Tax Year End and Fiscal Period Canada Ca 2022

Understanding the NY IT-205 Estimated Payments

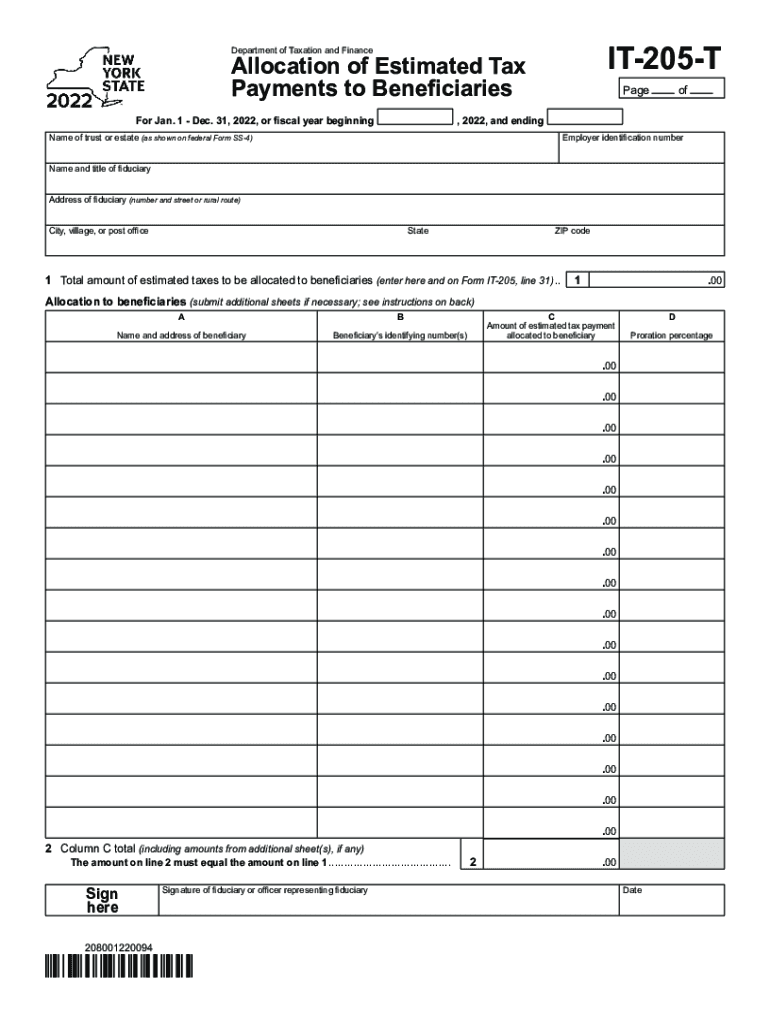

The NY IT-205 estimated payments form is essential for taxpayers who need to report estimated tax payments made throughout the year. This form is particularly relevant for individuals who anticipate owing tax on their income and want to avoid penalties for underpayment. It is designed to help taxpayers calculate their estimated tax liability and ensure compliance with New York State tax regulations.

Steps to Complete the NY IT-205 Estimated Payments Form

Completing the NY IT-205 estimated payments form involves several key steps:

- Gather Required Information: Collect your income details, deductions, and any credits that may apply.

- Calculate Estimated Tax: Use your previous year’s tax return as a guide to estimate your current year’s tax liability.

- Fill Out the Form: Accurately enter your estimated income, deductions, and tax credits on the IT-205 form.

- Review for Accuracy: Double-check all entries to ensure there are no errors that could affect your tax calculations.

- Submit the Form: Choose your preferred submission method, whether online or by mail, and ensure it is sent by the due date.

Filing Deadlines for the NY IT-205 Estimated Payments

Timely submission of the NY IT-205 estimated payments form is crucial to avoid penalties. Generally, estimated payments are due on the 15th of April, June, September, and January of the following year. However, it is important to verify specific dates each year as they may vary slightly based on weekends or holidays.

Required Documents for the NY IT-205 Estimated Payments

When preparing to complete the NY IT-205 estimated payments form, ensure you have the following documents:

- Previous year’s tax return for reference

- Income statements such as W-2s or 1099s

- Documentation for any deductions or credits you plan to claim

- Any notices from the New York State Department of Taxation and Finance regarding estimated payments

Penalties for Non-Compliance with the NY IT-205 Estimated Payments

Failure to file the NY IT-205 estimated payments form on time can result in penalties. Taxpayers may face a penalty for underpayment if their estimated payments are insufficient. It is advisable to calculate and submit estimated payments accurately to avoid these financial repercussions.

Digital vs. Paper Version of the NY IT-205 Estimated Payments Form

Taxpayers have the option to complete the NY IT-205 estimated payments form digitally or on paper. The digital version often allows for easier calculations and quicker submission, while the paper version may be preferred by those who are more comfortable with traditional methods. Regardless of the method chosen, ensuring accuracy is vital for compliance.

Quick guide on how to complete tax year end and fiscal period canadaca

Complete Tax Year end And Fiscal Period Canada ca effortlessly on any device

Online document management has become widely adopted by organizations and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and eSign your documents quickly without interruptions. Manage Tax Year end And Fiscal Period Canada ca on any platform using the airSlate SignNow Android or iOS applications and enhance any document-related task today.

The simplest method to modify and eSign Tax Year end And Fiscal Period Canada ca without any hassle

- Find Tax Year end And Fiscal Period Canada ca and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method of sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worry of missing or lost files, tiring form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from your chosen device. Modify and eSign Tax Year end And Fiscal Period Canada ca to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tax year end and fiscal period canadaca

Create this form in 5 minutes!

How to create an eSignature for the tax year end and fiscal period canadaca

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ny it205 estimated form used for?

The ny it205 estimated form is primarily used for estimating and reporting income tax obligations for New York-based businesses. This form allows taxpayers to provide an overview of their anticipated tax responsibilities, helping ensure compliance with state regulations.

-

How can airSlate SignNow help with the ny it205 estimated form?

airSlate SignNow offers a streamlined solution to complete and eSign the ny it205 estimated form digitally. This ensures that your documents are securely signed and easily accessible, saving time and enhancing efficiency throughout the tax filing process.

-

Is airSlate SignNow cost-effective for managing the ny it205 estimated form?

Yes, airSlate SignNow is a cost-effective solution for managing the ny it205 estimated form, offering competitive pricing plans that cater to businesses of all sizes. By minimizing paperwork and enhancing document workflows, it provides signNow savings on time and resources.

-

What features does airSlate SignNow offer for the ny it205 estimated form?

airSlate SignNow provides features such as customizable templates, seamless eSigning, and instant document sharing specifically for the ny it205 estimated form. These features help simplify the tax filing process while ensuring accuracy and compliance.

-

Are there integrations available for eSigning the ny it205 estimated form?

Absolutely! airSlate SignNow offers various integrations with popular platforms that facilitate the eSigning of the ny it205 estimated form. This connectivity allows for a smoother workflow by enabling you to send, sign, and manage documents right from your existing tools.

-

Can I track the status of my ny it205 estimated form using airSlate SignNow?

Yes, airSlate SignNow includes tracking features that allow you to monitor the status of your ny it205 estimated form. This functionality provides real-time updates, ensuring you are aware of when the document is signed and ready for submission.

-

What are the benefits of using airSlate SignNow for the ny it205 estimated form?

Using airSlate SignNow for the ny it205 estimated form enhances efficiency, reduces paper waste, and ensures security through encrypted eSigning. These benefits help businesses save time and reduce errors, making tax filing a more straightforward process.

Get more for Tax Year end And Fiscal Period Canada ca

- Plumbing contract for contractor south carolina form

- Brick mason contract for contractor south carolina form

- Roofing contract for contractor south carolina form

- Electrical contract for contractor south carolina form

- Sheetrock drywall contract for contractor south carolina form

- Flooring contract for contractor south carolina form

- Agreement or contract for deed for sale and purchase of real estate aka land or executory contract south carolina form

- Notice of intent to enforce forfeiture provisions of contact for deed south carolina form

Find out other Tax Year end And Fiscal Period Canada ca

- Sign Hawaii Non-Profit Limited Power Of Attorney Myself

- Sign Hawaii Non-Profit Limited Power Of Attorney Free

- Sign Idaho Non-Profit Lease Agreement Template Safe

- Help Me With Sign Illinois Non-Profit Business Plan Template

- Sign Maryland Non-Profit Business Plan Template Fast

- How To Sign Nevada Life Sciences LLC Operating Agreement

- Sign Montana Non-Profit Warranty Deed Mobile

- Sign Nebraska Non-Profit Residential Lease Agreement Easy

- Sign Nevada Non-Profit LLC Operating Agreement Free

- Sign Non-Profit Document New Mexico Mobile

- Sign Alaska Orthodontists Business Plan Template Free

- Sign North Carolina Life Sciences Purchase Order Template Computer

- Sign Ohio Non-Profit LLC Operating Agreement Secure

- Can I Sign Ohio Non-Profit LLC Operating Agreement

- Sign South Dakota Non-Profit Business Plan Template Myself

- Sign Rhode Island Non-Profit Residential Lease Agreement Computer

- Sign South Carolina Non-Profit Promissory Note Template Mobile

- Sign South Carolina Non-Profit Lease Agreement Template Online

- Sign Oregon Life Sciences LLC Operating Agreement Online

- Sign Texas Non-Profit LLC Operating Agreement Online