Get the MI 1040 PDF Reset Form Michigan Department 2021

Key elements of the MI 1040 form

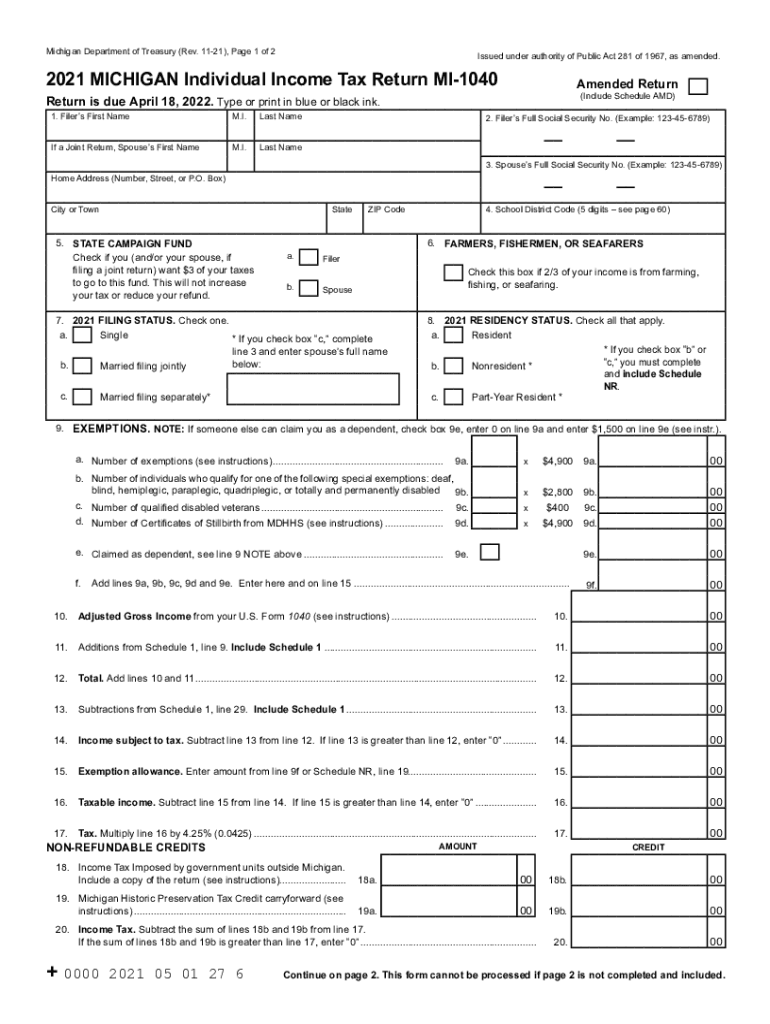

The MI 1040 form is a crucial document for individuals filing their state income tax in Michigan. This form collects essential information regarding the taxpayer's income, deductions, and credits. Key elements include:

- Personal Information: Taxpayer's name, address, and Social Security number.

- Filing Status: Options include single, married filing jointly, married filing separately, and head of household.

- Income Reporting: All sources of income, including wages, interest, and dividends, must be reported.

- Deductions and Credits: Taxpayers can claim various deductions and credits to reduce their taxable income.

- Signature: The form must be signed and dated to validate the information provided.

Steps to complete the MI 1040 form

Completing the MI 1040 form involves several steps to ensure accuracy and compliance with Michigan tax laws. Follow these steps:

- Gather necessary documents, including W-2s, 1099s, and any receipts for deductions.

- Fill out personal information accurately, ensuring all names and Social Security numbers are correct.

- Select the appropriate filing status based on your situation.

- Report all sources of income in the designated sections.

- Claim any applicable deductions and credits to lower your taxable income.

- Review the completed form for accuracy before signing.

- Submit the form either electronically or via mail, following the instructions provided by the Michigan Department of Treasury.

Filing deadlines / Important dates

Understanding the filing deadlines for the MI 1040 form is essential to avoid penalties. Key dates include:

- April 15: Standard deadline for filing the MI 1040 form for the previous tax year.

- October 15: Extended deadline for those who filed for an extension.

- Payment Due Date: Any taxes owed must be paid by the filing deadline to avoid interest and penalties.

Form submission methods

Taxpayers can submit the MI 1040 form through various methods, ensuring flexibility and convenience. Options include:

- Online Submission: Use approved e-filing software to submit the form electronically.

- Mail: Print and send the completed form to the Michigan Department of Treasury at the specified address.

- In-Person: Visit a local tax office to submit the form directly.

Legal use of the MI 1040 form

The MI 1040 form serves as a legally binding document for reporting income and taxes owed to the state of Michigan. To ensure its legal validity:

- Complete all required sections accurately and truthfully.

- Sign and date the form to affirm the information provided.

- Retain a copy of the submitted form for personal records.

IRS Guidelines

While the MI 1040 form is specific to Michigan, it is essential to align with federal IRS guidelines as well. Key points include:

- Ensure that all income reported on the MI 1040 matches the federal tax return.

- Understand how state deductions and credits may differ from federal ones.

- Consult IRS publications for specific rules regarding state tax obligations.

Quick guide on how to complete get the free mi 1040pdf reset form michigan department

Complete Get The MI 1040 pdf Reset Form Michigan Department effortlessly on any device

Online document administration has become popular with businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, edit, and eSign your documents quickly without delays. Manage Get The MI 1040 pdf Reset Form Michigan Department on any device with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest way to modify and eSign Get The MI 1040 pdf Reset Form Michigan Department seamlessly

- Locate Get The MI 1040 pdf Reset Form Michigan Department and then click Get Form to begin.

- Use the tools we offer to complete your form.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign feature, which takes only seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and then click the Done button to save your changes.

- Choose how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign Get The MI 1040 pdf Reset Form Michigan Department and ensure exceptional communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct get the free mi 1040pdf reset form michigan department

Create this form in 5 minutes!

How to create an eSignature for the get the free mi 1040pdf reset form michigan department

How to make an e-signature for your PDF file in the online mode

How to make an e-signature for your PDF file in Chrome

The way to make an e-signature for putting it on PDFs in Gmail

How to create an electronic signature straight from your smartphone

The best way to make an electronic signature for a PDF file on iOS devices

How to create an electronic signature for a PDF document on Android

People also ask

-

What is the mi 1040 form used for?

The mi 1040 form is utilized by residents of Michigan to report their income and calculate their state tax liabilities. It is essential for those required to file state taxes, ensuring compliance with local tax regulations. Accurately completing the mi 1040 helps avoid penalties and ensures you claim all eligible deductions.

-

How can airSlate SignNow assist with mi 1040 forms?

airSlate SignNow provides a seamless platform for electronically signing and sending documents like the mi 1040 form. With its user-friendly interface, users can manage their tax documents efficiently and securely. This facilitates a hassle-free filing process and saves precious time during tax season.

-

What are the pricing options for using airSlate SignNow for mi 1040 filings?

AirSlate SignNow offers competitive pricing plans tailored for businesses and individual users, which can help streamline the submission of the mi 1040. The pricing is designed to be cost-effective, ensuring you get maximum value when managing your tax documents. Explore various plans to find one that fits your budget and needs.

-

Are there any integrations available for mi 1040 filings?

Yes, airSlate SignNow integrates seamlessly with various accounting and tax software, making it easier to manage your mi 1040 filings. These integrations enhance workflow efficiency by allowing direct access to your documents within your preferred tools. This connectivity helps streamline the entire tax preparation process.

-

What features does airSlate SignNow offer for the mi 1040 form?

airSlate SignNow offers features such as electronic signatures, document tracking, and customizable templates specifically for the mi 1040 form. These features simplify the process of managing and sending tax documents. Additionally, the platform ensures your information remains secure with advanced encryption and compliance with industry standards.

-

Is airSlate SignNow secure for handling mi 1040 documents?

Absolutely! airSlate SignNow employs top-notch security measures to protect your mi 1040 documents. Your information is safeguarded through encryption, and the platform complies with stringent privacy regulations, ensuring that your sensitive data remains confidential during the entire signing process.

-

Can I access my mi 1040 documents from any device?

Yes, airSlate SignNow is designed to be accessible from any device, including desktops, tablets, and smartphones. This flexibility allows you to manage your mi 1040 documents on the go, making it convenient to review or sign your tax forms whenever and wherever you need. Enjoy the freedom of digital document management with airSlate SignNow.

Get more for Get The MI 1040 pdf Reset Form Michigan Department

- Warranty deed two individuals to one individual mississippi form

- Ms warranty deed 497313703 form

- Mississippi bylaws form

- Asset purchase agreement mississippi form

- Quitclaim deed life estate two grantors to one grantee mississippi form

- Mississippi lien 497313707 form

- Mississippi married get form

- Mississippi foreclosure form

Find out other Get The MI 1040 pdf Reset Form Michigan Department

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF