S 1040 Form XLS 2022

Understanding the MI S1040 Form

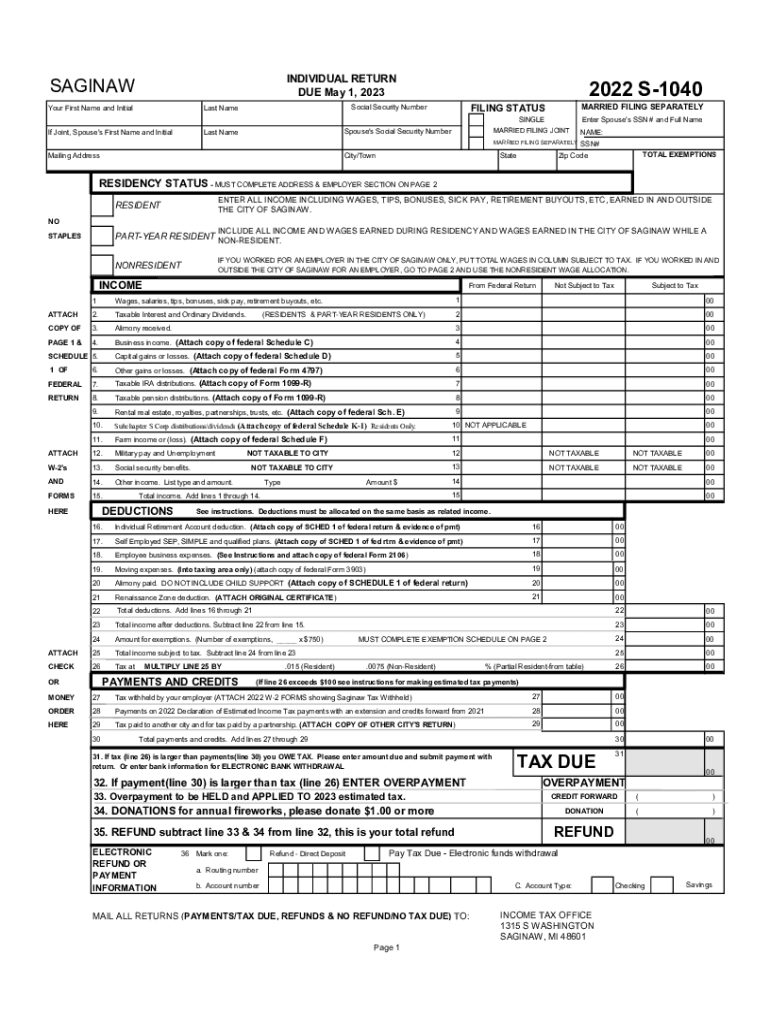

The MI S1040 form is a state income tax return used by residents of Michigan to report their income and calculate their tax liability. This form is essential for individuals who earn income in Michigan and need to comply with state tax regulations. The MI S1040 form allows taxpayers to claim deductions, credits, and exemptions that may apply to their specific financial situations. Understanding the purpose and requirements of this form is crucial for accurate tax filing.

Steps to Complete the MI S1040 Form

Completing the MI S1040 form involves several key steps:

- Gather Necessary Documents: Collect all relevant financial documents, including W-2s, 1099s, and any other income statements.

- Fill Out Personal Information: Enter your name, address, and Social Security number at the top of the form.

- Report Income: List all sources of income, including wages, interest, and dividends, in the appropriate sections.

- Claim Deductions and Credits: Identify any deductions or credits you qualify for, such as the Michigan Homestead Property Tax Credit.

- Calculate Tax Liability: Use the provided tax tables to determine your tax owed based on your taxable income.

- Review and Sign: Double-check all entries for accuracy, then sign and date the form before submission.

Filing Deadlines and Important Dates

It is important to be aware of the filing deadlines for the MI S1040 form to avoid penalties. Typically, the deadline for submitting your state income tax return is April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Additionally, taxpayers may request an extension to file, but any taxes owed must still be paid by the original deadline to avoid interest and penalties.

Form Submission Methods

Taxpayers have several options for submitting the MI S1040 form:

- Online Submission: Many taxpayers choose to file electronically using approved tax software or through the Michigan Department of Treasury's e-file system.

- Mail: You can print the completed form and mail it to the appropriate address listed in the form instructions. Ensure that you send it well before the deadline to allow for processing time.

- In-Person: Some individuals may prefer to file in person at their local tax office, where assistance may be available.

Legal Use of the MI S1040 Form

The MI S1040 form is legally binding once it is signed and submitted. It must comply with Michigan tax laws and regulations. Filing this form accurately is essential to avoid legal issues and potential audits. Taxpayers should ensure that all information provided is truthful and complete, as discrepancies can lead to penalties or legal consequences.

Required Documents for the MI S1040 Form

To complete the MI S1040 form, taxpayers must have several key documents on hand:

- W-2 Forms: These forms report wages and tax withholding from employers.

- 1099 Forms: Used to report various types of income, such as freelance earnings or interest income.

- Proof of Deductions: Any documentation supporting claims for deductions, such as property tax statements or receipts for medical expenses.

- Previous Year’s Tax Return: This can help in ensuring consistency and accuracy in reporting.

Quick guide on how to complete s 1040 form 2022xls

Effortlessly Prepare S 1040 Form xls on Any Device

Digital document management has become increasingly popular among businesses and individuals alike. It offers a superb eco-friendly alternative to traditional printed and signed papers, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly and without delays. Manage S 1040 Form xls on any platform with the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

Effortlessly Modify and eSign S 1040 Form xls

- Find S 1040 Form xls and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal significance as a traditional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method to deliver your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Edit and eSign S 1040 Form xls to ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct s 1040 form 2022xls

Create this form in 5 minutes!

How to create an eSignature for the s 1040 form 2022xls

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the mi s1040 form and why do I need it?

The mi s1040 form is a crucial tax document used by residents of Michigan to report their income and calculate their state tax obligations. Understanding how to prepare the mi s1040 form accurately can help ensure compliance with state laws and potentially reduce tax liabilities.

-

How can airSlate SignNow assist with filing the mi s1040 form?

airSlate SignNow simplifies the process of preparing and submitting the mi s1040 form by providing digital tools for easy document creation and eSigning. This ensures that your forms are completed accurately and submitted on time, reducing the hassle often associated with traditional filing methods.

-

Is airSlate SignNow suitable for small businesses filing the mi s1040 form?

Yes, airSlate SignNow is an excellent choice for small businesses that need to file the mi s1040 form efficiently. The platform offers a cost-effective solution that simplifies document management, allowing you to focus on running your business rather than worrying about paperwork.

-

What features does airSlate SignNow offer for managing the mi s1040 form?

airSlate SignNow includes features like customizable templates, eSignature capabilities, and automated workflows specifically designed for documents like the mi s1040 form. These tools ensure that your forms are completed accurately and securely, saving you time and reducing errors.

-

Are there integrations available for airSlate SignNow to assist with the mi s1040 form?

Yes, airSlate SignNow integrates seamlessly with various applications, allowing you to import data and documents relevant to the mi s1040 form directly. This interoperability enhances your workflow and makes it easier to manage tax-related documents alongside other business processes.

-

What is the pricing structure for airSlate SignNow related to the mi s1040 form?

airSlate SignNow offers various pricing plans that are designed to fit the needs of businesses of all sizes, including the tools necessary for efficient management of the mi s1040 form. By providing flexible options, users can choose a plan that aligns with their document signing and management requirements.

-

How secure is airSlate SignNow for handling the mi s1040 form?

airSlate SignNow prioritizes security by employing advanced encryption and compliance protocols to protect sensitive information related to the mi s1040 form. You can trust that your documents and personal data are secure, ensuring peace of mind during the eSigning process.

Get more for S 1040 Form xls

- Heirship affidavit descent minnesota form

- Warranty deed form mn

- Subcontractors notice to owner corporation or llc minnesota form

- Quitclaim deed from individual to two individuals in joint tenancy minnesota form

- Minnesota subcontractor form

- Quitclaim deed by two individuals to husband and wife minnesota form

- Warranty deed from two individuals to husband and wife minnesota form

- Minnesota corporation company form

Find out other S 1040 Form xls

- Sign Indiana Healthcare / Medical Moving Checklist Safe

- Sign Wisconsin Government Cease And Desist Letter Online

- Sign Louisiana Healthcare / Medical Limited Power Of Attorney Mobile

- Sign Healthcare / Medical PPT Michigan Now

- Sign Massachusetts Healthcare / Medical Permission Slip Now

- Sign Wyoming Government LLC Operating Agreement Mobile

- Sign Wyoming Government Quitclaim Deed Free

- How To Sign Nebraska Healthcare / Medical Living Will

- Sign Nevada Healthcare / Medical Business Plan Template Free

- Sign Nebraska Healthcare / Medical Permission Slip Now

- Help Me With Sign New Mexico Healthcare / Medical Medical History

- Can I Sign Ohio Healthcare / Medical Residential Lease Agreement

- How To Sign Oregon Healthcare / Medical Living Will

- How Can I Sign South Carolina Healthcare / Medical Profit And Loss Statement

- Sign Tennessee Healthcare / Medical Business Plan Template Free

- Help Me With Sign Tennessee Healthcare / Medical Living Will

- Sign Texas Healthcare / Medical Contract Mobile

- Sign Washington Healthcare / Medical LLC Operating Agreement Now

- Sign Wisconsin Healthcare / Medical Contract Safe

- Sign Alabama High Tech Last Will And Testament Online