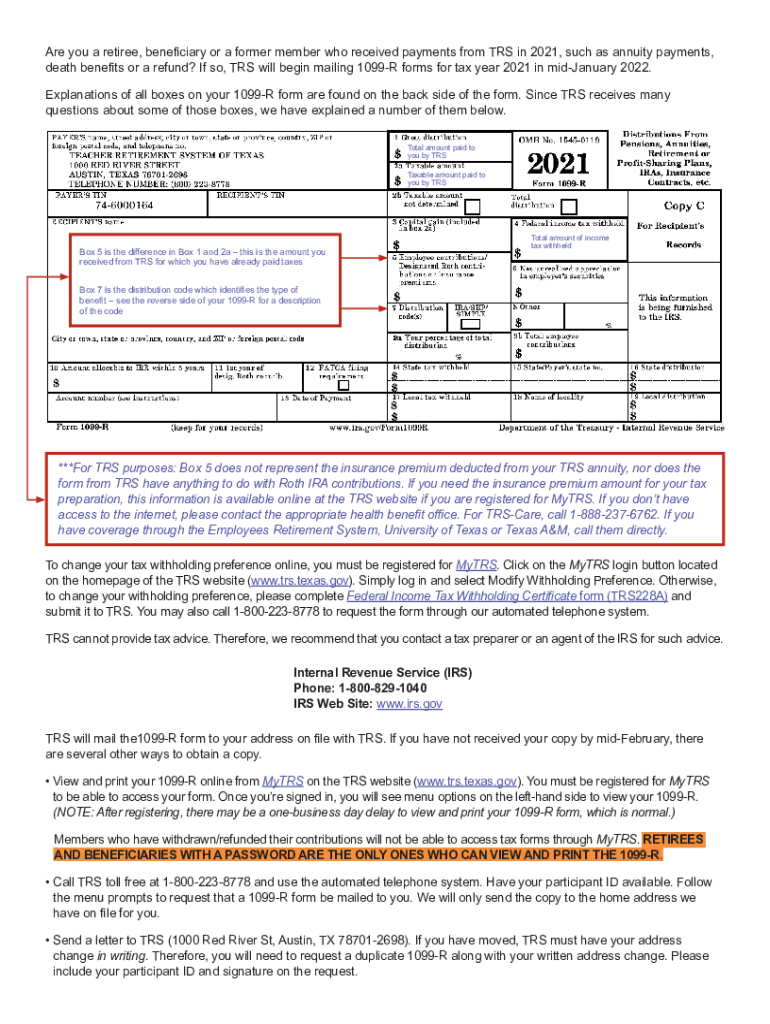

The Form 1099 R is a tax document used in the United States to report distributions from pensions, annuities, retirement plans, or other similar sources. This form is essential for both the payer and the recipient, as it provides the IRS with information about the amount of money distributed and any taxes withheld. Individuals who receive distributions from retirement accounts such as 401(k)s or IRAs will typically receive this form from their financial institution or plan administrator.

Steps to Complete the Form 1099 R

Completing the Form 1099 R involves several key steps to ensure accuracy and compliance with IRS regulations. First, gather all necessary information, including the recipient's name, address, and Social Security number. Next, input the gross distribution amount in Box 1, followed by any taxable amount in Box 2a. If applicable, include any federal income tax withheld in Box 4. Finally, ensure that all information is accurate before submitting the form to the IRS and providing a copy to the recipient.

How to Obtain the Form 1099 R

The Form 1099 R can be obtained through various methods. Taxpayers can request the form from their financial institution or plan administrator, who is responsible for issuing it. Additionally, the IRS provides downloadable versions of the form on its official website, allowing individuals to print and fill it out manually. It's important to ensure that the correct version of the form is used, as there may be updates or changes from year to year.

Legal Use of the Form 1099 R

The legal use of the Form 1099 R is crucial for tax reporting purposes. This form must be filed accurately to avoid penalties from the IRS. The information reported on the form must match the financial institution's records. If discrepancies arise, it could lead to audits or additional taxation. Understanding the legal implications of this form helps ensure compliance and protects taxpayers from potential legal issues.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1099 R are critical to adhere to in order to avoid penalties. Generally, the form must be sent to the IRS by the end of February if filing by paper, or by the end of March if filing electronically. Recipients should receive their copies by January 31. It is advisable to keep track of these important dates to ensure timely submission and avoid any complications with tax filings.

Who Issues the Form 1099 R

The Form 1099 R is typically issued by financial institutions, pension funds, or retirement plan administrators. These entities are responsible for reporting any distributions made to individuals from retirement accounts. It is essential for these organizations to provide accurate and timely information to both the IRS and the recipients to ensure compliance with tax regulations.

Quick guide on how to complete form 1099 r form 1099 r

Handle Form 1099 R Form 1099 R effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly option to traditional printed and signed papers, allowing you to locate the suitable form and securely save it online. airSlate SignNow equips you with all the necessary resources to create, modify, and eSign your documents promptly without any delays. Manage Form 1099 R Form 1099 R on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to modify and eSign Form 1099 R Form 1099 R with ease

- Locate Form 1099 R Form 1099 R and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign feature, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and hit the Done button to save your modifications.

- Choose how you would like to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form hunting, or mistakes that require printing new document versions. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Form 1099 R Form 1099 R to ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 1099 r form 1099 r

Create this form in 5 minutes!

People also ask

-

What is the Form 1099 R Form 1099 R used for?

The Form 1099 R Form 1099 R is used for reporting distributions from pensions, annuities, retirement or profit-sharing plans, IRAs, and other similar accounts. Understanding this form is crucial for tax filing and compliance. Businesses that manage such distributions need to accurately process the Form 1099 R Form 1099 R to avoid penalties.

-

How can airSlate SignNow assist with the Form 1099 R Form 1099 R?

airSlate SignNow provides a seamless solution for sending and electronically signing the Form 1099 R Form 1099 R. Our platform simplifies the process, ensuring that all necessary signatures are obtained efficiently and in compliance with regulatory requirements. Additionally, we keep your documents secure and accessible.

-

What features does airSlate SignNow offer for managing the Form 1099 R Form 1099 R?

airSlate SignNow offers features like customizable templates, real-time tracking, and secure storage, specifically designed to enhance the management of the Form 1099 R Form 1099 R. These features ensure that you have a streamlined process for preparing, sending, and signing your tax documents.

-

Is there a cost associated with using airSlate SignNow for the Form 1099 R Form 1099 R?

Yes, using airSlate SignNow for the Form 1099 R Form 1099 R involves a subscription fee, which is competitive and depends on the plan you choose. We offer various pricing tiers to fit the needs of businesses of all sizes. This cost-effective solution provides signNow value by reducing time and resources needed for document management.

-

Can I integrate airSlate SignNow with other software for the Form 1099 R Form 1099 R?

Absolutely! airSlate SignNow can seamlessly integrate with various software applications that facilitate financial and accounting tasks associated with the Form 1099 R Form 1099 R. These integrations enhance workflow efficiency and data accuracy, ensuring that you can manage document processes without hassle.

-

What are the benefits of using airSlate SignNow for eSigning the Form 1099 R Form 1099 R?

Using airSlate SignNow for eSigning the Form 1099 R Form 1099 R offers benefits such as increased efficiency, reduced turnaround time, and enhanced document security. You'll enjoy a user-friendly experience that streamlines your signing process while ensuring compliance with eSignature laws.

-

How secure is the information shared in the Form 1099 R Form 1099 R when using airSlate SignNow?

At airSlate SignNow, we prioritize your security. The information shared in the Form 1099 R Form 1099 R is protected with advanced encryption and compliance with industry standards. You can trust that your sensitive data is handled with the utmost care, providing you peace of mind.

Get more for Form 1099 R Form 1099 R

- Health care proxy oklahoma do not resuscitate form dnr oklahoma

- New state resident package oklahoma form

- Not resuscitate form oklahoma

- Health care directive statutory form oklahoma

- Commercial property sales package oklahoma form

- Revocation health care directive 497323342 form

- General partnership package oklahoma form

- Oklahoma contract deed 497323344 form

Find out other Form 1099 R Form 1099 R

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors