Form 3885L Depreciation and Amortization Ftb Ca 2015

What is the Form 3885L Depreciation And Amortization Ftb Ca

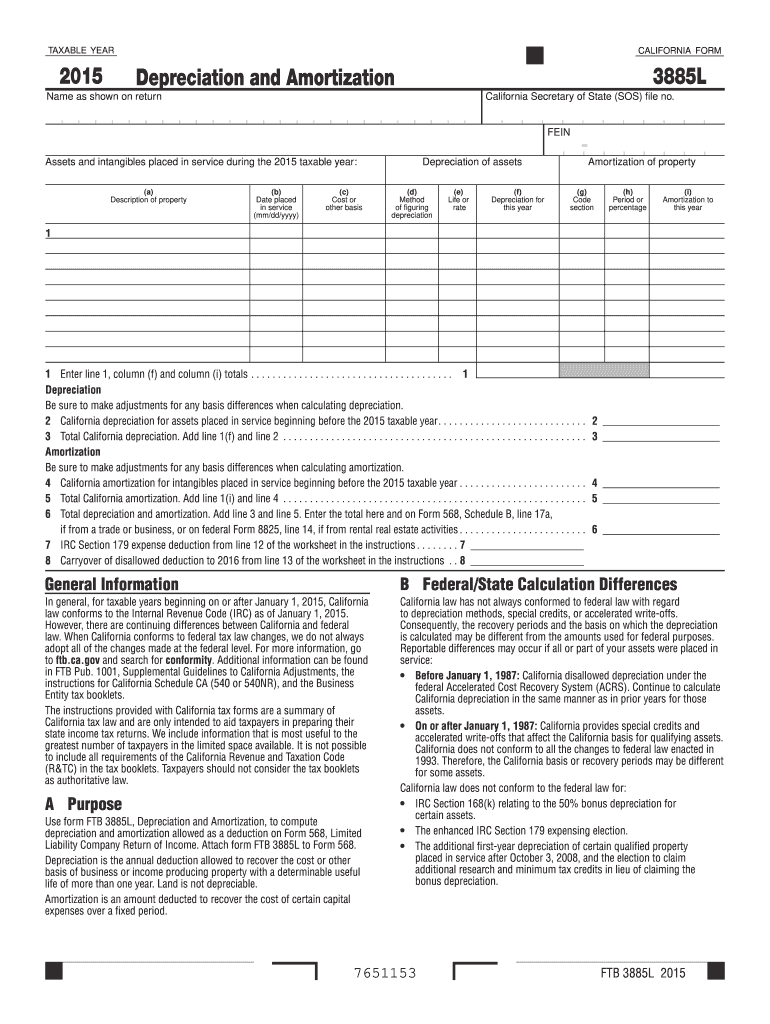

The Form 3885L is a California state tax form used for reporting depreciation and amortization for tax purposes. This form allows taxpayers to calculate and claim deductions for the depreciation of assets and the amortization of certain expenses. It is specifically designed for use by individuals and businesses in California who need to report these deductions on their state tax returns. Understanding the purpose of this form is crucial for accurate tax reporting and compliance with California tax laws.

How to use the Form 3885L Depreciation And Amortization Ftb Ca

Using the Form 3885L involves several steps to ensure accurate reporting. Taxpayers must first gather all relevant information regarding their assets, including purchase dates, costs, and the method of depreciation or amortization being applied. Once this information is collected, the form can be filled out by entering the necessary details in the designated fields. It is important to follow the instructions provided with the form to ensure compliance with California tax regulations.

Steps to complete the Form 3885L Depreciation And Amortization Ftb Ca

Completing the Form 3885L requires careful attention to detail. Here are the steps to follow:

- Gather all necessary documentation related to your assets.

- Choose the appropriate depreciation method (e.g., straight-line, declining balance).

- Fill in the asset details, including description, date placed in service, and cost.

- Calculate the depreciation or amortization amount for each asset.

- Transfer the totals to the appropriate sections of the form.

- Review the completed form for accuracy before submission.

Key elements of the Form 3885L Depreciation And Amortization Ftb Ca

Several key elements are essential when completing the Form 3885L. These include:

- Asset Description: A clear description of each asset being depreciated.

- Date Placed in Service: The date when the asset was first used.

- Cost Basis: The total cost of the asset, including purchase price and any additional expenses.

- Depreciation Method: The chosen method of depreciation that complies with IRS guidelines.

- Annual Depreciation Amount: The calculated amount of depreciation for the tax year.

Filing Deadlines / Important Dates

Filing deadlines for the Form 3885L align with the general California state tax return deadlines. Typically, individual taxpayers must file their state tax returns by April 15. However, if this date falls on a weekend or holiday, the deadline may be extended. It is crucial to stay informed about any changes to deadlines to avoid penalties and ensure timely submission of the form.

Form Submission Methods (Online / Mail / In-Person)

The Form 3885L can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online Submission: Many taxpayers opt to file electronically through the California Franchise Tax Board's online portal.

- Mail Submission: The completed form can be printed and mailed to the appropriate address provided by the Franchise Tax Board.

- In-Person Submission: Taxpayers may also choose to submit the form in person at designated tax offices.

Quick guide on how to complete 2015 form 3885l depreciation and amortization ftb ca

Your assistance manual on how to prepare your Form 3885L Depreciation And Amortization Ftb Ca

If you’re curious about how to finalize and submit your Form 3885L Depreciation And Amortization Ftb Ca, here are a few straightforward instructions to make tax reporting easier.

To start, you only need to create your airSlate SignNow account to revolutionize how you handle documents online. airSlate SignNow is an extremely intuitive and robust document management tool that enables you to edit, generate, and finalize your tax forms effortlessly. Utilizing its editor, you can toggle between text, checkboxes, and eSignatures and revisit to amend responses when necessary. Enhance your tax administration with advanced PDF editing, eSigning, and seamless sharing.

Adhere to the steps below to complete your Form 3885L Depreciation And Amortization Ftb Ca in just a few minutes:

- Create your profile and start working on PDFs in moments.

- Use our directory to locate any IRS tax document; browse through versions and schedules.

- Click Get form to load your Form 3885L Depreciation And Amortization Ftb Ca in our editor.

- Populate the necessary fillable fields with your information (text, numbers, check marks).

- Employ the Sign Tool to add your legally-binding eSignature (if necessary).

- Double-check your document and correct any mistakes.

- Save modifications, print your copy, send it to your recipient, and save it to your device.

Utilize this manual to submit your taxes electronically using airSlate SignNow. Please keep in mind that filing on paper can lead to return inaccuracies and delay refunds. It is essential to verify the IRS website for filing regulations in your state before e-filing your taxes.

Create this form in 5 minutes or less

Find and fill out the correct 2015 form 3885l depreciation and amortization ftb ca

FAQs

-

How can I fill out the FY 2015-16 and 2016-17 ITR forms after the 31st of March 2018?

As you know the last date of filling income tax retruns has been gone for the financial year 2015–16 and 2016–17. and if you haven’t done it before 31–03–2018. then i don’t think it is possible according to the current guidlines of IT Department. it may possible that they can send you the notice to answer for not filling the retrun and they may charge penalty alsoif your income was less than taxable limit then its ok it is a valid reson but you don’t need file ITR for those years but if your income was more than the limit then, i think you have to write the lette to your assessing officer with a genuine reason that why didn’t you file the ITR.This was only suggestion not adviceyou can also go through the professional chartered accountant

-

How do you convert your CGPA into a percentage when doing graduation from Mumbai University and filling out the CAT 2015 form?

There was unfortunately no conversion formula as far I know (I passed out last year so not sure if they introduced it this year). Even I faced a lot of problems because of this. I just calculated the percentage from my marks. Maybe you could do the same and later if they ask you could explain this. As everyone with more than equal to 70% in all subjects gets an O irrespective of whether he/she scores 70% or 90%, there is no way out unless you contact the University, which I dont think will benefit much. Anyways, all the best.

-

What is the procedure to fill out the DU admission form? How many colleges and courses can I fill in?

It's as simple as filling any school admission form but you need to be quite careful while filling for courses ,don't mind you are from which stream in class 12 choose all the courses you feel like choosing,there is no limitations in choosing course and yes you must fill all the courses related to your stream ,additionally there is no choice for filling of college names in the application form .

-

Why don't schools teach children about taxes and bills and things that they will definitely need to know as adults to get by in life?

Departments of education and school districts always have to make decisions about what to include in their curriculum. There are a lot of life skills that people need that aren't taught in school. The question is should those skills be taught in schools?I teach high school, so I'll talk about that. The typical high school curriculum is supposed to give students a broad-based education that prepares them to be citizens in a democracy and to be able to think critically. For a democracy to work, we need educated, discerning citizens with the ability to make good decisions based on evidence and objective thought. In theory, people who are well informed about history, culture, science, mathematics, etc., and are capable of critical, unbiased thinking, will have the tools to participate in a democracy and make good decisions for themselves and for society at large. In addition to that, they should be learning how to be learners, how to do effective, basic research, and collaborate with other people. If that happens, figuring out how to do procedural tasks in real life should not provide much of a challenge. We can't possibly teach every necessary life skill people need, but we can help students become better at knowing how to acquire the skills they need. Should we teach them how to change a tire when they can easily consult a book or search the internet to find step by step instructions for that? Should we teach them how to balance a check book or teach them how to think mathematically and make sense of problems so that the simple task of balancing a check book (which requires simple arithmetic and the ability to enter numbers and words in columns and rows in obvious ways) is easy for them to figure out. If we teach them to be good at critical thinking and have some problem solving skills they will be able to apply those overarching skills to all sorts of every day tasks that shouldn't be difficult for someone with decent cognitive ability to figure out. It's analogous to asking why a culinary school didn't teach its students the steps and ingredients to a specific recipe. The school taught them about more general food preparation and food science skills so that they can figure out how to make a lot of specific recipes without much trouble. They're also able to create their own recipes.So, do we want citizens with very specific skill sets that they need to get through day to day life or do we want citizens with critical thinking, problem solving, and other overarching cognitive skills that will allow them to easily acquire ANY simple, procedural skill they may come to need at any point in their lives?

Create this form in 5 minutes!

How to create an eSignature for the 2015 form 3885l depreciation and amortization ftb ca

How to generate an electronic signature for your 2015 Form 3885l Depreciation And Amortization Ftb Ca in the online mode

How to create an eSignature for your 2015 Form 3885l Depreciation And Amortization Ftb Ca in Google Chrome

How to create an electronic signature for signing the 2015 Form 3885l Depreciation And Amortization Ftb Ca in Gmail

How to create an electronic signature for the 2015 Form 3885l Depreciation And Amortization Ftb Ca straight from your smartphone

How to generate an eSignature for the 2015 Form 3885l Depreciation And Amortization Ftb Ca on iOS devices

How to create an eSignature for the 2015 Form 3885l Depreciation And Amortization Ftb Ca on Android

People also ask

-

What is Form 3885L Depreciation And Amortization Ftb Ca?

Form 3885L Depreciation And Amortization Ftb Ca is a tax form used in California for reporting depreciation and amortization of assets. This form helps businesses calculate their tax deductions for property and assets, which can signNowly reduce tax liabilities. Understanding this form is essential for accurate tax filing and financial planning.

-

How can airSlate SignNow assist with managing Form 3885L Depreciation And Amortization Ftb Ca?

airSlate SignNow allows users to easily eSign and manage Form 3885L Depreciation And Amortization Ftb Ca. By offering a secure platform for document handling, businesses can streamline their filing processes and ensure timely submissions. The ease of use enhances efficiency and accuracy, reducing the stress of tax season.

-

What are the costs associated with using airSlate SignNow for Form 3885L Depreciation And Amortization Ftb Ca?

airSlate SignNow offers various pricing plans that cater to different business needs when managing documents like Form 3885L Depreciation And Amortization Ftb Ca. The plans are designed to be cost-effective, providing excellent value with features that simplify document management and eSigning. Interested users can review the pricing options on our website to choose a plan that fits their budget.

-

What features does airSlate SignNow offer for handling Form 3885L Depreciation And Amortization Ftb Ca?

airSlate SignNow provides a range of features specifically geared towards document management, including eSigning, cloud storage, and customizable templates for forms like Form 3885L Depreciation And Amortization Ftb Ca. These features enhance collaboration, making it easy for teams to work together on tax forms and other documents securely and efficiently.

-

Can airSlate SignNow be integrated with accounting software for Form 3885L Depreciation And Amortization Ftb Ca?

Yes, airSlate SignNow offers integrations with various accounting software, which facilitates the seamless management of Form 3885L Depreciation And Amortization Ftb Ca. This integration allows for easy tracking of depreciation schedules and financial reports, ensuring consistent and accurate data across platforms. Businesses can boost their productivity and simplify their accounting processes with these integrations.

-

What are the benefits of using airSlate SignNow for Form 3885L Depreciation And Amortization Ftb Ca?

Using airSlate SignNow for managing Form 3885L Depreciation And Amortization Ftb Ca provides numerous benefits, including enhanced security, improved workflow, and reduced compliance risks. The platform's user-friendly interface makes it easier for teams to collaborate on forms and manage signatures seamlessly. Additionally, businesses can save time and minimize errors, ensuring their tax filings are always in order.

-

Is airSlate SignNow secure for handling Form 3885L Depreciation And Amortization Ftb Ca?

Absolutely, airSlate SignNow is designed with security in mind, ensuring that documents like Form 3885L Depreciation And Amortization Ftb Ca are protected. The platform employs advanced encryption and complies with industry-standard security practices to safeguard user data. Users can trust that their financial information is secure while using our services.

Get more for Form 3885L Depreciation And Amortization Ftb Ca

Find out other Form 3885L Depreciation And Amortization Ftb Ca

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors