Does it Matter Whose Name is Listed First on Tax Return? 2020

Understanding the Importance of Name Order on Tax Returns

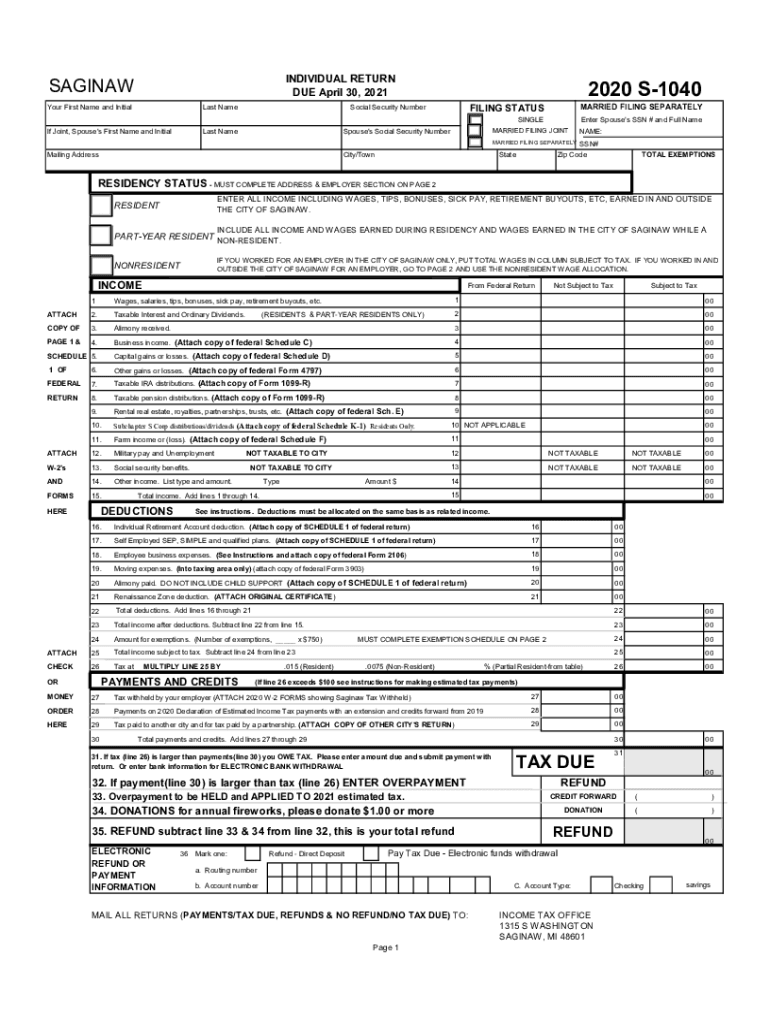

The order of names on a tax return can have implications for filing status and potential refunds. Generally, the IRS does not prioritize whose name appears first on the return, but it is recommended that the primary taxpayer’s name be listed first. This is particularly relevant for married couples filing jointly, as it may affect the processing of the return and any associated refunds.

Steps to Complete the Tax Return with Correct Name Order

To ensure accurate processing of your tax return, follow these steps:

- Identify the primary taxpayer, usually the one with the higher income.

- List the primary taxpayer's name first, followed by the spouse's name if applicable.

- Ensure that the Social Security numbers (SSNs) correspond to the names listed.

- Review the completed form for accuracy before submission.

IRS Guidelines on Name Order for Tax Returns

The IRS provides specific guidelines regarding the order of names on tax returns. According to IRS Publication 501, when filing jointly, the name of the person who earned more income should be listed first. This helps streamline the processing of the return and can prevent delays in receiving any refunds.

Filing Deadlines and Important Dates

For the 2017 tax year, the deadline to file your MI form was April 17, 2018. It is essential to adhere to these deadlines to avoid penalties and interest on any unpaid taxes. If you missed the deadline, consider filing for an extension or consulting a tax professional for guidance on your options.

Required Documents for Filing the MI Form

When preparing to file the MI form, gather the necessary documents to ensure a smooth filing process. Key documents include:

- Your W-2 forms from employers.

- Any 1099 forms for additional income.

- Records of any deductions or credits you plan to claim.

- Proof of identity, such as a driver's license or Social Security card.

Form Submission Methods for the MI Form

You can submit the MI form through various methods. These include:

- Online filing through approved tax software.

- Mailing a paper form to the appropriate state address.

- In-person submission at designated tax offices.

Quick guide on how to complete does it matter whose name is listed first on tax return

Easily Prepare Does It Matter Whose Name Is Listed First On Tax Return? on Any Gadget

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Does It Matter Whose Name Is Listed First On Tax Return? using the airSlate SignNow Android or iOS applications and enhance any document-driven process today.

The Simplest Way to Modify and eSign Does It Matter Whose Name Is Listed First On Tax Return? Effortlessly

- Find Does It Matter Whose Name Is Listed First On Tax Return? and then click on Get Form to begin.

- Make use of the tools we offer to complete your form.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Select how you wish to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from a device of your choice. Modify and eSign Does It Matter Whose Name Is Listed First On Tax Return? and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct does it matter whose name is listed first on tax return

Create this form in 5 minutes!

How to create an eSignature for the does it matter whose name is listed first on tax return

How to make an eSignature for your PDF in the online mode

How to make an eSignature for your PDF in Chrome

The way to generate an electronic signature for putting it on PDFs in Gmail

The way to create an electronic signature from your smart phone

The best way to make an electronic signature for a PDF on iOS devices

The way to create an electronic signature for a PDF file on Android OS

People also ask

-

What is the MI 1040 2017 form?

The MI 1040 2017 form is the Michigan state income tax return used by residents to report their annual income. This form is essential for determining the amount of tax owed or the refund due after filing. Familiarizing yourself with the MI 1040 2017 form is crucial for compliant and accurate tax reporting.

-

How can I eSign the MI 1040 2017 form using airSlate SignNow?

With airSlate SignNow, you can easily eSign the MI 1040 2017 form by uploading it to the platform and inviting your signers. The system provides a straightforward workflow for capturing signatures digitally, allowing for a seamless filing process. Enjoy the benefits of faster processing and secure digital storage.

-

Is there a cost associated with using airSlate SignNow to fill out the MI 1040 2017 form?

airSlate SignNow offers various pricing plans that cater to different business needs, including options for individuals needing to file forms like the MI 1040 2017 form. Our cost-effective solutions enhance efficiency while ensuring compliance with legislation. Check our website for the latest pricing details.

-

What features does airSlate SignNow offer for managing the MI 1040 2017 form?

AirSlate SignNow provides tools such as template creation, customizable workflows, and secure storage for managing documents like the MI 1040 2017 form. These features simplify the document preparation process and ensure you can track the status of each form effortlessly. You'll find that our features enhance the entire e-filing experience.

-

Can I integrate airSlate SignNow with other applications for filing the MI 1040 2017 form?

Yes, airSlate SignNow allows for integrations with various applications, making it easier to file the MI 1040 2017 form seamlessly. You can link it with popular accounting and productivity tools, ensuring you have a streamlined flow for managing your documentation. This connectivity enhances collaboration and efficiency.

-

What are the benefits of using airSlate SignNow for the MI 1040 2017 form?

Using airSlate SignNow for the MI 1040 2017 form offers benefits like increased efficiency, reduced paperwork, and improved compliance. The electronic signing process accelerates the filing timeline, while our secure platform ensures that your sensitive information is protected. Plus, access to documents from anywhere enhances convenience.

-

How does airSlate SignNow ensure security when handling the MI 1040 2017 form?

AirSlate SignNow prioritizes security, using bank-level encryption to protect your MI 1040 2017 form and other sensitive documents. Our platform complies with industry standards for data protection, ensuring your information remains confidential. Regular security audits also help maintain our commitment to your safety.

Get more for Does It Matter Whose Name Is Listed First On Tax Return?

- Complaint regarding wrongful death form

- Complaint regarding slip and fall form

- Fee contingency form

- Interrogatories and requests for production personal injury 497426734 form

- Defendant plaintiff 497426735 form

- Authorization release records 497426736 form

- Motion dismiss 497426737 form

- Serve subpoena form

Find out other Does It Matter Whose Name Is Listed First On Tax Return?

- How To Electronic signature Missouri Courts Word

- How Can I Electronic signature New Jersey Courts Document

- How Can I Electronic signature New Jersey Courts Document

- Can I Electronic signature Oregon Sports Form

- How To Electronic signature New York Courts Document

- How Can I Electronic signature Oklahoma Courts PDF

- How Do I Electronic signature South Dakota Courts Document

- Can I Electronic signature South Dakota Sports Presentation

- How To Electronic signature Utah Courts Document

- Can I Electronic signature West Virginia Courts PPT

- Send Sign PDF Free

- How To Send Sign PDF

- Send Sign Word Online

- Send Sign Word Now

- Send Sign Word Free

- Send Sign Word Android

- Send Sign Word iOS

- Send Sign Word iPad

- How To Send Sign Word

- Can I Send Sign Word