Personal Tax Payment Voucher for Form 502505, Estimated Tax 2022

What is the Personal Tax Payment Voucher for Form 502505, Estimated Tax

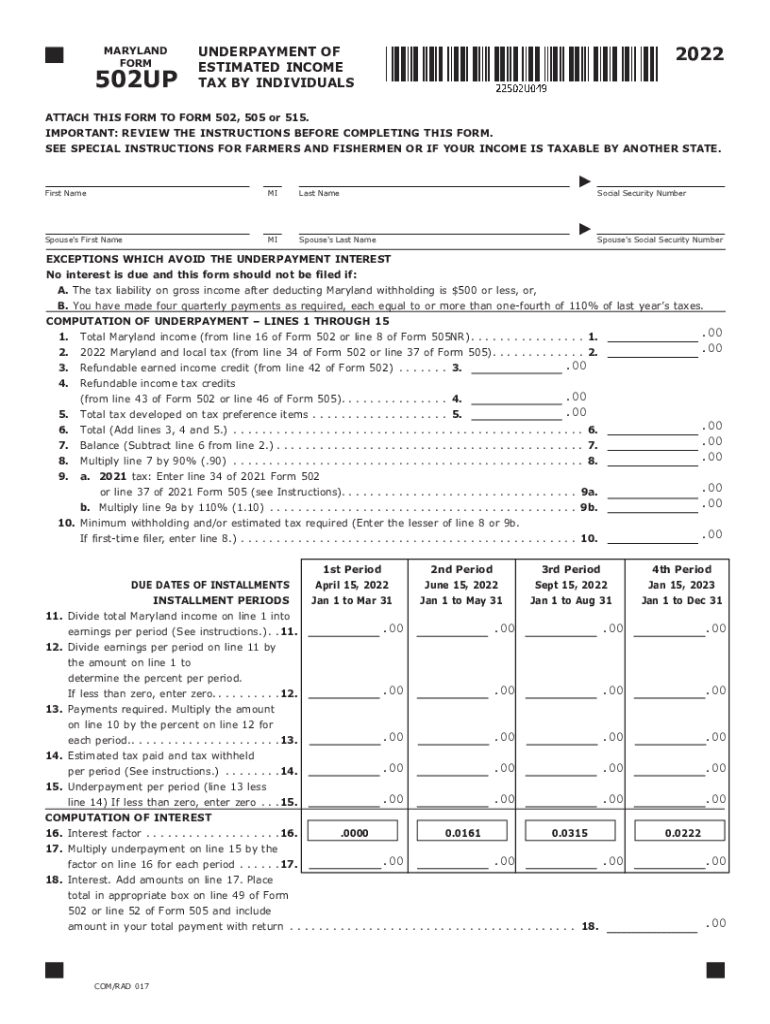

The Personal Tax Payment Voucher for Form 502505 is a crucial document for Maryland taxpayers who need to make estimated tax payments. This voucher is specifically designed for individuals who expect to owe tax of $500 or more when filing their Maryland income tax return. It serves as a means to facilitate timely payments throughout the year, helping taxpayers avoid penalties and interest associated with underpayment. By utilizing this voucher, individuals can ensure that their estimated tax payments are accurately recorded and applied to their tax obligations.

Steps to Complete the Personal Tax Payment Voucher for Form 502505, Estimated Tax

Completing the Personal Tax Payment Voucher for Form 502505 involves several straightforward steps:

- Obtain the form from the Maryland State Comptroller's website or through authorized tax preparation services.

- Fill in your personal information, including your name, address, and Social Security number.

- Indicate the amount of estimated tax you are paying with this voucher.

- Sign and date the voucher to certify that the information provided is accurate.

- Submit the voucher along with your payment, either online or by mailing it to the appropriate address.

How to Obtain the Personal Tax Payment Voucher for Form 502505, Estimated Tax

To obtain the Personal Tax Payment Voucher for Form 502505, taxpayers can visit the Maryland State Comptroller's website, where the form is available for download. Additionally, tax professionals and accountants can provide access to this form as part of their services. It is important to ensure that you are using the most current version of the voucher for the tax year to avoid any compliance issues.

Legal Use of the Personal Tax Payment Voucher for Form 502505, Estimated Tax

The Personal Tax Payment Voucher for Form 502505 is legally binding when completed and submitted according to Maryland tax laws. To ensure its validity, taxpayers must adhere to the guidelines set forth by the Maryland Comptroller's office, including accurate completion of the form and timely submission of payments. This voucher can be used as evidence of payment in case of any disputes with tax authorities.

Filing Deadlines / Important Dates

Taxpayers must be aware of the filing deadlines associated with the Personal Tax Payment Voucher for Form 502505. Estimated tax payments are typically due on the 15th of April, June, September, and January of the following year. Missing these deadlines can result in penalties and interest, so it is crucial to plan ahead and ensure timely submission of both the voucher and payment.

Form Submission Methods (Online / Mail / In-Person)

The Personal Tax Payment Voucher for Form 502505 can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online submission through the Maryland Comptroller's e-services portal, which allows for immediate processing.

- Mailing the completed voucher along with payment to the designated address provided on the form.

- In-person submission at local Comptroller offices, where taxpayers can receive immediate assistance.

Quick guide on how to complete personal tax payment voucher for form 502505 estimated tax

Effortlessly Prepare Personal Tax Payment Voucher For Form 502505, Estimated Tax on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an excellent environmentally friendly alternative to conventional printed and signed paperwork, as you can easily locate the necessary form and securely store it online. airSlate SignNow provides all the tools required to swiftly create, modify, and eSign your documents without delays. Handle Personal Tax Payment Voucher For Form 502505, Estimated Tax on any platform with airSlate SignNow's Android or iOS applications and enhance any document-based task today.

How to Modify and eSign Personal Tax Payment Voucher For Form 502505, Estimated Tax with Ease

- Obtain Personal Tax Payment Voucher For Form 502505, Estimated Tax and then click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and then click on the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, frustrating form searching, or mistakes that necessitate printing new document copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you choose. Modify and eSign Personal Tax Payment Voucher For Form 502505, Estimated Tax and ensure exceptional communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct personal tax payment voucher for form 502505 estimated tax

Create this form in 5 minutes!

How to create an eSignature for the personal tax payment voucher for form 502505 estimated tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are Maryland estimated tax vouchers 2023?

Maryland estimated tax vouchers 2023 are forms used by individuals and businesses to make quarterly estimated tax payments to the state of Maryland. These vouchers help taxpayers prepay their income tax obligations, ensuring they stay compliant and avoid penalties. The forms include specific instructions on how much to pay and when to submit the payments.

-

How can I obtain Maryland estimated tax vouchers 2023?

You can obtain Maryland estimated tax vouchers 2023 from the Maryland Comptroller's website or through your tax professional. The vouchers can typically be downloaded in PDF format, allowing you to print and fill them out for submission. It's essential to check for the latest versions each tax year to ensure compliance.

-

What is the deadline for submitting Maryland estimated tax vouchers 2023?

The deadlines for submitting Maryland estimated tax vouchers 2023 generally fall on April 15, June 15, September 15, and January 15 of the following year. Missing these deadlines can result in penalties and interest on any unpaid tax. Always verify the dates on the official Maryland Comptroller's website to avoid late fees.

-

How can airSlate SignNow help with Maryland estimated tax vouchers 2023?

AirSlate SignNow offers an efficient solution to electronically sign and submit your Maryland estimated tax vouchers 2023. This not only saves time but also ensures your documents are securely processed. By using SignNow, you can streamline your tax management and maintain a digital record of all filings.

-

Are there any fees associated with using Maryland estimated tax vouchers 2023?

There are typically no fees specifically associated with the Maryland estimated tax vouchers 2023 themselves, but taxpayers must pay their estimated taxes by the due dates to avoid penalties. If you're using a service like airSlate SignNow, there may be a subscription or usage fee for accessing their eSigning features. It's best to review all potential costs before making a decision.

-

What features does airSlate SignNow offer for tax document management?

AirSlate SignNow provides a range of features for managing tax documents like Maryland estimated tax vouchers 2023, including eSignature capabilities, document templates, and secure storage. You can easily send, receive, and track the status of your documents, ensuring efficient communication during tax season. These features enhance overall productivity while maintaining compliance.

-

Can I integrate airSlate SignNow with my accounting software for Maryland estimated tax vouchers 2023?

Yes, airSlate SignNow offers integrations with various accounting software solutions to facilitate the management of Maryland estimated tax vouchers 2023. By connecting SignNow with your existing tools, you can automate the process of generating and sending tax documents, reducing manual input and errors. Check the integrations available to see if it suits your needs.

Get more for Personal Tax Payment Voucher For Form 502505, Estimated Tax

- Postnuptial agreements package rhode island form

- Letters of recommendation package rhode island form

- Ri lien 497325410 form

- Ri corporation 497325411 form

- Storage business package rhode island form

- Child care services package rhode island form

- Special or limited power of attorney for real estate sales transaction by seller rhode island form

- Special or limited power of attorney for real estate purchase transaction by purchaser rhode island form

Find out other Personal Tax Payment Voucher For Form 502505, Estimated Tax

- Can I eSign Washington Charity LLC Operating Agreement

- eSign Wyoming Charity Living Will Simple

- eSign Florida Construction Memorandum Of Understanding Easy

- eSign Arkansas Doctors LLC Operating Agreement Free

- eSign Hawaii Construction Lease Agreement Mobile

- Help Me With eSign Hawaii Construction LLC Operating Agreement

- eSign Hawaii Construction Work Order Myself

- eSign Delaware Doctors Quitclaim Deed Free

- eSign Colorado Doctors Operating Agreement Computer

- Help Me With eSign Florida Doctors Lease Termination Letter

- eSign Florida Doctors Lease Termination Letter Myself

- eSign Hawaii Doctors Claim Later

- eSign Idaho Construction Arbitration Agreement Easy

- eSign Iowa Construction Quitclaim Deed Now

- How Do I eSign Iowa Construction Quitclaim Deed

- eSign Louisiana Doctors Letter Of Intent Fast

- eSign Maine Doctors Promissory Note Template Easy

- eSign Kentucky Construction Claim Online

- How Can I eSign Maine Construction Quitclaim Deed

- eSign Colorado Education Promissory Note Template Easy