Form it 205 T Allocation of Estimated Tax Payments to Beneficiaries Tax Year 2024-2026

Understanding Form IT-205-T: Allocation of Estimated Tax Payments to Beneficiaries

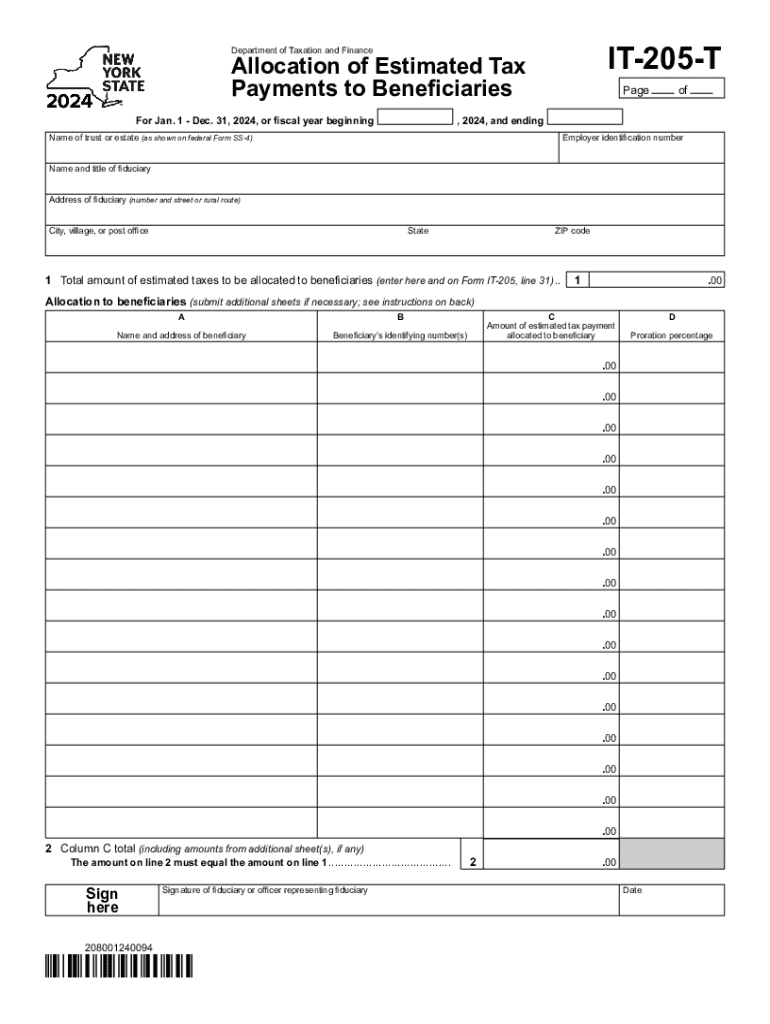

The Form IT-205-T is a crucial document used in the United States for allocating estimated tax payments made by estates or trusts to beneficiaries. This form allows fiduciaries to distribute tax credits appropriately, ensuring that beneficiaries receive their fair share of the estimated tax payments. It is essential for tax compliance and helps in accurately reporting income for the beneficiaries on their individual tax returns.

Steps to Complete Form IT-205-T

Completing Form IT-205-T involves several key steps:

- Gather all necessary financial documents, including the estate or trust's income and expenses.

- Determine the total estimated tax payments made by the estate or trust during the tax year.

- Identify each beneficiary's share of the income and the corresponding allocation of estimated tax payments.

- Fill out the form by providing the required information, including the names, addresses, and taxpayer identification numbers of the beneficiaries.

- Review the completed form for accuracy before submission.

Obtaining Form IT-205-T

Form IT-205-T can be obtained through various means. It is available for download from the official state tax department website. Additionally, physical copies can often be requested directly from the tax office or through authorized tax preparation services. It is advisable to ensure that you are using the most current version of the form to avoid any compliance issues.

Legal Use of Form IT-205-T

The legal use of Form IT-205-T is primarily to ensure that estimated tax payments are allocated correctly among beneficiaries of an estate or trust. This form is essential for fulfilling fiduciary responsibilities and adhering to tax laws. Proper use of the form helps prevent disputes among beneficiaries and ensures compliance with state tax regulations.

Key Elements of Form IT-205-T

Key elements of Form IT-205-T include:

- Identification of the estate or trust and its fiduciary.

- Details of the estimated tax payments made.

- Allocation percentages for each beneficiary.

- Signature of the fiduciary, affirming the accuracy of the information provided.

Filing Deadlines for Form IT-205-T

Filing deadlines for Form IT-205-T typically align with the tax return deadlines for estates and trusts. Generally, the form must be submitted by the same date as the estate or trust's income tax return. It is crucial to stay informed about any changes to deadlines to ensure timely filing and avoid penalties.

Create this form in 5 minutes or less

Find and fill out the correct form it 205 t allocation of estimated tax payments to beneficiaries tax year

Create this form in 5 minutes!

How to create an eSignature for the form it 205 t allocation of estimated tax payments to beneficiaries tax year

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 205t feature in airSlate SignNow?

The 205t feature in airSlate SignNow allows users to streamline their document signing process. It provides an intuitive interface for sending and eSigning documents, making it easier for businesses to manage their workflows efficiently.

-

How does pricing work for the 205t plan?

The pricing for the 205t plan is designed to be cost-effective, catering to businesses of all sizes. Users can choose from various subscription options that fit their needs, ensuring they only pay for the features they require.

-

What are the key benefits of using the 205t solution?

The 205t solution offers numerous benefits, including enhanced productivity, reduced turnaround times for document signing, and improved compliance. By utilizing airSlate SignNow, businesses can focus on their core operations while ensuring secure and efficient document management.

-

Can I integrate the 205t feature with other applications?

Yes, the 205t feature in airSlate SignNow supports integrations with various applications, including CRM and project management tools. This flexibility allows businesses to create a seamless workflow that enhances their overall efficiency.

-

Is the 205t feature suitable for small businesses?

Absolutely! The 205t feature is particularly beneficial for small businesses looking for an affordable and user-friendly eSigning solution. It empowers them to manage their documents without the need for extensive resources or technical expertise.

-

What types of documents can I send using the 205t feature?

With the 205t feature, users can send a wide variety of documents, including contracts, agreements, and forms. This versatility makes airSlate SignNow an ideal choice for businesses across different industries.

-

How secure is the 205t eSigning process?

The 205t eSigning process in airSlate SignNow is highly secure, utilizing advanced encryption and authentication measures. This ensures that all documents are protected, giving users peace of mind when handling sensitive information.

Get more for Form IT 205 T Allocation Of Estimated Tax Payments To Beneficiaries Tax Year

Find out other Form IT 205 T Allocation Of Estimated Tax Payments To Beneficiaries Tax Year

- Electronic signature Rhode Island Legal Last Will And Testament Simple

- Can I Electronic signature Rhode Island Legal Residential Lease Agreement

- How To Electronic signature South Carolina Legal Lease Agreement

- How Can I Electronic signature South Carolina Legal Quitclaim Deed

- Electronic signature South Carolina Legal Rental Lease Agreement Later

- Electronic signature South Carolina Legal Rental Lease Agreement Free

- How To Electronic signature South Dakota Legal Separation Agreement

- How Can I Electronic signature Tennessee Legal Warranty Deed

- Electronic signature Texas Legal Lease Agreement Template Free

- Can I Electronic signature Texas Legal Lease Agreement Template

- How To Electronic signature Texas Legal Stock Certificate

- How Can I Electronic signature Texas Legal POA

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now