it 216 Form 2016

What is the It 216 Form

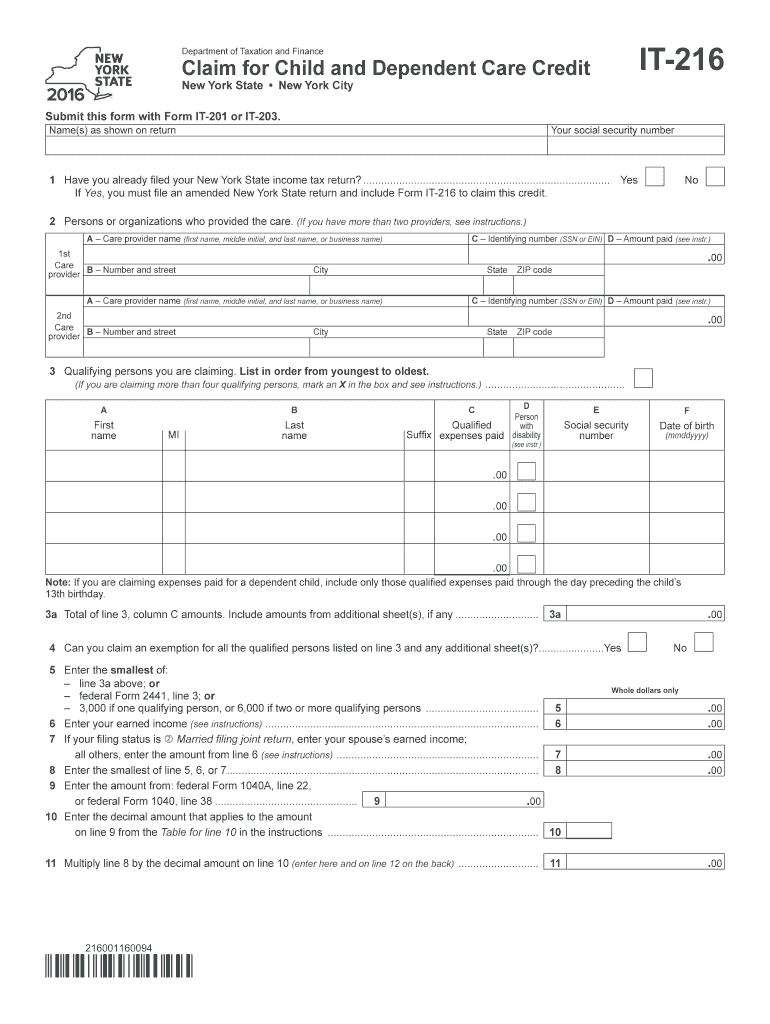

The It 216 Form is a tax document used primarily for reporting income tax in specific jurisdictions within the United States. This form is essential for individuals and businesses to accurately declare their earnings and calculate their tax obligations. It includes various sections for personal information, income details, and deductions, ensuring compliance with federal and state tax regulations. Understanding the purpose and structure of the It 216 Form is crucial for effective tax reporting.

How to use the It 216 Form

Using the It 216 Form involves several steps to ensure accurate completion and submission. First, gather all necessary financial documents, such as W-2s, 1099s, and receipts for deductions. Next, fill out the form by entering your personal information and income details in the designated fields. Be sure to double-check your entries for accuracy. After completing the form, it can be signed electronically or printed for submission. Finally, submit the form according to the specified guidelines, either online or by mail, ensuring you meet all deadlines.

Steps to complete the It 216 Form

Completing the It 216 Form requires careful attention to detail. Follow these steps for a smooth process:

- Gather all relevant financial documents, including income statements and deduction records.

- Access the It 216 Form through a reliable source, ensuring you have the most current version.

- Fill in your personal information accurately, including your name, address, and Social Security number.

- Report your income by entering figures from your financial documents in the appropriate sections.

- Claim any eligible deductions and credits to reduce your taxable income.

- Review the completed form for errors or omissions.

- Sign the form electronically or print it for manual submission.

- Submit the form by the required deadline to avoid penalties.

Legal use of the It 216 Form

The It 216 Form is legally recognized for tax reporting purposes in the United States. It must be completed accurately to comply with IRS regulations and state laws. Using this form correctly ensures that taxpayers meet their legal obligations while minimizing the risk of audits or penalties. It is important to keep a copy of the completed form and any supporting documents for your records, as they may be needed for future reference or verification.

Filing Deadlines / Important Dates

Filing deadlines for the It 216 Form vary depending on the tax year and specific state regulations. Generally, individual taxpayers must file by April fifteenth of the following year. However, extensions may be available under certain circumstances. It is crucial to stay informed about any changes in deadlines to avoid late fees or penalties. Mark important dates on your calendar to ensure timely submission of your tax documents.

Form Submission Methods (Online / Mail / In-Person)

The It 216 Form can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online Submission: Many jurisdictions allow electronic filing through secure portals, which can expedite processing times.

- Mail: Taxpayers may choose to print the completed form and send it via postal service to the appropriate tax authority.

- In-Person: Some individuals may prefer to deliver their forms directly to local tax offices, ensuring immediate confirmation of receipt.

Choosing the right submission method depends on personal preference and the specific requirements of the jurisdiction.

Quick guide on how to complete it 216 2016 form

Your assistance manual on how to prepare your It 216 Form

If you’re wondering how to generate and submit your It 216 Form, here are a few straightforward directions to make tax filing smoother.

To get started, you just need to create your airSlate SignNow account to revolutionize how you manage documents online. airSlate SignNow is an extremely user-friendly and robust document management solution that enables you to modify, draft, and complete your income tax paperwork with ease. With its editor, you can navigate between text, check boxes, and eSignatures and revisit to update any details as necessary. Simplify your tax administration with advanced PDF editing, eSigning, and user-friendly sharing features.

Follow the instructions below to complete your It 216 Form in no time:

- Establish your account and start working on PDFs in just a few moments.

- Utilize our directory to locate any IRS tax form; explore various versions and schedules.

- Click Get form to access your It 216 Form in our editor.

- Fill out the necessary fields with your information (text, numbers, check marks).

- Employ the Sign Tool to add your legally-binding eSignature (if required).

- Review your document and amend any inaccuracies.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to file your taxes electronically with airSlate SignNow. Keep in mind that paper submissions can lead to errors in returns and delay refunds. Of course, before e-filing your taxes, consult the IRS website for the filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct it 216 2016 form

FAQs

-

How do I fill out 2016 ITR form?

First of all you must know about all of your sources of income. In Indian Income Tax Act there are multiple forms for different types of sources of Income. If you have only salary & other source of income you can fill ITR-1 by registering your PAN on e-Filing Home Page, Income Tax Department, Government of India after registration you have to login & select option fill ITR online in this case you have to select ITR-1 for salary, house property & other source income.if you have income from business & profession and not maintaining books & also not mandatory to prepare books & total turnover in business less than 1 Crores & want to show profit more than 8% & if you are a professional and not required to make books want to show profit more than 50% of receipts than you can use online quick e-filling form ITR-4S i.s. for presumptive business income.for other source of income there are several forms according to source of income download Excel utility or JAVA utility form e-Filing Home Page, Income Tax Department, Government of India fill & upload after login to your account.Prerequisite before E-filling.Last year return copy (if available)Bank Account number with IFSC Code.Form 16/16A (if Available)Saving Details / Deduction Slips LIC,PPF, etc.Interest Statement from Banks or OthersProfit & Loss Account, Balance Sheet, Tax Audit Report only if filling ITR-4, ITR-5, ITR-6, ITR-7.hope this will help you in case any query please let me know.

-

How can I make it easier for users to fill out a form on mobile apps?

I’ll tell you a secret - you can thank me later for this.If you want to make the form-filling experience easy for a user - make sure that you have a great UI to offer.Everything boils down to UI at the end.Axonator is one of the best mobile apps to collect data since it offers powerful features bundled with a simple UI.The problem with most of the mobile form apps is that they are overloaded with features that aren’t really necessary.The same doesn’t hold true for Axonator. It has useful features but it is very unlikely that the user will feel overwhelmed in using them.So, if you are inclined towards having greater form completion rates for your survey or any data collection projects, then Axonator is the way to go.Apart from that, there are other features that make the data collection process faster like offline data collection, rich data capture - audio, video, images, QR code & barcode data capture, live location & time capture, and more!Check all the features here!You will be able to complete more surveys - because productivity will certainly shoot up.Since you aren’t using paper forms, errors will drop signNowly.The cost of the paper & print will be saved - your office expenses will drop dramatically.No repeat work. No data entry. Time & money saved yet again.Analytics will empower you to make strategic decisions and explore new revenue opportunities.The app is dirt-cheap & you don’t any training to use the app. They come in with a smooth UI. Forget using, even creating forms for your apps is easy on the platform. Just drag & drop - and it’s ready for use. Anyone can build an app under hours.

-

How can I fill out the FY 2015-16 and 2016-17 ITR forms after the 31st of March 2018?

As you know the last date of filling income tax retruns has been gone for the financial year 2015–16 and 2016–17. and if you haven’t done it before 31–03–2018. then i don’t think it is possible according to the current guidlines of IT Department. it may possible that they can send you the notice to answer for not filling the retrun and they may charge penalty alsoif your income was less than taxable limit then its ok it is a valid reson but you don’t need file ITR for those years but if your income was more than the limit then, i think you have to write the lette to your assessing officer with a genuine reason that why didn’t you file the ITR.This was only suggestion not adviceyou can also go through the professional chartered accountant

-

How do I fill out the IT-2104 form if I live in NJ?

Do you work only in NY? Married? Kids? If your w-2 shows NY state withholding on your taxes, fill out a non-resident NY tax return which is fairly simple. If it doesn't, you don't fill out NY at all. If it shows out NYC withholding you enter that as well on the same forms.Then you would fill out your NJ returns as well with any withholding for NJ. Make sure to put any taxes paid to other states on your reciprocal states (nj paid, on NY return and vice versa)

Create this form in 5 minutes!

How to create an eSignature for the it 216 2016 form

How to make an eSignature for the It 216 2016 Form in the online mode

How to make an eSignature for the It 216 2016 Form in Google Chrome

How to create an eSignature for putting it on the It 216 2016 Form in Gmail

How to make an eSignature for the It 216 2016 Form right from your smart phone

How to create an eSignature for the It 216 2016 Form on iOS devices

How to make an electronic signature for the It 216 2016 Form on Android devices

People also ask

-

What is the It 216 Form and why is it important?

The It 216 Form is a crucial document used for reporting specific tax-related information. Businesses often need to utilize this form to ensure compliance with local tax regulations. Understanding how to fill out the It 216 Form accurately can help prevent costly mistakes and streamline your tax filing process.

-

How can airSlate SignNow help with the It 216 Form?

airSlate SignNow offers an efficient platform for businesses to electronically sign and send the It 216 Form securely. With our easy-to-use interface, you can quickly prepare your documents for signing, ensuring that all necessary parties can sign the It 216 Form without hassle. This streamlines the submission process, making it faster and more efficient.

-

Is airSlate SignNow affordable for small businesses needing the It 216 Form?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes, including small businesses. Our pricing plans are competitive and provide value for features that help manage documents like the It 216 Form. You can choose a plan that fits your budget while gaining access to essential signing tools.

-

What features does airSlate SignNow offer for managing the It 216 Form?

airSlate SignNow provides features that make managing the It 216 Form easy, including customizable templates, automated workflows, and real-time tracking of document status. These tools help you organize, prepare, and monitor the signing process of the It 216 Form, ensuring a smooth experience for all parties involved.

-

Can I integrate airSlate SignNow with other software for the It 216 Form?

Absolutely! airSlate SignNow supports integration with a variety of other software applications, allowing you to seamlessly incorporate the It 216 Form into your existing workflows. This integration capability enhances productivity and ensures that your document management process remains efficient.

-

Is it secure to use airSlate SignNow for the It 216 Form?

Yes, using airSlate SignNow for the It 216 Form is secure. Our platform employs advanced encryption and security protocols to protect your sensitive information. You can confidently sign and send the It 216 Form, knowing that your data is safeguarded against unauthorized access.

-

How can I get started with airSlate SignNow for the It 216 Form?

Getting started with airSlate SignNow for the It 216 Form is simple. You can sign up for a free trial on our website, allowing you to explore the platform’s features and functionalities. Once you’re ready, choose a pricing plan that suits your needs and begin managing your documents effectively.

Get more for It 216 Form

- Waiver request form 1452903

- Market survey template for apartments form

- The pacific salmon and steelhead coloring book u s fish and fws form

- Rotc scholarship deadline form

- Litany for the dead pdf form

- Www uslegalforms comform library437392 masonicmasonic lodge scholarship deadline april 1st fillable

- Student athlete emergency amp family healy insurance information

- Wickson creek special utility district979 589 3030 form

Find out other It 216 Form

- How To Sign Connecticut Government LLC Operating Agreement

- How Can I Sign Delaware Government Residential Lease Agreement

- Sign Florida Government Cease And Desist Letter Online

- Sign Georgia Government Separation Agreement Simple

- Sign Kansas Government LLC Operating Agreement Secure

- How Can I Sign Indiana Government POA

- Sign Maryland Government Quitclaim Deed Safe

- Sign Louisiana Government Warranty Deed Easy

- Sign Government Presentation Massachusetts Secure

- How Can I Sign Louisiana Government Quitclaim Deed

- Help Me With Sign Michigan Government LLC Operating Agreement

- How Do I Sign Minnesota Government Quitclaim Deed

- Sign Minnesota Government Affidavit Of Heirship Simple

- Sign Missouri Government Promissory Note Template Fast

- Can I Sign Missouri Government Promissory Note Template

- Sign Nevada Government Promissory Note Template Simple

- How To Sign New Mexico Government Warranty Deed

- Help Me With Sign North Dakota Government Quitclaim Deed

- Sign Oregon Government Last Will And Testament Mobile

- Sign South Carolina Government Purchase Order Template Simple