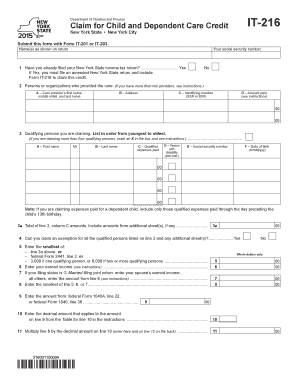

it 216 Form 2015

What is the It 216 Form

The It 216 Form is a tax document used for reporting specific income and deductions by individuals and businesses in the United States. This form is particularly relevant for those who need to declare certain types of income that may not be covered by standard tax forms. It serves as a means to ensure compliance with federal tax regulations and helps taxpayers accurately report their financial activities. Understanding the purpose of the It 216 Form is essential for proper tax filing and avoiding potential penalties.

How to use the It 216 Form

Using the It 216 Form involves several key steps. First, gather all necessary financial documents, such as income statements and receipts for deductions. Next, access the form through a reliable source, ensuring it is the current version. Fill out the form accurately, providing all required information, including your name, address, and details of your income and deductions. Once completed, review the form for accuracy before submitting it to the appropriate tax authority. This process can be streamlined by utilizing digital tools that allow for electronic signatures and document management.

Steps to complete the It 216 Form

Completing the It 216 Form requires careful attention to detail. Follow these steps:

- Collect all relevant financial documents, including W-2s, 1099s, and receipts.

- Download the It 216 Form from an official source.

- Fill in your personal information, including your Social Security number and contact details.

- Report your income accurately, ensuring to include all sources.

- Detail any deductions you are eligible for, providing necessary documentation.

- Review the completed form for any errors or omissions.

- Sign the form electronically or manually, as required.

- Submit the form via the designated method, whether online or by mail.

Legal use of the It 216 Form

The It 216 Form is legally recognized for tax reporting purposes, provided it is completed accurately and submitted on time. It adheres to IRS guidelines, ensuring that taxpayers can fulfill their legal obligations without facing penalties. It is important to keep copies of submitted forms and any supporting documents for your records. This practice not only helps in case of audits but also ensures compliance with federal and state tax laws.

Filing Deadlines / Important Dates

Filing deadlines for the It 216 Form are critical for compliance. Typically, the form must be submitted by the annual tax deadline, which is usually April 15. However, specific deadlines may vary based on individual circumstances, such as extensions or changes in tax law. It is essential to stay informed about any updates from the IRS regarding filing dates to avoid late penalties.

Form Submission Methods (Online / Mail / In-Person)

The It 216 Form can be submitted through various methods, offering flexibility to taxpayers. Options include:

- Online Submission: Many taxpayers prefer to file electronically, which allows for quicker processing and confirmation.

- Mail: The form can be printed and mailed to the appropriate tax authority. Ensure to use certified mail for tracking.

- In-Person: Some individuals may choose to submit their forms in person at local tax offices, especially if they require assistance.

Quick guide on how to complete it 216 2015 form

Your assistance manual for preparing your It 216 Form

If you’re curious about how to finalize and submit your It 216 Form, here are some brief tips on how to simplify your tax filing process.

To begin, you just need to create your airSlate SignNow account to transform how you manage documents online. airSlate SignNow is an extremely user-friendly and powerful document solution that enables you to modify, draft, and finalize your tax forms effortlessly. With its editor, you can toggle between text, check boxes, and eSignatures and easily return to amend information as necessary. Enhance your tax organization with advanced PDF editing, eSigning, and straightforward sharing.

Follow these steps to finalize your It 216 Form in just a few minutes:

- Establish your account and start working on PDFs in no time.

- Utilize our directory to find any IRS tax form; browse through versions and schedules.

- Click Get form to access your It 216 Form in our editor.

- Complete the necessary fillable fields with your details (text, numbers, check marks).

- Use the Sign Tool to add your legally-binding eSignature (if required).

- Examine your document and fix any errors.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Refer to this manual to file your taxes electronically using airSlate SignNow. Keep in mind that submitting by paper can lead to increased return errors and postpone refunds. Obviously, before e-filing your taxes, verify the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct it 216 2015 form

FAQs

-

How can I fill out the FY 2015-16 and 2016-17 ITR forms after the 31st of March 2018?

As you know the last date of filling income tax retruns has been gone for the financial year 2015–16 and 2016–17. and if you haven’t done it before 31–03–2018. then i don’t think it is possible according to the current guidlines of IT Department. it may possible that they can send you the notice to answer for not filling the retrun and they may charge penalty alsoif your income was less than taxable limit then its ok it is a valid reson but you don’t need file ITR for those years but if your income was more than the limit then, i think you have to write the lette to your assessing officer with a genuine reason that why didn’t you file the ITR.This was only suggestion not adviceyou can also go through the professional chartered accountant

-

How can I make it easier for users to fill out a form on mobile apps?

I’ll tell you a secret - you can thank me later for this.If you want to make the form-filling experience easy for a user - make sure that you have a great UI to offer.Everything boils down to UI at the end.Axonator is one of the best mobile apps to collect data since it offers powerful features bundled with a simple UI.The problem with most of the mobile form apps is that they are overloaded with features that aren’t really necessary.The same doesn’t hold true for Axonator. It has useful features but it is very unlikely that the user will feel overwhelmed in using them.So, if you are inclined towards having greater form completion rates for your survey or any data collection projects, then Axonator is the way to go.Apart from that, there are other features that make the data collection process faster like offline data collection, rich data capture - audio, video, images, QR code & barcode data capture, live location & time capture, and more!Check all the features here!You will be able to complete more surveys - because productivity will certainly shoot up.Since you aren’t using paper forms, errors will drop signNowly.The cost of the paper & print will be saved - your office expenses will drop dramatically.No repeat work. No data entry. Time & money saved yet again.Analytics will empower you to make strategic decisions and explore new revenue opportunities.The app is dirt-cheap & you don’t any training to use the app. They come in with a smooth UI. Forget using, even creating forms for your apps is easy on the platform. Just drag & drop - and it’s ready for use. Anyone can build an app under hours.

-

How do I fill out the IT-2104 form if I live in NJ?

Do you work only in NY? Married? Kids? If your w-2 shows NY state withholding on your taxes, fill out a non-resident NY tax return which is fairly simple. If it doesn't, you don't fill out NY at all. If it shows out NYC withholding you enter that as well on the same forms.Then you would fill out your NJ returns as well with any withholding for NJ. Make sure to put any taxes paid to other states on your reciprocal states (nj paid, on NY return and vice versa)

Create this form in 5 minutes!

How to create an eSignature for the it 216 2015 form

How to generate an eSignature for your It 216 2015 Form online

How to make an electronic signature for the It 216 2015 Form in Chrome

How to generate an electronic signature for signing the It 216 2015 Form in Gmail

How to create an eSignature for the It 216 2015 Form straight from your smartphone

How to make an electronic signature for the It 216 2015 Form on iOS devices

How to create an electronic signature for the It 216 2015 Form on Android devices

People also ask

-

What is the It 216 Form and why is it important?

The It 216 Form is a specific document used for various tax-related purposes. It assists businesses in ensuring compliance with state regulations while providing a clear overview of financial obligations. Understanding the It 216 Form can help streamline your tax preparation process effectively.

-

How can airSlate SignNow help with the It 216 Form?

airSlate SignNow provides a seamless solution for sending and eSigning the It 216 Form. Our platform allows you to prepare, send, and manage your documents efficiently, ensuring that they are signed quickly and securely. This enhances productivity and reduces turnaround time for important forms like the It 216 Form.

-

What are the pricing options for using airSlate SignNow with the It 216 Form?

airSlate SignNow offers competitive pricing plans tailored to different business needs, ensuring affordability while you manage documents like the It 216 Form. We provide flexible subscription options that allow you to choose a plan based on your usage frequency and volume. For detailed pricing, visit our website or contact our sales team.

-

Are there any features specific to handling the It 216 Form with airSlate SignNow?

Yes, airSlate SignNow includes features designed to enhance your experience with the It 216 Form. These features include customizable templates, real-time collaboration, and built-in security measures for document integrity. These tools simplify the process of preparing and managing the It 216 Form efficiently.

-

Can I integrate airSlate SignNow with other tools while working with the It 216 Form?

Absolutely! airSlate SignNow supports integrations with various third-party applications, making it easy to incorporate the It 216 Form into your existing workflows. Popular integrations include CRM systems, email platforms, and document storage services, allowing for a more streamlined document management process.

-

How secure is the airSlate SignNow platform for handling the It 216 Form?

Security is a top priority at airSlate SignNow. While handling the It 216 Form, we ensure data protection through end-to-end encryption, secure storage, and compliance with industry standards. This guarantees that your sensitive information remains safe and confidential throughout the signing process.

-

Is it easy to track the status of the It 216 Form with airSlate SignNow?

Yes, airSlate SignNow offers robust tracking features that allow you to monitor the status of the It 216 Form in real time. You will receive notifications about when the document is sent, viewed, and signed, making it easy to manage your documents efficiently without any hassle.

Get more for It 216 Form

- Forums marokko nlarchive proxy wideru com www economie portaal form

- Application for electrical permit form

- Dumas isd texas education agency texas public school form

- Paraprofessional applicant questions allenisd form

- Gr a c e sc h o o l au t h o r i z a t i o n graceschool form

- Proof of residency from homeowner exhibit b front form

- 4 h livestock ampamp animal information urban programs travis

- Form h5railroad commission of texas11042020oil a

Find out other It 216 Form

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy

- How To eSignature Maryland Business Operations Business Letter Template