UNDERPAYMENT of ESTIMATED MARYLAND INCOME TAX by INDIVIDUALS FORM 502UP ATTACH THIS FORM to FORM 502, 503 or 2010

What is the Underpayment of Estimated Maryland Income Tax by Individuals Form 502UP?

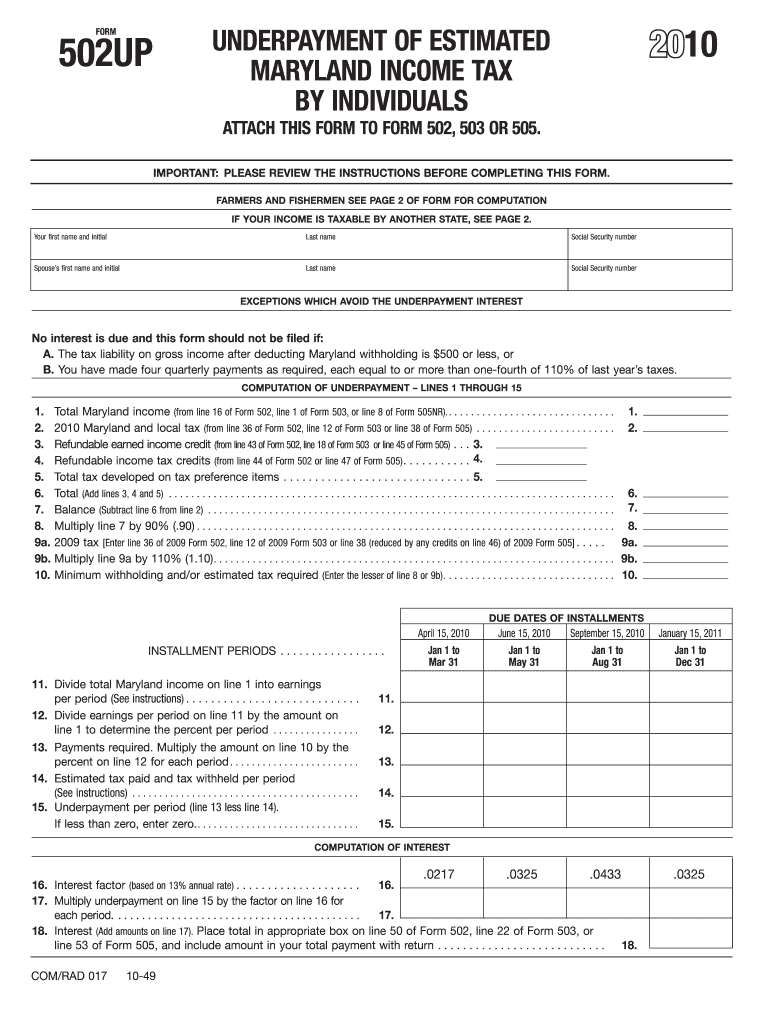

The Underpayment of Estimated Maryland Income Tax by Individuals Form 502UP is a tax form used by Maryland residents to report any underpayment of estimated income tax. This form must be attached to either Form 502 or Form 503 when filing state income taxes. It is crucial for individuals who have not paid enough estimated tax throughout the year to ensure compliance with Maryland tax regulations. Completing this form accurately helps avoid penalties and ensures that taxpayers meet their obligations to the state.

Steps to Complete the Underpayment of Estimated Maryland Income Tax by Individuals Form 502UP

To complete the Underpayment of Estimated Maryland Income Tax by Individuals Form 502UP, follow these steps:

- Gather your financial documents, including income statements and previous tax returns.

- Calculate your total estimated income tax liability for the year.

- Determine the amount of estimated tax payments you have made.

- Fill out the form by providing the necessary information, including your personal details and tax calculations.

- Review the completed form for accuracy before submission.

Once completed, attach Form 502UP to your main tax form and submit it according to state guidelines.

How to Obtain the Underpayment of Estimated Maryland Income Tax by Individuals Form 502UP

The Underpayment of Estimated Maryland Income Tax by Individuals Form 502UP can be obtained from the Maryland State Comptroller's website. It is available as a downloadable PDF, which can be printed and filled out manually or completed digitally. Additionally, many tax preparation software programs include this form, allowing for easier completion and submission.

