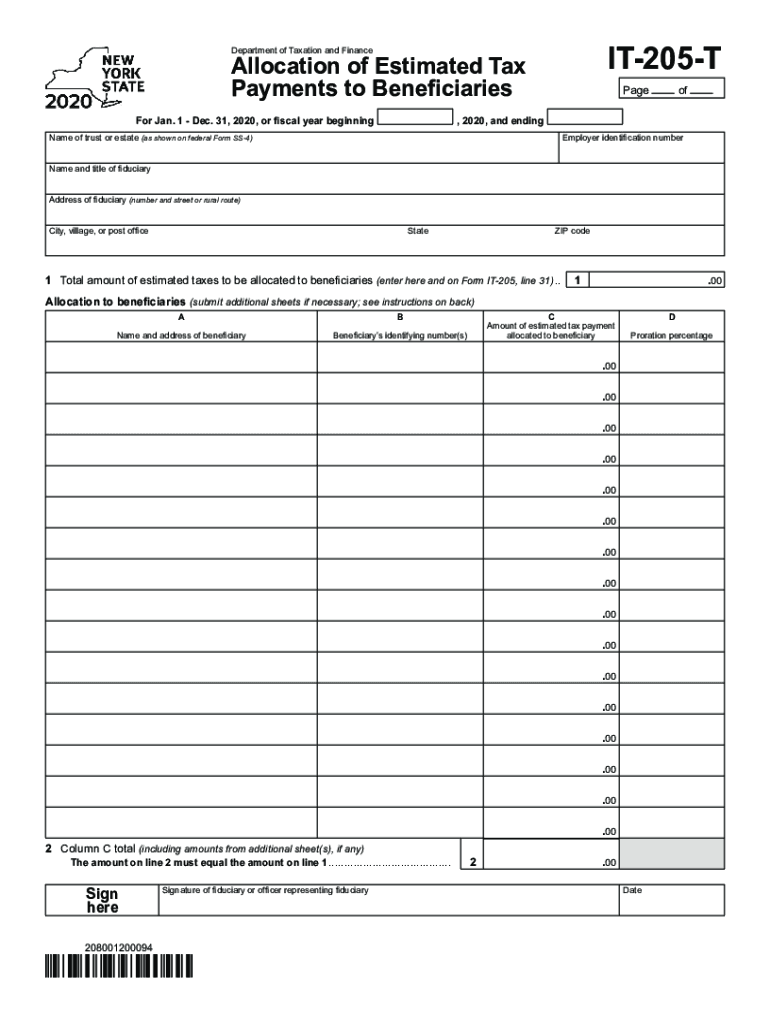

Form it 205 T Allocation of Estimated Tax Payments to 2020

What is the Form IT 205 T Allocation Of Estimated Tax Payments To

The Form IT 205 T is a tax form used in New York for the allocation of estimated tax payments. This form allows taxpayers to distribute their estimated tax payments among various beneficiaries, such as family members or partners, who may be entitled to a share of the tax benefits. Understanding the purpose of this form is essential for ensuring accurate tax reporting and compliance with state tax regulations.

How to use the Form IT 205 T Allocation Of Estimated Tax Payments To

Using the Form IT 205 T involves several steps to ensure proper allocation of estimated tax payments. Taxpayers must first gather all necessary information regarding their estimated tax payments and the beneficiaries involved. Next, the form must be filled out accurately, specifying the amounts allocated to each beneficiary. After completing the form, it should be submitted along with the taxpayer's annual tax return to ensure that the allocations are recognized by the New York State Department of Taxation and Finance.

Steps to complete the Form IT 205 T Allocation Of Estimated Tax Payments To

Completing the Form IT 205 T requires careful attention to detail. Here are the steps to follow:

- Gather your estimated tax payment records and information about all beneficiaries.

- Fill in your personal information, including your name, address, and Social Security number.

- List each beneficiary's name and their respective share of the estimated tax payments.

- Double-check the calculations to ensure accuracy in the amounts allocated.

- Sign and date the form before submission.

Legal use of the Form IT 205 T Allocation Of Estimated Tax Payments To

The legal use of the Form IT 205 T is governed by New York State tax laws. To be considered valid, the form must be filled out completely and accurately, reflecting the true allocation of estimated tax payments. It is important to retain copies of the completed form and any supporting documents, as they may be required for future reference or audits by tax authorities.

Filing Deadlines / Important Dates

Filing deadlines for the Form IT 205 T coincide with the annual tax return deadlines in New York. Typically, individual income tax returns are due on April fifteenth. However, if this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also be aware of any specific deadlines related to estimated tax payments to ensure compliance and avoid penalties.

Penalties for Non-Compliance

Failure to properly complete and submit the Form IT 205 T can result in penalties from the New York State Department of Taxation and Finance. These penalties may include fines or interest on unpaid taxes. It is crucial for taxpayers to ensure that the form is filled out accurately and submitted on time to avoid these potential consequences.

Quick guide on how to complete form it 205 t allocation of estimated tax payments to

Manage Form IT 205 T Allocation Of Estimated Tax Payments To seamlessly on any device

Digital document management has become increasingly popular among organizations and individuals. It offers an ideal environmentally-friendly substitute for traditional printed and signed paperwork, enabling you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents swiftly without interruptions. Handle Form IT 205 T Allocation Of Estimated Tax Payments To on any platform using the airSlate SignNow Android or iOS applications and enhance any document-driven process today.

Steps to modify and eSign Form IT 205 T Allocation Of Estimated Tax Payments To effortlessly

- Obtain Form IT 205 T Allocation Of Estimated Tax Payments To and click Get Form to initiate.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign feature, which takes moments and carries the same legal authority as a conventional handwritten signature.

- Review all the details and press the Done button to save your changes.

- Choose your preferred delivery method for your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that require creating new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign Form IT 205 T Allocation Of Estimated Tax Payments To to ensure outstanding communication throughout every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form it 205 t allocation of estimated tax payments to

Create this form in 5 minutes!

How to create an eSignature for the form it 205 t allocation of estimated tax payments to

The best way to generate an eSignature for your PDF file online

The best way to generate an eSignature for your PDF file in Google Chrome

How to make an eSignature for signing PDFs in Gmail

How to create an eSignature straight from your mobile device

How to create an electronic signature for a PDF file on iOS

How to create an eSignature for a PDF document on Android devices

People also ask

-

What is the 205 t form used for?

The 205 t form is a vital document that allows businesses to streamline their signing process. It's typically used for transmittal and reporting purposes and can facilitate quick eSignatures through airSlate SignNow. This efficiency helps ensure that your documents are processed in a timely manner.

-

How does airSlate SignNow help with the 205 t form?

airSlate SignNow simplifies the management and execution of the 205 t form by providing digital signature capabilities. Users can easily upload, send, and track the form, ensuring a hassle-free experience. This not only saves time but also enhances the overall workflow for your business.

-

Is there a cost associated with using airSlate SignNow for the 205 t form?

Yes, airSlate SignNow offers various pricing plans that cater to businesses of different sizes and needs. The cost-effectiveness of these plans allows you to handle the 205 t form and other documents without breaking the bank. Explore our pricing options to find the best fit for your organization.

-

Can I integrate airSlate SignNow with other software for the 205 t form?

Absolutely! airSlate SignNow offers seamless integrations with a range of popular software applications. This means you can easily incorporate the 205 t form into your existing systems, enhancing your overall document management strategy.

-

What are the benefits of using airSlate SignNow for the 205 t form?

Using airSlate SignNow for the 205 t form allows for quick turnaround times with secure electronic signatures. The platform is designed for ease of use, enabling users to manage and send documents efficiently. In addition, you'll benefit from improved compliance and reduced paper usage.

-

How secure is the 205 t form when using airSlate SignNow?

Security is a top priority for airSlate SignNow. The 205 t form and all other documents are protected with high-level encryption and secure storage solutions. This ensures that your data remains safe and confidential while being signed and processed electronically.

-

Can I track the status of the 205 t form using airSlate SignNow?

Yes, airSlate SignNow provides tracking features that allow you to monitor the status of the 205 t form. You can easily see when the document was viewed, signed, and completed. This transparency helps you manage your workflows more effectively.

Get more for Form IT 205 T Allocation Of Estimated Tax Payments To

Find out other Form IT 205 T Allocation Of Estimated Tax Payments To

- How To eSign Alaska Legal Warranty Deed

- eSign Alaska Legal Cease And Desist Letter Simple

- eSign Arkansas Legal LLC Operating Agreement Simple

- eSign Alabama Life Sciences Residential Lease Agreement Fast

- How To eSign Arkansas Legal Residential Lease Agreement

- Help Me With eSign California Legal Promissory Note Template

- eSign Colorado Legal Operating Agreement Safe

- How To eSign Colorado Legal POA

- eSign Insurance Document New Jersey Online

- eSign Insurance Form New Jersey Online

- eSign Colorado Life Sciences LLC Operating Agreement Now

- eSign Hawaii Life Sciences Letter Of Intent Easy

- Help Me With eSign Hawaii Life Sciences Cease And Desist Letter

- eSign Hawaii Life Sciences Lease Termination Letter Mobile

- eSign Hawaii Life Sciences Permission Slip Free

- eSign Florida Legal Warranty Deed Safe

- Help Me With eSign North Dakota Insurance Residential Lease Agreement

- eSign Life Sciences Word Kansas Fast

- eSign Georgia Legal Last Will And Testament Fast

- eSign Oklahoma Insurance Business Associate Agreement Mobile