Trs 1099r Form 2019

What is the TRS 1099-R Form

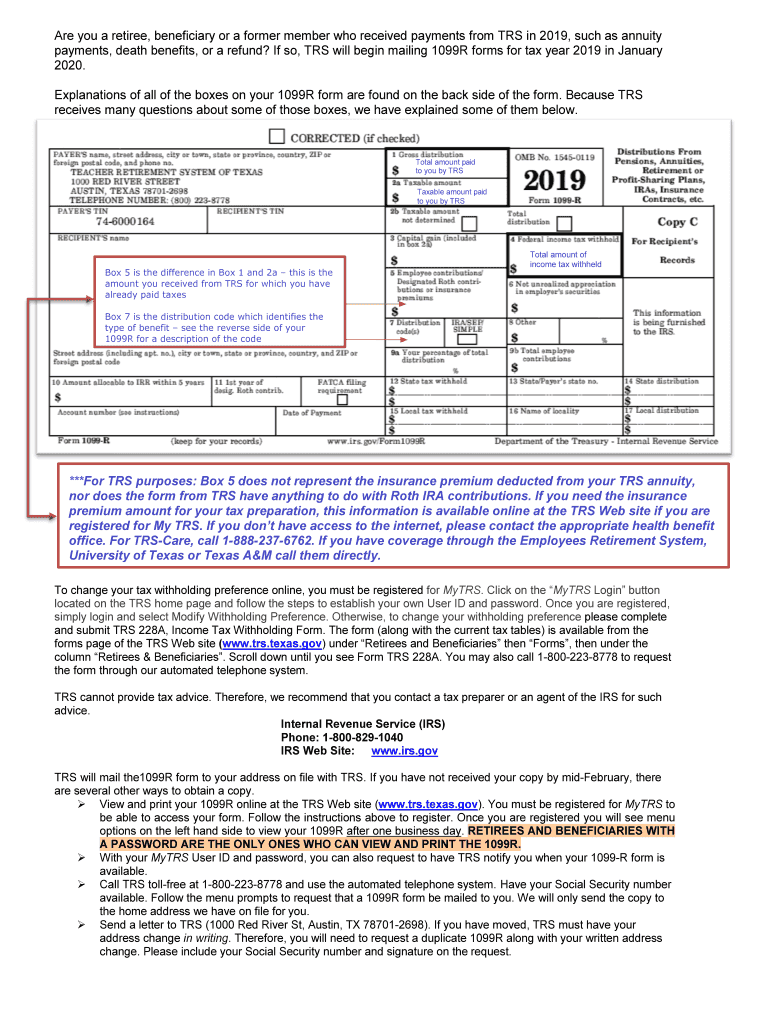

The TRS 1099-R form is a tax document used in the United States to report distributions from retirement plans, pensions, and other similar financial arrangements. This form is essential for retirees and beneficiaries who receive taxable income from their retirement accounts. It provides detailed information about the amount distributed and any taxes withheld, ensuring that individuals can accurately report their income to the IRS. Understanding the TRS 1099-R form is crucial for proper tax filing and compliance with federal regulations.

How to Use the TRS 1099-R Form

Using the TRS 1099-R form involves several steps to ensure accurate reporting of retirement income. First, individuals should carefully review the information provided on the form, including the gross distribution, taxable amount, and any federal income tax withheld. It is important to cross-reference this information with personal records to confirm its accuracy. After verifying the details, taxpayers must report the amounts on their federal tax return, typically on Form 1040. Properly utilizing this form helps avoid potential tax liabilities and ensures compliance with IRS requirements.

Steps to Complete the TRS 1099-R Form

Completing the TRS 1099-R form requires careful attention to detail. Here are the essential steps involved:

- Gather necessary documents, including previous tax returns and retirement account statements.

- Fill in personal information, such as name, address, and Social Security number.

- Input the gross distribution amount and the taxable amount as reported on the form.

- Indicate any federal income tax withheld, if applicable.

- Review the completed form for accuracy before submission.

Following these steps ensures that the TRS 1099-R form is completed correctly, minimizing the risk of errors during tax filing.

Legal Use of the TRS 1099-R Form

The TRS 1099-R form serves a legal purpose by documenting retirement distributions for tax purposes. It is essential for individuals to understand that this form must be filed with the IRS and retained for personal records. Failure to report the information accurately can lead to penalties or audits. The legal framework surrounding the use of this form is governed by IRS guidelines, which stipulate the requirements for reporting retirement income and the consequences of non-compliance.

Filing Deadlines / Important Dates

Filing deadlines for the TRS 1099-R form are critical to ensure compliance with tax regulations. Typically, the form must be issued by the end of January of the following year after the distribution. Taxpayers should be aware of the following key dates:

- January 31: Deadline for issuers to provide the TRS 1099-R form to recipients.

- April 15: Deadline for individuals to file their federal tax returns, including any information from the TRS 1099-R form.

Staying informed about these dates helps individuals avoid late filing penalties and ensures timely submission of tax documents.

Who Issues the TRS 1099-R Form

The TRS 1099-R form is typically issued by the retirement plan administrator or financial institution managing the retirement account. This entity is responsible for reporting the distributions made to the account holder during the tax year. It is crucial for recipients to ensure they receive their TRS 1099-R form in a timely manner, as it contains essential information needed for accurate tax reporting. If a recipient does not receive the form, they should contact the issuing entity to obtain a copy.

Quick guide on how to complete information about the 1099 r form

Prepare Trs 1099r Form effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, as you can easily locate the right form and securely save it online. airSlate SignNow equips you with all the resources necessary to create, alter, and electronically sign your documents swiftly without obstacles. Manage Trs 1099r Form on any system with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The simplest way to modify and electronically sign Trs 1099r Form with ease

- Obtain Trs 1099r Form and click Get Form to begin.

- Utilize the tools we provide to finish your form.

- Emphasize important sections of your documents or redact sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Review all the details and click the Done button to save your changes.

- Select how you wish to share your form, via email, SMS, or invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or errors that require new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Trs 1099r Form and guarantee effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct information about the 1099 r form

Create this form in 5 minutes!

How to create an eSignature for the information about the 1099 r form

How to generate an eSignature for your Information About The 1099 R Form in the online mode

How to create an electronic signature for the Information About The 1099 R Form in Google Chrome

How to generate an electronic signature for putting it on the Information About The 1099 R Form in Gmail

How to make an electronic signature for the Information About The 1099 R Form straight from your mobile device

How to create an electronic signature for the Information About The 1099 R Form on iOS

How to generate an eSignature for the Information About The 1099 R Form on Android devices

People also ask

-

What is the form trs 1099 used for?

The form trs 1099 is used to report income received by independent contractors and freelancers. It helps businesses keep track of payments made to non-employees for tax reporting purposes. Accurate management of form trs 1099 is crucial to ensure compliance with IRS regulations.

-

How can airSlate SignNow help with form trs 1099?

airSlate SignNow streamlines the process of sending and eSigning the form trs 1099, making it easy for businesses to manage their tax reporting documents. With our platform, you can ensure that your documents are securely signed and returned promptly. This efficiency can save you time and reduce the risk of errors.

-

Is there a cost associated with using airSlate SignNow for form trs 1099?

Yes, airSlate SignNow offers various pricing plans that include features to manage documents, including form trs 1099. Our plans are designed to be cost-effective, ensuring that businesses of all sizes can afford our services while effectively managing their document signing needs.

-

Can I integrate airSlate SignNow with other applications for managing form trs 1099?

Absolutely! airSlate SignNow offers seamless integrations with various applications, allowing for a more efficient workflow when managing form trs 1099. Whether you're using accounting software or customer management tools, our platform enhances connectivity and ease of use.

-

What features does airSlate SignNow provide for managing form trs 1099?

airSlate SignNow includes features such as document templates, real-time tracking, and electronic signatures for managing the form trs 1099. These tools ensure that your documents are ready for quick approval and compliance. Our user-friendly interface allows for easy navigation and enhanced productivity.

-

How secure is airSlate SignNow when handling form trs 1099 documents?

Security is a top priority at airSlate SignNow. We use advanced encryption and authentication methods to ensure that your form trs 1099 documents are protected. Our compliance with industry standards helps guarantee the confidentiality and integrity of sensitive information.

-

Can I access my form trs 1099 documents from anywhere?

Yes, airSlate SignNow is a cloud-based solution, allowing you to access your form trs 1099 documents from any device with an internet connection. This flexibility ensures that you can manage your documents on-the-go, improving your efficiency and responsiveness in business operations.

Get more for Trs 1099r Form

Find out other Trs 1099r Form

- Electronic signature California Business partnership agreement Myself

- Electronic signature Wisconsin Business associate agreement Computer

- eSignature Colorado Deed of Indemnity Template Safe

- Electronic signature New Mexico Credit agreement Mobile

- Help Me With Electronic signature New Mexico Credit agreement

- How Do I eSignature Maryland Articles of Incorporation Template

- How Do I eSignature Nevada Articles of Incorporation Template

- How Do I eSignature New Mexico Articles of Incorporation Template

- How To Electronic signature Georgia Home lease agreement

- Can I Electronic signature South Carolina Home lease agreement

- Can I Electronic signature Wisconsin Home lease agreement

- How To Electronic signature Rhode Island Generic lease agreement

- How Can I eSignature Florida Car Lease Agreement Template

- How To eSignature Indiana Car Lease Agreement Template

- How Can I eSignature Wisconsin Car Lease Agreement Template

- Electronic signature Tennessee House rent agreement format Myself

- How To Electronic signature Florida House rental agreement

- eSignature Connecticut Retainer Agreement Template Myself

- How To Electronic signature Alaska House rental lease agreement

- eSignature Illinois Retainer Agreement Template Free