Tax Form Search 2020

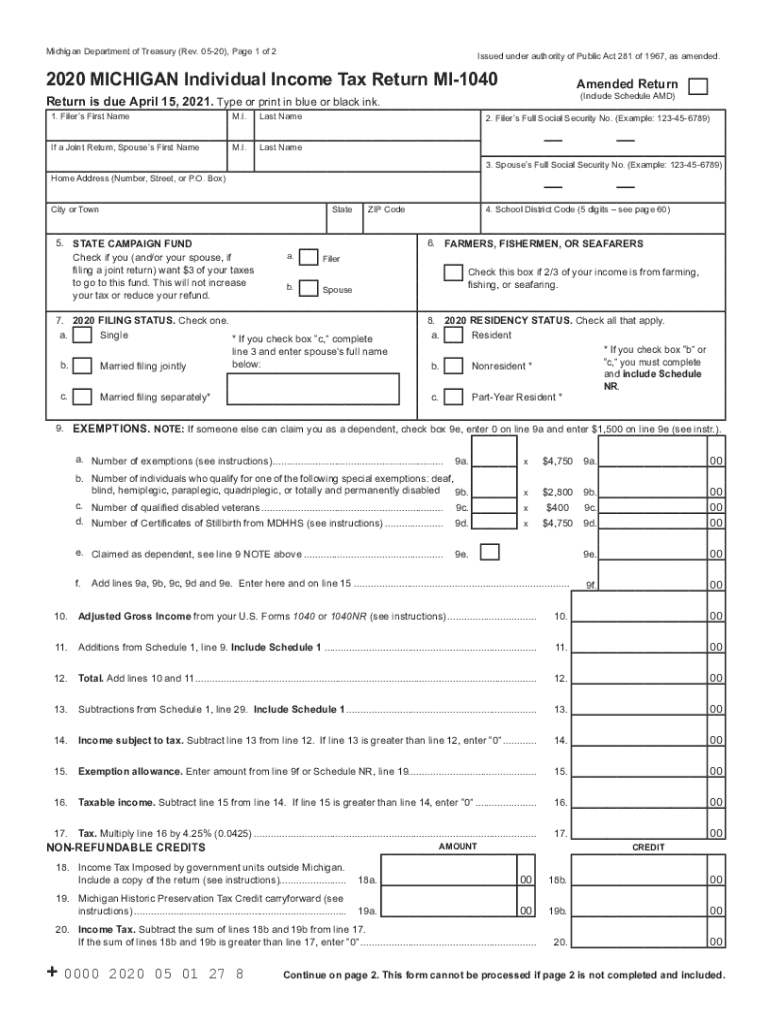

What is the mi 1040 Form?

The mi 1040 form is the official Michigan Individual Income Tax Return used by residents of Michigan to report their income and calculate their state tax liability. This form is essential for individuals who earn income within the state, whether through employment, self-employment, or other sources. The mi 1040 allows taxpayers to detail their income, claim deductions, and determine any tax credits applicable to their situation. Understanding this form is crucial for ensuring compliance with state tax laws and optimizing potential refunds.

Steps to Complete the mi 1040 Form

Filling out the mi 1040 form involves several key steps to ensure accuracy and compliance. First, gather all necessary documents, including W-2s, 1099s, and records of any other income. Next, accurately report your total income on the form. After that, identify and apply any deductions you qualify for, such as those for education or medical expenses. Once you have calculated your tax liability, review the form for completeness and accuracy. Finally, submit your completed mi 1040 form either electronically or by mail to the appropriate state tax authority.

Required Documents for the mi 1040 Form

To successfully complete the mi 1040 form, certain documents are necessary. These include:

- W-2 forms from employers detailing annual earnings

- 1099 forms for any freelance or contract work

- Records of other income sources, such as interest or dividends

- Documentation for deductions, like receipts for medical expenses or education costs

- Any previous year tax returns, which can provide useful information for the current filing

Having these documents on hand will streamline the process and help ensure that all income and deductions are accurately reported.

Filing Deadlines for the mi 1040 Form

The deadline for filing the mi 1040 form typically aligns with the federal tax return deadline, which is usually April fifteenth. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is important for taxpayers to be aware of these deadlines to avoid penalties and interest on late payments. Additionally, if you anticipate needing more time to file, you may apply for an extension, but this does not extend the time to pay any taxes owed.

Legal Use of the mi 1040 Form

The mi 1040 form is legally recognized as the official document for reporting income and calculating state taxes in Michigan. To ensure its legal validity, taxpayers must complete the form accurately and submit it within the designated deadlines. Utilizing electronic filing methods can enhance security and efficiency, as electronic submissions are encrypted and often processed faster. Compliance with state regulations, including maintaining accurate records and supporting documentation, is essential to uphold the legal standing of the submitted form.

Digital vs. Paper Version of the mi 1040 Form

Taxpayers have the option to file the mi 1040 form either digitally or on paper. The digital version offers several advantages, such as faster processing times, immediate confirmation of receipt, and enhanced security features. Conversely, some individuals may prefer the paper version for its tangible nature. Regardless of the method chosen, it is crucial to ensure that all information is complete and accurate to avoid delays or issues with the state tax authority.

Quick guide on how to complete tax form search

Easily Prepare Tax Form Search on Any Device

Online document management has gained popularity among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed papers, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, edit, and eSign your documents swiftly, without any hold-ups. Manage Tax Form Search on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to Edit and eSign Tax Form Search Effortlessly

- Locate Tax Form Search and then click Get Form to begin.

- Utilize the tools available to fill out your document.

- Highlight important sections of your documents or obscure sensitive information using tools provided by airSlate SignNow specifically for this task.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet signature.

- Review all information and then click the Done button to store your modifications.

- Choose how you wish to share your form, whether via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Tax Form Search to ensure excellent communication at every step of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tax form search

Create this form in 5 minutes!

How to create an eSignature for the tax form search

How to create an electronic signature for your PDF document online

How to create an electronic signature for your PDF document in Google Chrome

How to make an electronic signature for signing PDFs in Gmail

How to create an electronic signature right from your smart phone

How to create an electronic signature for a PDF document on iOS

How to create an electronic signature for a PDF on Android OS

People also ask

-

What is the MI 1040 form and why do I need it?

The MI 1040 form is the Michigan individual income tax return that residents must file each year. It is essential for reporting your income and calculating any taxes owed or refunds due. Understanding how to accurately complete the MI 1040 can help ensure compliance with state tax laws and maximize your refund.

-

How can airSlate SignNow assist with the MI 1040 process?

airSlate SignNow streamlines the MI 1040 filing process by allowing you to send and eSign your tax documents securely. With its user-friendly interface, you can easily manage your forms and ensure that everything is completed correctly, saving you time and reducing errors. This helps you focus on more important aspects of your finances.

-

What features does airSlate SignNow offer for MI 1040 filing?

airSlate SignNow offers features like customizable templates, electronic signatures, and real-time document tracking specifically for MI 1040 filings. These functionalities enhance the efficiency of your tax preparation and submission process, ensuring you have everything organized in one place. Plus, you can collaborate with tax professionals directly within the platform.

-

What pricing options are available for using airSlate SignNow to file the MI 1040?

airSlate SignNow provides a range of pricing plans tailored to suit various user needs when filing the MI 1040. Whether you are an individual taxpayer or a business, you can select a plan that fits your budget. The platform also offers a free trial, allowing you to explore its features before committing to a subscription.

-

Can airSlate SignNow integrate with tax software for MI 1040 filings?

Yes, airSlate SignNow can seamlessly integrate with various tax software applications that support filing the MI 1040. This allows you to import and export necessary documents effortlessly, enhancing the overall workflow of your tax preparation process. Integration ensures that you can use your preferred tools while benefiting from SignNow's features.

-

What are the benefits of eSigning the MI 1040 with airSlate SignNow?

eSigning the MI 1040 with airSlate SignNow offers signNow benefits, including speed, security, and convenience. You can sign documents from anywhere, reducing the need for physical paperwork and in-person meetings. This not only enhances the efficiency of your filing but also ensures your sensitive data is well-protected.

-

Is there customer support available for MI 1040 questions within airSlate SignNow?

Absolutely! airSlate SignNow offers comprehensive customer support to assist users with any MI 1040 related queries. Whether you need help navigating the platform or specific questions about filing, their support team is available via chat, email, or phone to guide you through the process.

Get more for Tax Form Search

Find out other Tax Form Search

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe