Form or 18, Tax Payments on Real Property Conveyances 2023

What is the Form OR 18, Tax Payments On Real Property Conveyances

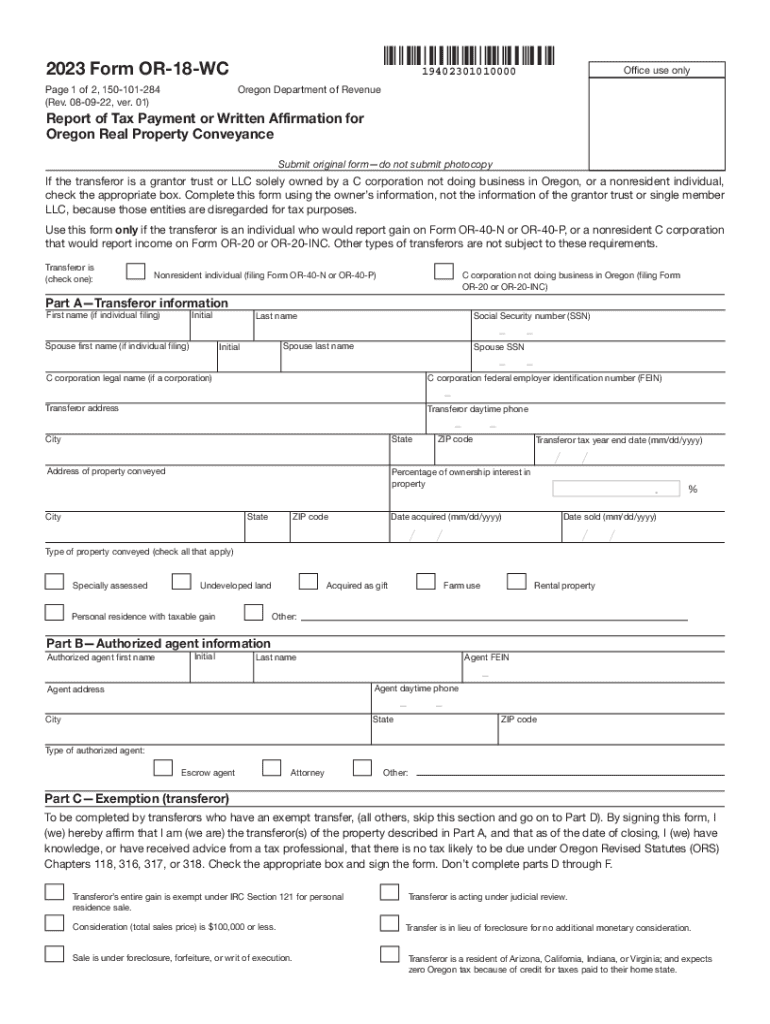

The Form OR 18 is a crucial document used in the state of Oregon for reporting tax payments related to real property conveyances. This form is essential for individuals and businesses involved in the transfer of real estate, as it ensures compliance with state tax laws. The tax imposed on property conveyances is typically calculated based on the sale price or the fair market value of the property being transferred. Understanding this form is vital for both buyers and sellers to avoid penalties and ensure proper tax reporting.

How to use the Form OR 18, Tax Payments On Real Property Conveyances

Using the Form OR 18 involves several straightforward steps. First, obtain the form from the Oregon Department of Revenue or a reliable source. Next, fill out the required information, including the names of the parties involved, the property details, and the tax amount due. After completing the form, it must be submitted along with the payment to the appropriate tax authority. It is important to retain a copy for your records, as it serves as proof of tax payment and compliance.

Steps to complete the Form OR 18, Tax Payments On Real Property Conveyances

Completing the Form OR 18 requires careful attention to detail. Follow these steps:

- Gather necessary information, including property details and the parties' names.

- Access the form online or request a physical copy.

- Fill in the form accurately, ensuring all required fields are completed.

- Calculate the tax based on the property's sale price or fair market value.

- Review the form for accuracy before submission.

- Submit the form along with payment to the Oregon Department of Revenue.

Legal use of the Form OR 18, Tax Payments On Real Property Conveyances

The legal use of the Form OR 18 is governed by Oregon tax law, which mandates that all property conveyances must be reported and taxed appropriately. Failure to submit this form can result in penalties or fines. The form serves as a legal document that verifies the payment of taxes on property transactions, making it essential for compliance. It is important for all parties involved in real estate transactions to understand their obligations under the law.

Filing Deadlines / Important Dates

Filing deadlines for the Form OR 18 are critical to ensure compliance with Oregon tax regulations. Typically, the form must be submitted at the time of the property transfer or within a specified period thereafter. It is advisable to check the Oregon Department of Revenue's official guidelines for the most current deadlines, as these can vary based on specific circumstances or changes in legislation. Timely submission helps avoid penalties and ensures that all tax obligations are met.

Penalties for Non-Compliance

Non-compliance with the requirements of the Form OR 18 can lead to significant penalties. These may include fines, interest on unpaid taxes, and potential legal action. It is crucial for individuals and businesses to understand the implications of failing to file or pay the necessary taxes associated with property conveyances. Staying informed about filing requirements and deadlines can help mitigate the risk of non-compliance and its associated consequences.

Quick guide on how to complete form or 18 tax payments on real property conveyances

Effortlessly Prepare Form OR 18, Tax Payments On Real Property Conveyances on Any Gadget

Digital document management has gained traction among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the appropriate form and securely keep it online. airSlate SignNow equips you with all the resources necessary to create, edit, and electronically sign your documents swiftly without holdups. Manage Form OR 18, Tax Payments On Real Property Conveyances on any gadget using airSlate SignNow's Android or iOS applications, and simplify any document-related task today.

The Easiest Way to Alter and eSign Form OR 18, Tax Payments On Real Property Conveyances with No Hassle

- Locate Form OR 18, Tax Payments On Real Property Conveyances and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or obscure sensitive information using tools specially provided by airSlate SignNow for that purpose.

- Create your eSignature with the Sign tool, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to save your changes.

- Choose how you wish to deliver your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate worries about lost or misplaced files, tiring document searches, or mistakes that require printing new copies. airSlate SignNow meets your document management requirements in just a few clicks from any device you prefer. Revise and eSign Form OR 18, Tax Payments On Real Property Conveyances, ensuring outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form or 18 tax payments on real property conveyances

Create this form in 5 minutes!

How to create an eSignature for the form or 18 tax payments on real property conveyances

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to or 18 wc?

airSlate SignNow is an electronic signature solution designed for businesses to efficiently send and eSign documents. The term 'or 18 wc' often refers to specific workflows in contract management, and our platform streamlines this process to enhance productivity.

-

How much does airSlate SignNow cost for businesses using or 18 wc?

airSlate SignNow offers various pricing plans tailored to different business sizes. Depending on your organization's needs involving or 18 wc, you can select a plan that provides the best value while ensuring you have access to necessary features.

-

What features does airSlate SignNow offer for or 18 wc documentation?

Our platform provides a variety of features specifically designed for managing or 18 wc documentation, such as templates, customizable workflows, and secure eSigning capabilities, ensuring comprehensive document management.

-

How does airSlate SignNow ensure security for or 18 wc transactions?

Security is a top priority at airSlate SignNow. We employ industry-standard encryption and compliance protocols to protect your documents and data related to or 18 wc transactions.

-

Can airSlate SignNow integrate with other software for or 18 wc?

Yes, airSlate SignNow supports numerous integrations with popular business applications, making it easy to incorporate or 18 wc into your existing workflows. This ensures a seamless transition and enhanced productivity.

-

What are the benefits of using airSlate SignNow for or 18 wc?

Using airSlate SignNow for or 18 wc enables you to automate your document workflows, reducing turnaround time and enhancing efficiency. It simplifies eSigning while improving collaboration among team members.

-

Is there a trial period available for testing airSlate SignNow with or 18 wc?

Absolutely! We offer a free trial period for businesses interested in testing airSlate SignNow with or 18 wc documentation. This allows you to experience the platform and its features without any commitment.

Get more for Form OR 18, Tax Payments On Real Property Conveyances

- Unconditional waiver and release of claim of lien upon progress payment rhode island form

- Quitclaim deed by two individuals to corporation rhode island form

- Rhode island warranty form

- Rhode island disclaimer 497325071 form

- Rhode island claim file form

- Quitclaim deed from individual to corporation rhode island form

- Warranty deed from individual to corporation rhode island form

- Ri waiver form

Find out other Form OR 18, Tax Payments On Real Property Conveyances

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word

- How Do I Electronic signature Florida Car Dealer Document

- Help Me With Electronic signature Florida Car Dealer Presentation

- Can I Electronic signature Georgia Car Dealer PDF

- How Do I Electronic signature Georgia Car Dealer Document