Form it 216 "Claim for Child and Dependent Care Credit 2021

What is the Form IT 216 "Claim For Child And Dependent Care Credit"

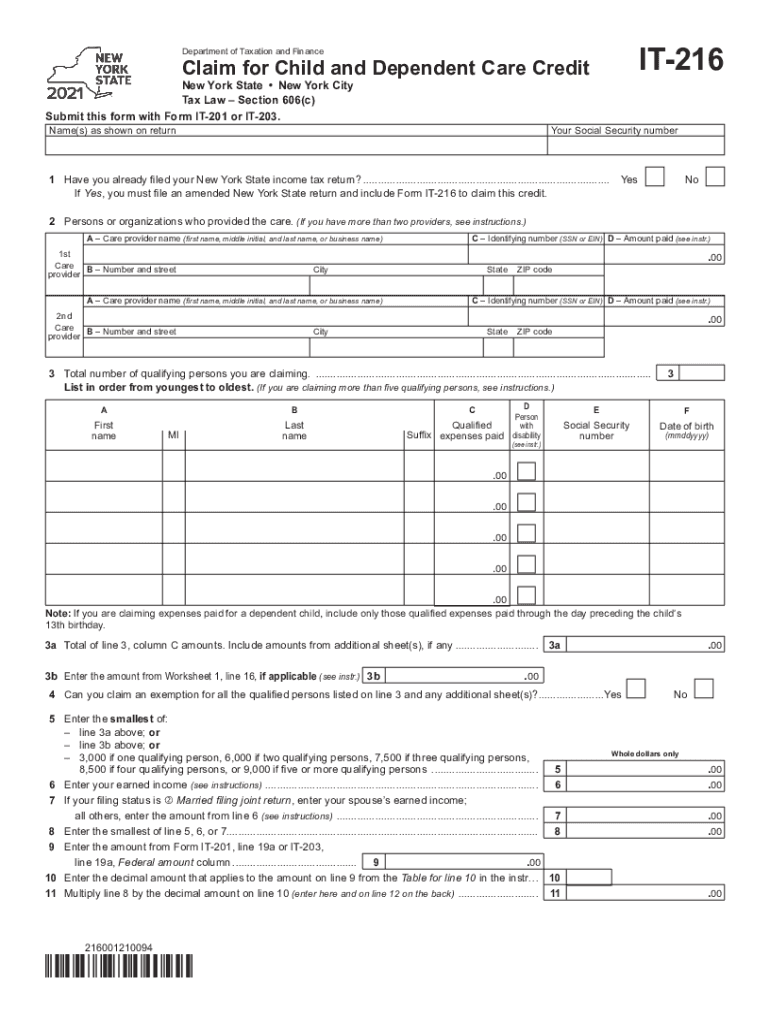

The Form IT 216 is a tax form used in New York State for claiming the Child and Dependent Care Credit. This credit is designed to assist taxpayers who incur expenses for the care of qualifying children or dependents while they work or look for work. The form allows individuals to report eligible expenses and calculate the amount of credit they may receive, which can significantly reduce their overall tax liability.

How to use the Form IT 216 "Claim For Child And Dependent Care Credit"

Using the Form IT 216 involves several steps. First, gather all necessary information regarding your dependents and the care expenses incurred. Next, complete the form by providing details such as the names and Social Security numbers of the dependents, the total amount spent on care, and the provider's information. After filling out the form, ensure that all information is accurate before submitting it to the appropriate tax authority. This process can be done electronically or by mail.

Steps to complete the Form IT 216 "Claim For Child And Dependent Care Credit"

To complete the Form IT 216, follow these steps:

- Gather documentation for all childcare expenses, including receipts and provider information.

- Fill out your personal information at the top of the form.

- List each dependent for whom you are claiming care expenses, including their names and Social Security numbers.

- Enter the total amount of care expenses incurred for each dependent.

- Calculate the credit amount based on the provided instructions and any applicable tax rates.

- Review the completed form for accuracy and completeness.

- Submit the form electronically or via mail to the New York State Department of Taxation and Finance.

Eligibility Criteria

To qualify for the Child and Dependent Care Credit using Form IT 216, taxpayers must meet specific eligibility criteria. The care must be provided for children under the age of thirteen or for dependents who are physically or mentally incapable of self-care. Additionally, the taxpayer must have earned income and must not be married filing separately. The expenses claimed must also be for care that enables the taxpayer to work or actively look for work.

Required Documents

When completing Form IT 216, certain documents are necessary to substantiate your claim. These include:

- Receipts or invoices from the care provider detailing the services rendered and the amounts charged.

- The provider's name, address, and taxpayer identification number (TIN).

- Documentation of your employment status, if applicable, to demonstrate the need for care.

Filing Deadlines / Important Dates

It is essential to be aware of the filing deadlines associated with Form IT 216. Generally, the form must be submitted by the same deadline as your federal tax return, which is typically April fifteenth. However, if you file for an extension, ensure that you also extend the deadline for submitting Form IT 216. Keeping track of these dates helps avoid penalties and ensures timely processing of your claim.

Quick guide on how to complete form it 216 ampquotclaim for child and dependent care credit

Effortlessly Prepare Form IT 216 "Claim For Child And Dependent Care Credit on Any Device

Managing documents online has become increasingly appealing to businesses and individuals. It offers a superb eco-friendly substitute for traditional printed and signed paperwork, allowing you to locate the appropriate form and securely store it in the cloud. airSlate SignNow equips you with all the essential tools to create, edit, and eSign your documents quickly without delays. Manage Form IT 216 "Claim For Child And Dependent Care Credit using airSlate SignNow's Android or iOS applications and enhance any document-centered process today.

How to Edit and eSign Form IT 216 "Claim For Child And Dependent Care Credit with Ease

- Locate Form IT 216 "Claim For Child And Dependent Care Credit and click Get Form to begin.

- Use the tools available to complete your document.

- Highlight important sections of the document or obscure sensitive information using the tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign feature, which takes mere seconds and carries the same legal validity as an ink signature.

- Review the information and click Done to save your changes.

- Choose how to send your form—via email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or errors that require printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and eSign Form IT 216 "Claim For Child And Dependent Care Credit to guarantee exceptional communication throughout your document preparation workflow with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form it 216 ampquotclaim for child and dependent care credit

Create this form in 5 minutes!

How to create an eSignature for the form it 216 ampquotclaim for child and dependent care credit

How to create an e-signature for your PDF document in the online mode

How to create an e-signature for your PDF document in Chrome

The best way to make an electronic signature for putting it on PDFs in Gmail

How to generate an e-signature from your mobile device

How to generate an electronic signature for a PDF document on iOS devices

How to generate an e-signature for a PDF file on Android devices

People also ask

-

What is it 216 and how does it relate to airSlate SignNow?

It 216 refers to airSlate SignNow’s feature set designed to streamline electronic signatures and document management. With it 216, users can easily send, receive, and manage documents electronically, which saves time and enhances productivity.

-

How much does it cost to use airSlate SignNow with it 216 features?

airSlate SignNow offers several pricing plans, including options that integrate the robust it 216 features. Depending on your needs, plans start at an affordable monthly fee, ensuring businesses of all sizes can benefit from it 216 capabilities.

-

What are the key features of it 216 in airSlate SignNow?

The key features of it 216 include easy document eSigning, secure storage, and customizable templates. Additionally, it 216 supports real-time collaboration, making it a great solution for businesses looking to enhance their document workflow.

-

How can it 216 improve my business processes?

By implementing it 216, businesses can improve efficiency by reducing the time spent on manual document handling. The automation and seamless integration with existing workflows provided by it 216 allow teams to focus on their core activities instead of paperwork.

-

Is it 216 secure for handling sensitive documents?

Yes, it 216 is designed with security as a priority, using advanced encryption methods to protect sensitive documents. This ensures that your data is safe during transmission and storage, meeting the compliance requirements businesses need.

-

What types of integrations does it 216 support?

it 216 supports a wide range of integrations with popular business applications, such as CRM and document management systems. This flexibility enables businesses to streamline their operations by connecting it 216 to tools they already use.

-

Can I try it 216 before making a commitment?

Absolutely! airSlate SignNow offers a free trial for potential customers interested in exploring it 216. This allows you to experience its features firsthand and evaluate how it can meet your business needs before committing.

Get more for Form IT 216 "Claim For Child And Dependent Care Credit

Find out other Form IT 216 "Claim For Child And Dependent Care Credit

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast