Form 3885L Depreciation and Amortization Form 3885L Depreciation and Amortization 2023-2026

Overview of CA Form 3885L

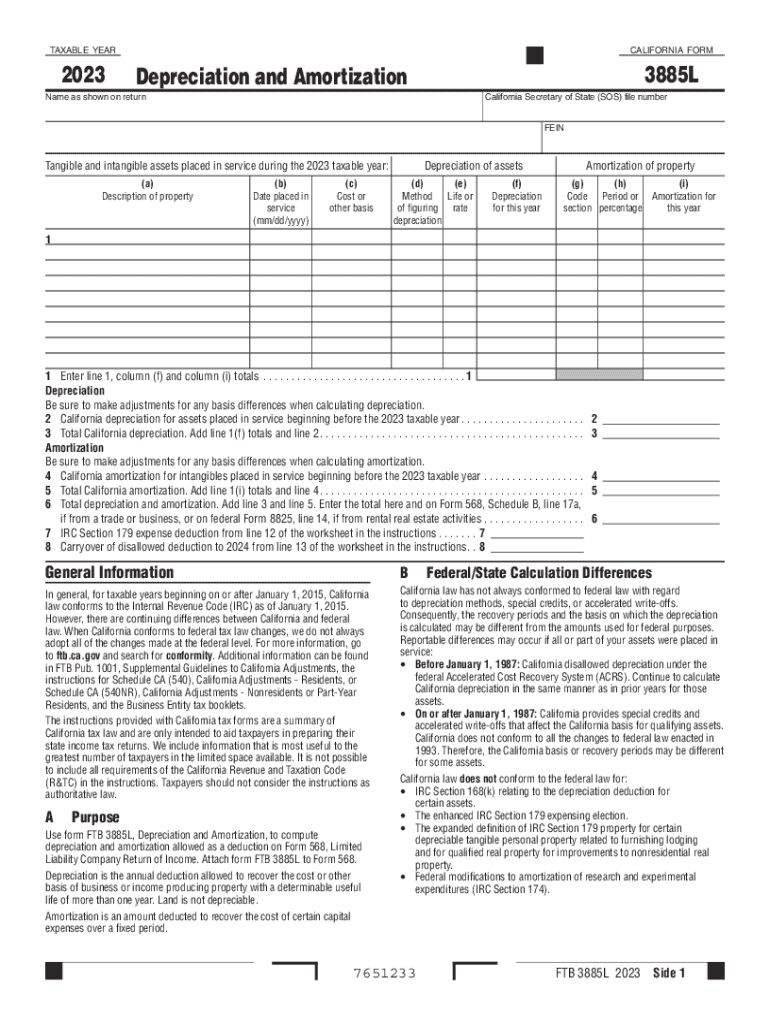

The CA Form 3885L is a crucial document used for reporting depreciation and amortization for California state tax purposes. This form allows taxpayers to calculate the depreciation of assets, which can significantly impact the taxable income reported to the state. Understanding how to properly fill out this form is essential for accurate tax reporting and compliance.

Steps to Complete CA Form 3885L

Completing the CA Form 3885L involves several key steps:

- Gather all necessary financial documents, including asset purchase invoices and prior depreciation schedules.

- Identify the assets that qualify for depreciation and determine their useful lives.

- Calculate the depreciation expense for each asset using the appropriate method, such as straight-line or declining balance.

- Fill out the form by entering the calculated depreciation amounts in the designated sections.

- Review the completed form for accuracy before submission.

Legal Use of CA Form 3885L

The CA Form 3885L is legally required for taxpayers who wish to claim depreciation on their state tax returns. It is important to comply with California tax laws when using this form. Failing to report depreciation accurately can lead to penalties or audits. Therefore, understanding the legal implications of the information provided on this form is essential for maintaining compliance.

Key Elements of CA Form 3885L

Several key elements must be included when completing the CA Form 3885L:

- Taxpayer identification information, including name and Social Security number or Employer Identification Number.

- A detailed list of assets, including their purchase dates and costs.

- The method of depreciation used for each asset.

- The total depreciation claimed for the taxable year.

Filing Deadlines for CA Form 3885L

It is important to be aware of the filing deadlines associated with the CA Form 3885L. Generally, this form must be submitted along with the California state tax return. Taxpayers should ensure they meet the deadlines to avoid penalties. The typical deadline for filing state tax returns is April 15, unless an extension is requested.

Examples of Using CA Form 3885L

Understanding practical examples can clarify how to use the CA Form 3885L effectively. For instance, a small business that purchases new equipment for $10,000 can use the form to report the annual depreciation expense. If the equipment has a useful life of five years, the business can apply the straight-line method to deduct $2,000 each year. This deduction reduces the taxable income, benefiting the overall financial standing of the business.

Create this form in 5 minutes or less

Find and fill out the correct form 3885l depreciation and amortization form 3885l depreciation and amortization

Create this form in 5 minutes!

How to create an eSignature for the form 3885l depreciation and amortization form 3885l depreciation and amortization

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the CA Form 3885L?

The CA Form 3885L is a tax form used in California for claiming a credit for the purchase of qualified property. It is essential for businesses looking to maximize their tax benefits. Understanding how to properly fill out the CA Form 3885L can help ensure compliance and optimize your tax filings.

-

How can airSlate SignNow help with CA Form 3885L?

airSlate SignNow simplifies the process of signing and sending the CA Form 3885L electronically. With our platform, you can easily prepare, eSign, and share this important tax document securely. This streamlines your workflow and ensures that your forms are submitted on time.

-

Is there a cost associated with using airSlate SignNow for CA Form 3885L?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Our cost-effective solutions allow you to manage documents like the CA Form 3885L without breaking the bank. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for managing CA Form 3885L?

airSlate SignNow provides features such as customizable templates, secure eSigning, and document tracking for CA Form 3885L. These tools enhance your document management process, making it easier to handle tax forms efficiently. Additionally, our user-friendly interface ensures a smooth experience.

-

Can I integrate airSlate SignNow with other software for CA Form 3885L?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, allowing you to manage your CA Form 3885L alongside your existing tools. This integration helps streamline your workflow and enhances productivity by connecting all your essential applications.

-

What are the benefits of using airSlate SignNow for CA Form 3885L?

Using airSlate SignNow for CA Form 3885L offers numerous benefits, including time savings, improved accuracy, and enhanced security. Our platform ensures that your documents are signed and sent quickly, reducing the risk of errors. Additionally, your sensitive information is protected with advanced security measures.

-

How secure is airSlate SignNow when handling CA Form 3885L?

airSlate SignNow prioritizes security, employing encryption and secure access protocols to protect your CA Form 3885L and other documents. We comply with industry standards to ensure that your data remains confidential and secure throughout the signing process. You can trust us to safeguard your sensitive information.

Get more for Form 3885L Depreciation And Amortization Form 3885L Depreciation And Amortization

- Room inventory list form

- Observation hours form

- Dog behavior assessment form

- How a bill becomes a law flowchart form

- Smouldering charcoal summary pdf download form

- Child care director evaluation template form

- Reference form texas aampm university at qatar qatar tamu

- Florida quit claim deed form pdf word eforms

Find out other Form 3885L Depreciation And Amortization Form 3885L Depreciation And Amortization

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors