Resident 1040R Form 2024-2026

What is the Resident 1040R Form

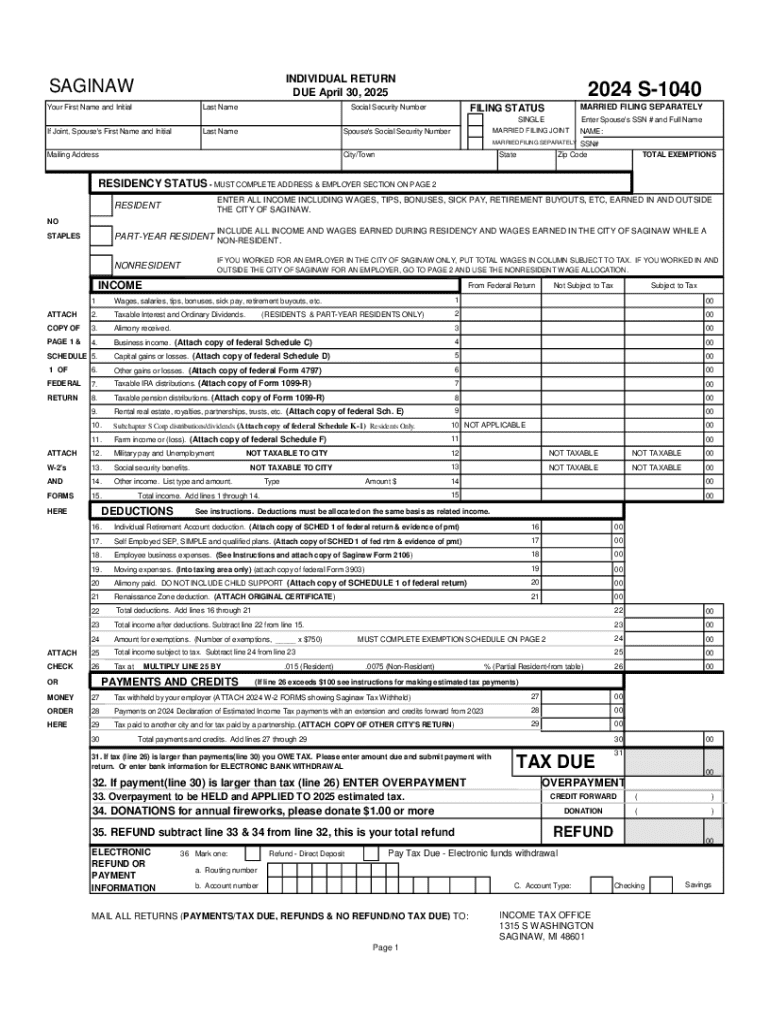

The Resident 1040R Form is a tax document used by residents of Michigan to report their income and calculate their state tax obligations. This form is specifically designed for individuals who are considered residents for tax purposes and is essential for accurately reporting earnings, deductions, and credits applicable to state taxes. Completing this form correctly ensures compliance with Michigan tax laws and helps in determining any tax refund or liability owed to the state.

How to obtain the Resident 1040R Form

The Resident 1040R Form can be obtained through several means. Taxpayers can download a printable version directly from the Michigan Department of Treasury website. Additionally, physical copies may be available at local government offices, tax preparation services, or libraries. It is important to ensure that the most current version of the form is used to avoid any issues during the filing process.

Steps to complete the Resident 1040R Form

Completing the Resident 1040R Form involves several key steps. First, gather all necessary financial documents, including W-2 forms, 1099s, and any other income statements. Next, fill out personal information, including your name, address, and Social Security number. Then, report your total income and any applicable deductions. After completing the income section, calculate your tax liability using the provided tax tables. Finally, review the form for accuracy, sign it, and choose your preferred method of submission.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the Resident 1040R Form. Typically, the deadline for submitting this form is April fifteenth of each year, coinciding with the federal tax filing deadline. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also keep in mind any extensions that may be available and ensure that they file their forms on time to avoid penalties.

Required Documents

When preparing to complete the Resident 1040R Form, certain documents are required to ensure accurate reporting. These documents include:

- W-2 forms from employers

- 1099 forms for any additional income

- Records of any deductions, such as mortgage interest or property taxes

- Proof of any tax credits claimed

Having these documents ready will streamline the completion of the form and help avoid errors.

Form Submission Methods (Online / Mail / In-Person)

The Resident 1040R Form can be submitted through various methods. Taxpayers have the option to file online using approved tax software that supports Michigan state tax forms. Alternatively, the completed form can be printed and mailed to the appropriate address listed on the form instructions. For those who prefer face-to-face interactions, some local tax offices may accept in-person submissions. Each method has its own processing times and requirements, so it is advisable to choose the one that best fits individual needs.

Create this form in 5 minutes or less

Find and fill out the correct resident 1040r form

Create this form in 5 minutes!

How to create an eSignature for the resident 1040r form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the michigan tax form printable?

The michigan tax form printable refers to the official tax forms provided by the state of Michigan that can be printed and filled out manually. These forms are essential for individuals and businesses to report their income and calculate their tax obligations. Using airSlate SignNow, you can easily access and eSign these forms, streamlining your tax filing process.

-

How can I obtain a michigan tax form printable?

You can obtain a michigan tax form printable directly from the Michigan Department of Treasury's website or through airSlate SignNow. Our platform allows you to download, fill out, and eSign these forms quickly and efficiently. This ensures that you have the most up-to-date forms for your tax needs.

-

Are there any costs associated with using airSlate SignNow for michigan tax form printable?

Using airSlate SignNow to access and eSign your michigan tax form printable is cost-effective. We offer various pricing plans that cater to different business needs, ensuring you only pay for what you use. Additionally, our platform saves you time and resources, making it a valuable investment for your tax filing process.

-

What features does airSlate SignNow offer for michigan tax form printable?

airSlate SignNow provides a range of features for handling your michigan tax form printable, including easy document upload, eSignature capabilities, and secure storage. Our user-friendly interface allows you to manage your forms efficiently, ensuring that you can complete your tax filings without hassle. Plus, you can track the status of your documents in real-time.

-

Can I integrate airSlate SignNow with other software for michigan tax form printable?

Yes, airSlate SignNow offers seamless integrations with various software applications, enhancing your experience with michigan tax form printable. You can connect our platform with popular accounting and tax software to streamline your workflow. This integration helps you manage your documents and data more effectively.

-

What are the benefits of using airSlate SignNow for michigan tax form printable?

Using airSlate SignNow for your michigan tax form printable provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform allows you to complete and eSign your forms from anywhere, saving you time and effort. Additionally, your documents are securely stored, ensuring compliance and peace of mind.

-

Is airSlate SignNow suitable for businesses handling michigan tax form printable?

Absolutely! airSlate SignNow is designed to cater to businesses of all sizes that need to manage michigan tax form printable. Our platform simplifies the process of sending and eSigning documents, making it easier for teams to collaborate and stay organized. This is particularly beneficial during tax season when timely submissions are crucial.

Get more for Resident 1040R Form

- New mexico decree 497320108 form

- Nm withholding form

- Mutual wills containing last will and testaments for unmarried persons living together with no children new mexico form

- Mutual wills package of last wills and testaments for unmarried persons living together with adult children new mexico form

- Mutual wills or last will and testaments for unmarried persons living together with minor children new mexico form

- Non marital cohabitation living together agreement new mexico form

- New mexico paternity form

- Bill of sale in connection with sale of business by individual or corporate seller new mexico form

Find out other Resident 1040R Form

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself

- eSignature Maryland Non-Profit Cease And Desist Letter Fast

- eSignature Pennsylvania Life Sciences Rental Lease Agreement Easy

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter