Form it 216 Claim for Child and Dependent Care Credit 2022

What is the Form IT 216 Claim For Child And Dependent Care Credit

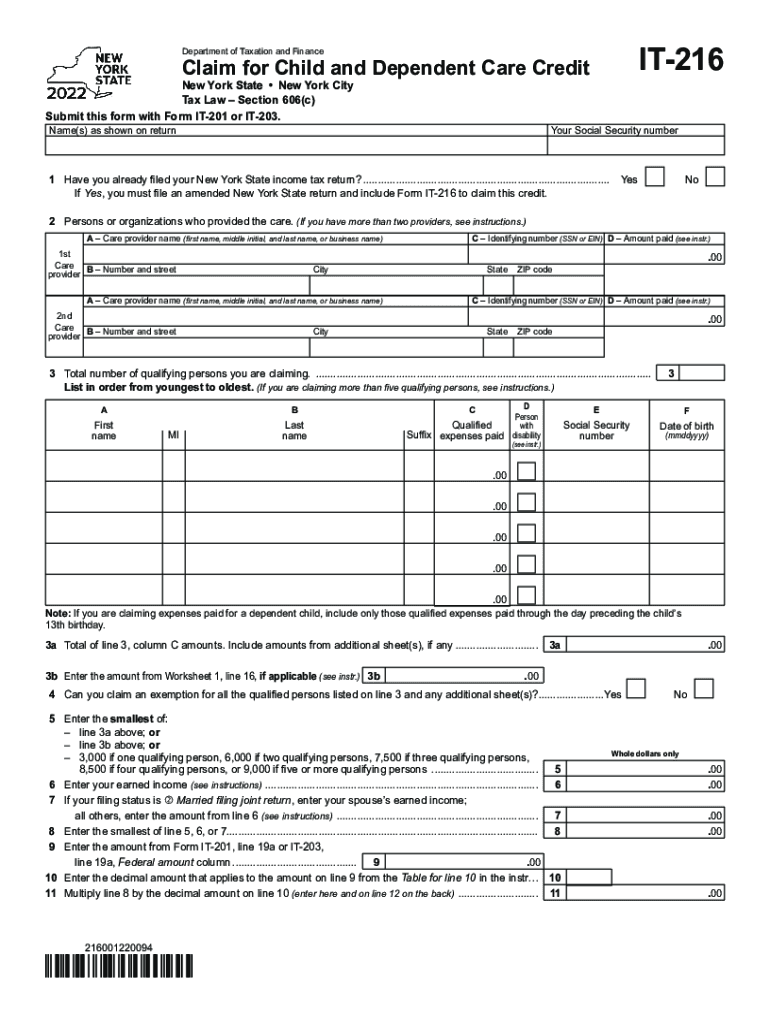

The Form IT 216 is a tax document used in New York to claim the Child and Dependent Care Credit. This credit is designed to assist taxpayers who incur expenses for the care of qualifying children or dependents while they work or look for work. The form allows individuals to report eligible expenses and calculate the amount of credit they may receive, which can significantly reduce their overall tax liability.

How to use the Form IT 216 Claim For Child And Dependent Care Credit

Using the Form IT 216 involves several steps to ensure accurate reporting of dependent care expenses. Taxpayers must first gather all relevant documentation, including receipts for care expenses and information about the care provider. Next, the form requires details such as the taxpayer's income, the number of qualifying individuals, and the total amount spent on care. After filling out the form, it should be submitted along with the New York State tax return.

Steps to complete the Form IT 216 Claim For Child And Dependent Care Credit

Completing the Form IT 216 involves a systematic approach:

- Gather necessary documents, including receipts for care expenses and provider information.

- Fill in personal information, including your name, address, and Social Security number.

- Provide details about the qualifying individuals, including their names and ages.

- Report the total amount spent on care and any other required financial information.

- Review the form for accuracy before submission.

Eligibility Criteria

To qualify for the Child and Dependent Care Credit using Form IT 216, certain eligibility criteria must be met. The taxpayer must have incurred expenses for the care of a child under the age of thirteen or a dependent who is physically or mentally incapable of self-care. Additionally, the taxpayer must have earned income and must be able to provide documentation of the care expenses incurred. The credit amount is also subject to income limits, which may affect the total credit available.

Required Documents

When filing Form IT 216, it is essential to have specific documentation ready to support your claim. Required documents include:

- Receipts or invoices from the care provider detailing the services rendered.

- The care provider's name, address, and taxpayer identification number.

- Proof of income, such as W-2 forms or 1099s, to establish eligibility for the credit.

Form Submission Methods

Form IT 216 can be submitted through various methods to ensure compliance with New York State tax regulations. Taxpayers can file the form online as part of their state tax return, submit it by mail, or deliver it in person to the appropriate tax office. Each method has its own processing times and requirements, so it is advisable to choose the method that best suits your needs.

Quick guide on how to complete form it 216 claim for child and dependent care credit

Effortlessly prepare Form IT 216 Claim For Child And Dependent Care Credit on any device

Managing documents online has gained popularity among companies and individuals. It serves as an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without any delays. Manage Form IT 216 Claim For Child And Dependent Care Credit on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to alter and electronically sign Form IT 216 Claim For Child And Dependent Care Credit with ease

- Locate Form IT 216 Claim For Child And Dependent Care Credit and click on Get Form to initiate.

- Make use of the tools we offer to complete your form.

- Emphasize important sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Craft your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Verify the information and click on the Done button to store your changes.

- Select your preferred method for submitting your form—via email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form hunting, or errors requiring new printed copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and electronically sign Form IT 216 Claim For Child And Dependent Care Credit to ensure exceptional communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form it 216 claim for child and dependent care credit

Create this form in 5 minutes!

How to create an eSignature for the form it 216 claim for child and dependent care credit

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it work in New York?

airSlate SignNow is an eSignature solution that allows individuals and businesses in New York to send, sign, and manage documents electronically. The platform streamlines the signing process by eliminating the need for physical paperwork, making it faster and more efficient. Users can easily upload documents, add signers, and track the status of their agreements from anywhere.

-

How much does airSlate SignNow cost for users in New York?

Pricing for airSlate SignNow varies based on the plan you choose, with options suitable for individuals and businesses in New York. We aim to provide a cost-effective eSignature solution that fits any budget. You can explore different plans on our website, allowing you to select the features that meet your specific needs.

-

What features does airSlate SignNow offer for New York businesses?

airSlate SignNow offers a range of features tailored for New York businesses, including document templates, advanced security options, and real-time tracking. These features enhance efficiency and compliance, helping businesses streamline their workflows. Additionally, users can integrate with various applications to improve overall productivity.

-

Is it safe to use airSlate SignNow in New York?

Yes, airSlate SignNow prioritizes the security of your documents and personal information, making it a safe choice for users in New York. The platform employs advanced encryption and complies with industry standards to protect data integrity. You can confidently eSign and manage documents knowing your information is secure.

-

Can I integrate airSlate SignNow with other software used in New York?

Absolutely! airSlate SignNow integrates seamlessly with many popular applications, including CRM and project management tools commonly used in New York. This interoperability allows for smoother workflows, enabling users to streamline processes and improve collaboration. Explore our integrations to find the best fit for your business needs.

-

What are the benefits of using airSlate SignNow for New Yorkers?

Using airSlate SignNow provides numerous benefits for New Yorkers, such as improved efficiency, reduced paperwork, and faster transaction times. The platform simplifies document management, allowing you to focus on core business activities. Furthermore, businesses can access their documents anytime and anywhere, which enhances flexibility.

-

How can I get started with airSlate SignNow in New York?

Getting started with airSlate SignNow in New York is easy. Simply visit our website to sign up for a free trial, giving you access to all features. You can quickly create an account, upload your documents, and start sending eSignatures in minutes without any initial commitment.

Get more for Form IT 216 Claim For Child And Dependent Care Credit

- Letter from tenant to landlord about fair housing reduction or denial of services to family with children south carolina form

- Letter from tenant to landlord containing notice of termination for landlords noncompliance with possibility to cure south form

- Letter from tenant to landlord responding to notice to terminate for noncompliance noncompliant condition caused by landlords 497325656 form

- Letter from tenant to landlord for failure of landlord to return all prepaid and unearned rent and security recoverable by 497325657 form

- Letter from tenant to landlord for failure of landlord to comply with building codes affecting health and safety or resulting 497325658 form

- Letter from landlord to tenant where tenant complaint was caused by the deliberate or negligent act of tenant or tenants guest 497325659 form

- Letter from landlord to tenant for failure to keep premises as clean and safe as condition of premises permits remedy or lease 497325660 form

- Sc tenant in form

Find out other Form IT 216 Claim For Child And Dependent Care Credit

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT