Form or TM, Tri County Metropolitan Transportation District Self Employment Tax, 150 555 001 2023

Understanding the Form OR TM

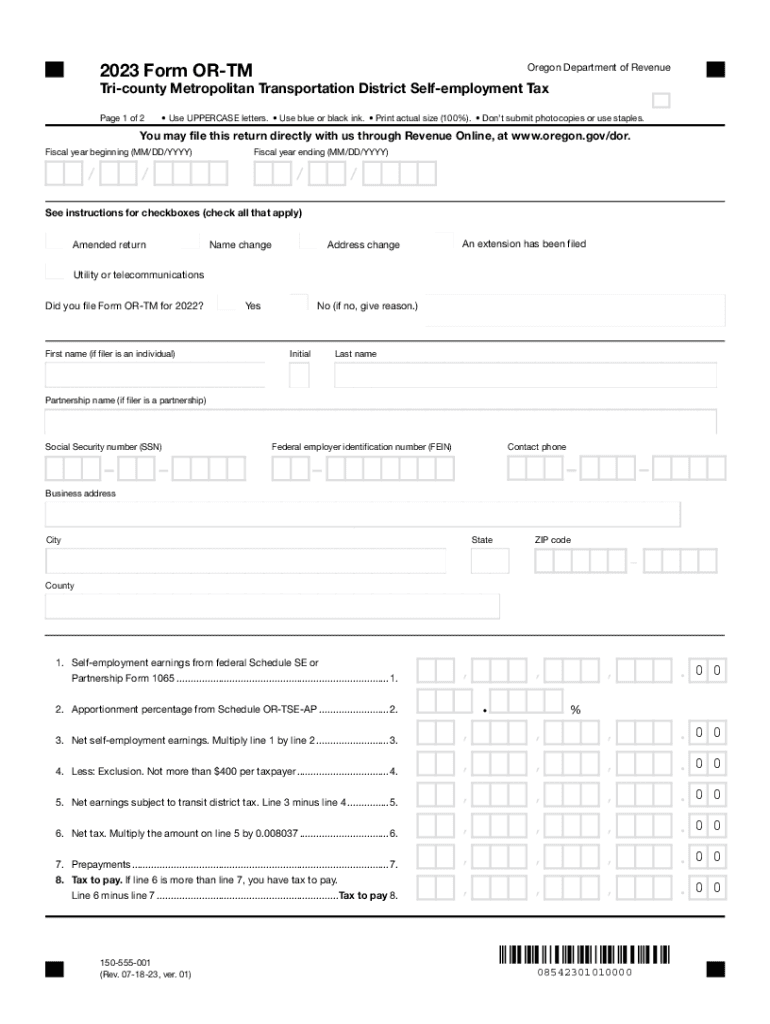

The Form OR TM, officially known as the Tri County Metropolitan Transportation District Self Employment Tax, is a crucial document for individuals who are self-employed within the Tri County Metropolitan area. This form is used to report and pay self-employment taxes, which contribute to Social Security and Medicare. It is essential for ensuring compliance with local tax regulations and for maintaining eligibility for various benefits.

How to Use the Form OR TM

Using the Form OR TM involves several steps to ensure accurate reporting of self-employment income. First, gather all necessary financial documentation, including income statements and expense records. Next, complete the form by accurately entering your income and any deductions. Once completed, review the form for accuracy before submission. This process helps avoid potential penalties and ensures that all tax obligations are met.

Steps to Complete the Form OR TM

Completing the Form OR TM requires attention to detail. Begin by entering your personal information, including your name and address. Then, report your total self-employment income and any allowable deductions. Ensure you calculate your self-employment tax correctly based on the income reported. Finally, sign and date the form before submitting it to the appropriate tax authority. Following these steps will help streamline the filing process.

Legal Use of the Form OR TM

The Form OR TM serves a legal purpose in the context of self-employment taxation. It is essential for individuals to use this form to report their income accurately and fulfill their tax obligations. Failure to file this form can result in penalties and interest on unpaid taxes. Understanding the legal implications of this form ensures that self-employed individuals remain compliant with local tax laws.

Filing Deadlines / Important Dates

Timely filing of the Form OR TM is crucial to avoid penalties. Typically, the deadline for submitting this form aligns with the federal tax filing deadline, which is April 15 each year. However, if this date falls on a weekend or holiday, the deadline may be adjusted. It is essential to stay informed about these dates to ensure compliance and avoid late fees.

Required Documents

To complete the Form OR TM, several documents are necessary. These include proof of income, such as 1099 forms or invoices, and records of business expenses. Additionally, any previous tax returns may be helpful for reference. Collecting these documents in advance can simplify the process of filling out the form and ensure that all information is accurate.

Examples of Using the Form OR TM

There are various scenarios in which the Form OR TM is applicable. For instance, a freelance graphic designer would use this form to report income earned from multiple clients. Similarly, a self-employed consultant would complete the form to account for income received from consulting services. Each of these examples illustrates the importance of the form in accurately reporting self-employment income and fulfilling tax obligations.

Create this form in 5 minutes or less

Find and fill out the correct form or tm tri county metropolitan transportation district self employment tax 150 555 001

Create this form in 5 minutes!

How to create an eSignature for the form or tm tri county metropolitan transportation district self employment tax 150 555 001

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to form or tm?

airSlate SignNow is a powerful tool that allows businesses to send and eSign documents efficiently. It simplifies the process of managing forms or tm, making it easier for users to create, send, and track their documents in a secure environment.

-

How much does airSlate SignNow cost for using form or tm?

airSlate SignNow offers various pricing plans to accommodate different business needs. The cost for using form or tm features is competitive, providing excellent value for the capabilities it offers, including unlimited document signing and customizable templates.

-

What features does airSlate SignNow offer for managing form or tm?

airSlate SignNow includes a range of features designed for managing form or tm, such as customizable templates, automated workflows, and real-time tracking. These features help streamline document management and enhance productivity for businesses.

-

Can I integrate airSlate SignNow with other applications for form or tm?

Yes, airSlate SignNow supports integrations with various applications, allowing you to enhance your form or tm processes. This includes popular tools like Google Drive, Salesforce, and Zapier, enabling seamless workflows across platforms.

-

What are the benefits of using airSlate SignNow for form or tm?

Using airSlate SignNow for form or tm provides numerous benefits, including increased efficiency, reduced turnaround times, and improved document security. Businesses can easily manage their forms or tm, ensuring a smooth and professional experience for all parties involved.

-

Is airSlate SignNow user-friendly for managing form or tm?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for anyone to manage form or tm without extensive training. Its intuitive interface allows users to navigate the platform effortlessly, ensuring quick adoption.

-

How does airSlate SignNow ensure the security of my form or tm?

airSlate SignNow prioritizes security by implementing advanced encryption and compliance with industry standards. This ensures that your form or tm and sensitive information are protected throughout the signing process.

Get more for Form OR TM, Tri County Metropolitan Transportation District Self Employment Tax, 150 555 001

- Form of application for leave see rule 13 hindi

- Form rd 3560 10

- Wesley medical center medical records form

- Raiffeisen online nalog osnov priliva form

- Vanguard trustee certification form

- Ladder register template 425785469 form

- Arbonne order form pdf uk

- Repossession of motorcycle letter sample from bank form

Find out other Form OR TM, Tri County Metropolitan Transportation District Self Employment Tax, 150 555 001

- eSign Michigan Car Dealer Operating Agreement Mobile

- Can I eSign Mississippi Car Dealer Resignation Letter

- eSign Missouri Car Dealer Lease Termination Letter Fast

- Help Me With eSign Kentucky Business Operations Quitclaim Deed

- eSign Nevada Car Dealer Warranty Deed Myself

- How To eSign New Hampshire Car Dealer Purchase Order Template

- eSign New Jersey Car Dealer Arbitration Agreement Myself

- eSign North Carolina Car Dealer Arbitration Agreement Now

- eSign Ohio Car Dealer Business Plan Template Online

- eSign Ohio Car Dealer Bill Of Lading Free

- How To eSign North Dakota Car Dealer Residential Lease Agreement

- How Do I eSign Ohio Car Dealer Last Will And Testament

- Sign North Dakota Courts Lease Agreement Form Free

- eSign Oregon Car Dealer Job Description Template Online

- Sign Ohio Courts LLC Operating Agreement Secure

- Can I eSign Michigan Business Operations POA

- eSign Car Dealer PDF South Dakota Computer

- eSign Car Dealer PDF South Dakota Later

- eSign Rhode Island Car Dealer Moving Checklist Simple

- eSign Tennessee Car Dealer Lease Agreement Form Now