State-Specific Rules for the Underpayment of Estimated Maryland Income Tax by Individuals Form 502UP

Maryland has specific rules regarding the underpayment of estimated income tax. Taxpayers are required to make estimated payments if they expect to owe a certain amount in taxes. The state typically requires individuals to pay at least 90% of their current year's tax liability or 110% of the previous year's tax liability to avoid penalties. Understanding these rules is essential for accurate reporting and compliance.

Penalties for Non-Compliance with the Underpayment of Estimated Maryland Income Tax

Failure to file the Underpayment of Estimated Maryland Income Tax by Individuals Form 502UP or to pay the required estimated taxes can result in penalties. Maryland may impose a penalty based on the amount of underpayment, which can accumulate over time. To avoid these penalties, it is important to stay informed about tax obligations and ensure timely and accurate submissions.

Form Submission Methods for the Underpayment of Estimated Maryland Income Tax by Individuals Form 502UP

The Underpayment of Estimated Maryland Income Tax by Individuals Form 502UP can be submitted in several ways. Taxpayers can file the form electronically through approved tax software, which simplifies the process and ensures compliance with state requirements. Alternatively, the form can be mailed to the appropriate state tax office or submitted in person at designated locations. Choosing the right submission method can enhance efficiency and accuracy in tax reporting.

Quick guide on how to complete 2010 underpayment of estimated maryland income tax by individuals form 502up attach this form to form 502 503 or

Your assistance manual on how to prepare your UNDERPAYMENT OF ESTIMATED MARYLAND INCOME TAX BY INDIVIDUALS FORM 502UP ATTACH THIS FORM TO FORM 502, 503 OR

If you’re looking to learn how to complete and submit your UNDERPAYMENT OF ESTIMATED MARYLAND INCOME TAX BY INDIVIDUALS FORM 502UP ATTACH THIS FORM TO FORM 502, 503 OR, here are some brief guidelines on how to simplify tax submissions.

To start, you simply need to set up your airSlate SignNow profile to transform your handling of documents online. airSlate SignNow is a user-friendly and robust document solution that enables you to modify, generate, and finalize your tax forms effortlessly. Utilizing its editor, you can alternate between text, check boxes, and eSignatures, returning to modify responses as necessary. Enhance your tax management with advanced PDF editing, eSigning, and seamless sharing.

Adhere to the steps outlined below to complete your UNDERPAYMENT OF ESTIMATED MARYLAND INCOME TAX BY INDIVIDUALS FORM 502UP ATTACH THIS FORM TO FORM 502, 503 OR in just minutes:

- Create your account and start working on PDFs within moments.

- Utilize our catalog to obtain any IRS tax form; examine various versions and schedules.

- Click Get form to access your UNDERPAYMENT OF ESTIMATED MARYLAND INCOME TAX BY INDIVIDUALS FORM 502UP ATTACH THIS FORM TO FORM 502, 503 OR in our editor.

- Fill out the mandatory fields with your information (text, numbers, check marks).

- Employ the Sign Tool to insert your legally-binding eSignature (if necessary).

- Examine your document and correct any mistakes.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to file your taxes electronically with airSlate SignNow. Please be aware that filing on paper can lead to return errors and delay refunds. Before e-filing your taxes, ensure to check the IRS website for filing guidelines in your state.

Create this form in 5 minutes or less

Find and fill out the correct 2010 underpayment of estimated maryland income tax by individuals form 502up attach this form to form 502 503 or

Create this form in 5 minutes!

How to create an eSignature for the 2010 underpayment of estimated maryland income tax by individuals form 502up attach this form to form 502 503 or

How to create an eSignature for your 2010 Underpayment Of Estimated Maryland Income Tax By Individuals Form 502up Attach This Form To Form 502 503 Or online

How to create an eSignature for your 2010 Underpayment Of Estimated Maryland Income Tax By Individuals Form 502up Attach This Form To Form 502 503 Or in Chrome

How to generate an electronic signature for signing the 2010 Underpayment Of Estimated Maryland Income Tax By Individuals Form 502up Attach This Form To Form 502 503 Or in Gmail

How to generate an electronic signature for the 2010 Underpayment Of Estimated Maryland Income Tax By Individuals Form 502up Attach This Form To Form 502 503 Or from your mobile device

How to create an electronic signature for the 2010 Underpayment Of Estimated Maryland Income Tax By Individuals Form 502up Attach This Form To Form 502 503 Or on iOS

How to generate an electronic signature for the 2010 Underpayment Of Estimated Maryland Income Tax By Individuals Form 502up Attach This Form To Form 502 503 Or on Android devices

People also ask

-

What is the UNDERPAYMENT OF ESTIMATED MARYLAND INCOME TAX BY INDIVIDUALS FORM 502UP?

The UNDERPAYMENT OF ESTIMATED MARYLAND INCOME TAX BY INDIVIDUALS FORM 502UP is a tax form used to report any underpayment of estimated income tax owed by individuals in Maryland. It is crucial to attach this form to FORM 502 or FORM 503 to ensure your tax filings are complete and accurate.

-

How do I fill out the UNDERPAYMENT OF ESTIMATED MARYLAND INCOME TAX BY INDIVIDUALS FORM 502UP?

Filling out the UNDERPAYMENT OF ESTIMATED MARYLAND INCOME TAX BY INDIVIDUALS FORM 502UP involves gathering your income data and any previous payments made. Carefully follow the instructions provided on the form, and ensure it's attached to FORM 502 or FORM 503 before submission to avoid penalties.

-

What are the benefits of using airSlate SignNow for submitting the UNDERPAYMENT OF ESTIMATED MARYLAND INCOME TAX BY INDIVIDUALS FORM 502UP?

Using airSlate SignNow streamlines the process of submitting the UNDERPAYMENT OF ESTIMATED MARYLAND INCOME TAX BY INDIVIDUALS FORM 502UP by allowing you to securely eSign and send documents seamlessly. This not only saves time but also enhances document management and ensures compliance.

-

Is there a cost associated with using airSlate SignNow for tax form submissions?

Yes, airSlate SignNow offers a variety of pricing plans to cater to different business needs. The cost-effective solution provides all the necessary tools for sending and eSigning documents, including the UNDERPAYMENT OF ESTIMATED MARYLAND INCOME TAX BY INDIVIDUALS FORM 502UP.

-

Can I track the status of my UNDERPAYMENT OF ESTIMATED MARYLAND INCOME TAX BY INDIVIDUALS FORM 502UP once submitted?

Yes, airSlate SignNow allows you to track the status of your submitted documents, including the UNDERPAYMENT OF ESTIMATED MARYLAND INCOME TAX BY INDIVIDUALS FORM 502UP. You can receive notifications upon completion and access records at any time.

-

Does airSlate SignNow integrate with other applications for tax purposes?

Absolutely! airSlate SignNow integrates with numerous applications, enhancing your workflow for tax-related paperwork, including the UNDERPAYMENT OF ESTIMATED MARYLAND INCOME TAX BY INDIVIDUALS FORM 502UP. This integration supports a seamless experience, allowing you to manage all your documents efficiently.

-

What documents do I need to attach with the UNDERPAYMENT OF ESTIMATED MARYLAND INCOME TAX BY INDIVIDUALS FORM 502UP?

When submitting the UNDERPAYMENT OF ESTIMATED MARYLAND INCOME TAX BY INDIVIDUALS FORM 502UP, you must attach it to either FORM 502 or FORM 503, depending on your filing situation. Ensure all relevant income documentation and previous estimated tax payments are included for accurate processing.

Get more for UNDERPAYMENT OF ESTIMATED MARYLAND INCOME TAX BY INDIVIDUALS FORM 502UP ATTACH THIS FORM TO FORM 502, 503 OR

- Temporary guardian legal form

- Dc bankruptcy online form

- Bill of sale with warranty by individual seller district of columbia form

- Bill of sale with warranty for corporate seller district of columbia form

- Bill of sale without warranty by individual seller district of columbia form

- Bill of sale without warranty by corporate seller district of columbia form

- Chapter 13 plan form

- District of columbia interest form

Find out other UNDERPAYMENT OF ESTIMATED MARYLAND INCOME TAX BY INDIVIDUALS FORM 502UP ATTACH THIS FORM TO FORM 502, 503 OR

- eSign Tennessee Police Cease And Desist Letter Now

- Help Me With eSign Texas Police Promissory Note Template

- eSign Utah Police LLC Operating Agreement Online

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed

- eSignature Arizona Banking Moving Checklist Secure

- eSignature California Banking Warranty Deed Later

- eSignature Alabama Business Operations Cease And Desist Letter Now

- How To eSignature Iowa Banking Quitclaim Deed

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself