California Form 3885 L Depreciation and Amortization , California Form 3885 L, Depreciation and Amortization 2019

What is the California Form 3885L Depreciation and Amortization?

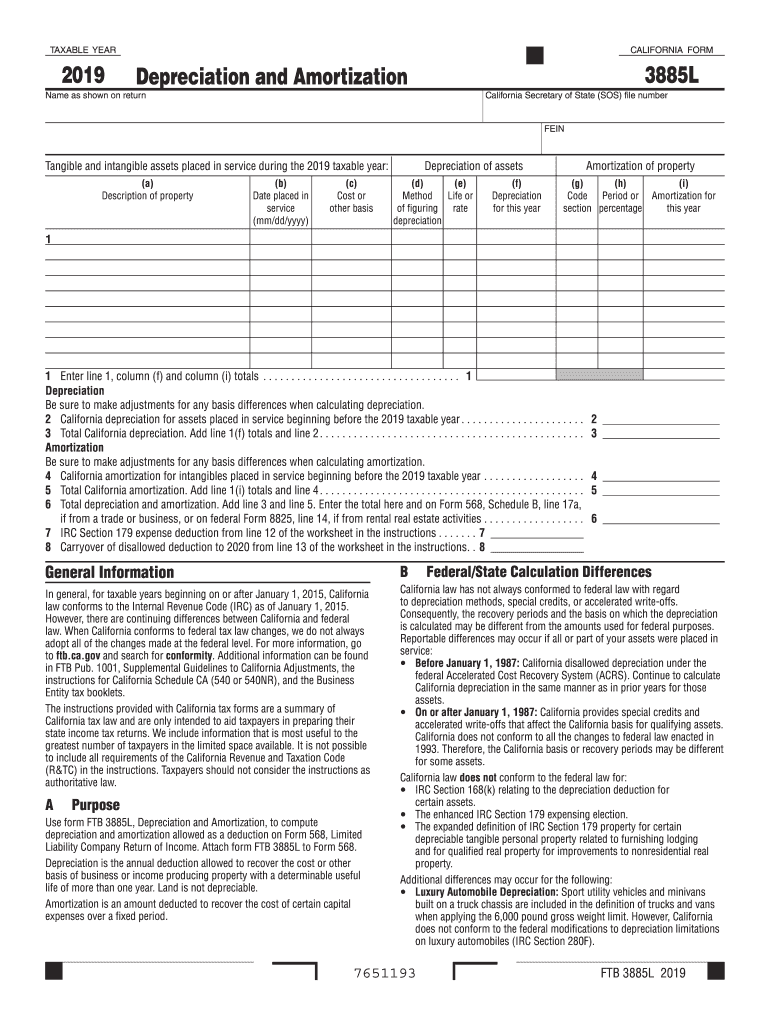

The California Form 3885L is a crucial document used for reporting depreciation and amortization for tax purposes. This form is specifically designed for businesses and individuals who need to calculate and report their depreciation deductions on property used in California. The form allows taxpayers to detail the depreciation of assets, which can significantly impact taxable income. Understanding how to accurately complete this form is essential for compliance with California tax regulations.

Steps to Complete the California Form 3885L

Completing the California Form 3885L involves several key steps to ensure accuracy and compliance. First, gather all necessary information regarding the assets you are depreciating, including purchase dates, costs, and useful lives. Next, follow these steps:

- Begin by entering your personal or business information at the top of the form.

- List each asset separately, including the description, date placed in service, and cost.

- Calculate the depreciation for each asset using the appropriate method, such as straight-line or declining balance.

- Transfer the total depreciation amounts to the designated sections of the form.

- Review the completed form for accuracy before submission.

Legal Use of the California Form 3885L

The California Form 3885L is legally binding when completed and submitted according to state tax laws. It is essential for taxpayers to understand that any inaccuracies or omissions can lead to penalties or audits. The form must be filed with the California Franchise Tax Board (FTB) as part of your annual tax return. Adhering to the legal requirements ensures that your depreciation claims are valid and recognized by the state.

Key Elements of the California Form 3885L

Understanding the key elements of the California Form 3885L is vital for effective completion. The form includes sections for:

- Taxpayer identification information.

- Details of each depreciable asset, including type and acquisition cost.

- Depreciation methods and calculations.

- Total depreciation claimed for the tax year.

Each section must be filled out accurately to ensure that the form reflects the true financial position of the taxpayer.

Filing Deadlines for the California Form 3885L

Timely filing of the California Form 3885L is crucial to avoid penalties. The form must be submitted along with your annual tax return, which is generally due on April 15th for individual taxpayers. If you are a business entity, the deadline may vary based on your fiscal year. It is advisable to check the California Franchise Tax Board's guidelines for any updates on deadlines or extensions.

Examples of Using the California Form 3885L

Examples of situations where the California Form 3885L is necessary include:

- A small business purchasing new equipment and needing to deduct depreciation over several years.

- An individual claiming depreciation on rental property to reduce taxable income.

- Corporations reporting depreciation on machinery used in manufacturing processes.

These examples illustrate the form's importance in various financial scenarios, highlighting its role in tax planning and compliance.

Quick guide on how to complete 2019 california form 3885 l depreciation and amortization 2019 california form 3885 l depreciation and amortization

Effortlessly prepare California Form 3885 L Depreciation And Amortization , California Form 3885 L, Depreciation And Amortization on any device

Managing documents online has gained traction among businesses and individuals. It serves as an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow offers all the necessary tools to create, edit, and electronically sign your documents quickly and efficiently. Handle California Form 3885 L Depreciation And Amortization , California Form 3885 L, Depreciation And Amortization on any device using the airSlate SignNow applications for Android or iOS and enhance any document-related task today.

The easiest way to edit and electronically sign California Form 3885 L Depreciation And Amortization , California Form 3885 L, Depreciation And Amortization with ease

- Obtain California Form 3885 L Depreciation And Amortization , California Form 3885 L, Depreciation And Amortization and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal significance as a traditional handwritten signature.

- Verify all the details and then click on the Done button to save your changes.

- Select your method of sharing your form, by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about missing or lost documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow addresses your document management needs within a few clicks from any device you choose. Edit and electronically sign California Form 3885 L Depreciation And Amortization , California Form 3885 L, Depreciation And Amortization to ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2019 california form 3885 l depreciation and amortization 2019 california form 3885 l depreciation and amortization

Create this form in 5 minutes!

How to create an eSignature for the 2019 california form 3885 l depreciation and amortization 2019 california form 3885 l depreciation and amortization

The way to generate an electronic signature for a PDF online

The way to generate an electronic signature for a PDF in Google Chrome

The way to create an eSignature for signing PDFs in Gmail

The way to create an eSignature straight from your smartphone

The best way to make an eSignature for a PDF on iOS

The way to create an eSignature for a PDF document on Android

People also ask

-

What is the 2017 ca 3885l fillable form?

The 2017 ca 3885l fillable form is a California tax document used for reporting specific information related to income and deductions. Using airSlate SignNow, you can easily fill out and eSign this form online, ensuring accuracy and compliance with state regulations.

-

How can I access the 2017 ca 3885l fillable form?

You can access the 2017 ca 3885l fillable form through airSlate SignNow's user-friendly platform. Simply navigate to the forms section, search for '2017 ca 3885l fillable,' and start filling it out instantly.

-

Is there a cost associated with using the 2017 ca 3885l fillable form on airSlate SignNow?

AirSlate SignNow offers a range of pricing plans tailored to meet different needs. Many features, including access to the 2017 ca 3885l fillable form, are available at competitive rates, making it a cost-effective solution for businesses.

-

What features does airSlate SignNow provide for the 2017 ca 3885l fillable form?

AirSlate SignNow provides several features for the 2017 ca 3885l fillable form, including easy document editing, electronic signatures, and secure storage. These features streamline the process, ensuring you can complete your forms efficiently.

-

How does airSlate SignNow ensure the security of my 2017 ca 3885l fillable form?

Security is a priority at airSlate SignNow. The platform uses advanced encryption and secure servers to protect your 2017 ca 3885l fillable form and any other sensitive documents you manage, ensuring your information remains confidential.

-

Can I integrate other tools with airSlate SignNow while working on the 2017 ca 3885l fillable form?

Yes, airSlate SignNow offers integrations with various tools, including CRM systems and cloud storage services. This allows you to work seamlessly on your 2017 ca 3885l fillable form alongside other essential applications, enhancing your productivity.

-

What are the benefits of using the 2017 ca 3885l fillable form with airSlate SignNow?

Using the 2017 ca 3885l fillable form on airSlate SignNow comes with numerous benefits, such as faster processing times and reduced paperwork. The platform makes it easier to manage your documents digitally, saving you time and effort.

Get more for California Form 3885 L Depreciation And Amortization , California Form 3885 L, Depreciation And Amortization

- Warranty deed to child reserving a life estate in the parents utah form

- Discovery interrogatories from plaintiff to defendant with production requests utah form

- Utah small claims form

- Discovery interrogatories from defendant to plaintiff with production requests utah form

- Discovery interrogatories for divorce proceeding for either plaintiff or defendant utah form

- Quitclaim deed two individuals to one individual utah form

- Ut affidavit form

- Utah quitclaim deed 497427379 form

Find out other California Form 3885 L Depreciation And Amortization , California Form 3885 L, Depreciation And Amortization

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT