Processing Time Frames Teacher Retirement System of Texas 2022-2026

Understanding the TX 1099R Form

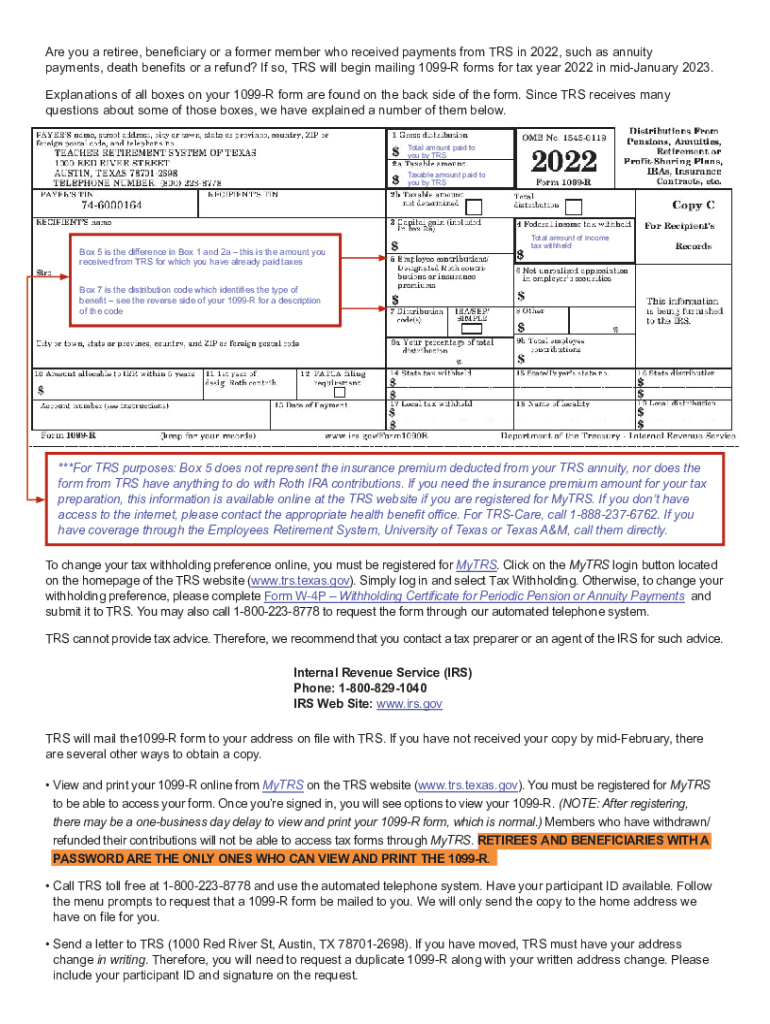

The TX 1099R form, also known as the Teacher Retirement System of Texas (TRS) 1099R, is a crucial document for individuals receiving retirement benefits from the TRS. This form reports distributions from retirement plans, including pensions and annuities, and is essential for tax reporting purposes. Recipients use this form to accurately report income on their federal tax returns, ensuring compliance with IRS regulations.

Filing Deadlines and Important Dates

It is important to be aware of the filing deadlines associated with the TX 1099R form. The IRS typically requires that the form be issued to recipients by January thirty-first of the year following the tax year in which distributions were made. Additionally, the form must be filed with the IRS by the end of February if submitted on paper, or by the end of March if submitted electronically. Missing these deadlines can result in penalties, so timely submission is essential.

Required Documents for Completion

When filling out the TX 1099R form, certain documents and information are necessary to ensure accuracy. Recipients should have their Social Security number, the amount of distributions received during the tax year, and any tax withheld from those distributions. It is also helpful to have previous year’s tax returns on hand for reference. Gathering these documents in advance can streamline the completion process.

How to Obtain the TX 1099R Form

Obtaining the TX 1099R form is a straightforward process. Recipients typically receive this form directly from the Teacher Retirement System of Texas. If a recipient does not receive their form by the end of January, they can request a duplicate through the TRS website or by contacting their customer service. It is important to ensure that the TRS has the correct mailing address on file to avoid delays.

Digital vs. Paper Version of the TX 1099R Form

Both digital and paper versions of the TX 1099R form are available, providing flexibility for recipients. The digital version can be accessed through the TRS online portal, allowing for easy retrieval and storage. This option is often preferred for its convenience and environmental benefits. However, some individuals may still prefer a paper version for their records. Both formats are legally valid, provided they contain the necessary information and signatures.

Penalties for Non-Compliance

Failing to file the TX 1099R form or inaccuracies in reporting can lead to penalties imposed by the IRS. These penalties may include fines for late filing or failure to file, which can accumulate over time. Additionally, incorrect reporting of income can result in audits or further scrutiny from tax authorities. It is crucial for recipients to ensure that their forms are completed accurately and submitted on time to avoid these consequences.

Eligibility Criteria for Receiving the TX 1099R Form

Eligibility for receiving the TX 1099R form is primarily determined by participation in the Teacher Retirement System of Texas. Individuals who have received distributions from their retirement accounts, including pensions or annuities, are required to receive this form. It is important for recipients to understand their eligibility status to ensure they are compliant with tax reporting requirements.

Quick guide on how to complete processing time frames teacher retirement system of texas

Complete Processing Time Frames Teacher Retirement System Of Texas effortlessly on any device

Digital document management has gained popularity among companies and individuals. It serves as a perfect eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Manage Processing Time Frames Teacher Retirement System Of Texas on any platform using the airSlate SignNow Android or iOS applications and enhance any document-focused process today.

The easiest way to modify and eSign Processing Time Frames Teacher Retirement System Of Texas without hassle

- Find Processing Time Frames Teacher Retirement System Of Texas and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Mark important sections of the documents or redact sensitive information using the tools specifically provided by airSlate SignNow for this purpose.

- Generate your eSignature with the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Processing Time Frames Teacher Retirement System Of Texas and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct processing time frames teacher retirement system of texas

Create this form in 5 minutes!

How to create an eSignature for the processing time frames teacher retirement system of texas

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a tx 1099r form?

The tx 1099r form is a tax document used to report distributions from pensions, annuities, retirement plans, or insurance contracts. Understanding this form is essential for accurately filing your taxes. airSlate SignNow makes it easy to manage and eSign your tx 1099r form electronically.

-

How can airSlate SignNow help with the tx 1099r form?

airSlate SignNow provides an easy-to-use platform for sending and electronically signing your tx 1099r form. With its intuitive interface, businesses can streamline document management, ensuring that all necessary tax forms are signed and submitted on time.

-

Is there a cost associated with using airSlate SignNow for tx 1099r forms?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs, including the management of tx 1099r forms. You can choose a plan that best suits your volume of document processing and budget, ensuring a cost-effective solution for your needs.

-

What features does airSlate SignNow offer for handling the tx 1099r form?

airSlate SignNow includes features like customizable templates, document tracking, and secure storage specifically for tax forms like the tx 1099r form. These features enhance efficiency, ensuring that you can easily prepare and manage your tax documentation.

-

Can I integrate airSlate SignNow with other software for tx 1099r forms?

Yes, airSlate SignNow integrates seamlessly with various software applications to simplify your workflow around tx 1099r forms. You can connect your existing tools to streamline document preparation, signing, and storage processes.

-

What are the benefits of using airSlate SignNow for my tx 1099r form needs?

The benefits of using airSlate SignNow for your tx 1099r form include enhanced efficiency, improved accuracy, and secure storage. By using a digital solution, you can speed up the signing process and reduce the risk of errors associated with manual handling of tax forms.

-

How secure is airSlate SignNow for handling sensitive information on tx 1099r forms?

airSlate SignNow employs high-level security measures, including encryption and secure access controls, to protect sensitive information on tx 1099r forms. This ensures that your tax documents remain safe and compliant with legal standards.

Get more for Processing Time Frames Teacher Retirement System Of Texas

Find out other Processing Time Frames Teacher Retirement System Of Texas

- Sign Colorado Business Operations LLC Operating Agreement Online

- Sign Colorado Business Operations LLC Operating Agreement Myself

- Sign Hawaii Business Operations Warranty Deed Easy

- Sign Idaho Business Operations Resignation Letter Online

- Sign Illinois Business Operations Affidavit Of Heirship Later

- How Do I Sign Kansas Business Operations LLC Operating Agreement

- Sign Kansas Business Operations Emergency Contact Form Easy

- How To Sign Montana Business Operations Warranty Deed

- Sign Nevada Business Operations Emergency Contact Form Simple

- Sign New Hampshire Business Operations Month To Month Lease Later

- Can I Sign New York Business Operations Promissory Note Template

- Sign Oklahoma Business Operations Contract Safe

- Sign Oregon Business Operations LLC Operating Agreement Now

- Sign Utah Business Operations LLC Operating Agreement Computer

- Sign West Virginia Business Operations Rental Lease Agreement Now

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile

- Sign Delaware Car Dealer Limited Power Of Attorney Fast