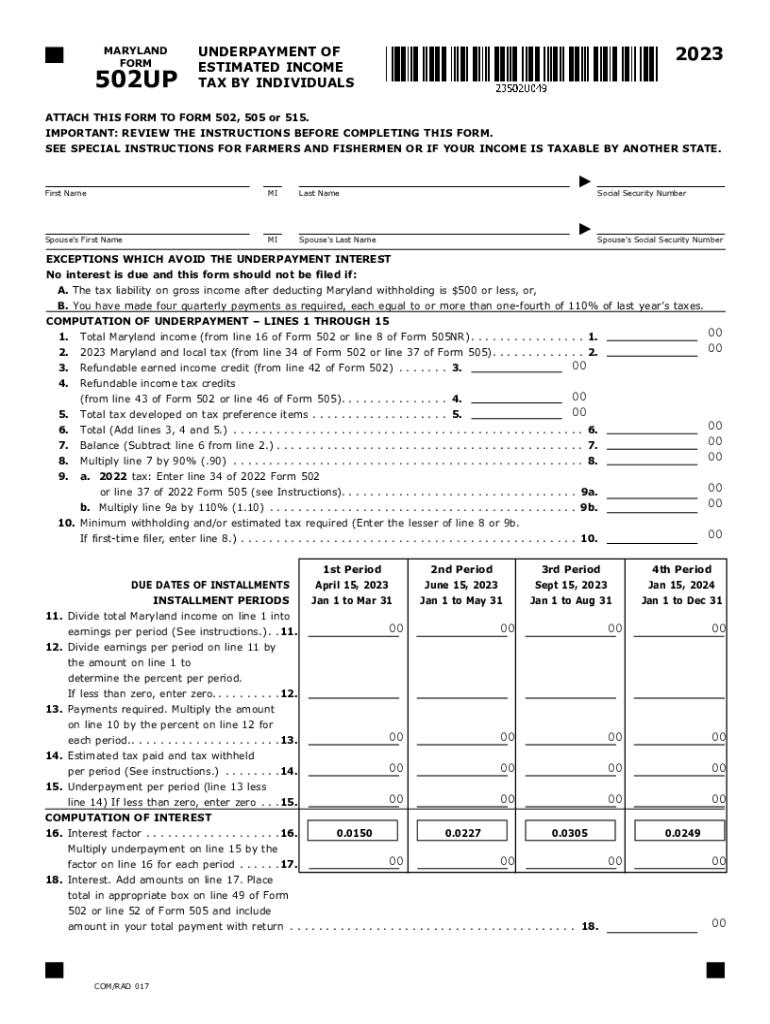

Tax Year 502UP Underpayment of Estimated Income Tax by Individuals Tax Year 502UP Underpayment of Estimated Income Tax by Indivi 2023-2026

Understanding Maryland Form PV 2025

The Maryland Form PV 2025 is an essential document for individuals who need to make estimated tax payments to the state. This form is specifically designed for taxpayers who expect to owe tax of $500 or more when filing their Maryland income tax return. The form allows individuals to report and pay their estimated tax liability for the year, ensuring compliance with state tax regulations.

Steps to Complete Maryland Form PV 2025

Filling out the Maryland Form PV 2025 involves several straightforward steps:

- Gather necessary information, including your expected income, deductions, and credits for the year.

- Calculate your estimated tax liability using the Maryland tax rates applicable to your income level.

- Fill out the form with your personal information, including your name, address, and Social Security number.

- Enter the calculated estimated tax amount on the form.

- Choose your payment method, whether by mail or electronically.

- Submit the form by the specified deadline to avoid penalties.

Filing Deadlines for Maryland Form PV 2025

It is crucial to be aware of the filing deadlines associated with Maryland Form PV 2025 to avoid late fees. Typically, estimated tax payments are due quarterly. The specific due dates are:

- First payment: April 15

- Second payment: June 15

- Third payment: September 15

- Fourth payment: January 15 of the following year

Ensure that payments are made on time to maintain compliance with Maryland tax laws.

Required Documents for Maryland Form PV 2025

To accurately complete the Maryland Form PV 2025, you will need several documents:

- Your previous year’s tax return for reference

- Income statements such as W-2s or 1099s

- Records of any deductions or credits you plan to claim

- Any other relevant financial documents that reflect your income

Having these documents ready will streamline the process of filling out the form.

Penalties for Non-Compliance with Maryland Form PV 2025

Failing to file or pay the estimated taxes on time can result in significant penalties. Maryland imposes interest and penalties on late payments, which can accumulate quickly. The penalty for underpayment may be calculated based on the amount owed and the duration of the delay. To avoid these penalties, it is advisable to make timely payments and ensure accurate calculations on the form.

Digital Submission of Maryland Form PV 2025

Maryland allows for the electronic submission of Form PV 2025, making the process more efficient. Taxpayers can utilize online platforms to fill out and submit the form directly to the Maryland Comptroller's office. This method not only saves time but also provides immediate confirmation of submission, reducing the risk of lost paperwork.

Quick guide on how to complete tax year 502up underpayment of estimated income tax by individuals tax year 502up underpayment of estimated income tax by

Complete Tax Year 502UP Underpayment Of Estimated Income Tax By Individuals Tax Year 502UP Underpayment Of Estimated Income Tax By Indivi effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers a superb environmentally friendly substitute to traditional printed and signed documents, enabling you to find the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents quickly without delays. Manage Tax Year 502UP Underpayment Of Estimated Income Tax By Individuals Tax Year 502UP Underpayment Of Estimated Income Tax By Indivi on any platform using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The easiest way to modify and electronically sign Tax Year 502UP Underpayment Of Estimated Income Tax By Individuals Tax Year 502UP Underpayment Of Estimated Income Tax By Indivi with ease

- Find Tax Year 502UP Underpayment Of Estimated Income Tax By Individuals Tax Year 502UP Underpayment Of Estimated Income Tax By Indivi and click on Get Form to begin.

- Use the tools we provide to complete your document.

- Select important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes just seconds and has the same legal validity as a conventional ink signature.

- Review the information and click on the Done button to save your changes.

- Decide how you would like to send your form, whether by email, SMS, or invitation link, or download it to your computer.

No more worrying about lost or misplaced documents, cumbersome form searches, or errors that require reprinting new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from a device of your choice. Edit and electronically sign Tax Year 502UP Underpayment Of Estimated Income Tax By Individuals Tax Year 502UP Underpayment Of Estimated Income Tax By Indivi and guarantee outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tax year 502up underpayment of estimated income tax by individuals tax year 502up underpayment of estimated income tax by

Create this form in 5 minutes!

How to create an eSignature for the tax year 502up underpayment of estimated income tax by individuals tax year 502up underpayment of estimated income tax by

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Maryland form PV 2024 and why is it important?

The Maryland form PV 2024 is a critical document designed for vehicle owners in Maryland who need to apply for a new title or registration. This form ensures that all necessary details are captured for processing your application efficiently. By using airSlate SignNow, completing the Maryland form PV 2024 becomes easier, faster, and more secure.

-

How does airSlate SignNow help with the Maryland form PV 2024?

airSlate SignNow streamlines the process of filling out and electronically signing the Maryland form PV 2024. Our platform offers user-friendly tools that ensure you can complete and submit your form quickly from any device. This saves time and minimizes the likelihood of errors, making it ideal for busy vehicle owners.

-

What are the pricing options for using airSlate SignNow for the Maryland form PV 2024?

airSlate SignNow offers flexible pricing plans, including a free trial, so you can explore its features for the Maryland form PV 2024 without any commitment. Our packages cater to individual users, small businesses, and larger enterprises, ensuring that you find a solution that fits your needs and budget.

-

Can I integrate airSlate SignNow with other applications when handling the Maryland form PV 2024?

Yes, airSlate SignNow seamlessly integrates with a variety of applications, making it easy to manage your Maryland form PV 2024 alongside other critical business tools. Whether you need to connect with CRM systems, cloud storage, or project management software, our integrations ensure your documentation is always at your fingertips.

-

What features does airSlate SignNow offer for managing the Maryland form PV 2024?

airSlate SignNow provides several powerful features for managing the Maryland form PV 2024, including template creation, automated workflows, and real-time tracking of document status. These features not only enhance your efficiency but also facilitate collaboration with other stakeholders involved in the document process.

-

Is airSlate SignNow secure for submitting the Maryland form PV 2024?

Absolutely! Security is a top priority at airSlate SignNow. We use industry-standard encryption and authentication methods to protect your information while filling out and submitting the Maryland form PV 2024, ensuring that your sensitive data remains safe and confidential.

-

What benefits can I expect from using airSlate SignNow for the Maryland form PV 2024?

Using airSlate SignNow for the Maryland form PV 2024 offers numerous benefits, including increased efficiency, reduced processing times, and enhanced accuracy. Additionally, our platform provides a paperless and environmentally friendly solution, allowing you to manage your documents with ease while saving resources.

Get more for Tax Year 502UP Underpayment Of Estimated Income Tax By Individuals Tax Year 502UP Underpayment Of Estimated Income Tax By Indivi

- Artofchiuhere comes the bride its time to run and form

- Appalachian research ampamp defense fund of ky appalred legal form

- Hereinafter referred to as quotco petitionersquot are now married and form

- Krs chapter 403 form

- Aoc fc 3 490141742 form

- County commonwealth of kentucky form

- Under the same terms and conditions described in the original lease agreement except for increased rent form

- Assignee date form

Find out other Tax Year 502UP Underpayment Of Estimated Income Tax By Individuals Tax Year 502UP Underpayment Of Estimated Income Tax By Indivi

- eSign Connecticut Banking Business Associate Agreement Secure

- Sign Georgia Courts Moving Checklist Simple

- Sign Georgia Courts IOU Mobile

- How Can I Sign Georgia Courts Lease Termination Letter

- eSign Hawaii Banking Agreement Simple

- eSign Hawaii Banking Rental Application Computer

- eSign Hawaii Banking Agreement Easy

- eSign Hawaii Banking LLC Operating Agreement Fast

- eSign Hawaii Banking Permission Slip Online

- eSign Minnesota Banking LLC Operating Agreement Online

- How Do I eSign Mississippi Banking Living Will

- eSign New Jersey Banking Claim Mobile

- eSign New York Banking Promissory Note Template Now

- eSign Ohio Banking LLC Operating Agreement Now

- Sign Maryland Courts Quitclaim Deed Free

- How To Sign Massachusetts Courts Quitclaim Deed

- Can I Sign Massachusetts Courts Quitclaim Deed

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast