Texas 1099 Form 2018

What is the Texas 1099 Form

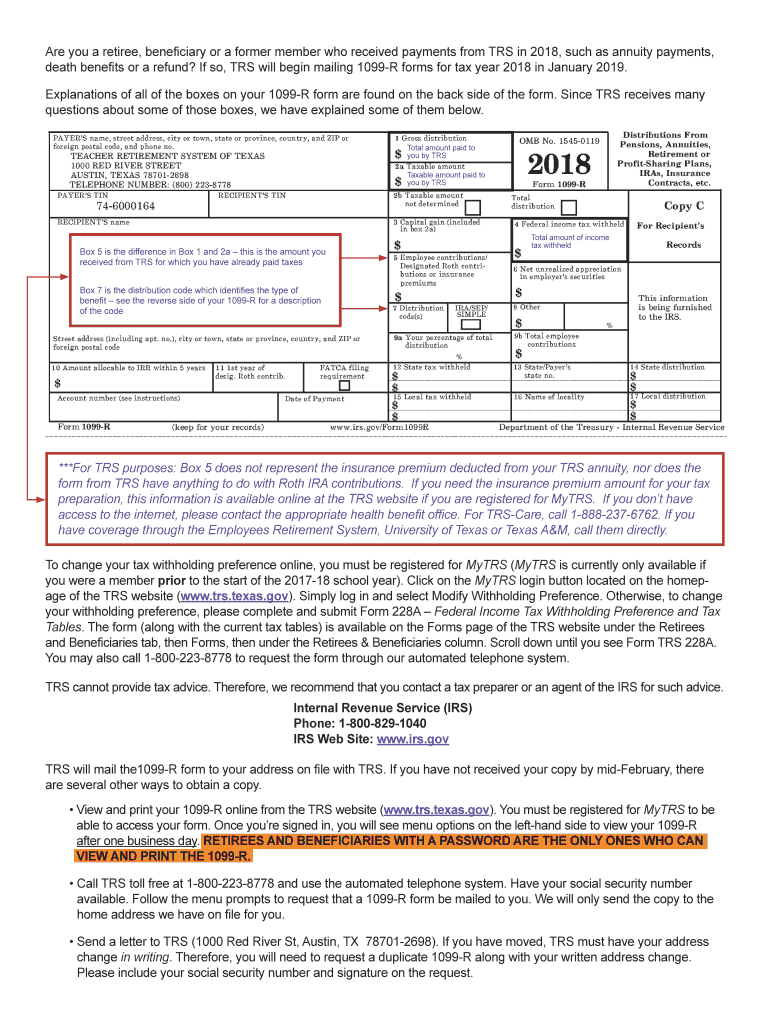

The Texas 1099 form is a crucial document used to report various types of income other than wages, salaries, and tips. This form is typically issued by businesses or individuals who have made payments to independent contractors, freelancers, or other entities. It serves as a record for both the payer and the recipient, ensuring that all income is accurately reported to the Internal Revenue Service (IRS). The Texas 1099 form includes important details such as the payer's and recipient's information, the amount paid, and the type of income being reported.

How to obtain the Texas 1099 Form

Obtaining the Texas 1099 form is a straightforward process. You can access the form through the official IRS website or the Texas Comptroller's office. Many accounting software programs also provide the option to generate the form automatically when you input the relevant payment information. If you prefer a physical copy, you can request it from your accountant or financial advisor. Ensure that you have all necessary details at hand, such as the payer's and recipient's identification information, to complete the form accurately.

Steps to complete the Texas 1099 Form

Completing the Texas 1099 form involves several key steps:

- Gather all relevant information about the payer and recipient, including names, addresses, and taxpayer identification numbers (TIN).

- Determine the type of income being reported, such as nonemployee compensation or rental income.

- Fill out the form accurately, ensuring all amounts are correct and correspond to the payments made during the tax year.

- Review the completed form for any errors or omissions before submission.

- Submit the form to the IRS and provide a copy to the recipient by the required deadlines.

Legal use of the Texas 1099 Form

The Texas 1099 form is legally binding when completed correctly and submitted on time. It is essential for compliance with IRS regulations, as failure to file or inaccuracies can result in penalties. The form must be filled out in accordance with IRS guidelines, including accurate reporting of income amounts. Digital signatures are accepted, provided they comply with the Electronic Signatures in Global and National Commerce Act (ESIGN) and other relevant laws. Using a reliable eSignature platform can help ensure that the form is executed legally and securely.

Filing Deadlines / Important Dates

Filing deadlines for the Texas 1099 form are crucial to avoid penalties. Typically, the form must be submitted to the IRS by January thirty-first of the year following the tax year in which payments were made. If you are filing electronically, the deadline may extend to March thirty-first. Recipients should also receive their copies by these dates. Staying aware of these deadlines helps ensure compliance and avoids unnecessary fines.

Who Issues the Form

The Texas 1099 form is issued by various entities, including businesses, non-profits, and individuals who have paid out certain types of income. Common issuers include employers who hire independent contractors, property owners who pay rent, and financial institutions that distribute dividends or interest. Each issuer is responsible for accurately reporting the payments made to recipients, ensuring that all parties fulfill their tax obligations.

Quick guide on how to complete annual 1099 r income tax form trs

Easily Prepare Texas 1099 Form on Any Device

Digital document management has become popular among businesses and individuals. It offers a great eco-friendly alternative to conventional printed and signed documents, as you can access the correct template and store it securely online. airSlate SignNow provides all the necessary tools to create, edit, and eSign your documents swiftly without delays. Manage Texas 1099 Form on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

Effortlessly Modify and eSign Texas 1099 Form

- Find Texas 1099 Form and click Get Form to begin.

- Utilize the tools available to complete your form.

- Highlight important sections of your documents or obscure sensitive data with the tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes seconds and carries the same legal significance as a traditional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Select your preferred delivery method for your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate reprinting new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Modify and eSign Texas 1099 Form to ensure effective communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct annual 1099 r income tax form trs

Create this form in 5 minutes!

How to create an eSignature for the annual 1099 r income tax form trs

How to generate an eSignature for your Annual 1099 R Income Tax Form Trs in the online mode

How to make an eSignature for the Annual 1099 R Income Tax Form Trs in Google Chrome

How to create an electronic signature for signing the Annual 1099 R Income Tax Form Trs in Gmail

How to make an eSignature for the Annual 1099 R Income Tax Form Trs from your mobile device

How to create an eSignature for the Annual 1099 R Income Tax Form Trs on iOS devices

How to make an electronic signature for the Annual 1099 R Income Tax Form Trs on Android OS

People also ask

-

What is a trs 1099 form and how can airSlate SignNow assist with it?

The trs 1099 form is a tax document used to report income received by non-employees, such as freelancers or contractors. airSlate SignNow streamlines the process of sending and eSigning this form, ensuring that all parties have access to it in a secure and efficient manner.

-

How much does it cost to eSign a trs 1099 form with airSlate SignNow?

Pricing for eSigning a trs 1099 form with airSlate SignNow is competitive and cost-effective. We offer various plans tailored to businesses of all sizes, including features that simplify document management and signing.

-

What features does airSlate SignNow offer for handling trs 1099 forms?

airSlate SignNow includes features like customizable templates, automated workflows, and secure cloud storage, making it easy to manage trs 1099 forms. These tools help reduce processing time and enhance compliance with tax regulations.

-

Can I integrate airSlate SignNow with other software for my trs 1099 forms?

Yes, airSlate SignNow offers integrations with popular accounting and productivity software, allowing for seamless processing of trs 1099 forms. This integration helps streamline your workflow and maintain accurate records.

-

How secure is airSlate SignNow when handling trs 1099 forms?

Security is a top priority for airSlate SignNow. We utilize advanced encryption and authentication methods to protect sensitive information on trs 1099 forms, ensuring that your documents remain confidential and secure.

-

What are the benefits of using airSlate SignNow for trs 1099 forms?

Using airSlate SignNow for trs 1099 forms provides enhanced efficiency, reduced turnaround times, and improved compliance. Our easy-to-use platform simplifies the signing process, allowing businesses to focus on their core operations.

-

Is it easy to track the status of my trs 1099 forms with airSlate SignNow?

Absolutely! airSlate SignNow offers real-time tracking for all your trs 1099 forms. You'll receive notifications for document views, completions, and any required actions, keeping you updated throughout the signing process.

Get more for Texas 1099 Form

Find out other Texas 1099 Form

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online