Maryland and Underpayment of Estimated Income Tax by Individuals Form 2013

What is the Maryland And Underpayment Of Estimated Income Tax By Individuals Form

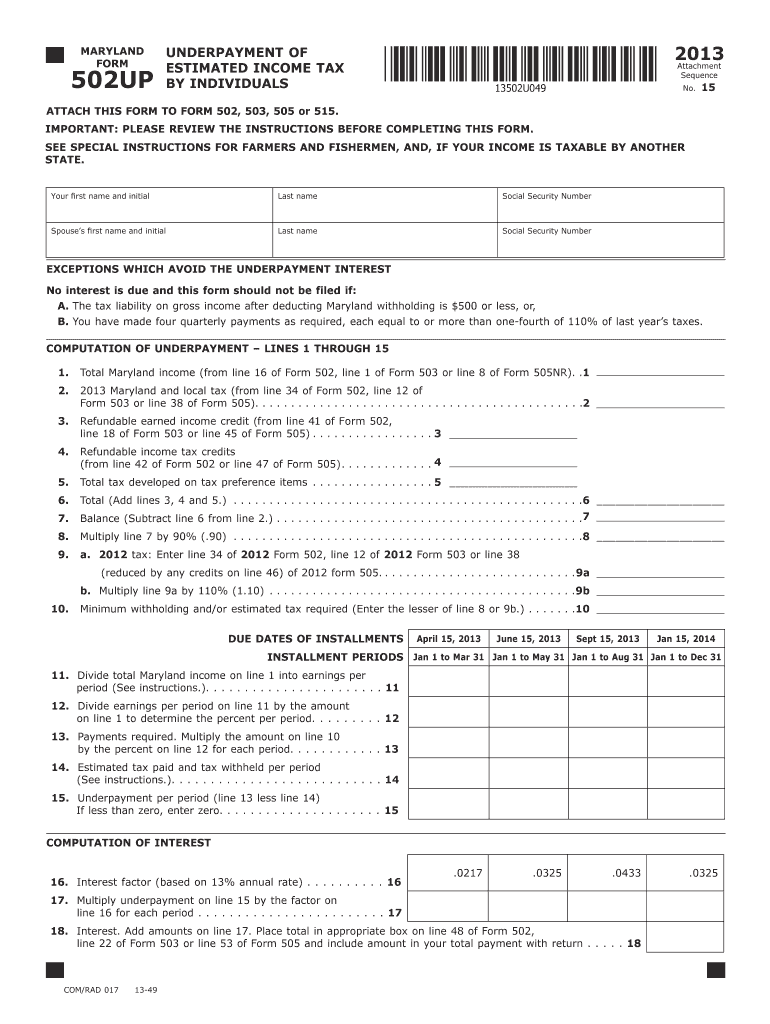

The Maryland And Underpayment Of Estimated Income Tax By Individuals Form is a crucial document for individuals who need to report underpayment of their estimated income tax. This form helps taxpayers calculate any penalties they may owe due to insufficient tax payments throughout the year. It is specifically designed for residents of Maryland and is essential for ensuring compliance with state tax regulations. By accurately completing this form, individuals can avoid potential penalties and interest charges associated with underpayment.

How to use the Maryland And Underpayment Of Estimated Income Tax By Individuals Form

Using the Maryland And Underpayment Of Estimated Income Tax By Individuals Form involves several straightforward steps. First, gather all necessary financial information, including your total income, tax withheld, and any estimated payments made. Next, follow the instructions provided on the form to calculate your total tax liability and determine if you have underpaid. Ensure that all calculations are accurate to avoid errors. Once completed, the form can be submitted either electronically or via mail, depending on your preference.

Steps to complete the Maryland And Underpayment Of Estimated Income Tax By Individuals Form

Completing the Maryland And Underpayment Of Estimated Income Tax By Individuals Form requires careful attention to detail. Begin by entering your personal information, including your name, address, and Social Security number. Next, provide your total income and any tax credits or deductions applicable to you. Calculate your estimated tax payments and compare them to your total tax liability. If you find a discrepancy indicating underpayment, fill in the appropriate sections to report this. Finally, review the form for accuracy before signing and submitting it.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the Maryland And Underpayment Of Estimated Income Tax By Individuals Form is essential for compliance. Generally, individuals must file this form by the due date of their annual income tax return. For most taxpayers, this date falls on April 15. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is advisable to keep track of any changes in tax law or deadlines announced by the Maryland Comptroller's office to ensure timely submission.

Penalties for Non-Compliance

Failing to submit the Maryland And Underpayment Of Estimated Income Tax By Individuals Form or underreporting your estimated tax can lead to significant penalties. Maryland imposes interest and penalties on any unpaid tax amounts, which can accumulate over time. The penalty for underpayment is typically a percentage of the underpaid amount, and interest is charged on any unpaid balance. To avoid these penalties, it is crucial to accurately assess your tax obligations and submit the form by the required deadlines.

Digital vs. Paper Version

When it comes to submitting the Maryland And Underpayment Of Estimated Income Tax By Individuals Form, taxpayers have the option of using a digital or paper version. The digital version offers convenience, allowing for quick completion and submission through secure online platforms. This method often provides immediate confirmation of submission. On the other hand, the paper version requires mailing, which can introduce delays. Regardless of the method chosen, ensuring accuracy and compliance with state regulations is paramount.

Quick guide on how to complete maryland and underpayment of estimated income tax by individuals 2013 form

Your assistance manual on how to prepare your Maryland And Underpayment Of Estimated Income Tax By Individuals Form

If you’re curious about how to finalize and submit your Maryland And Underpayment Of Estimated Income Tax By Individuals Form, here are some straightforward guidelines to streamline tax processing.

To start, you simply need to create your airSlate SignNow account to revolutionize how you manage documents online. airSlate SignNow is an exceptionally user-friendly and powerful document platform that enables you to edit, generate, and finalize your tax forms with ease. Utilizing its editor, you can alternate between text, checkboxes, and eSignatures, and revisit information for modifications as necessary. Enhance your tax administration with advanced PDF editing, eSigning, and convenient sharing options.

Follow the instructions below to complete your Maryland And Underpayment Of Estimated Income Tax By Individuals Form in just a few minutes:

- Set up your account and start handling PDFs in moments.

- Browse our directory to locate any IRS tax form; review variations and schedules.

- Click Get form to access your Maryland And Underpayment Of Estimated Income Tax By Individuals Form in our editor.

- Complete the necessary fillable fields with your details (text, numbers, checkmarks).

- Utilize the Sign Tool to include your legally recognized eSignature (if applicable).

- Review your document and rectify any mistakes.

- Save changes, print your copy, deliver it to your recipient, and download it to your device.

Refer to this manual to submit your taxes electronically with airSlate SignNow. Keep in mind that filing in paper form may lead to return inaccuracies and delays in refunds. Additionally, before e-filing your taxes, verify the IRS website for filing guidelines in your jurisdiction.

Create this form in 5 minutes or less

Find and fill out the correct maryland and underpayment of estimated income tax by individuals 2013 form

FAQs

-

How can I fill out the details of my PPF and LIC in income tax return along with Form 16 details?

PPF contribution and LIC premium paid is shown under section 80C deductions ( chapter VIA deduction) in ITR.However total limit under 80C is 1.5L.( I am assuming that you have referred to investments made -ppf/LIC and not withdrawals (income)from the same).Regards.

-

How much will a doctor with a physical disability and annual net income of around Rs. 2.8 lakhs pay in income tax? Which ITR form is to be filled out?

For disability a deduction of ₹75,000/- is available u/s 80U.Rebate u/s87AFor AY 17–18, rebate was ₹5,000/- or income tax which ever is lower for person with income less than ₹5,00,000/-For AY 18–19, rebate is ₹2,500/- or income tax whichever is lower for person with income less than 3,50,000/-So, for an income of 2.8 lakhs, taxable income after deduction u/s 80U will remain ₹2,05,000/- which is below the slab rate and hence will not be taxable for any of the above said AY.For ITR,If doctor is practicing himself i.e. He has a professional income than ITR 4 should be filedIf doctor is getting any salary than ITR 1 should be filed.:)

-

If poker is your only profession and you have no other sources of income, how do you pay taxes for that in India? Which ITR forms should I fill out?

As per Section 115BB of the Income tax Act, 1961 any income of winnings from any lottery or crossword puzzle or race including horse race or card game and other game of any sort or from gambling or betting of any form or nature whatsoever (which includes income from poker) is taxable at 30% plus education cess of 3% (Total 30.9%). There is not benefit of basic exemption limit but Chapter VIA deductions are available i.e. section 80C, 80 D and other seciton 80- deductions. TDS is also deductible at 30%.

-

Why should it be so complicated just figuring out how much tax to pay? (record keeping, software, filling out forms . . . many times cost much more than the amount of taxes due) The cost of compliance makes the U.S. uncompetitive and costs jobs and lowers our standard of living.

Taxes can be viewed as having 4 uses (or purposes) in our (and most) governments:Revenue generation (to pay for public services).Fiscal policy control (e.g., If the government wishes to reduce the money supply in order to reduce the risk of inflation, they can raise interest rates, sell fewer bonds, burn money, or raise taxes. In the last case, this represents excess tax revenue over the actual spending needs of the government).Wealth re-distribution. One argument for this is that the earnings of a country can be perceived as belonging to all of its citizens since the we all have a stake in the resources of the country (natural resources, and intangibles such as culture, good citizenship, civic duties). Without some tax policy complexity, the free market alone does not re-distribute wealth according to this "shared" resources concept. However, this steps into the boundary of Purpose # 4...A way to implement Social Policy (and similar government mandated policies, such as environmental policy, health policy, savings and debt policy, etc.). As Government spending can be use to implement policies (e.g., spending money on public health care, environmental cleanup, education, etc.), it is equivalent to provide tax breaks (income deductions or tax credits) for the private sector to act in certain ways -- e.g., spend money on R&D, pay for their own education or health care, avoid spending money on polluting cars by having a higher sales tax on these cars or offering a credit for trade-ins [ref: Cash for Clunkers]).Uses # 1 & 2 are rather straight-forward, and do not require a complex tax code to implement. Flat income and/or consumption (sales) taxes can easily be manipulated up or down overall for these top 2 uses. Furthermore, there is clarity when these uses are invoked. For spending, we publish a budget. For fiscal policy manipulation, the official economic agency (The Fed) publishes their outlook and agenda.Use # 3 is controversial because there is no Constitutional definition for the appropriate level of wealth re-distribution, and the very concept of wealth re-distribution is considered by some to be inappropriate and unconstitutional. Thus, the goal of wealth re-distribution is pretty much hidden in with the actions and policies of Use #4 (social policy manipulation).Use # 4, however, is where the complexity enters the Taxation system. Policy implementation through taxation (or through spending) occurs via legislation. Legislation (law making) is inherently complex and subject to gross manipulation by special interests during formation and amendments. Legislation is subject to interpretation, is prone to errors (leading to loopholes) and both unintentional or intentional (criminal / fraudulent) avoidance.The record keeping and forms referred to in the question are partially due to the basic formula for calculating taxes (i.e., percentage of income, cost of property, amount of purchase for a sales tax, ...). However, it is the complexity (and associated opportunities for exploitation) of taxation legislation for Use # 4 (Social Policy implementation) that naturally leads to complexity in the reporting requirements for the tax system.

Create this form in 5 minutes!

How to create an eSignature for the maryland and underpayment of estimated income tax by individuals 2013 form

How to make an eSignature for your Maryland And Underpayment Of Estimated Income Tax By Individuals 2013 Form online

How to create an electronic signature for your Maryland And Underpayment Of Estimated Income Tax By Individuals 2013 Form in Google Chrome

How to generate an eSignature for putting it on the Maryland And Underpayment Of Estimated Income Tax By Individuals 2013 Form in Gmail

How to generate an electronic signature for the Maryland And Underpayment Of Estimated Income Tax By Individuals 2013 Form from your mobile device

How to generate an eSignature for the Maryland And Underpayment Of Estimated Income Tax By Individuals 2013 Form on iOS devices

How to generate an electronic signature for the Maryland And Underpayment Of Estimated Income Tax By Individuals 2013 Form on Android

People also ask

-

What is the Maryland And Underpayment Of Estimated Income Tax By Individuals Form?

The Maryland And Underpayment Of Estimated Income Tax By Individuals Form is a document used by individuals to report and estimate their income tax obligations in Maryland. It helps taxpayers calculate any underpayment penalties they may owe. Completing this form accurately is essential for compliance with state tax laws.

-

How can airSlate SignNow help with the Maryland And Underpayment Of Estimated Income Tax By Individuals Form?

AirSlate SignNow provides an easy-to-use platform for electronically signing and managing the Maryland And Underpayment Of Estimated Income Tax By Individuals Form. With our solutions, individuals can efficiently fill out the form, add signatures, and submit it seamlessly. This not only saves time but also enhances accuracy and compliance.

-

Is there a cost associated with using airSlate SignNow for tax forms like the Maryland And Underpayment Of Estimated Income Tax By Individuals Form?

AirSlate SignNow offers competitive pricing for its electronic signature solutions that include features for handling various tax forms, including the Maryland And Underpayment Of Estimated Income Tax By Individuals Form. We provide flexible subscription plans to cater to different user needs, ensuring you get the best value for your investment.

-

What features does airSlate SignNow offer for the Maryland And Underpayment Of Estimated Income Tax By Individuals Form?

AirSlate SignNow offers features such as customizable templates, secure e-signature capabilities, and document tracking to streamline the completion of the Maryland And Underpayment Of Estimated Income Tax By Individuals Form. These features simplify the signing process and ensure that all documents remain secure and organized.

-

How do I integrate airSlate SignNow with other applications for tax management?

AirSlate SignNow provides seamless integrations with various applications, allowing you to manage the Maryland And Underpayment Of Estimated Income Tax By Individuals Form alongside your other financial tools. Our API and integration options enhance productivity, enabling you to automate workflows and keep everything in sync.

-

Can I save and reuse my Maryland And Underpayment Of Estimated Income Tax By Individuals Form on airSlate SignNow?

Yes, airSlate SignNow allows you to save your completed Maryland And Underpayment Of Estimated Income Tax By Individuals Form as a template for future use. This feature reduces repetitive tasks and ensures that your information is readily available for subsequent tax filings, enhancing overall efficiency.

-

What security measures does airSlate SignNow implement for sensitive tax documents?

AirSlate SignNow prioritizes the security of your documents, including the Maryland And Underpayment Of Estimated Income Tax By Individuals Form. We employ advanced encryption methods and secure storage practices to keep your data safe. Additionally, we comply with industry standards to ensure the highest level of document security.

Get more for Maryland And Underpayment Of Estimated Income Tax By Individuals Form

- Sf 701 form

- Nationwide beneficiary change form 612319173

- Us individual income tax return form

- Cacfp 39 refrigerator zer temperature log form

- Bishops certificate the diocese of southwark anglican org form

- Dse assessment form 573529252

- Concept special risks claim leaflet form

- Statutory sick pay and an employees claim for gov uk form

Find out other Maryland And Underpayment Of Estimated Income Tax By Individuals Form

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation