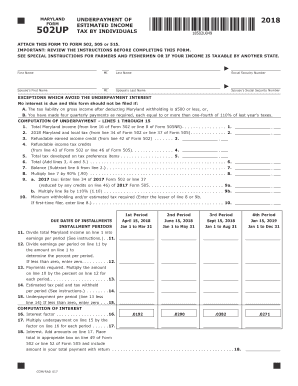

Md 502up Form 2018

What is the Md 502up Form

The Md 502up form, also known as the Maryland estimated income tax form, is a crucial document for individuals and businesses in Maryland who expect to owe tax of $500 or more when they file their annual tax return. This form allows taxpayers to estimate their tax liability and make quarterly payments throughout the year. By using the Md 502up form, taxpayers can avoid penalties for underpayment and ensure they meet their tax obligations in a timely manner.

How to use the Md 502up Form

Using the Md 502up form involves several steps to accurately estimate your tax liability. First, gather your financial information, including income sources and deductions. Next, follow the instructions provided on the form to calculate your estimated tax based on your expected income for the year. After completing the calculations, submit the form along with your estimated tax payments by the specified deadlines. This proactive approach helps maintain compliance with Maryland tax regulations.

Steps to complete the Md 502up Form

Completing the Md 502up form requires careful attention to detail. Begin by entering your personal information, including your name, address, and Social Security number. Then, proceed to estimate your total income for the year, factoring in any deductions or credits you may qualify for. Calculate your estimated tax liability based on the provided tax rates. Finally, review your entries for accuracy before submitting the form along with your payment. Ensure that you keep a copy for your records.

Filing Deadlines / Important Dates

Filing deadlines for the Md 502up form are critical to avoid penalties. Typically, estimated tax payments are due quarterly, with deadlines falling on April 15, June 15, September 15, and January 15 of the following year. It is essential to adhere to these dates to ensure compliance with Maryland tax laws. Mark these deadlines on your calendar to stay organized and avoid any last-minute rush.

Legal use of the Md 502up Form

The Md 502up form is legally recognized by the state of Maryland as a valid means for taxpayers to report estimated income tax. It is important to fill out this form accurately and submit it on time to avoid penalties for non-compliance. The form must be signed and dated by the taxpayer, affirming that the information provided is true and complete to the best of their knowledge.

Who Issues the Form

The Md 502up form is issued by the Maryland Comptroller's Office, which is responsible for the administration of tax laws in the state. This office provides the necessary forms and guidance for taxpayers to ensure they meet their tax obligations. For any questions or clarifications regarding the form, taxpayers can contact the Comptroller's Office directly for assistance.

Required Documents

To complete the Md 502up form, taxpayers need to gather several documents. Essential documents include prior year tax returns, W-2 forms, 1099 forms, and any records of deductions or credits. Having these documents on hand will facilitate accurate calculations of estimated income and tax liability, helping to ensure compliance with state tax requirements.

Quick guide on how to complete maryland and underpayment of estimated income tax by individuals 2018 2019 form

Your assistance manual on how to prepare your Md 502up Form

If you wish to learn how to complete and submit your Md 502up Form, here are some brief instructions to simplify tax declaration.

To begin with, you simply need to sign up for your airSlate SignNow account to transform how you manage documents online. airSlate SignNow is an extremely intuitive and powerful document solution that enables you to modify, draft, and finalize your tax paperwork with ease. With its editor, you can alternate between text, checkboxes, and electronic signatures and return to edit information as necessary. Streamline your tax organization with enhanced PDF editing, eSigning, and straightforward sharing.

Follow the instructions below to complete your Md 502up Form in just a few minutes:

- Establish your account and begin working on PDFs in moments.

- Utilize our directory to obtain any IRS tax form; browse through versions and schedules.

- Click Get form to access your Md 502up Form within our editor.

- Complete the necessary fillable fields with your details (text, numbers, checkmarks).

- Utilize the Sign Tool to affix your legally-binding electronic signature (if necessary).

- Inspect your document and rectify any mistakes.

- Save modifications, print your copy, send it to your recipient, and download it to your device.

Refer to this guide to submit your taxes digitally using airSlate SignNow. Please keep in mind that filing on paper may lead to more errors and delayed refunds. Additionally, before e-filing your taxes, consult the IRS website for declaration regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct maryland and underpayment of estimated income tax by individuals 2018 2019 form

FAQs

-

How can I file the income tax returns Form 16 for the year of 2017–2018 and 2018–2019? Is there any chance, with a late fee?

No, you can’t file ITR for AY:2017–18 & 2018–19 as the due date for filing ITR is over i.e 31st March 2019.But you can apply for condonation of delay in filing ITR with reasons to CIT. Once the condonation is accepted you can file but it is a complex process.For specific clarifications / legal advice feel free to write to dsssvtax[at]gmail or call/WhatsApp: 9052535440.

-

How can I fill out the details of my PPF and LIC in income tax return along with Form 16 details?

PPF contribution and LIC premium paid is shown under section 80C deductions ( chapter VIA deduction) in ITR.However total limit under 80C is 1.5L.( I am assuming that you have referred to investments made -ppf/LIC and not withdrawals (income)from the same).Regards.

-

How much will a doctor with a physical disability and annual net income of around Rs. 2.8 lakhs pay in income tax? Which ITR form is to be filled out?

For disability a deduction of ₹75,000/- is available u/s 80U.Rebate u/s87AFor AY 17–18, rebate was ₹5,000/- or income tax which ever is lower for person with income less than ₹5,00,000/-For AY 18–19, rebate is ₹2,500/- or income tax whichever is lower for person with income less than 3,50,000/-So, for an income of 2.8 lakhs, taxable income after deduction u/s 80U will remain ₹2,05,000/- which is below the slab rate and hence will not be taxable for any of the above said AY.For ITR,If doctor is practicing himself i.e. He has a professional income than ITR 4 should be filedIf doctor is getting any salary than ITR 1 should be filed.:)

-

If poker is your only profession and you have no other sources of income, how do you pay taxes for that in India? Which ITR forms should I fill out?

As per Section 115BB of the Income tax Act, 1961 any income of winnings from any lottery or crossword puzzle or race including horse race or card game and other game of any sort or from gambling or betting of any form or nature whatsoever (which includes income from poker) is taxable at 30% plus education cess of 3% (Total 30.9%). There is not benefit of basic exemption limit but Chapter VIA deductions are available i.e. section 80C, 80 D and other seciton 80- deductions. TDS is also deductible at 30%.

-

If our economy falls into recession in 2018 and 2019 and unemployment rises back to pre-Obama levels, how much of a tax cut will the top 1% need to get us out of it?

The premise of the question is faulty. The question asks “how much of a tax cut will the top 1% need to get us out of a recession later this year or early in 2019?Clearly, since we are not in a recession right now, the assumption is that the tax cuts recently enacted by the Trump administration will cause a recession in a few months or so. That is probably a good prediction. Reagan’s tax cuts for billionaires caused a recessionary economy. So did GW Bush’s tax cut swindle. There is no reason to presume that the most recent incarnation of Trickle Down economic voodoo will not have the same results that every previous tax cut policy has had. The US will almost certainly fall into a recession. The only question really is “when will it happen”, and “how deep will it be?”The fallacy of the question is in the assumption that once the economy goes into a recession thanks to tax cuts for billionaires, that more tax cuts for the richest billionaires will be the way to remedy the situation. You cannot enact tax cuts, that then go on to cause a recession, and then fix the recession with more of the policy that caused it in the first place.While there are no doubt many people who have been exposed for so long to Republican Trickle Down economic voodoo that they actually believe tax cuts will be good for the economy, the fact is that you don’t fix a problem by increasing the policies that caused the problem in the first place.The real world doesn’t work that way.

-

Why should it be so complicated just figuring out how much tax to pay? (record keeping, software, filling out forms . . . many times cost much more than the amount of taxes due) The cost of compliance makes the U.S. uncompetitive and costs jobs and lowers our standard of living.

Taxes can be viewed as having 4 uses (or purposes) in our (and most) governments:Revenue generation (to pay for public services).Fiscal policy control (e.g., If the government wishes to reduce the money supply in order to reduce the risk of inflation, they can raise interest rates, sell fewer bonds, burn money, or raise taxes. In the last case, this represents excess tax revenue over the actual spending needs of the government).Wealth re-distribution. One argument for this is that the earnings of a country can be perceived as belonging to all of its citizens since the we all have a stake in the resources of the country (natural resources, and intangibles such as culture, good citizenship, civic duties). Without some tax policy complexity, the free market alone does not re-distribute wealth according to this "shared" resources concept. However, this steps into the boundary of Purpose # 4...A way to implement Social Policy (and similar government mandated policies, such as environmental policy, health policy, savings and debt policy, etc.). As Government spending can be use to implement policies (e.g., spending money on public health care, environmental cleanup, education, etc.), it is equivalent to provide tax breaks (income deductions or tax credits) for the private sector to act in certain ways -- e.g., spend money on R&D, pay for their own education or health care, avoid spending money on polluting cars by having a higher sales tax on these cars or offering a credit for trade-ins [ref: Cash for Clunkers]).Uses # 1 & 2 are rather straight-forward, and do not require a complex tax code to implement. Flat income and/or consumption (sales) taxes can easily be manipulated up or down overall for these top 2 uses. Furthermore, there is clarity when these uses are invoked. For spending, we publish a budget. For fiscal policy manipulation, the official economic agency (The Fed) publishes their outlook and agenda.Use # 3 is controversial because there is no Constitutional definition for the appropriate level of wealth re-distribution, and the very concept of wealth re-distribution is considered by some to be inappropriate and unconstitutional. Thus, the goal of wealth re-distribution is pretty much hidden in with the actions and policies of Use #4 (social policy manipulation).Use # 4, however, is where the complexity enters the Taxation system. Policy implementation through taxation (or through spending) occurs via legislation. Legislation (law making) is inherently complex and subject to gross manipulation by special interests during formation and amendments. Legislation is subject to interpretation, is prone to errors (leading to loopholes) and both unintentional or intentional (criminal / fraudulent) avoidance.The record keeping and forms referred to in the question are partially due to the basic formula for calculating taxes (i.e., percentage of income, cost of property, amount of purchase for a sales tax, ...). However, it is the complexity (and associated opportunities for exploitation) of taxation legislation for Use # 4 (Social Policy implementation) that naturally leads to complexity in the reporting requirements for the tax system.

Create this form in 5 minutes!

How to create an eSignature for the maryland and underpayment of estimated income tax by individuals 2018 2019 form

How to create an electronic signature for your Maryland And Underpayment Of Estimated Income Tax By Individuals 2018 2019 Form in the online mode

How to generate an eSignature for your Maryland And Underpayment Of Estimated Income Tax By Individuals 2018 2019 Form in Chrome

How to generate an electronic signature for signing the Maryland And Underpayment Of Estimated Income Tax By Individuals 2018 2019 Form in Gmail

How to make an electronic signature for the Maryland And Underpayment Of Estimated Income Tax By Individuals 2018 2019 Form straight from your smart phone

How to make an eSignature for the Maryland And Underpayment Of Estimated Income Tax By Individuals 2018 2019 Form on iOS devices

How to make an electronic signature for the Maryland And Underpayment Of Estimated Income Tax By Individuals 2018 2019 Form on Android

People also ask

-

What is form 502up and how does it work with airSlate SignNow?

Form 502up is a vital document for businesses that need to collect and store information efficiently. With airSlate SignNow, you can easily create, send, and eSign form 502up digitally, streamlining your document management processes.

-

How much does it cost to use airSlate SignNow for form 502up?

airSlate SignNow offers competitive pricing plans tailored to your needs for managing form 502up. You can choose from various subscription options that provide a cost-effective solution for businesses of all sizes.

-

What features does airSlate SignNow offer for completing form 502up?

airSlate SignNow provides features like customizable templates, automated workflows, and real-time tracking that enhance the efficiency of handling form 502up. These capabilities allow you to save time and reduce errors associated with manual data entry.

-

Can I integrate airSlate SignNow with other software while using form 502up?

Yes, airSlate SignNow supports integration with various third-party applications, ensuring seamless workflow management when dealing with form 502up. This allows you to connect your existing tools and enhance your productivity.

-

What are the benefits of using airSlate SignNow for form 502up?

Using airSlate SignNow for form 502up provides numerous benefits, including faster turnaround times, improved accuracy, and enhanced security. Businesses can ensure that their document management is efficient and compliant with industry standards.

-

Is it easy to eSign form 502up with airSlate SignNow?

Absolutely! airSlate SignNow simplifies the eSigning process for form 502up, allowing multiple signers to complete documents quickly and securely. The user-friendly interface makes it accessible for all users, regardless of technical skill.

-

How can I ensure my data is secure when using airSlate SignNow and form 502up?

airSlate SignNow prioritizes security for all documents, including form 502up. The platform employs advanced encryption methods and security protocols to protect your data from unauthorized access, ensuring peace of mind.

Get more for Md 502up Form

Find out other Md 502up Form

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF