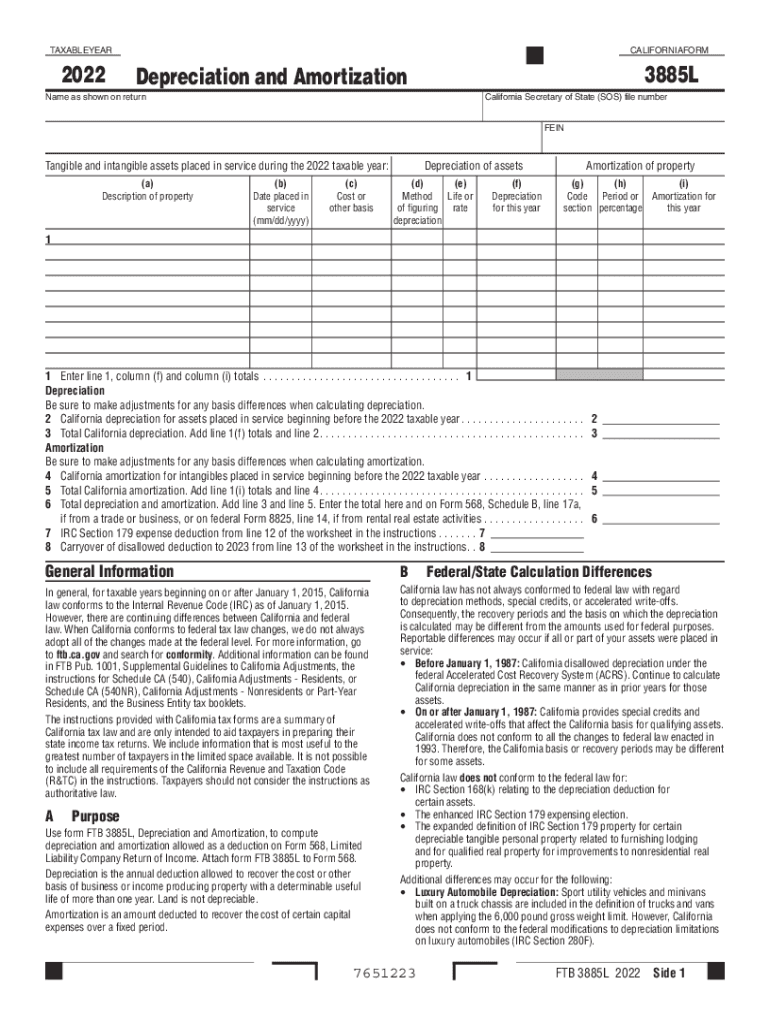

California Form 3885 L Depreciation and Amortization California Form 3885 L Depreciation and Amortization 2022

Overview of California Form 3885L

The California Form 3885L is essential for taxpayers to report depreciation and amortization related to their business assets. This form is specifically designed for California state tax purposes, allowing businesses to calculate and claim depreciation on qualified property. Understanding the nuances of this form is crucial for ensuring compliance with California tax regulations and maximizing potential tax benefits.

Steps to Complete California Form 3885L

Completing the California Form 3885L involves several key steps:

- Gather necessary documentation, including purchase invoices and asset details.

- Determine the type of property being depreciated, such as machinery, equipment, or buildings.

- Calculate the depreciation using the appropriate method, such as straight-line or declining balance.

- Fill out the form accurately, ensuring all calculations reflect the correct figures.

- Review the completed form for any errors or omissions before submission.

Legal Use of California Form 3885L

The legal validity of California Form 3885L is upheld under state tax laws, provided it is completed accurately and submitted on time. The form must be signed and dated by the taxpayer or an authorized representative to ensure compliance. Utilizing a reliable eSignature solution can enhance the security and legitimacy of the submission.

Key Elements of California Form 3885L

Key elements of the California Form 3885L include:

- Identification of the taxpayer and business entity details.

- Asset descriptions and classifications.

- Depreciation methods used for each asset.

- Total depreciation claimed for the tax year.

Filing Deadlines for California Form 3885L

It is important to adhere to filing deadlines for the California Form 3885L to avoid penalties. Typically, the form must be submitted along with the California state tax return by the due date, which is usually April 15 for most taxpayers. Extensions may be available, but it is crucial to verify specific dates each tax year.

Obtaining California Form 3885L

The California Form 3885L can be obtained through the California Franchise Tax Board (FTB) website or by contacting the FTB directly. It is available in a printable format, allowing taxpayers to complete the form manually or electronically. Ensuring you have the most current version of the form is essential for accurate reporting.

Quick guide on how to complete 2022 california form 3885 l depreciation and amortization 2022 california form 3885 l depreciation and amortization

Complete California Form 3885 L Depreciation And Amortization California Form 3885 L Depreciation And Amortization effortlessly on any device

Digital document management has become increasingly favored by companies and individuals. It serves as an excellent eco-friendly alternative to conventional printed and signed documents, allowing you to locate the correct form and securely keep it online. airSlate SignNow provides you with all the necessary tools to generate, modify, and electronically sign your documents swiftly without delays. Manage California Form 3885 L Depreciation And Amortization California Form 3885 L Depreciation And Amortization on any device using airSlate SignNow's Android or iOS applications and enhance any document-related procedure today.

How to modify and electronically sign California Form 3885 L Depreciation And Amortization California Form 3885 L Depreciation And Amortization seamlessly

- Locate California Form 3885 L Depreciation And Amortization California Form 3885 L Depreciation And Amortization and click on Get Form to begin.

- Utilize the features we provide to complete your document.

- Highlight important sections of your documents or obscure sensitive information with tools offered by airSlate SignNow specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you wish to deliver your form, via email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that necessitate reprinting new document copies. airSlate SignNow addresses your document management requirements in just a few clicks from any device you prefer. Modify and electronically sign California Form 3885 L Depreciation And Amortization California Form 3885 L Depreciation And Amortization and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2022 california form 3885 l depreciation and amortization 2022 california form 3885 l depreciation and amortization

Create this form in 5 minutes!

How to create an eSignature for the 2022 california form 3885 l depreciation and amortization 2022 california form 3885 l depreciation and amortization

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the form 3885l and why is it important?

The form 3885l is a crucial document used for tax purposes, specifically in relation to claiming depreciation on certain assets. Understanding how to properly fill out and submit the form 3885l can signNowly affect your business's tax liabilities and improve compliance with IRS regulations. Utilizing airSlate SignNow can streamline the process of signing and submitting the form 3885l securely.

-

How does airSlate SignNow help with completing the form 3885l?

airSlate SignNow offers a user-friendly platform that allows you to easily input and eSign the form 3885l with customized templates. The solution facilitates collaboration among team members and ensures that the document remains compliant with legal standards. With airSlate SignNow, you can focus on accuracy and efficiency while completing the form 3885l.

-

What are the pricing options for airSlate SignNow for managing form 3885l?

AirSlate SignNow offers flexible pricing plans that cater to various business sizes, ensuring that you can manage your form 3885l needs economically. Whether you are a small business or a large enterprise, you can choose a plan that provides the necessary features to handle form 3885l efficiently. Each plan is designed to maximize your investment while streamlining document processes.

-

Can I integrate airSlate SignNow with other software for handling form 3885l?

Yes, airSlate SignNow supports a wide range of integrations with popular accounting and document management software. This allows for seamless data transfer and enhances the workflow in managing the form 3885l. By integrating with your existing tools, you can improve efficiency and reduce the time spent on administrative tasks.

-

What features does airSlate SignNow offer for eSigning form 3885l?

airSlate SignNow provides robust eSigning features that ensure the authenticity and legality of your form 3885l. You can track the status of your document in real-time and receive notifications upon completion. These features protect your business by ensuring that all signatures are valid and secure.

-

Is airSlate SignNow compliant with regulations for submitting form 3885l?

Absolutely, airSlate SignNow is designed to comply with all necessary regulations related to document signing and submissions, including the form 3885l. Utilizing a compliant platform helps mitigate risks of non-compliance and enhances the trustworthiness of your documentation process. Ensuring that your form 3885l is submitted correctly can save your business from potential penalties.

-

What benefits can businesses gain from using airSlate SignNow for form 3885l?

By using airSlate SignNow for form 3885l, businesses can experience improved efficiency and reduced turnaround time for document processing. The ease of use and automation features allow for quicker eSignatures and a more organized approach to document management. Additionally, it enhances collaboration and visibility among teams, ensuring everyone stays informed.

Get more for California Form 3885 L Depreciation And Amortization California Form 3885 L Depreciation And Amortization

- South dakota lease form

- Sd lien form

- Assignment of claim of lien corporation or llc south dakota form

- Sd lien form

- South dakota corporation form

- Business credit application south dakota form

- Individual credit application south dakota form

- Interrogatories to plaintiff for motor vehicle occurrence south dakota form

Find out other California Form 3885 L Depreciation And Amortization California Form 3885 L Depreciation And Amortization

- eSignature Texas Roommate Contract Easy

- eSignature Arizona Sublease Agreement Template Free

- eSignature Georgia Sublease Agreement Template Online

- eSignature Arkansas Roommate Rental Agreement Template Mobile

- eSignature Maryland Roommate Rental Agreement Template Free

- How Do I eSignature California Lodger Agreement Template

- eSignature Kentucky Lodger Agreement Template Online

- eSignature North Carolina Lodger Agreement Template Myself

- eSignature Alabama Storage Rental Agreement Free

- eSignature Oregon Housekeeping Contract Computer

- eSignature Montana Home Loan Application Online

- eSignature New Hampshire Home Loan Application Online

- eSignature Minnesota Mortgage Quote Request Simple

- eSignature New Jersey Mortgage Quote Request Online

- Can I eSignature Kentucky Temporary Employment Contract Template

- eSignature Minnesota Email Cover Letter Template Fast

- How To eSignature New York Job Applicant Rejection Letter

- How Do I eSignature Kentucky Executive Summary Template

- eSignature Hawaii CV Form Template Mobile

- eSignature Nevada CV Form Template Online