OregonInternal Revenue Service 2024-2026

What is the Oregon WC Tax?

The Oregon WC Tax, or Workers' Compensation Tax, is a tax imposed on employers in the state of Oregon. This tax is used to fund the workers' compensation system, which provides benefits to employees who suffer work-related injuries or illnesses. The tax is calculated based on the employer's payroll and is essential for maintaining the safety net for injured workers.

Steps to Complete the Oregon WC Tax Form

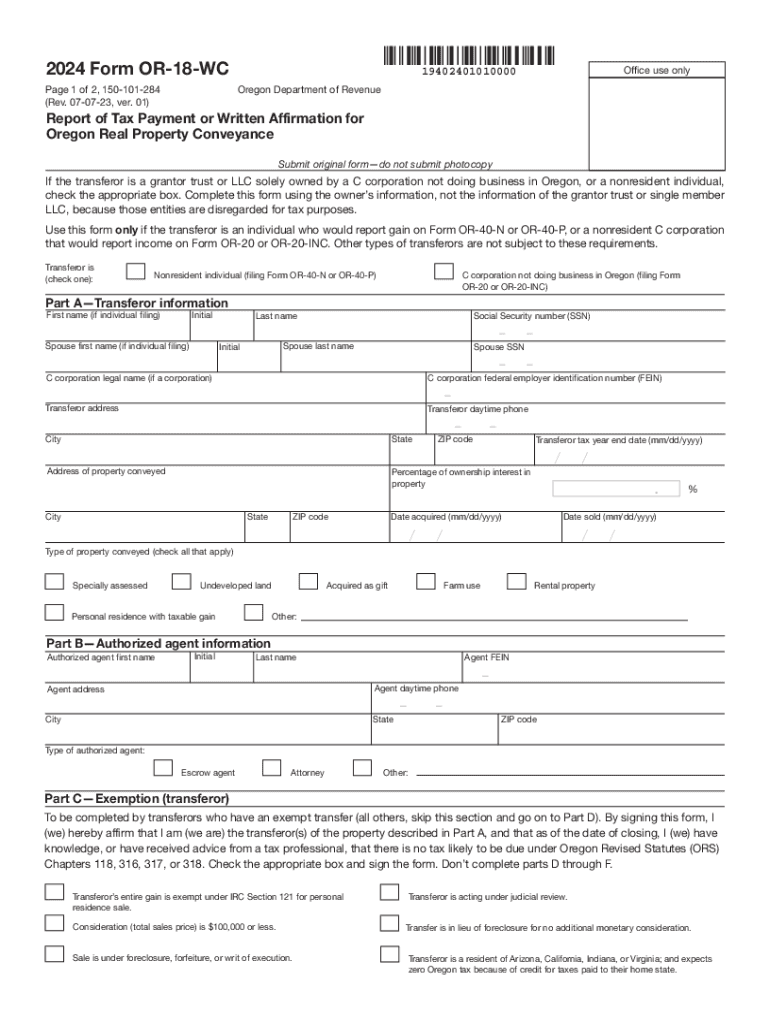

Completing the Oregon WC Tax form involves several key steps:

- Gather necessary information, including your business details and employee payroll data.

- Access the appropriate form, typically the Oregon Form 18 WC.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the form by the designated deadline to avoid penalties.

Required Documents for Oregon WC Tax Filing

When filing the Oregon WC Tax, certain documents are necessary to ensure compliance:

- Employee payroll records for the reporting period.

- Previous tax filings, if applicable, to provide context and continuity.

- Any correspondence from the Oregon Department of Consumer and Business Services regarding your account.

Filing Deadlines for Oregon WC Tax

It is crucial to be aware of the filing deadlines for the Oregon WC Tax to avoid penalties. Typically, employers must file their tax returns quarterly. The deadlines are as follows:

- First quarter: April 30

- Second quarter: July 31

- Third quarter: October 31

- Fourth quarter: January 31 of the following year

Penalties for Non-Compliance with Oregon WC Tax

Failure to comply with Oregon WC Tax regulations can result in significant penalties. Employers may face fines for late submissions or inaccuracies in reporting. Additionally, non-compliance can lead to increased scrutiny from the Oregon Department of Consumer and Business Services, potentially resulting in further legal complications.

Who Issues the Oregon WC Tax Form?

The Oregon WC Tax form is issued by the Oregon Department of Consumer and Business Services. This department oversees the workers' compensation system in Oregon and provides essential resources and guidance for employers to ensure compliance with state regulations.

Create this form in 5 minutes or less

Find and fill out the correct oregoninternal revenue service

Create this form in 5 minutes!

How to create an eSignature for the oregoninternal revenue service

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to or 18 wc?

airSlate SignNow is a powerful eSignature solution that allows businesses to send and sign documents electronically. It streamlines the signing process, making it efficient and cost-effective, especially for those looking for solutions like or 18 wc. With its user-friendly interface, you can easily manage your documents and signatures.

-

How much does airSlate SignNow cost for users interested in or 18 wc?

The pricing for airSlate SignNow is competitive and designed to fit various business needs, including those seeking or 18 wc solutions. Plans typically start at a low monthly fee, with options for additional features and integrations. This makes it an affordable choice for businesses of all sizes.

-

What features does airSlate SignNow offer that support or 18 wc?

airSlate SignNow includes a range of features that enhance document management, such as customizable templates, real-time tracking, and secure cloud storage. These features are particularly beneficial for users looking for or 18 wc solutions, as they simplify the signing process and improve workflow efficiency.

-

Can airSlate SignNow integrate with other tools for or 18 wc users?

Yes, airSlate SignNow offers seamless integrations with various applications, making it ideal for users interested in or 18 wc. Whether you need to connect with CRM systems, cloud storage, or productivity tools, airSlate SignNow can enhance your existing workflows and improve overall productivity.

-

What are the benefits of using airSlate SignNow for or 18 wc?

Using airSlate SignNow provides numerous benefits for businesses looking for or 18 wc solutions. It not only saves time and reduces paperwork but also enhances security and compliance with legally binding eSignatures. This ensures that your documents are handled efficiently and securely.

-

Is airSlate SignNow suitable for small businesses interested in or 18 wc?

Absolutely! airSlate SignNow is designed to cater to businesses of all sizes, including small businesses seeking or 18 wc solutions. Its affordability and ease of use make it an ideal choice for small teams looking to streamline their document signing processes without breaking the bank.

-

How does airSlate SignNow ensure the security of documents related to or 18 wc?

airSlate SignNow prioritizes security by employing advanced encryption and authentication measures to protect your documents. For users focused on or 18 wc, this means that your sensitive information remains confidential and secure throughout the signing process, ensuring peace of mind.

Get more for OregonInternal Revenue Service

- Wi tenant landlord 497430615 form

- Temporary lease agreement to prospective buyer of residence prior to closing wisconsin form

- Letter from tenant to landlord containing notice to landlord to cease retaliatory threats to evict or retaliatory eviction 497430617 form

- Letter from landlord to tenant returning security deposit less deductions wisconsin form

- Letter from tenant to landlord containing notice of failure to return security deposit and demand for return wisconsin form

- Letter from tenant to landlord containing notice of wrongful deductions from security deposit and demand for return wisconsin form

- Letter from tenant to landlord containing request for permission to sublease wisconsin form

- Letter from landlord to tenant that sublease granted rent paid by subtenant but tenant still liable for rent and damages 497430622 form

Find out other OregonInternal Revenue Service

- How To Sign New York Amendment to an LLC Operating Agreement

- Sign Washington Amendment to an LLC Operating Agreement Now

- Can I Sign Wyoming Amendment to an LLC Operating Agreement

- How To Sign California Stock Certificate

- Sign Louisiana Stock Certificate Free

- Sign Maine Stock Certificate Simple

- Sign Oregon Stock Certificate Myself

- Sign Pennsylvania Stock Certificate Simple

- How Do I Sign South Carolina Stock Certificate

- Sign New Hampshire Terms of Use Agreement Easy

- Sign Wisconsin Terms of Use Agreement Secure

- Sign Alabama Affidavit of Identity Myself

- Sign Colorado Trademark Assignment Agreement Online

- Can I Sign Connecticut Affidavit of Identity

- Can I Sign Delaware Trademark Assignment Agreement

- How To Sign Missouri Affidavit of Identity

- Can I Sign Nebraska Affidavit of Identity

- Sign New York Affidavit of Identity Now

- How Can I Sign North Dakota Affidavit of Identity

- Sign Oklahoma Affidavit of Identity Myself