Internal Revenue Service IRS Phone 1 800 829 1040 2020

Understanding the TRS Form 1099-R

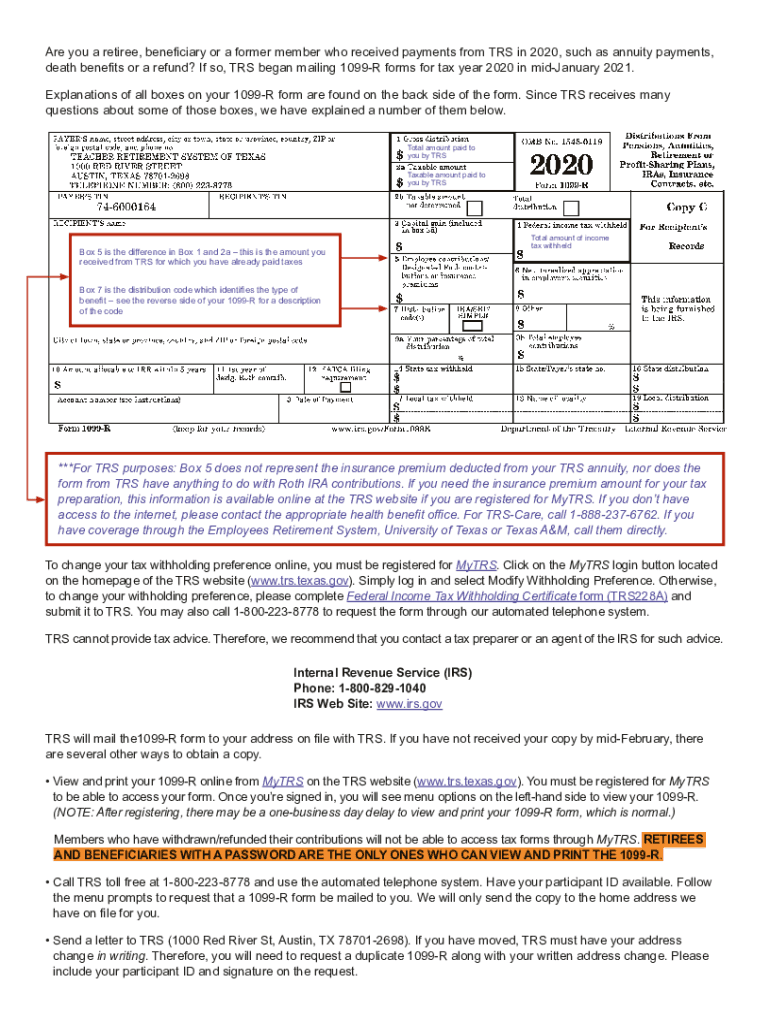

The TRS Form 1099-R is a crucial document for individuals receiving distributions from retirement plans, particularly those under the Texas Retirement System. This form reports income that may be subject to federal income tax. It is essential for recipients to understand the information provided on the form, including the gross distribution amount, taxable amount, and any federal income tax withheld. Proper comprehension of this form ensures accurate reporting on your tax return.

Steps to Complete the TRS Form 1099-R

Filling out the TRS Form 1099-R involves several important steps. Start by gathering all necessary documents related to your retirement plan distributions. Next, ensure that you accurately fill in your personal information, including your Social Security number and address. Pay close attention to the amounts reported on the form, as errors can lead to complications with the IRS. Finally, review the completed form for accuracy before submitting it with your tax return.

Legal Use of the TRS Form 1099-R

The TRS Form 1099-R is legally binding when it is filled out correctly and submitted on time. It is essential to comply with IRS regulations regarding the reporting of retirement distributions. Failure to report income accurately can result in penalties or interest charges. Using a reliable electronic signature solution, such as signNow, can help ensure that your form is executed legally and securely, providing peace of mind throughout the process.

Filing Deadlines for the TRS Form 1099-R

Understanding the filing deadlines for the TRS Form 1099-R is crucial for compliance. Typically, recipients must receive their forms by January 31 of the year following the tax year in which distributions were made. Additionally, the completed form must be filed with the IRS by the appropriate deadline, which is usually April 15 for individual tax returns. Keeping track of these dates helps avoid late penalties and ensures timely processing of your tax return.

Required Documents for Filing the TRS Form 1099-R

When preparing to file the TRS Form 1099-R, certain documents are necessary to ensure accurate reporting. These include your previous year’s tax return, any relevant retirement account statements, and documentation of any other income sources. Having these documents on hand will facilitate a smoother filing process and help in verifying the information reported on the form.

Penalties for Non-Compliance with the TRS Form 1099-R

Failing to comply with the requirements associated with the TRS Form 1099-R can lead to significant penalties. The IRS may impose fines for late filings, inaccurate information, or failure to file altogether. Understanding these potential penalties emphasizes the importance of accurate and timely submission of the form, ensuring you remain compliant with tax regulations.

Quick guide on how to complete internal revenue service irs phone 1 800 829 1040

Effortlessly Prepare Internal Revenue Service IRS Phone 1 800 829 1040 on Any Device

The management of documents online has become increasingly favored by businesses and individuals alike. It serves as an excellent eco-friendly substitute for traditional printed and signed papers, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly without interruptions. Manage Internal Revenue Service IRS Phone 1 800 829 1040 on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

Simple Steps to Modify and eSign Internal Revenue Service IRS Phone 1 800 829 1040 with Ease

- Find Internal Revenue Service IRS Phone 1 800 829 1040 and click Get Form to initiate the process.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your modifications.

- Choose how you want to send your form: via email, text message (SMS), invite link, or download it to your computer.

Eliminate the worries of missing or lost documents, tedious form searching, or the errors that require printing new document versions. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Internal Revenue Service IRS Phone 1 800 829 1040 to ensure effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct internal revenue service irs phone 1 800 829 1040

Create this form in 5 minutes!

How to create an eSignature for the internal revenue service irs phone 1 800 829 1040

The way to generate an electronic signature for a PDF online

The way to generate an electronic signature for a PDF in Google Chrome

The way to create an e-signature for signing PDFs in Gmail

The best way to create an e-signature straight from your smartphone

The best way to make an e-signature for a PDF on iOS

The best way to create an e-signature for a PDF document on Android

People also ask

-

What is the tx form trs and how can airSlate SignNow assist with it?

The tx form trs is a vital document often required for transactions in Texas. airSlate SignNow streamlines the process of filling out and signing the tx form trs, ensuring that your submissions are efficient and compliant with legal standards. With our intuitive platform, you can easily manage your documents and signatures.

-

What features does airSlate SignNow offer for managing tx form trs?

airSlate SignNow offers a variety of features specifically designed to simplify the management of the tx form trs. You can use templates for quick access, track document status in real time, and even get reminders for signatures. This functionality saves you time and ensures that you meet deadlines with ease.

-

Is there a free trial available for using airSlate SignNow for tx form trs?

Yes, airSlate SignNow offers a free trial that allows you to explore all features relevant to the tx form trs before committing to a paid plan. This is a great opportunity for prospective customers to test our platform and see how it can enhance their document management process without any financial commitment.

-

How does airSlate SignNow ensure the security of my tx form trs?

Security is a priority for airSlate SignNow, especially when it comes to sensitive documents like the tx form trs. Our platform utilizes advanced encryption protocols and complies with industry regulations to ensure that your data is protected. You can sign and store your documents with confidence, knowing they are secure.

-

What pricing plans does airSlate SignNow offer for users needing tx form trs processing?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of users who frequently handle the tx form trs. Plans vary based on features, user count, and usage frequency, allowing you to choose an option that best fits your business requirements. You can start with our basic plans and upgrade as your needs grow.

-

Can I integrate airSlate SignNow with other software for tx form trs?

Absolutely! airSlate SignNow supports a range of integrations with popular software solutions to facilitate the handling of the tx form trs. Whether you're using CRM tools, document storage services, or communication platforms, our integrations ensure a seamless workflow that enhances productivity and efficiency.

-

What are the benefits of using airSlate SignNow for tx form trs over traditional methods?

Using airSlate SignNow for the tx form trs provides numerous benefits compared to traditional paper methods. It eliminates the need for printing and mailing, reduces turnaround times, and enhances accuracy by minimizing human error. Plus, the platform allows for easy tracking and management of signatures, which traditional methods can’t match.

Get more for Internal Revenue Service IRS Phone 1 800 829 1040

Find out other Internal Revenue Service IRS Phone 1 800 829 1040

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself

- eSignature Maryland Non-Profit Cease And Desist Letter Fast

- eSignature Pennsylvania Life Sciences Rental Lease Agreement Easy

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter