Form it 205 T "Allocation of Estimated Tax Payments to 2021

What is the Form IT 205 T?

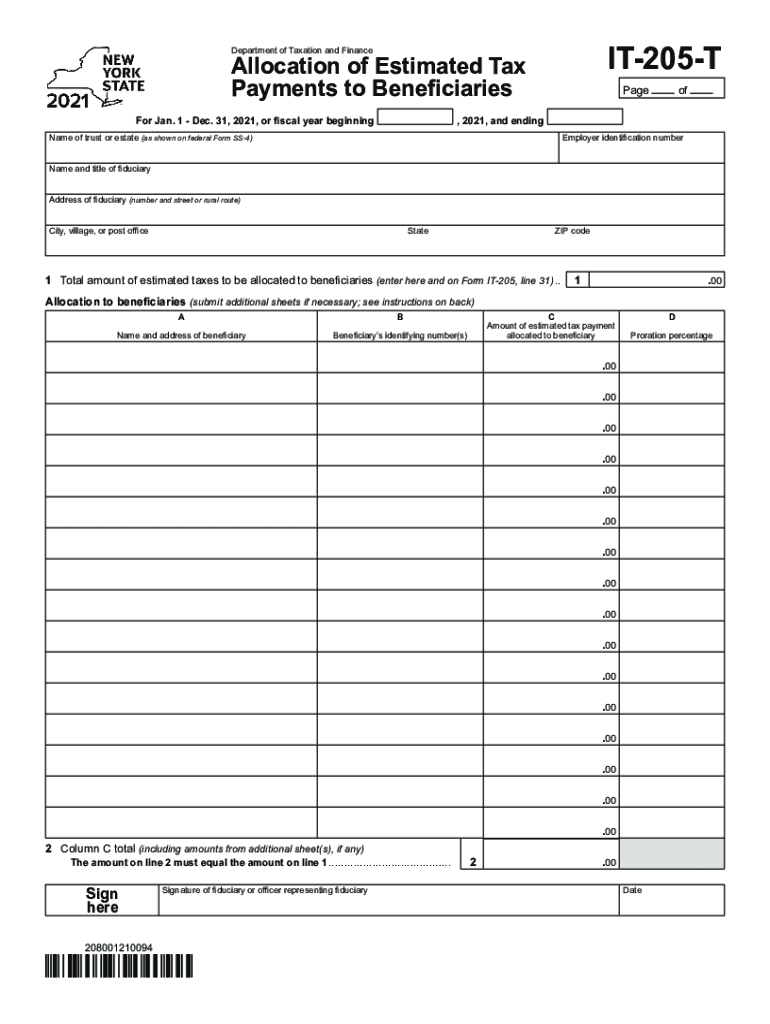

The Form IT 205 T, also known as the Allocation of Estimated Tax Payments, is a crucial document for taxpayers in New York. It allows individuals to allocate their estimated tax payments among different beneficiaries. This form is particularly relevant for those who have made estimated tax payments on behalf of others, such as family members or business partners. Understanding the purpose and function of this form is essential for ensuring accurate tax reporting and compliance with state regulations.

How to Use the Form IT 205 T

Using the Form IT 205 T involves a few straightforward steps. First, gather all necessary information, including the names and taxpayer identification numbers of the beneficiaries. Next, accurately fill out the form by entering the total estimated tax payments made and the amounts allocated to each beneficiary. It is important to ensure that the allocations add up to the total payments made. After completing the form, it should be submitted along with your tax return to ensure proper credit for the estimated payments.

Steps to Complete the Form IT 205 T

Completing the Form IT 205 T requires careful attention to detail. Follow these steps for accurate completion:

- Obtain the latest version of the form from the New York State Department of Taxation and Finance website.

- Provide your personal information, including your name, address, and taxpayer identification number.

- List all beneficiaries who will receive an allocation of estimated tax payments.

- Enter the total amount of estimated payments made and allocate specific amounts to each beneficiary.

- Review the form for accuracy, ensuring all calculations and entries are correct.

- Sign and date the form before submission.

Legal Use of the Form IT 205 T

The Form IT 205 T is legally binding when filled out correctly and submitted according to New York State tax regulations. It serves as an official record of the allocation of estimated tax payments, which can impact the tax liabilities of both the payer and the beneficiaries. Proper use of this form ensures compliance with state tax laws and helps to avoid potential penalties associated with misreporting.

Filing Deadlines / Important Dates

Timely filing of the Form IT 205 T is essential to avoid penalties. The form must be submitted along with your annual tax return. Key deadlines typically align with the New York State tax filing deadlines, which are generally due on April fifteenth for most taxpayers. However, it is advisable to check the New York State Department of Taxation and Finance for any updates or changes to filing dates.

Penalties for Non-Compliance

Failing to properly complete and submit the Form IT 205 T can lead to significant penalties. Taxpayers may face fines for incorrect allocations or late submissions. Additionally, beneficiaries may not receive the intended tax credits, which can result in unexpected tax liabilities. It is crucial to ensure that all information is accurate and submitted on time to avoid these consequences.

Quick guide on how to complete form it 205 t ampquotallocation of estimated tax payments to

Complete Form IT 205 T "Allocation Of Estimated Tax Payments To effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct forms and securely store them online. airSlate SignNow provides all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Manage Form IT 205 T "Allocation Of Estimated Tax Payments To on any platform with airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to modify and eSign Form IT 205 T "Allocation Of Estimated Tax Payments To with ease

- Find Form IT 205 T "Allocation Of Estimated Tax Payments To and click on Get Form to begin.

- Utilize the tools we provide to finalize your form.

- Emphasize important sections of the documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign feature, which takes seconds and holds the same legal validity as a traditional ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, or an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, cumbersome form searching, or mistakes requiring re-printing. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and eSign Form IT 205 T "Allocation Of Estimated Tax Payments To and guarantee excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form it 205 t ampquotallocation of estimated tax payments to

Create this form in 5 minutes!

How to create an eSignature for the form it 205 t ampquotallocation of estimated tax payments to

How to create an e-signature for a PDF online

How to create an e-signature for a PDF in Google Chrome

The best way to create an e-signature for signing PDFs in Gmail

How to create an electronic signature from your smartphone

How to generate an e-signature for a PDF on iOS

How to create an electronic signature for a PDF file on Android

People also ask

-

What is the it205 t tax form and how does it relate to airSlate SignNow?

The it205 t tax form is essential for businesses that need to file New York State taxes. Using airSlate SignNow, you can easily electronically sign and send the it205 t tax form, making your filing process faster and more efficient.

-

How can airSlate SignNow assist with the preparation of the it205 t tax?

airSlate SignNow provides seamless document management features, allowing users to prepare, sign, and share the it205 t tax form securely. This platform simplifies the tax preparation process by ensuring compliance and improving accuracy.

-

What are the pricing options for using airSlate SignNow for the it205 t tax?

AirSlate SignNow offers flexible pricing plans suitable for individuals and businesses that need to manage the it205 t tax form. Plans are designed to be cost-effective, ensuring that you can choose one that fits your budget while providing all necessary features.

-

Are there integrations available for airSlate SignNow to facilitate filing the it205 t tax?

Yes, airSlate SignNow integrates with various accounting and tax software that can help streamline the filing of the it205 t tax form. These integrations ensure that your documents are efficiently managed and that data transfers are seamless.

-

What features does airSlate SignNow offer for handling the it205 t tax form?

AirSlate SignNow offers features like e-signature, document templates, and automated workflows to simplify the handling of the it205 t tax form. These tools help ensure that all necessary signatures are obtained quickly and that your documents are properly formatted.

-

How does airSlate SignNow ensure the security of my it205 t tax documents?

AirSlate SignNow employs robust encryption and security protocols to protect all documents, including the it205 t tax form. This commitment to security ensures that sensitive information remains confidential and that your data is safe from unauthorized access.

-

Can I track the status of my it205 t tax documents using airSlate SignNow?

Absolutely! AirSlate SignNow allows users to track the status of their it205 t tax documents in real-time. You will receive notifications when documents are viewed or signed, providing transparency throughout the process.

Get more for Form IT 205 T "Allocation Of Estimated Tax Payments To

Find out other Form IT 205 T "Allocation Of Estimated Tax Payments To

- Electronic signature Colorado Charity Promissory Note Template Simple

- Electronic signature Alabama Construction Quitclaim Deed Free

- Electronic signature Alaska Construction Lease Agreement Template Simple

- Electronic signature Construction Form Arizona Safe

- Electronic signature Kentucky Charity Living Will Safe

- Electronic signature Construction Form California Fast

- Help Me With Electronic signature Colorado Construction Rental Application

- Electronic signature Connecticut Construction Business Plan Template Fast

- Electronic signature Delaware Construction Business Letter Template Safe

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template