Form or TM, Tri County Metropolitan Transportation District Self Employment Tax, 150 555 001 2022

What is the Form OR TM?

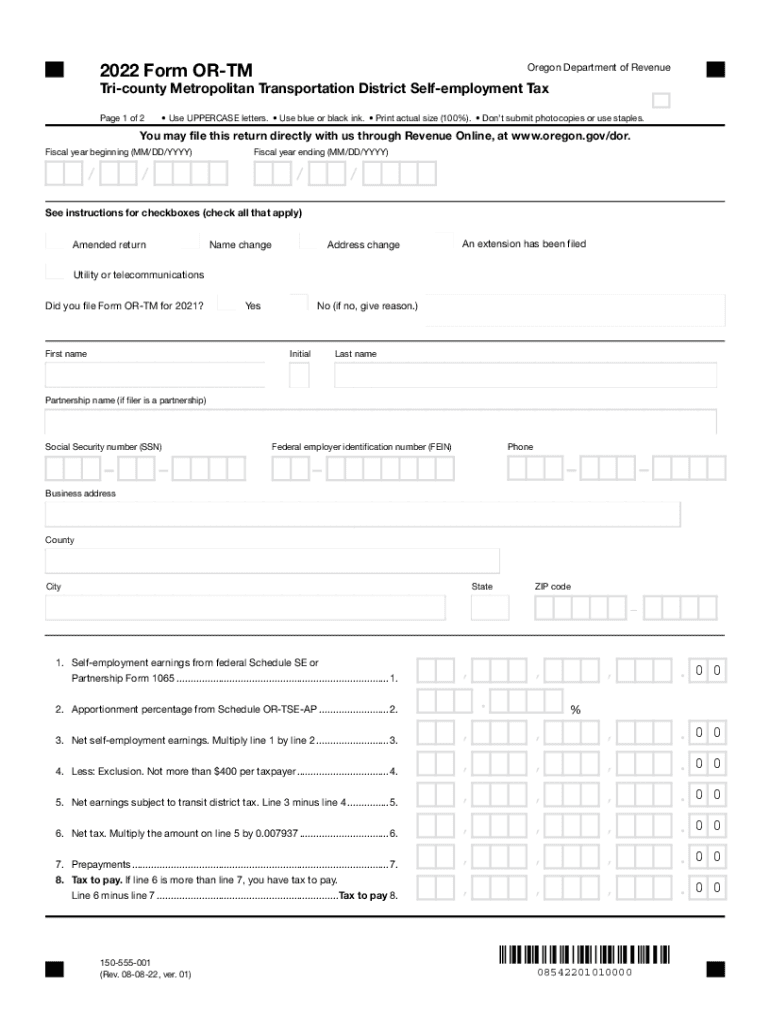

The Form OR TM is a tax document specifically designed for individuals and businesses operating within the Tri-County Metropolitan Transportation District in Oregon. This form is used to report self-employment income and calculate the associated self-employment tax. It is essential for those who earn income from self-employment activities within the district, ensuring compliance with local tax regulations. The form is identified by the number 150 555 001 and plays a crucial role in the overall tax filing process for self-employed individuals.

How to use the Form OR TM

Using the Form OR TM involves several steps to ensure accurate reporting of self-employment income. First, gather all necessary financial records, including income statements and expense receipts. Next, download or obtain a physical copy of the form. Fill out the required sections, detailing your income and any deductions applicable to your self-employment activities. After completing the form, review it for accuracy before submission. It is essential to keep copies of the completed form and any supporting documents for your records.

Steps to complete the Form OR TM

Completing the Form OR TM requires careful attention to detail. Follow these steps:

- Gather all relevant financial documents, including income and expense records.

- Download the Form OR TM from an official source or obtain a physical copy.

- Fill in your personal information, including your name, address, and taxpayer identification number.

- Report your total self-employment income in the designated section.

- List any eligible deductions to reduce your taxable income.

- Calculate the self-employment tax based on the provided instructions.

- Sign and date the form to certify its accuracy.

Legal use of the Form OR TM

The Form OR TM is legally recognized for reporting self-employment income within the Tri-County Metropolitan Transportation District. To ensure its legal validity, it must be completed accurately and submitted by the designated deadlines. Compliance with local tax laws is essential, as failure to file this form can result in penalties or fines. It is advisable to consult with a tax professional if there are any uncertainties regarding the completion or submission of the form.

Filing Deadlines / Important Dates

Filing deadlines for the Form OR TM are crucial for maintaining compliance with tax regulations. Typically, the form must be submitted by April 15 of the following tax year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is important to stay informed about any changes to these deadlines, as they can vary from year to year. Mark your calendar to ensure timely submission and avoid any potential penalties.

Penalties for Non-Compliance

Failure to file the Form OR TM or inaccuracies in reporting can result in significant penalties. The penalties may include fines, interest on unpaid taxes, and potential legal action for persistent non-compliance. It is essential to understand the importance of timely and accurate filings to avoid these consequences. If you encounter difficulties in completing the form, seeking assistance from a tax professional can help mitigate risks associated with non-compliance.

Quick guide on how to complete 2022 form or tm tri county metropolitan transportation district self employment tax 150 555 001

Complete Form OR TM, Tri County Metropolitan Transportation District Self Employment Tax, 150 555 001 effortlessly on any device

Managing documents online has gained signNow traction among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow equips you with all the tools you need to create, modify, and electronically sign your documents swiftly and without delays. Handle Form OR TM, Tri County Metropolitan Transportation District Self Employment Tax, 150 555 001 on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and electronically sign Form OR TM, Tri County Metropolitan Transportation District Self Employment Tax, 150 555 001 effortlessly

- Find Form OR TM, Tri County Metropolitan Transportation District Self Employment Tax, 150 555 001 and click on Get Form to initiate the process.

- Utilize the tools we provide to fill out your form.

- Highlight pertinent sections of the documents or obscure sensitive information using tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal standing as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Select how you wish to send your form, either by email, text message (SMS), invite link, or download it to your computer.

Eliminate the worries of lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Form OR TM, Tri County Metropolitan Transportation District Self Employment Tax, 150 555 001 and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2022 form or tm tri county metropolitan transportation district self employment tax 150 555 001

Create this form in 5 minutes!

How to create an eSignature for the 2022 form or tm tri county metropolitan transportation district self employment tax 150 555 001

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to form or tm?

airSlate SignNow is a powerful electronic signature solution designed to streamline document workflows. With its focus on ease of use and cost-effectiveness, it allows businesses to send and eSign documents efficiently, which can signNowly enhance the form or tm process.

-

What features does airSlate SignNow offer for managing form or tm?

airSlate SignNow includes features such as customizable templates, collaborative signing, and secure document storage, all of which aid in managing your form or tm. These tools ensure that your documents are not only prepared correctly but also signed promptly, improving overall workflow efficiency.

-

How does airSlate SignNow integrate with other software for form or tm?

airSlate SignNow provides seamless integrations with various applications like Google Drive, Salesforce, and DropBox, which can enhance your form or tm processes. By connecting with these tools, businesses can streamline their workflows, ensuring that document management is both convenient and efficient.

-

Is there a cost associated with using airSlate SignNow for form or tm?

Yes, airSlate SignNow offers flexible pricing plans that are designed to suit businesses of all sizes. By investing in its services, organizations can discover signNow savings in terms of time and resources when handling form or tm, ultimately leading to a higher return on investment.

-

Can I create custom forms using airSlate SignNow for my form or tm needs?

Absolutely! airSlate SignNow enables users to create custom forms tailored to their unique form or tm requirements. This feature allows businesses to capture the necessary information efficiently while ensuring compliance and accuracy in document management.

-

What security measures does airSlate SignNow implement for form or tm?

airSlate SignNow prioritizes the security of your documents with advanced security measures like encryption and authentication protocols. These safeguards protect sensitive information during the form or tm process, ensuring that your data remains secure at all times.

-

How does airSlate SignNow enhance collaboration on form or tm?

With airSlate SignNow, teams can collaborate effectively by sharing documents and tracking the signing process in real-time. This collaborative approach enhances the form or tm experience, allowing multiple parties to participate and expedite the completion of important documents.

Get more for Form OR TM, Tri County Metropolitan Transportation District Self Employment Tax, 150 555 001

- Warranty deed from two individuals to husband and wife rhode island form

- Rhode island deed 497325059 form

- Rhode island llc 497325060 form

- Renunciation and disclaimer of joint tenant or tenancy interest rhode island form

- Ri lien form

- Quitclaim deed by two individuals to llc rhode island form

- Warranty deed from two individuals to llc rhode island form

- Life estate deed 497325066 form

Find out other Form OR TM, Tri County Metropolitan Transportation District Self Employment Tax, 150 555 001

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer

- Electronic signature Doctors Word South Dakota Safe

- Electronic signature South Dakota Doctors Confidentiality Agreement Myself

- How Do I Electronic signature Vermont Doctors NDA

- Electronic signature Utah Doctors Promissory Note Template Secure

- Electronic signature West Virginia Doctors Bill Of Lading Online

- Electronic signature West Virginia Construction Quitclaim Deed Computer

- Electronic signature Construction PDF Wisconsin Myself

- How Do I Electronic signature Wyoming Doctors Rental Lease Agreement

- Help Me With Electronic signature Wyoming Doctors Rental Lease Agreement

- How Do I Electronic signature Colorado Education RFP

- Electronic signature Colorado Education Lease Agreement Form Online

- How To Electronic signature Colorado Education Business Associate Agreement