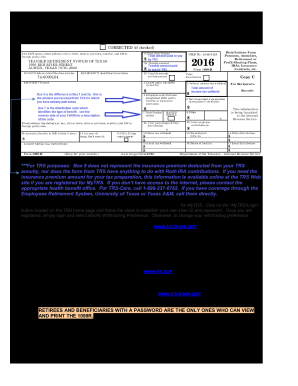

Trs 1099 Form 2016

What is the TRS 1099 Form

The TRS 1099 Form is a tax document used in the United States to report various types of income received by individuals who are not classified as employees. This form is particularly relevant for independent contractors, freelancers, and other self-employed individuals who earn income from services rendered. The TRS 1099 Form helps the Internal Revenue Service (IRS) track income that may not be reported through traditional wage and salary channels. It includes essential information such as the total amount paid to the individual, the payer's information, and the recipient's taxpayer identification number.

How to use the TRS 1099 Form

Using the TRS 1099 Form involves several steps to ensure accurate reporting of income. First, the payer must complete the form by entering their details, including name, address, and taxpayer identification number. Next, the total amount paid to the recipient during the tax year should be reported in the appropriate box on the form. Once completed, the payer must provide a copy of the TRS 1099 Form to the recipient and file the form with the IRS. Recipients should use the information on the form to report their income accurately on their tax returns.

Steps to complete the TRS 1099 Form

Completing the TRS 1099 Form requires careful attention to detail. Follow these steps:

- Gather necessary information, including the payer's and recipient's names, addresses, and taxpayer identification numbers.

- Determine the total amount paid to the recipient for the tax year.

- Fill out the form, ensuring all information is accurate and complete.

- Provide copies to both the recipient and the IRS by the specified deadlines.

Double-check all entries for accuracy to avoid potential issues with the IRS.

Legal use of the TRS 1099 Form

The legal use of the TRS 1099 Form is governed by IRS regulations. It is essential for payers to issue this form when payments exceed a specified threshold, typically $600, for services provided during the tax year. Failure to issue the form when required can result in penalties for the payer. Recipients are also responsible for reporting the income accurately on their tax returns, as the IRS receives a copy of the form. Proper use of the TRS 1099 Form helps maintain compliance with tax laws and ensures that all income is reported correctly.

Filing Deadlines / Important Dates

Filing deadlines for the TRS 1099 Form are crucial for compliance. Generally, the payer must provide a copy of the form to the recipient by January thirty-first of the year following the tax year in which the payments were made. Additionally, the form must be filed with the IRS by the end of February if filing on paper or by March thirty-first if filing electronically. Staying aware of these deadlines helps avoid penalties and ensures timely reporting of income.

Penalties for Non-Compliance

Non-compliance with TRS 1099 Form requirements can lead to significant penalties. If a payer fails to issue the form when required, they may face fines imposed by the IRS. The penalties can vary based on how late the form is filed, with higher fines for forms submitted after the deadline. Recipients who do not report the income listed on the form may also face tax liabilities and penalties. It is essential for both payers and recipients to adhere to the regulations associated with the TRS 1099 Form to avoid these consequences.

Quick guide on how to complete trs 1099 form

Complete Trs 1099 Form effortlessly on any gadget

Digital document management has become increasingly favored by companies and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can easily locate the necessary template and securely store it online. airSlate SignNow equips you with all the resources you need to create, modify, and electronically sign your documents swiftly and without interruptions. Handle Trs 1099 Form on any gadget with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The simplest method to modify and eSign Trs 1099 Form with ease

- Find Trs 1099 Form and click on Get Form to initiate.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of the documents or obscure sensitive information using tools that airSlate SignNow offers specifically for this purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to finalize your changes.

- Choose how you would like to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Put an end to lost or misplaced documents, tedious form searching, or errors that require printing new copies. airSlate SignNow meets your document management requirements in just a few clicks from any device of your choice. Modify and eSign Trs 1099 Form and ensure effective communication at any stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct trs 1099 form

Create this form in 5 minutes!

How to create an eSignature for the trs 1099 form

How to make an electronic signature for your Trs 1099 Form in the online mode

How to generate an eSignature for your Trs 1099 Form in Google Chrome

How to make an electronic signature for putting it on the Trs 1099 Form in Gmail

How to create an eSignature for the Trs 1099 Form from your smart phone

How to generate an eSignature for the Trs 1099 Form on iOS

How to make an electronic signature for the Trs 1099 Form on Android OS

People also ask

-

What is the Trs 1099 Form and why is it important?

The Trs 1099 Form is a tax document used to report income other than wages, salaries, and tips. It's crucial for independent contractors and businesses to accurately report earnings to the IRS, ensuring compliance and avoiding penalties. Using airSlate SignNow simplifies the process of collecting signatures for your Trs 1099 Form, making tax season less stressful.

-

How can airSlate SignNow help me with the Trs 1099 Form?

airSlate SignNow provides an easy-to-use platform for sending and eSigning your Trs 1099 Form. Our solution streamlines document management and ensures that all necessary parties can sign the form electronically, saving you time and reducing paperwork. Plus, you can track the signing status in real-time.

-

What features does airSlate SignNow offer for managing the Trs 1099 Form?

With airSlate SignNow, you gain access to features like customizable templates, secure cloud storage, and automated reminders for signing the Trs 1099 Form. Additionally, our platform integrates seamlessly with various accounting software, making it easier to manage your tax documents in one place.

-

Is there a cost associated with using airSlate SignNow for the Trs 1099 Form?

Yes, airSlate SignNow offers several pricing plans to fit your business needs, whether you’re a freelancer or a large organization. You can choose a plan that allows you to efficiently manage the Trs 1099 Form and other documents at a cost-effective price. We also provide a free trial to help you explore our features.

-

Can I integrate airSlate SignNow with my existing software for the Trs 1099 Form?

Absolutely! airSlate SignNow integrates with popular accounting and payroll software, allowing you to sync your data for the Trs 1099 Form seamlessly. This integration helps ensure that all your financial information is accurate and up-to-date, simplifying your tax reporting process.

-

What are the benefits of using airSlate SignNow for the Trs 1099 Form compared to traditional methods?

Using airSlate SignNow for the Trs 1099 Form offers numerous benefits over traditional methods, such as faster processing times and reduced paper usage. Our electronic solution ensures that signatures are collected quickly and securely, leading to a more efficient workflow and fewer errors. Additionally, you can access your documents from anywhere, increasing flexibility.

-

How secure is airSlate SignNow for handling the Trs 1099 Form?

Security is a top priority at airSlate SignNow. When handling the Trs 1099 Form, we use advanced encryption protocols and comply with industry standards to protect your sensitive information. You can confidently send and receive documents, knowing that your data is secure and private.

Get more for Trs 1099 Form

Find out other Trs 1099 Form

- Electronic signature North Carolina Life Sciences Stock Certificate Fast

- Help Me With Electronic signature North Dakota Legal Warranty Deed

- Electronic signature North Dakota Legal Cease And Desist Letter Online

- Electronic signature North Dakota Legal Cease And Desist Letter Free

- Electronic signature Delaware Orthodontists Permission Slip Free

- How Do I Electronic signature Hawaii Orthodontists Lease Agreement Form

- Electronic signature North Dakota Life Sciences Business Plan Template Now

- Electronic signature Oklahoma Legal Bill Of Lading Fast

- Electronic signature Oklahoma Legal Promissory Note Template Safe

- Electronic signature Oregon Legal Last Will And Testament Online

- Electronic signature Life Sciences Document Pennsylvania Simple

- Electronic signature Legal Document Pennsylvania Online

- How Can I Electronic signature Pennsylvania Legal Last Will And Testament

- Electronic signature Rhode Island Legal Last Will And Testament Simple

- Can I Electronic signature Rhode Island Legal Residential Lease Agreement

- How To Electronic signature South Carolina Legal Lease Agreement

- How Can I Electronic signature South Carolina Legal Quitclaim Deed

- Electronic signature South Carolina Legal Rental Lease Agreement Later

- Electronic signature South Carolina Legal Rental Lease Agreement Free

- How To Electronic signature South Dakota Legal Separation Agreement