Form it 205 T Allocation of Estimated Tax Tax NY Gov 2023

Understanding Form IT-205-T: Allocation of Estimated Tax

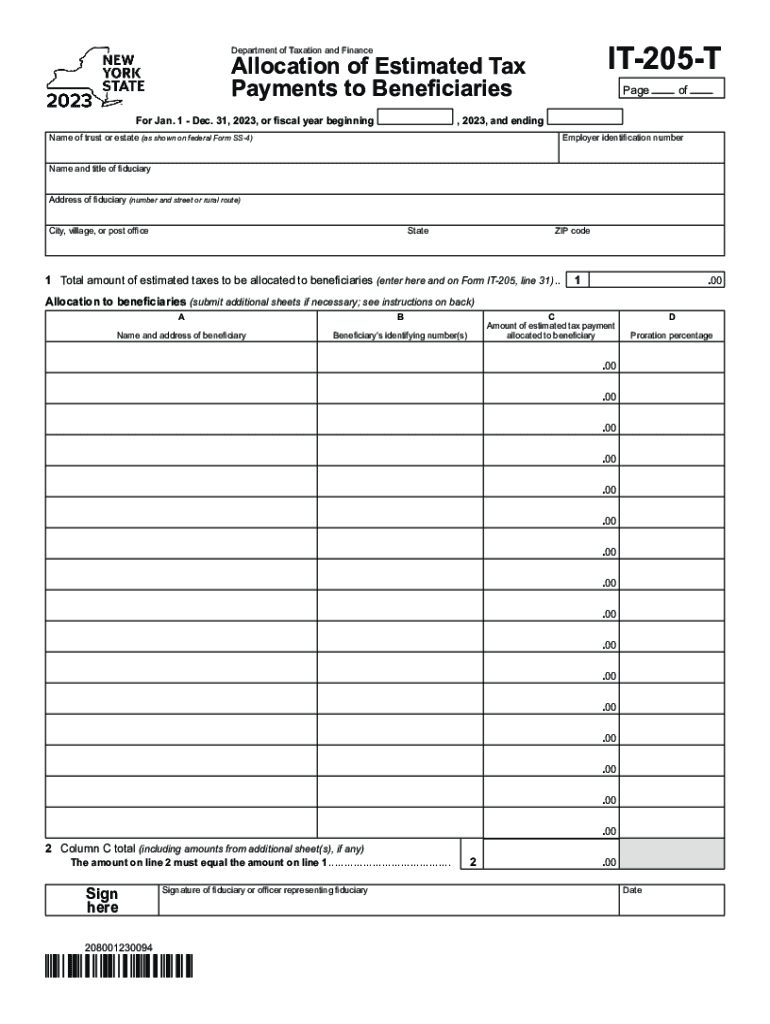

The Form IT-205-T is a crucial document used in New York for the allocation of estimated tax payments. This form is primarily designed for individuals who need to allocate their estimated tax payments among various tax jurisdictions. It is particularly relevant for taxpayers who earn income from multiple sources or who have income that is subject to different tax rates. Understanding this form is essential for accurate tax reporting and compliance.

Steps to Complete Form IT-205-T

Completing Form IT-205-T involves several key steps to ensure accuracy and compliance with New York tax regulations. First, gather all necessary documentation, including income statements and previous tax returns. Next, accurately fill out the form by providing information about your income sources and the estimated tax payments made. Pay close attention to the allocation sections, as these determine how your payments are distributed across different jurisdictions. Finally, review the completed form for any errors before submission.

Obtaining Form IT-205-T

Form IT-205-T can be obtained through the New York State Department of Taxation and Finance website. It is available for download in PDF format, allowing taxpayers to print and fill it out manually. Additionally, the form may be accessible through tax preparation software, which can streamline the completion process. Ensure that you are using the most current version of the form to comply with any recent tax law changes.

Legal Use of Form IT-205-T

Form IT-205-T is legally required for New York residents who need to allocate estimated tax payments. Failure to file this form correctly can lead to penalties or interest on unpaid taxes. It is essential to understand the legal implications of the information provided on the form, as it directly impacts your tax obligations. Keeping accurate records and ensuring compliance with state tax laws will help avoid any legal issues.

Filing Deadlines for Form IT-205-T

Timely submission of Form IT-205-T is critical to avoid penalties. The filing deadlines typically align with the estimated tax payment due dates, which are usually set for April, June, September, and January of the following year. Taxpayers should be aware of these dates and plan accordingly to ensure that their estimated tax payments are allocated correctly and on time.

Examples of Using Form IT-205-T

Form IT-205-T can be utilized in various scenarios. For instance, a self-employed individual who earns income from both freelance work and a part-time job may need to allocate their estimated tax payments between different income sources. Similarly, a retiree with pension income and investment earnings may also find this form necessary to ensure proper tax allocation. Understanding these examples can help taxpayers recognize the importance of the form in their specific financial situations.

Quick guide on how to complete form it 205 t allocation of estimated tax tax ny gov

Complete Form IT 205 T Allocation Of Estimated Tax Tax NY gov effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Form IT 205 T Allocation Of Estimated Tax Tax NY gov on any device with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign Form IT 205 T Allocation Of Estimated Tax Tax NY gov without hassle

- Locate Form IT 205 T Allocation Of Estimated Tax Tax NY gov and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize pertinent sections of the documents or conceal sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your choice. Edit and eSign Form IT 205 T Allocation Of Estimated Tax Tax NY gov and ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form it 205 t allocation of estimated tax tax ny gov

Create this form in 5 minutes!

How to create an eSignature for the form it 205 t allocation of estimated tax tax ny gov

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the airSlate SignNow 205t and how does it work?

The airSlate SignNow 205t is a powerful electronic signature solution that allows businesses to effortlessly send and sign documents online. With its user-friendly interface, users can easily upload documents, add fields for signatures, and send them to recipients for e-signing. The 205t ensures a secure and legally binding process for all types of documents.

-

How much does the airSlate SignNow 205t cost?

The pricing for airSlate SignNow 205t is designed to be cost-effective for businesses of all sizes. Various plans are available to meet your organization's needs, starting from a competitive monthly fee. By opting for the 205t, you gain access to essential features without breaking the bank.

-

What features are included with the airSlate SignNow 205t?

The airSlate SignNow 205t includes a robust set of features such as templates, custom branding, and advanced security options. Additionally, users can track document status and receive real-time notifications, enhancing overall efficiency. These features make the 205t ideal for streamlining your e-signature workflows.

-

How can the airSlate SignNow 205t benefit my business?

By using airSlate SignNow 205t, your business can signNowly reduce the time spent on document management and signing processes. This leads to faster turnaround times and improved customer satisfaction. The 205t also helps in minimizing paper waste, aligning with sustainable business practices.

-

Does the airSlate SignNow 205t integrate with other software?

Yes, the airSlate SignNow 205t seamlessly integrates with numerous third-party applications such as Google Drive, Salesforce, and Zapier. These integrations allow you to streamline your workflows and keep all your tools connected. By using the 205t, you can enhance productivity and ensure a cohesive workflow.

-

Is the airSlate SignNow 205t compliant with legal standards?

The airSlate SignNow 205t is compliant with various electronic signature laws such as ESIGN and UETA, ensuring that your e-signatures are legally valid. This compliance gives you peace of mind when using the 205t for important business documents. You can confidently rely on it for secure and trustworthy transactions.

-

Can I try the airSlate SignNow 205t before purchasing?

Absolutely! airSlate SignNow offers a free trial for the 205t, allowing you to test its features and capabilities without any commitment. This trial gives you a firsthand experience of how the 205t can benefit your business before making a financial decision.

Get more for Form IT 205 T Allocation Of Estimated Tax Tax NY gov

- Poetic devices worksheet 1 answer key form

- Authorization agreement for automatic withdrawal form

- Ad hoc report request form the office of sponsored programs uab

- Softball camp registration form trinity university web trinity

- Form p524 where an examiner wjec wjec co

- Unemployment claim form

- Fm 038 family matter summons and preliminary injunction 109 ptla form

- Temporary child custody agreement template form

Find out other Form IT 205 T Allocation Of Estimated Tax Tax NY gov

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free

- Can I eSign Montana Courts NDA

- eSign Montana Courts LLC Operating Agreement Mobile

- eSign Oklahoma Sports Rental Application Simple

- eSign Oklahoma Sports Rental Application Easy

- eSign Missouri Courts Lease Agreement Template Mobile

- Help Me With eSign Nevada Police Living Will

- eSign New York Courts Business Plan Template Later

- Can I eSign North Carolina Courts Limited Power Of Attorney

- eSign North Dakota Courts Quitclaim Deed Safe

- How To eSign Rhode Island Sports Quitclaim Deed

- Help Me With eSign Oregon Courts LLC Operating Agreement

- eSign North Dakota Police Rental Lease Agreement Now

- eSign Tennessee Courts Living Will Simple

- eSign Utah Courts Last Will And Testament Free

- eSign Ohio Police LLC Operating Agreement Mobile

- eSign Virginia Courts Business Plan Template Secure

- How To eSign West Virginia Courts Confidentiality Agreement

- eSign Wyoming Courts Quitclaim Deed Simple