it 216 2024-2026

What is the IT-216?

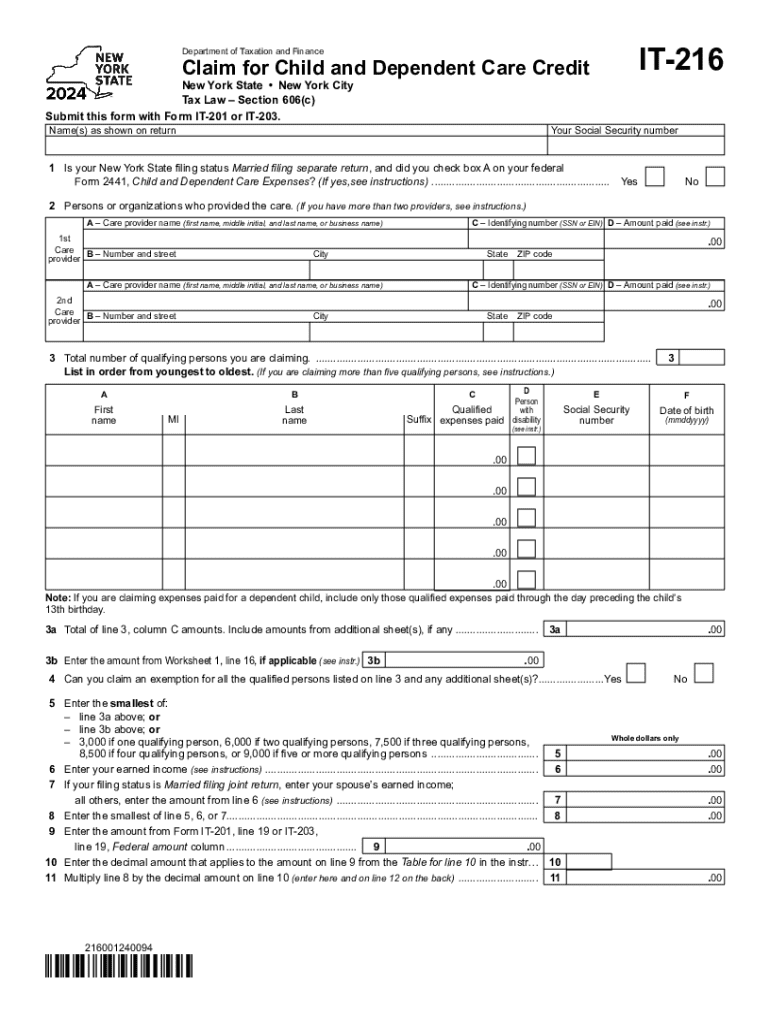

The IT-216 is a tax form used in New York State, specifically designed to claim the Child and Dependent Care Credit. This credit assists taxpayers who incur expenses for the care of children or dependents while they work or look for work. The form helps to reduce the overall tax liability, making it an essential document for eligible taxpayers in New York.

How to Obtain the IT-216

To obtain the IT-216 form, taxpayers can visit the New York State Department of Taxation and Finance website. The form is available for download in PDF format, allowing users to print it for completion. Additionally, taxpayers can request a physical copy by contacting the department directly. It is advisable to ensure that you have the most current version of the form to avoid any issues during filing.

Steps to Complete the IT-216

Completing the IT-216 involves several key steps:

- Gather necessary information, including Social Security numbers for all dependents and details of care expenses.

- Fill out personal information, such as name, address, and filing status.

- Provide details about the care provider, including their name, address, and taxpayer identification number.

- Calculate the amount of credit based on the expenses incurred and the number of qualifying individuals.

- Review the completed form for accuracy before submission.

Eligibility Criteria

To qualify for the Child and Dependent Care Credit on the IT-216, several criteria must be met:

- The taxpayer must have incurred expenses for the care of a qualifying child under the age of thirteen or a dependent who is physically or mentally incapable of self-care.

- The taxpayer must have earned income during the year in which the expenses were incurred.

- Care must be provided so that the taxpayer can work or look for work.

Filing Deadlines / Important Dates

Filing deadlines for the IT-216 typically align with the general tax filing deadlines in New York State. Taxpayers should ensure that they submit their forms by the due date to avoid penalties. For the 2024 tax year, the deadline is usually April fifteenth, unless extensions are filed. It is crucial to stay updated on any changes to these dates that may arise.

Form Submission Methods

The IT-216 can be submitted through various methods:

- Online submission via the New York State Department of Taxation and Finance portal.

- Mailing a completed paper form to the designated tax office.

- In-person submission at local tax offices, if applicable.

Create this form in 5 minutes or less

Find and fill out the correct it 216

Create this form in 5 minutes!

How to create an eSignature for the it 216

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2024 it 216 pricing structure for airSlate SignNow?

The 2024 it 216 pricing structure for airSlate SignNow is designed to be cost-effective for businesses of all sizes. We offer various plans that cater to different needs, ensuring you only pay for the features you require. You can choose from monthly or annual billing options to suit your budget.

-

What features are included in the 2024 it 216 plan?

The 2024 it 216 plan includes a comprehensive set of features such as document templates, advanced eSignature capabilities, and real-time tracking. Additionally, users can enjoy integrations with popular applications, making it easier to streamline workflows. This plan is tailored to enhance productivity and efficiency.

-

How does airSlate SignNow benefit businesses in 2024?

In 2024, airSlate SignNow empowers businesses by providing a seamless way to send and eSign documents. This not only saves time but also reduces operational costs associated with traditional paper-based processes. The user-friendly interface ensures that teams can adopt the solution quickly and effectively.

-

Can I integrate airSlate SignNow with other software in 2024?

Yes, the 2024 it 216 plan allows for easy integration with various software applications, including CRM systems and cloud storage services. This flexibility helps businesses maintain their existing workflows while enhancing document management capabilities. Integrations are designed to be straightforward, ensuring a smooth transition.

-

Is airSlate SignNow secure for handling sensitive documents in 2024?

Absolutely, airSlate SignNow prioritizes security, especially for sensitive documents in 2024. We implement industry-standard encryption and compliance measures to protect your data. This commitment to security ensures that your documents remain confidential and secure throughout the signing process.

-

What support options are available for 2024 it 216 users?

For users of the 2024 it 216 plan, airSlate SignNow offers comprehensive support options, including live chat, email support, and an extensive knowledge base. Our dedicated support team is available to assist with any questions or issues you may encounter. We strive to ensure that your experience is smooth and hassle-free.

-

How can airSlate SignNow improve my team's efficiency in 2024?

By utilizing airSlate SignNow in 2024, your team can signNowly improve efficiency through streamlined document workflows. The platform allows for quick document preparation, sending, and signing, reducing turnaround times. This efficiency translates into faster decision-making and enhanced productivity across your organization.

Get more for It 216

- Letter from landlord to tenant where tenant complaint was caused by the deliberate or negligent act of tenant or tenants guest 497323029 form

- Letter from landlord to tenant for failure to keep premises as clean and safe as condition of premises permits remedy or lease 497323030 form

- Letter from landlord to tenant for failure of to dispose all ashes rubbish garbage or other waste in a clean and safe manner in 497323031 form

- Letter from landlord to tenant for failure to keep all plumbing fixtures in the dwelling unit as clean as their condition 497323032 form

- Letter from landlord to tenant for failure to use electrical plumbing sanitary heating ventilating air conditioning and other 497323033 form

- Letter from landlord to tenant as notice to tenant of tenants disturbance of neighbors peaceful enjoyment to remedy or lease 497323034 form

- Landlord tenant damage form

- Ok landlord tenant form

Find out other It 216

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template

- How Can I eSignature Nevada Doctors Lease Agreement Template

- eSignature Finance & Tax Accounting Presentation Arkansas Secure

- eSignature Arkansas Government Affidavit Of Heirship Online

- eSignature New Jersey Doctors Permission Slip Mobile

- eSignature Colorado Government Residential Lease Agreement Free

- Help Me With eSignature Colorado Government Medical History

- eSignature New Mexico Doctors Lease Termination Letter Fast

- eSignature New Mexico Doctors Business Associate Agreement Later

- eSignature North Carolina Doctors Executive Summary Template Free

- eSignature North Dakota Doctors Bill Of Lading Online