Enter Spouse's SSN # and Full Name 2017

What is the Enter Spouse's SSN and Full Name

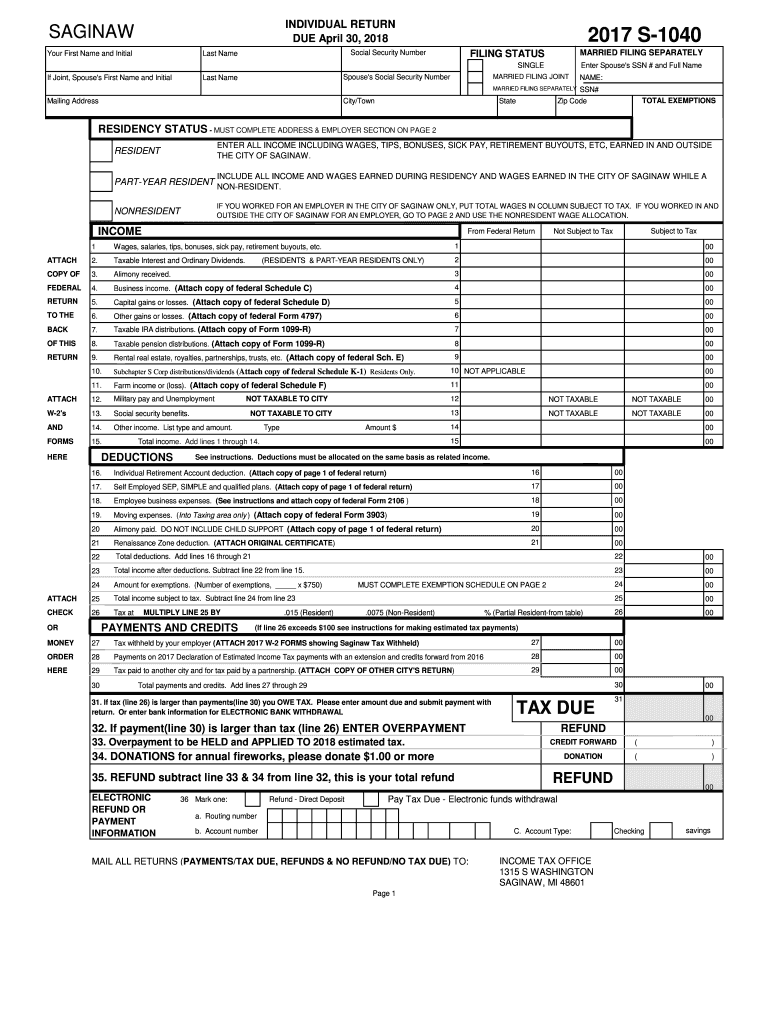

The Enter Spouse's SSN and Full Name form is a crucial document often required in various legal and financial contexts, particularly for tax purposes. This form typically requests the full Social Security Number (SSN) of a spouse along with their complete name. Providing accurate information is essential, as it helps ensure compliance with IRS regulations and facilitates proper processing of tax returns and other legal documents. The full SSN is a unique identifier that plays a vital role in verifying identity and ensuring that all financial records are correctly attributed to the right individuals.

How to Use the Enter Spouse's SSN and Full Name

Using the Enter Spouse's SSN and Full Name form involves several straightforward steps. First, ensure you have the correct and complete information for your spouse, including their full name as it appears on official documents and their full SSN. Next, fill out the form carefully, checking for accuracy to avoid any potential issues with processing. Once completed, the form can be submitted electronically or printed for mailing, depending on the specific requirements of the agency or institution requesting the information. Always retain a copy for your records.

Steps to Complete the Enter Spouse's SSN and Full Name

Completing the Enter Spouse's SSN and Full Name form can be done efficiently by following these steps:

- Gather necessary information, including your spouse's full name and SSN.

- Access the form through the appropriate platform or agency website.

- Fill in the required fields accurately, ensuring that all information matches official documents.

- Review the form for any errors or omissions before submission.

- Submit the form electronically or print it for mailing, as needed.

Legal Use of the Enter Spouse's SSN and Full Name

The legal use of the Enter Spouse's SSN and Full Name form is primarily linked to tax filings and various financial transactions. It is essential for ensuring compliance with federal regulations, particularly those set forth by the IRS. When used correctly, this form helps to establish the identity of individuals involved in joint financial matters, such as tax returns or loan applications. Failure to provide accurate information can lead to penalties or delays in processing, making it imperative to handle this form with care.

IRS Guidelines

The IRS has specific guidelines regarding the use of the Enter Spouse's SSN and Full Name. These guidelines stipulate that the SSN must be valid and correspond to the name provided. It is crucial to ensure that both names and numbers are entered correctly to avoid issues with tax filings. The IRS may require this information for various forms, including joint tax returns and other financial documents. Adhering to these guidelines helps maintain compliance and facilitates smoother processing of tax-related matters.

Disclosure Requirements

When completing the Enter Spouse's SSN and Full Name form, there are important disclosure requirements to consider. Individuals must ensure that they are providing accurate and truthful information, as any discrepancies can lead to legal ramifications. Additionally, it is essential to understand who will have access to this information and how it will be used. Organizations requesting this information are often required to explain their data protection policies to ensure compliance with privacy laws.

Penalties for Non-Compliance

Non-compliance with the requirements surrounding the Enter Spouse's SSN and Full Name can lead to significant penalties. The IRS may impose fines for incorrect or incomplete information, which can affect tax filings and financial transactions. Additionally, failure to provide accurate information can result in delays in processing or even legal action in severe cases. It is crucial to take the completion of this form seriously and ensure that all information is accurate and submitted in a timely manner.

Quick guide on how to complete enter spouses ssn and full name

Complete Enter Spouse's SSN # And Full Name effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the required form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and eSign your documents swiftly without delays. Manage Enter Spouse's SSN # And Full Name on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and eSign Enter Spouse's SSN # And Full Name with ease

- Obtain Enter Spouse's SSN # And Full Name and click on Get Form to begin.

- Utilize the tools at your disposal to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive details with tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Verify the details and click on the Done button to save your changes.

- Choose how you wish to send your form—via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign Enter Spouse's SSN # And Full Name and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct enter spouses ssn and full name

Create this form in 5 minutes!

How to create an eSignature for the enter spouses ssn and full name

How to create an eSignature for your Enter Spouses Ssn And Full Name in the online mode

How to make an eSignature for the Enter Spouses Ssn And Full Name in Chrome

How to make an eSignature for signing the Enter Spouses Ssn And Full Name in Gmail

How to generate an eSignature for the Enter Spouses Ssn And Full Name from your mobile device

How to generate an eSignature for the Enter Spouses Ssn And Full Name on iOS

How to create an electronic signature for the Enter Spouses Ssn And Full Name on Android devices

People also ask

-

What is a full SSN and why is it necessary for signing documents?

A full SSN, or Social Security Number, is a unique identifier assigned to individuals for various administrative purposes. In the context of document signing, providing a full SSN can enhance the security and legitimacy of transactions. By using airSlate SignNow, businesses can ensure that their documents are verified accurately, which is essential for legal compliance.

-

Is it safe to provide my full SSN when using airSlate SignNow?

Yes, airSlate SignNow prioritizes the security of your personal information, including your full SSN. The platform implements advanced encryption and security protocols to protect your data. Therefore, you can confidently enter your full SSN knowing that it is handled with the utmost care.

-

Are there any costs associated with using full SSN for eSigning documents?

Using a full SSN within airSlate SignNow may be subject to normal usage fees associated with the eSigning service. However, airSlate SignNow offers competitive pricing plans that provide signNow value to businesses looking to streamline their document management. Consider checking our pricing page for detailed information on costs.

-

What features does airSlate SignNow offer for managing documents that require a full SSN?

airSlate SignNow offers various features such as secure eSigning, document tracking, and templates specifically designed for compliance that may include the inclusion of a full SSN. Users can customize their workflows to ensure that all necessary information, including full SSNs, is accurately captured and protected. This makes it easier to manage sensitive documents efficiently.

-

Can I integrate airSlate SignNow with other applications when using a full SSN?

Yes, airSlate SignNow offers several integration options with popular applications. This means you can seamlessly collect and manage your full SSN along with other data across platforms. Integrating airSlate SignNow into your existing systems ensures a smooth workflow and enhanced productivity.

-

How does airSlate SignNow help in verifying identities using a full SSN?

airSlate SignNow uses a variety of verification methods, including full SSN validation, to ensure the identities of signers. By incorporating full SSNs into the authentication process, businesses can signNowly reduce the risk of fraudulent activities. This feature enhances the overall trustworthiness of the eSigning process.

-

What are the benefits of using airSlate SignNow for documents that require full SSN?

Using airSlate SignNow for documents that require a full SSN streamlines the signing process and adds an extra layer of compliance. This solution ensures that sensitive information is handled securely while providing a user-friendly experience for all parties involved. Additionally, businesses can save time and resources by digitizing their workflows.

Get more for Enter Spouse's SSN # And Full Name

Find out other Enter Spouse's SSN # And Full Name

- Electronic signature Minnesota Lawers Lease Termination Letter Free

- Electronic signature Michigan Lawers Stock Certificate Mobile

- How Can I Electronic signature Ohio High Tech Job Offer

- How To Electronic signature Missouri Lawers Job Description Template

- Electronic signature Lawers Word Nevada Computer

- Can I Electronic signature Alabama Legal LLC Operating Agreement

- How To Electronic signature North Dakota Lawers Job Description Template

- Electronic signature Alabama Legal Limited Power Of Attorney Safe

- How To Electronic signature Oklahoma Lawers Cease And Desist Letter

- How To Electronic signature Tennessee High Tech Job Offer

- Electronic signature South Carolina Lawers Rental Lease Agreement Online

- How Do I Electronic signature Arizona Legal Warranty Deed

- How To Electronic signature Arizona Legal Lease Termination Letter

- How To Electronic signature Virginia Lawers Promissory Note Template

- Electronic signature Vermont High Tech Contract Safe

- Electronic signature Legal Document Colorado Online

- Electronic signature Washington High Tech Contract Computer

- Can I Electronic signature Wisconsin High Tech Memorandum Of Understanding

- How Do I Electronic signature Wisconsin High Tech Operating Agreement

- How Can I Electronic signature Wisconsin High Tech Operating Agreement