New York 216 2018

What is the New York 216

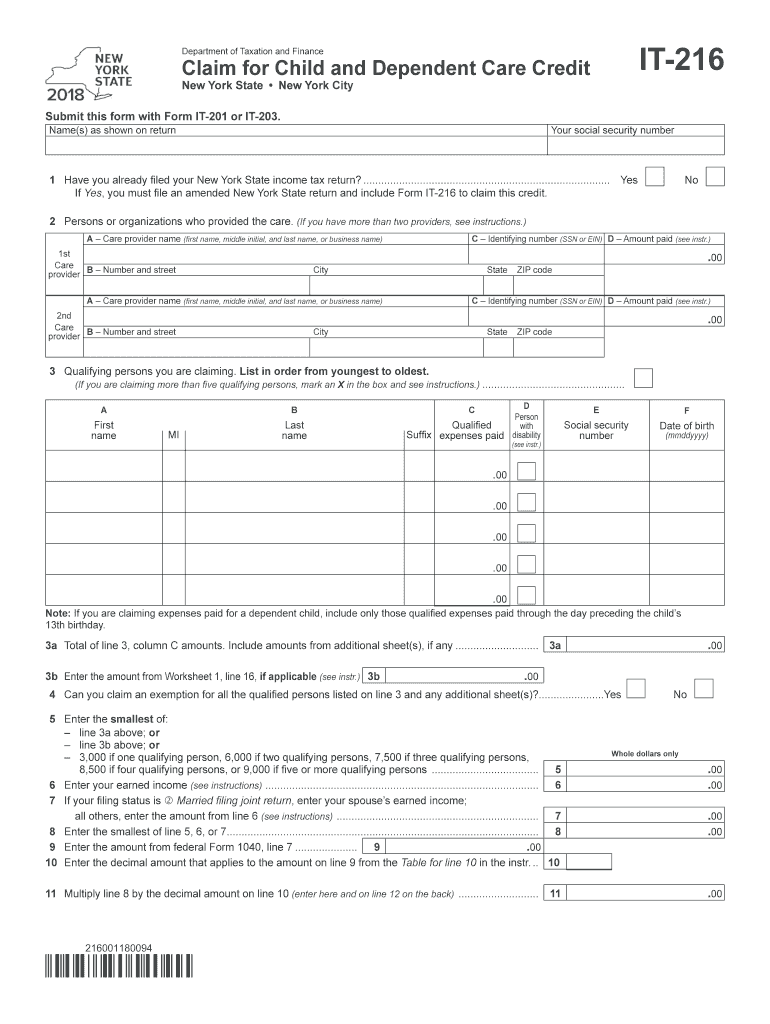

The New York 216, also known as the IT-216, is a tax form used by residents of New York to claim various tax credits and benefits. This form is primarily associated with the New York State Child and Dependent Care Credit, which allows taxpayers to receive a credit for expenses incurred while caring for eligible dependents. Understanding the purpose of this form is essential for ensuring that you maximize your tax benefits while remaining compliant with state regulations.

How to use the New York 216

Using the New York 216 involves several steps to ensure accurate completion and submission. First, gather all necessary documentation, including records of dependent care expenses and any relevant tax information. Next, fill out the form by providing your personal information, details about your dependents, and the amounts you wish to claim. After completing the form, review it for accuracy before submitting it either electronically or via mail. Utilizing an eSignature platform can simplify this process, ensuring your submission is secure and legally binding.

Steps to complete the New York 216

Completing the New York 216 requires careful attention to detail. Follow these steps:

- Gather all necessary documents, including receipts for child care expenses.

- Enter your personal information, including your name, address, and Social Security number.

- List your dependents, providing their names and Social Security numbers.

- Detail the expenses incurred for each dependent, ensuring to include only eligible costs.

- Calculate the credit amount based on the provided information and follow the instructions for the specific year.

- Review the completed form for accuracy and completeness.

- Submit the form electronically or print it for mailing.

Legal use of the New York 216

The New York 216 must be used in accordance with state tax laws to ensure compliance and avoid penalties. The form is designed to help taxpayers claim legitimate credits for child and dependent care expenses. It is important to keep accurate records and only claim expenses that meet the eligibility criteria set forth by the New York State Department of Taxation and Finance. Failure to adhere to these regulations can result in audits and potential fines.

Filing Deadlines / Important Dates

Filing deadlines for the New York 216 typically align with the federal tax filing deadlines. For most taxpayers, the deadline to submit your state tax return, including the New York 216, is April fifteenth. However, if you file for an extension, you may have additional time to submit your form. It is crucial to stay informed about any changes in deadlines, especially during tax season, to ensure timely filing and avoid penalties.

Required Documents

To complete the New York 216 accurately, you will need several key documents:

- Receipts or statements for child care expenses.

- Social Security numbers for all dependents.

- Your New York State tax return from the previous year, if applicable.

- Any additional documentation required by the New York State Department of Taxation and Finance.

Form Submission Methods (Online / Mail / In-Person)

The New York 216 can be submitted through various methods, providing flexibility for taxpayers. You can file the form electronically using approved e-filing software, which often includes built-in checks for accuracy. Alternatively, you may print the completed form and mail it to the appropriate state tax office. In-person submissions are typically not required, but you can visit local tax offices for assistance if needed. Each method ensures that your submission is processed efficiently and securely.

Quick guide on how to complete it 216 2018 2019 form

Your assistance manual on how to prepare your New York 216

If you’re wondering how to create and submit your New York 216, here are some straightforward guidelines on how to make tax processing less challenging.

To start, all you need to do is register for your airSlate SignNow account to change how you manage documents online. airSlate SignNow is a highly user-friendly and powerful document solution that enables you to modify, draft, and complete your tax documents with ease. With its editor, you can toggle between text, checkboxes, and eSignatures, allowing you to revisit and change information as necessary. Streamline your tax handling with advanced PDF editing, eSigning, and easy sharing.

Follow the instructions below to finalize your New York 216 in just a few minutes:

- Set up your account and start working on PDFs within minutes.

- Utilize our directory to find any IRS tax form; browse through versions and schedules.

- Click Get form to access your New York 216 in our editor.

- Complete the necessary fillable fields with your information (text, numbers, check marks).

- Use the Sign Tool to append your legally-recognized eSignature (if needed).

- Examine your document and correct any mistakes.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Make use of this guide to file your taxes electronically with airSlate SignNow. Please remember that submitting on paper can increase errors and delay refunds. Before e-filing your taxes, be sure to check the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct it 216 2018 2019 form

FAQs

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

Which ITR form should an NRI fill out for AY 2018–2019 for salary income?

File ITR 2 and for taking credit of foreign taxes fill form 67 before filling ITR.For specific clarifications / legal advice feel free to write to dsssvtax[at]gmail or call/WhatsApp: 9052535440.

-

How do I fill out the BHU's form of B.Com in 2018 and crack it?

you can fill from to go through bhu portal and read all those instruction and download previous year question paper . that u will get at the portal and solve more and more question paper and read some basics from your study level .focus on study save ur time and energy .do best to achieve your goal .for more detail discus with gajendra ta mtech in iit bhu .AND PKN .good luck .

-

Is it advantageous to fill out the JEE Mains 2018 form as soon as possible?

Yes. It is advantageous to fill out the JEE Mains 2018 form as soon as possible? Click here to know more about what are the advantage of filling JEE Main Application Form Earlier.

-

Which ITR form should an NRI fill out for AY 2018–2019 if there are two rental incomes in India other than that from interests?

Choosing Correct Income Tax form is the important aspect of filling Income tax return.Lets us discuss it one by one.ITR -1 —— Mainly used for salary income , other source income, one house property income ( upto Rs. 50 Lakhs ) for Individual Resident Assessees only.ITR-2 —- For Salary Income , Other source income ( exceeding Rs. 50 lakhs) house property income from more than one house and Capital Gains / Loss Income for Individual Resident or Non- Resident Assessees and HUF Assessees only.ITR 3— Income from Business or profession Together with any other income such as Salary Income, Other sources, Capital Gains , House property ( Business/ Profession income is must for filling this form) . For individual and HUF Assessees OnlySo in case NRI Assessees having rental income from two house property , then ITR need to be filed in Form ITR 2.For Detail understanding please refer to my video link.

-

Can I fill the form for the SSC CGL 2018 which will be held in June 2019 and when will the form for 2019 come out?

No, you can’t fill the form for SSC CGL 2018 as application process has been long over.SSC CGL 2019 : No concrete information at this time. Some update should come by August-September 2019.Like Exambay on facebook for all latest updates on SSC CGL 2018 , SSC CGL 2019 and other upcoming exams

Create this form in 5 minutes!

How to create an eSignature for the it 216 2018 2019 form

How to make an eSignature for your It 216 2018 2019 Form in the online mode

How to make an eSignature for the It 216 2018 2019 Form in Chrome

How to create an eSignature for putting it on the It 216 2018 2019 Form in Gmail

How to make an electronic signature for the It 216 2018 2019 Form right from your smartphone

How to make an electronic signature for the It 216 2018 2019 Form on iOS devices

How to make an electronic signature for the It 216 2018 2019 Form on Android

People also ask

-

What is airSlate SignNow and how does it relate to New York 216?

airSlate SignNow is an innovative eSignature solution designed to streamline document management for businesses. In the context of New York 216, it helps organizations in this region to efficiently send and eSign documents, ensuring compliance and enhancing productivity. With user-friendly features, airSlate SignNow is the ideal choice for businesses looking to modernize their document workflows.

-

How does airSlate SignNow support businesses in New York 216?

Businesses in New York 216 can greatly benefit from airSlate SignNow's easy-to-use platform, which simplifies document signing and management. This powerful tool allows companies to send documents for eSignature quickly, reducing turnaround time and improving operational efficiency. Additionally, it provides a secure and legally binding way to manage contracts and agreements.

-

What are the pricing options for airSlate SignNow in New York 216?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses in New York 216. Whether you're a small business or a large enterprise, there's a plan that fits your budget and requirements. You can choose from monthly or annual subscriptions, each designed to provide maximum value while ensuring comprehensive eSignature capabilities.

-

What features does airSlate SignNow offer for New York 216 businesses?

airSlate SignNow includes a variety of features specifically designed to enhance the document signing process for New York 216 businesses. Key features include customizable templates, mobile compatibility, and advanced security measures, ensuring that your documents are secure and accessible anytime, anywhere. These functionalities make it easier for businesses to manage their documentation efficiently.

-

How can airSlate SignNow improve efficiency for businesses in New York 216?

By implementing airSlate SignNow, businesses in New York 216 can signNowly improve their efficiency in handling documents. The platform automates many tedious tasks associated with document management, allowing teams to focus on more important aspects of their operations. This results in faster turnaround times and a more streamlined workflow overall.

-

Does airSlate SignNow integrate with other applications for New York 216 users?

Absolutely! airSlate SignNow seamlessly integrates with a variety of applications, making it a versatile choice for users in New York 216. Popular integrations include CRM systems, cloud storage services, and productivity tools, which help businesses create a cohesive workflow and enhance their document management processes.

-

What are the security measures of airSlate SignNow for users in New York 216?

Security is a top priority for airSlate SignNow, especially for businesses operating in New York 216. The platform employs robust encryption, secure data storage, and compliance with industry standards to protect sensitive information. This ensures that all documents signed using airSlate SignNow are secure and legally compliant, giving users peace of mind.

Get more for New York 216

- Hold harmless 46454701 form

- Year 2 nouns worksheet form

- Miis objection form

- Swedish birth preferences form

- Frequency data sheet exceptional student education form

- Overview of air and army national guard benefits mid state form

- Holy cross breast cancer t shirt order form

- Performer general release form espn wisconsin

Find out other New York 216

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors