Maryland and Underpayment of Estimated Income Tax by Individuals Form 2017

What is the Maryland And Underpayment Of Estimated Income Tax By Individuals Form

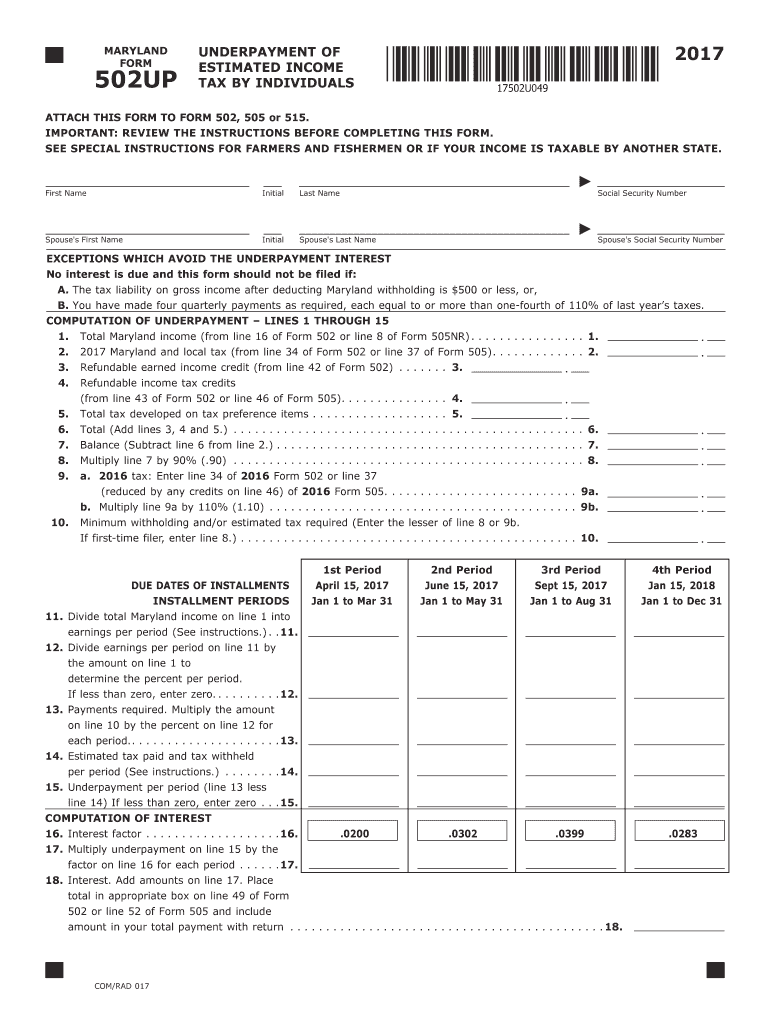

The Maryland And Underpayment Of Estimated Income Tax By Individuals Form is a tax document required for individuals who may not have paid enough tax throughout the year. This form is essential for those who need to report any underpayment of estimated income tax to the Maryland Comptroller's office. It helps ensure that taxpayers meet their state tax obligations and avoid potential penalties.

How to use the Maryland And Underpayment Of Estimated Income Tax By Individuals Form

To effectively use the Maryland And Underpayment Of Estimated Income Tax By Individuals Form, individuals should first gather their income information and any relevant tax documents. After obtaining the form, taxpayers must fill out the required fields, including their personal information and details about their income and tax payments. Once completed, the form can be submitted electronically or via mail, depending on the taxpayer's preference.

Steps to complete the Maryland And Underpayment Of Estimated Income Tax By Individuals Form

Completing the Maryland And Underpayment Of Estimated Income Tax By Individuals Form involves several steps:

- Gather necessary documents, such as W-2s, 1099s, and previous tax returns.

- Obtain the form from the Maryland Comptroller's website or through tax software.

- Fill in personal information, including name, address, and Social Security number.

- Report income and calculate any underpayment of estimated taxes.

- Review the form for accuracy and completeness.

- Submit the form electronically or mail it to the appropriate address.

Legal use of the Maryland And Underpayment Of Estimated Income Tax By Individuals Form

The Maryland And Underpayment Of Estimated Income Tax By Individuals Form is legally binding when filled out correctly and submitted on time. Taxpayers must ensure that all information provided is accurate to avoid legal repercussions. The form serves as a formal declaration of any underpayment and is subject to review by the Maryland Comptroller's office.

