TY 502UP TAX YEAR 502UP INDIVIDUAL TAXPAYER FORM 2020

What is the TY 502UP Tax Year 502UP Individual Taxpayer Form

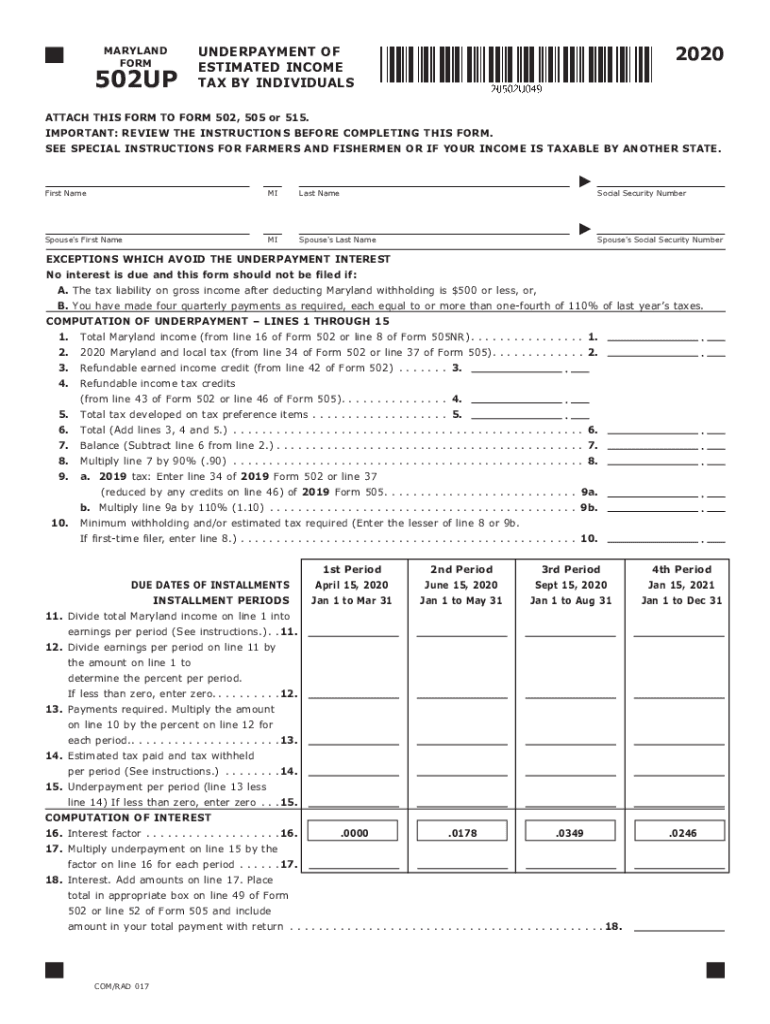

The TY 502UP is a specific tax form used by individuals in Maryland to report underpayment of state income tax. This form is essential for taxpayers who have not met their estimated tax payment obligations throughout the year. By utilizing the 502UP, individuals can accurately calculate their tax liability and ensure compliance with Maryland state tax regulations. Understanding the purpose of this form is crucial for maintaining good standing with the Maryland Comptroller's office.

Steps to Complete the TY 502UP Tax Year 502UP Individual Taxpayer Form

Completing the TY 502UP form involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements and previous tax returns. Next, follow these steps:

- Begin by entering your personal information, including your name, address, and Social Security number.

- Calculate your total income and any applicable deductions to determine your taxable income.

- Use the provided tables to find your estimated tax liability based on your income level.

- Compare your estimated tax liability to the amount you have already paid throughout the year to identify any underpayment.

- Complete the form by signing and dating it, ensuring all information is accurate.

Legal Use of the TY 502UP Tax Year 502UP Individual Taxpayer Form

The TY 502UP form is recognized as a legal document for reporting tax obligations in Maryland. To be considered valid, it must be completed accurately and submitted by the designated deadline. Compliance with state tax laws is critical, as failure to file or incorrect reporting can lead to penalties. The form must also be signed by the taxpayer, affirming that the information provided is true and correct to the best of their knowledge.

Filing Deadlines / Important Dates

Timely filing of the TY 502UP is essential to avoid penalties. The deadline for submitting the form typically aligns with the Maryland state tax filing deadline, which is usually April 15. However, if this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also be aware of any changes in deadlines due to state regulations or extensions that may be granted in special circumstances.

Required Documents

When completing the TY 502UP form, certain documents are necessary to ensure accurate reporting. These include:

- W-2 forms from employers showing total earnings.

- 1099 forms for any additional income received.

- Records of estimated tax payments made throughout the year.

- Documentation of any deductions or credits claimed.

Having these documents on hand will facilitate a smoother completion process and help prevent errors.

Who Issues the Form

The TY 502UP form is issued by the Maryland Comptroller's office. This state agency is responsible for tax collection and ensuring compliance with Maryland tax laws. Taxpayers can obtain the form directly from the Comptroller's website or through authorized tax preparation services. It is important to use the most current version of the form to ensure compliance with any updates to tax regulations.

Quick guide on how to complete ty 2020 502up tax year 2020 502up individual taxpayer form

Easily prepare TY 502UP TAX YEAR 502UP INDIVIDUAL TAXPAYER FORM on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can access the appropriate form and securely save it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents swiftly without any delays. Manage TY 502UP TAX YEAR 502UP INDIVIDUAL TAXPAYER FORM on any device using the airSlate SignNow applications available for Android and iOS, and simplify any document-related process today.

Effortlessly modify and eSign TY 502UP TAX YEAR 502UP INDIVIDUAL TAXPAYER FORM

- Obtain TY 502UP TAX YEAR 502UP INDIVIDUAL TAXPAYER FORM and select Get Form to begin.

- Utilize the tools we offer to complete your document.

- Mark pertinent sections of your documents or obscure sensitive information with tools provided by airSlate SignNow specifically for this purpose.

- Generate your signature using the Sign feature, which takes seconds and holds the same legal validity as a conventional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method for sharing your form, via email, text message (SMS), or an invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, cumbersome form navigation, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign TY 502UP TAX YEAR 502UP INDIVIDUAL TAXPAYER FORM and guarantee exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ty 2020 502up tax year 2020 502up individual taxpayer form

Create this form in 5 minutes!

How to create an eSignature for the ty 2020 502up tax year 2020 502up individual taxpayer form

The way to create an eSignature for your PDF file online

The way to create an eSignature for your PDF file in Google Chrome

The best way to make an eSignature for signing PDFs in Gmail

How to create an eSignature right from your mobile device

The best way to generate an electronic signature for a PDF file on iOS

How to create an eSignature for a PDF on Android devices

People also ask

-

What is 502up and how does it relate to airSlate SignNow?

502up refers to airSlate SignNow's robust electronic signature solution that simplifies the process of signing documents. With 502up, users can securely send and eSign documents from anywhere, enhancing productivity and streamlining workflows.

-

What features does 502up offer for document management?

502up offers a comprehensive set of features including document templates, customizable workflows, and real-time tracking. These features enable businesses to manage documents efficiently and ensure that all signatures are collected in a timely manner.

-

How much does the 502up solution cost?

The pricing for 502up varies based on the plan you choose, catering to different business needs. airSlate SignNow offers competitive pricing tailored to help organizations efficiently budget for their document management solutions.

-

What are the benefits of using 502up for businesses?

By adopting 502up, businesses can reduce turnaround times for document signing, improve compliance through secure eSignatures, and enhance customer satisfaction. The solution’s user-friendly interface also minimizes training time, allowing teams to get started quickly.

-

Can 502up integrate with other software solutions?

Yes, 502up offers integrations with various popular software applications such as CRM systems, project management tools, and cloud storage services. This allows for a seamless workflow and management of documents across platforms.

-

Is 502up secure for sensitive document signing?

Absolutely! 502up employs industry-standard encryption and complies with security regulations such as GDPR and eIDAS. This ensures that all your documents are handled with the highest level of security and confidentiality.

-

How does 502up enhance the signing experience for users?

502up enhances the signing experience by providing a simple and intuitive interface, allowing signers to electronically sign documents with ease. This results in higher engagement and quicker completion rates, ultimately improving overall workflow efficiency.

Get more for TY 502UP TAX YEAR 502UP INDIVIDUAL TAXPAYER FORM

Find out other TY 502UP TAX YEAR 502UP INDIVIDUAL TAXPAYER FORM

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- Can I Sign Colorado Banking PPT

- How Do I Sign Idaho Banking Presentation

- Can I Sign Indiana Banking Document

- How Can I Sign Indiana Banking PPT

- How To Sign Maine Banking PPT

- Help Me With Sign Massachusetts Banking Presentation

- Can I Sign Michigan Banking PDF