Form 1041 T Internal Revenue Service 2018

What is the Form 1041 T Internal Revenue Service

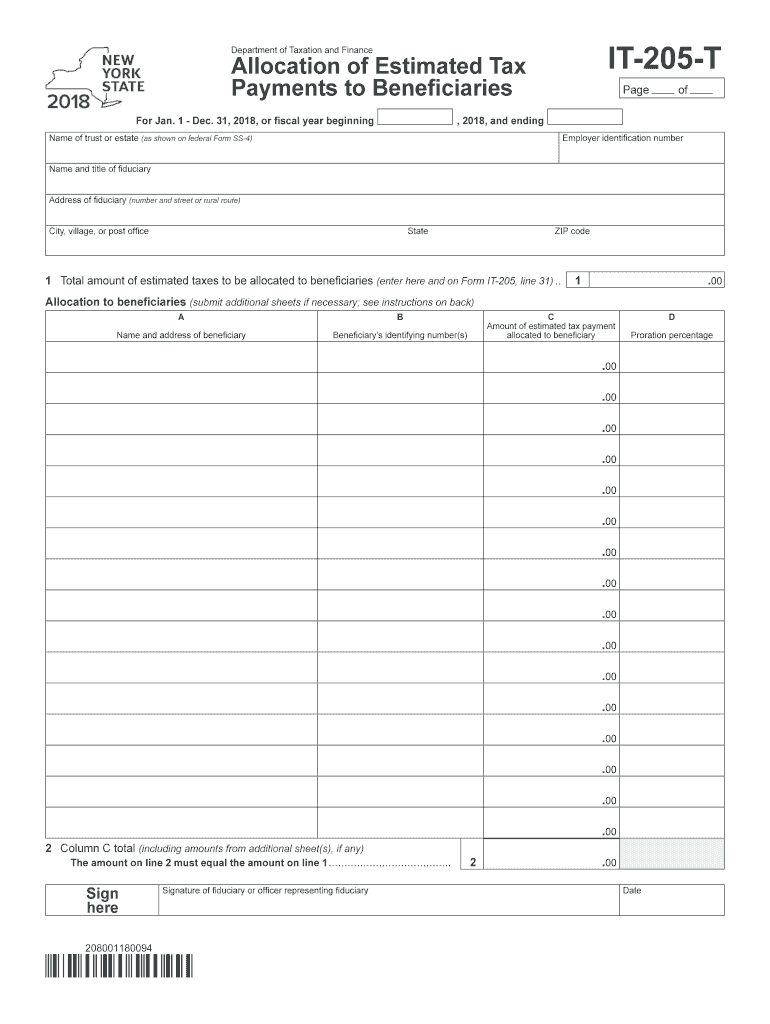

The Form 1041 T is a tax document used by estates and trusts to report income, deductions, and tax liability to the Internal Revenue Service (IRS). This form is specifically designed for the reporting of income distributions to beneficiaries. The form allows fiduciaries to report the income that is passed on to beneficiaries, ensuring that the income is taxed at the beneficiary's tax rate rather than the trust's rate. Understanding the purpose of Form 1041 T is crucial for proper tax compliance and management of estate or trust finances.

How to use the Form 1041 T Internal Revenue Service

Using the Form 1041 T involves several key steps. First, the fiduciary must gather all relevant financial information regarding the estate or trust, including income sources and deductions. Next, the fiduciary fills out the form, detailing the income earned by the estate or trust and the amounts distributed to beneficiaries. It is important to ensure that all figures are accurate to avoid issues with the IRS. Once completed, the form must be submitted along with any required schedules or attachments, typically by the tax filing deadline.

Steps to complete the Form 1041 T Internal Revenue Service

Completing the Form 1041 T requires careful attention to detail. Here are the steps to follow:

- Gather all financial records related to the estate or trust, including income statements and expense receipts.

- Fill out the identifying information section, including the name and tax identification number of the estate or trust.

- Report the total income earned during the tax year on the appropriate lines of the form.

- Detail the distributions made to beneficiaries, ensuring that each amount is accurately reported.

- Complete any additional schedules required, such as Schedule A for deductions.

- Review the form thoroughly for accuracy and completeness before submission.

Legal use of the Form 1041 T Internal Revenue Service

The legal use of Form 1041 T is governed by IRS regulations that dictate how estates and trusts must report income. Proper completion and submission of this form are essential for compliance with federal tax laws. Failure to accurately report income or distributions can lead to penalties, including fines or increased scrutiny from the IRS. The form must be filed by the due date, typically the fifteenth day of the fourth month following the end of the tax year.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1041 T are critical to avoid penalties. Generally, the form is due on the fifteenth day of the fourth month after the end of the tax year. For estates and trusts operating on a calendar year, this means the form is typically due by April 15. If the due date falls on a weekend or holiday, the deadline is extended to the next business day. Fiduciaries may also apply for an extension, which can provide additional time to file, but any taxes owed must still be paid by the original deadline.

Form Submission Methods (Online / Mail / In-Person)

The Form 1041 T can be submitted to the IRS through various methods. The preferred method is electronic filing, which allows for quicker processing and confirmation of receipt. Alternatively, the form can be mailed to the appropriate IRS address, depending on the state of residence of the estate or trust. In-person submissions are generally not accepted for this form, making electronic and mail options the most viable. It is essential to keep a copy of the submitted form and any supporting documents for record-keeping purposes.

Quick guide on how to complete 2018 form 1041 t internal revenue service

Effortlessly prepare Form 1041 T Internal Revenue Service on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely save it online. airSlate SignNow provides all the necessary tools to create, modify, and eSign your documents swiftly without any hold-ups. Manage Form 1041 T Internal Revenue Service on any device with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and eSign Form 1041 T Internal Revenue Service effortlessly

- Obtain Form 1041 T Internal Revenue Service and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tiresome form searches, or errors that necessitate the printing of new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from a device of your choice. Edit and eSign Form 1041 T Internal Revenue Service and ensure seamless communication at any point of the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2018 form 1041 t internal revenue service

Create this form in 5 minutes!

How to create an eSignature for the 2018 form 1041 t internal revenue service

How to generate an electronic signature for your 2018 Form 1041 T Internal Revenue Service online

How to make an eSignature for the 2018 Form 1041 T Internal Revenue Service in Chrome

How to create an electronic signature for putting it on the 2018 Form 1041 T Internal Revenue Service in Gmail

How to make an eSignature for the 2018 Form 1041 T Internal Revenue Service straight from your smart phone

How to generate an electronic signature for the 2018 Form 1041 T Internal Revenue Service on iOS devices

How to create an electronic signature for the 2018 Form 1041 T Internal Revenue Service on Android devices

People also ask

-

What is Form 1041 T from the Internal Revenue Service?

Form 1041 T is a tax form used by estates and trusts to report income and calculate taxes owed to the Internal Revenue Service. It is essential for those managing an estate or trust, ensuring compliance with IRS regulations. Understanding this form is crucial for legal fiduciaries to fulfill their tax obligations accurately.

-

How can airSlate SignNow help with Form 1041 T filings?

airSlate SignNow simplifies the process of preparing and signing Form 1041 T by providing a secure platform for document management. Users can easily upload, edit, and eSign necessary documents, ensuring that everything is completed efficiently. This helps reduce errors and saves valuable time during tax season.

-

Is airSlate SignNow affordable for small businesses needing to file Form 1041 T?

Yes, airSlate SignNow offers cost-effective plans suitable for small businesses that need to manage Form 1041 T filings. With a range of pricing options, users can choose a plan that meets their budget while benefiting from our document management features. This makes it accessible for businesses of all sizes.

-

What features does airSlate SignNow offer for managing Form 1041 T?

airSlate SignNow provides a variety of features tailored for managing tax documents like Form 1041 T. Users can utilize templates, eSignature functionality, and document tracking to streamline the preparation process. These features make it easier to stay organized and ensure timely submissions.

-

Can I integrate airSlate SignNow with other tools for Form 1041 T preparation?

Yes, airSlate SignNow supports integrations with various accounting and document management tools that can aid in the preparation of Form 1041 T. This integration capability enhances workflow efficiency and data sharing, making it easier to gather and submit the necessary information to the Internal Revenue Service.

-

What are the benefits of using airSlate SignNow for eSigning Form 1041 T?

Using airSlate SignNow for eSigning Form 1041 T provides several benefits, including enhanced security and quick turnaround times. The platform ensures that all signed documents are securely stored and easily accessible. Additionally, electronic signatures are legally recognized, making the submission process more efficient.

-

Is training available for using airSlate SignNow with Form 1041 T?

Absolutely! airSlate SignNow offers tutorials and customer support to help users effectively navigate the platform for Form 1041 T. This training ensures that users can fully utilize all features, making their experience seamless and enhancing their confidence when preparing important tax documents.

Get more for Form 1041 T Internal Revenue Service

- Form 08 111a follow up report for as 4555900b19 commerce alaska

- Transporter activity report state of alaska commerce alaska form

- Sweet frog application 2014 form

- Contract to buy and sell real estate land colorado real estate commission approved form

- Addendum to contract for residential sale and purchase peopleamp39s form

- Contract lbarcom form

- Special sale contract form

- Diamond life member delta sigma theta form

Find out other Form 1041 T Internal Revenue Service

- Can I Electronic signature Missouri Car Dealer Document

- How Do I Electronic signature Nevada Car Dealer PDF

- How To Electronic signature South Carolina Banking Document

- Can I Electronic signature New York Car Dealer Document

- How To Electronic signature North Carolina Car Dealer Word

- How Do I Electronic signature North Carolina Car Dealer Document

- Can I Electronic signature Ohio Car Dealer PPT

- How Can I Electronic signature Texas Banking Form

- How Do I Electronic signature Pennsylvania Car Dealer Document

- How To Electronic signature South Carolina Car Dealer Document

- Can I Electronic signature South Carolina Car Dealer Document

- How Can I Electronic signature Texas Car Dealer Document

- How Do I Electronic signature West Virginia Banking Document

- How To Electronic signature Washington Car Dealer Document

- Can I Electronic signature West Virginia Car Dealer Document

- How Do I Electronic signature West Virginia Car Dealer Form

- How Can I Electronic signature Wisconsin Car Dealer PDF

- How Can I Electronic signature Wisconsin Car Dealer Form

- How Do I Electronic signature Montana Business Operations Presentation

- How To Electronic signature Alabama Charity Form