Filing Deadlines / Important Dates

Filing deadlines for the Maryland And Underpayment Of Estimated Income Tax By Individuals Form typically align with the state tax return deadlines. Taxpayers should be aware of the due dates for estimated tax payments, which are usually quarterly. Missing these deadlines may result in penalties and interest on unpaid taxes.

Penalties for Non-Compliance

Failure to submit the Maryland And Underpayment Of Estimated Income Tax By Individuals Form on time may lead to penalties. These penalties can include interest on the unpaid tax amount and additional fees for late filing. It is crucial for individuals to understand their tax obligations and file the form promptly to avoid these consequences.

Quick guide on how to complete maryland and underpayment of estimated income tax by individuals 2017 form

Your assistance manual on how to prepare your Maryland And Underpayment Of Estimated Income Tax By Individuals Form

If you're wondering how to finalize and submit your Maryland And Underpayment Of Estimated Income Tax By Individuals Form, here are a few brief guidelines on how to simplify tax filing.

To begin, all you need to do is create your airSlate SignNow profile to revolutionize how you manage documents online. airSlate SignNow is a very user-friendly and powerful document solution that enables you to modify, generate, and finalize your income tax files with ease. With its editor, you can alternate between text, checkboxes, and electronic signatures, and go back to amend details as necessary. Optimize your tax management with advanced PDF editing, eSigning, and user-friendly sharing features.

Follow these steps to complete your Maryland And Underpayment Of Estimated Income Tax By Individuals Form in no time:

- Establish your account and start working on PDFs almost instantly.

- Utilize our directory to find any IRS tax form; browse through different versions and schedules.

- Press Get form to access your Maryland And Underpayment Of Estimated Income Tax By Individuals Form in our editor.

- Populate the required fillable fields with your details (text, numbers, checkmarks).

- Employ the Sign Tool to insert your legally binding electronic signature (if necessary).

- Review your document and correct any mistakes.

- Save modifications, print your copy, send it to your recipient, and download it to your device.

Refer to this manual to submit your taxes electronically with airSlate SignNow. Be aware that filing on paper can lead to return errors and postpone refunds. Additionally, before e-filing your taxes, visit the IRS website for submission guidelines in your state.

Create this form in 5 minutes or less

Find and fill out the correct maryland and underpayment of estimated income tax by individuals 2017 form

FAQs

-

How can I fill out the details of my PPF and LIC in income tax return along with Form 16 details?

PPF contribution and LIC premium paid is shown under section 80C deductions ( chapter VIA deduction) in ITR.However total limit under 80C is 1.5L.( I am assuming that you have referred to investments made -ppf/LIC and not withdrawals (income)from the same).Regards.

-

How much will a doctor with a physical disability and annual net income of around Rs. 2.8 lakhs pay in income tax? Which ITR form is to be filled out?

For disability a deduction of ₹75,000/- is available u/s 80U.Rebate u/s87AFor AY 17–18, rebate was ₹5,000/- or income tax which ever is lower for person with income less than ₹5,00,000/-For AY 18–19, rebate is ₹2,500/- or income tax whichever is lower for person with income less than 3,50,000/-So, for an income of 2.8 lakhs, taxable income after deduction u/s 80U will remain ₹2,05,000/- which is below the slab rate and hence will not be taxable for any of the above said AY.For ITR,If doctor is practicing himself i.e. He has a professional income than ITR 4 should be filedIf doctor is getting any salary than ITR 1 should be filed.:)

-

Is the filing of Individual Income tax returns mandatory to claim Relief u/s 89(1) of the income tax act? Suppose I received arrears of 2014-15 in 2017-18, is ITR mandatory for 2014-15? Or is relief allowed by filing form 10E?

Its not mandatory to file ITR for 2014–15. However you need to consider the income of 2014–15, to calculate the relief u.s 89(1), basically the calculation is to consider the fact that had the amount been received in 2014–15, what would be tax liablity, and its not appropriate to pay the tax liablity on arrears received, considering it completely in 2017–18.For any further information you can ping me at sfstaxsolutions17@gmail.com

-

If someone has filled income tax RETURN before 30th of July 2017 and sent ITR V for varification by hard copy, still that is mandatory to link PAN with AADHAR CARD?

Yes, it is mandatory because your aadhaar card has nothing to do with online or manual process. Aadhaar is being virtually linked with almost every source of income and payment modes a common man uses, so that it will be easy for department to track the total cash inflows. Govt. has given last date for linking aadhar as 31 august 2017. Please do it before otherwise your ITR filed will be treated as null and void. Please watch the video for more details on Aadhar linking process…

-

If poker is your only profession and you have no other sources of income, how do you pay taxes for that in India? Which ITR forms should I fill out?

As per Section 115BB of the Income tax Act, 1961 any income of winnings from any lottery or crossword puzzle or race including horse race or card game and other game of any sort or from gambling or betting of any form or nature whatsoever (which includes income from poker) is taxable at 30% plus education cess of 3% (Total 30.9%). There is not benefit of basic exemption limit but Chapter VIA deductions are available i.e. section 80C, 80 D and other seciton 80- deductions. TDS is also deductible at 30%.

-

Why should it be so complicated just figuring out how much tax to pay? (record keeping, software, filling out forms . . . many times cost much more than the amount of taxes due) The cost of compliance makes the U.S. uncompetitive and costs jobs and lowers our standard of living.

Taxes can be viewed as having 4 uses (or purposes) in our (and most) governments:Revenue generation (to pay for public services).Fiscal policy control (e.g., If the government wishes to reduce the money supply in order to reduce the risk of inflation, they can raise interest rates, sell fewer bonds, burn money, or raise taxes. In the last case, this represents excess tax revenue over the actual spending needs of the government).Wealth re-distribution. One argument for this is that the earnings of a country can be perceived as belonging to all of its citizens since the we all have a stake in the resources of the country (natural resources, and intangibles such as culture, good citizenship, civic duties). Without some tax policy complexity, the free market alone does not re-distribute wealth according to this "shared" resources concept. However, this steps into the boundary of Purpose # 4...A way to implement Social Policy (and similar government mandated policies, such as environmental policy, health policy, savings and debt policy, etc.). As Government spending can be use to implement policies (e.g., spending money on public health care, environmental cleanup, education, etc.), it is equivalent to provide tax breaks (income deductions or tax credits) for the private sector to act in certain ways -- e.g., spend money on R&D, pay for their own education or health care, avoid spending money on polluting cars by having a higher sales tax on these cars or offering a credit for trade-ins [ref: Cash for Clunkers]).Uses # 1 & 2 are rather straight-forward, and do not require a complex tax code to implement. Flat income and/or consumption (sales) taxes can easily be manipulated up or down overall for these top 2 uses. Furthermore, there is clarity when these uses are invoked. For spending, we publish a budget. For fiscal policy manipulation, the official economic agency (The Fed) publishes their outlook and agenda.Use # 3 is controversial because there is no Constitutional definition for the appropriate level of wealth re-distribution, and the very concept of wealth re-distribution is considered by some to be inappropriate and unconstitutional. Thus, the goal of wealth re-distribution is pretty much hidden in with the actions and policies of Use #4 (social policy manipulation).Use # 4, however, is where the complexity enters the Taxation system. Policy implementation through taxation (or through spending) occurs via legislation. Legislation (law making) is inherently complex and subject to gross manipulation by special interests during formation and amendments. Legislation is subject to interpretation, is prone to errors (leading to loopholes) and both unintentional or intentional (criminal / fraudulent) avoidance.The record keeping and forms referred to in the question are partially due to the basic formula for calculating taxes (i.e., percentage of income, cost of property, amount of purchase for a sales tax, ...). However, it is the complexity (and associated opportunities for exploitation) of taxation legislation for Use # 4 (Social Policy implementation) that naturally leads to complexity in the reporting requirements for the tax system.

Create this form in 5 minutes!

How to create an eSignature for the maryland and underpayment of estimated income tax by individuals 2017 form

How to create an electronic signature for the Maryland And Underpayment Of Estimated Income Tax By Individuals 2017 Form online

How to create an electronic signature for your Maryland And Underpayment Of Estimated Income Tax By Individuals 2017 Form in Chrome

How to generate an electronic signature for putting it on the Maryland And Underpayment Of Estimated Income Tax By Individuals 2017 Form in Gmail

How to create an eSignature for the Maryland And Underpayment Of Estimated Income Tax By Individuals 2017 Form from your smartphone

How to generate an eSignature for the Maryland And Underpayment Of Estimated Income Tax By Individuals 2017 Form on iOS

How to make an electronic signature for the Maryland And Underpayment Of Estimated Income Tax By Individuals 2017 Form on Android devices

People also ask

-

What is the Maryland And Underpayment Of Estimated Income Tax By Individuals Form?

The Maryland And Underpayment Of Estimated Income Tax By Individuals Form is a document used by individuals to report any additional tax owed to the state of Maryland due to underpayment of estimated income taxes. This form is essential for ensuring compliance with Maryland tax laws and avoiding potential penalties. By completing this form, you can accurately calculate any tax due based on your estimated income.

-

How can airSlate SignNow help with the Maryland And Underpayment Of Estimated Income Tax By Individuals Form?

airSlate SignNow streamlines the process of filling out and submitting the Maryland And Underpayment Of Estimated Income Tax By Individuals Form. With our user-friendly platform, you can easily eSign and send the form directly to the Maryland tax authority. This eliminates the need for printing and mailing, saving you time and hassle.

-

What features does airSlate SignNow offer for managing the Maryland And Underpayment Of Estimated Income Tax By Individuals Form?

airSlate SignNow offers a variety of features designed to simplify the management of the Maryland And Underpayment Of Estimated Income Tax By Individuals Form. Our platform allows you to create templates, track document status, and easily share the form with relevant parties. Additionally, secure cloud storage ensures that your documents are easily accessible and safe.

-

Is airSlate SignNow cost-effective for filing the Maryland And Underpayment Of Estimated Income Tax By Individuals Form?

Yes, airSlate SignNow is a cost-effective solution for filing the Maryland And Underpayment Of Estimated Income Tax By Individuals Form. We offer competitive pricing plans that cater to various business needs, ensuring you have access to essential eSigning and document management features without breaking the bank. Plus, by reducing administrative work, you save on time and costs.

-

Can I integrate airSlate SignNow with other software for tax management?

Absolutely! airSlate SignNow integrates seamlessly with many popular accounting and tax software solutions, making it easy to manage the Maryland And Underpayment Of Estimated Income Tax By Individuals Form alongside your other financial documents. This integration enhances your workflow by allowing you to keep all your documents organized within one system.

-

What benefits does airSlate SignNow provide for filing tax forms like Maryland And Underpayment Of Estimated Income Tax By Individuals Form?

One of the key benefits of using airSlate SignNow for the Maryland And Underpayment Of Estimated Income Tax By Individuals Form is the speed and efficiency of the process. With eSigning, you can get your forms signed and submitted quickly, reducing turnaround time. Additionally, our secure platform ensures that your sensitive tax information remains protected.

-

How does airSlate SignNow ensure the security of my tax forms, including the Maryland And Underpayment Of Estimated Income Tax By Individuals Form?

airSlate SignNow takes document security very seriously. We implement advanced encryption and compliance measures to ensure that your Maryland And Underpayment Of Estimated Income Tax By Individuals Form is safe during transmission and storage. Our platform is designed to protect your sensitive information at all stages of the signing process.

Get more for Maryland And Underpayment Of Estimated Income Tax By Individuals Form

- Colorie si tu entends on form

- Rt3199 form

- Vote by mail application gregg county form

- Staar science tutorial 39 answer key 470579524 form

- 5a notice of possible exposure to rabies mass gov mass form

- Dcc transcript request form

- Standard short form agreement between constructor and subcontractor

- Prudential financials portfolio of business form

Find out other Maryland And Underpayment Of Estimated Income Tax By Individuals Form

- How To Sign Texas Education Profit And Loss Statement

- Sign Vermont Education Residential Lease Agreement Secure

- How Can I Sign Washington Education NDA

- Sign Wisconsin Education LLC Operating Agreement Computer

- Sign Alaska Finance & Tax Accounting Purchase Order Template Computer

- Sign Alaska Finance & Tax Accounting Lease Termination Letter Free

- Can I Sign California Finance & Tax Accounting Profit And Loss Statement

- Sign Indiana Finance & Tax Accounting Confidentiality Agreement Later

- Sign Iowa Finance & Tax Accounting Last Will And Testament Mobile

- Sign Maine Finance & Tax Accounting Living Will Computer

- Sign Montana Finance & Tax Accounting LLC Operating Agreement Computer

- How Can I Sign Montana Finance & Tax Accounting Residential Lease Agreement

- Sign Montana Finance & Tax Accounting Residential Lease Agreement Safe

- How To Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Help Me With Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Sign Nebraska Finance & Tax Accounting Business Letter Template Online

- Sign Rhode Island Finance & Tax Accounting Cease And Desist Letter Computer

- Sign Vermont Finance & Tax Accounting RFP Later

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter

- Sign California Government Job Offer Now