Michigan 1040 Form 2017

What is the Michigan 1040 Form

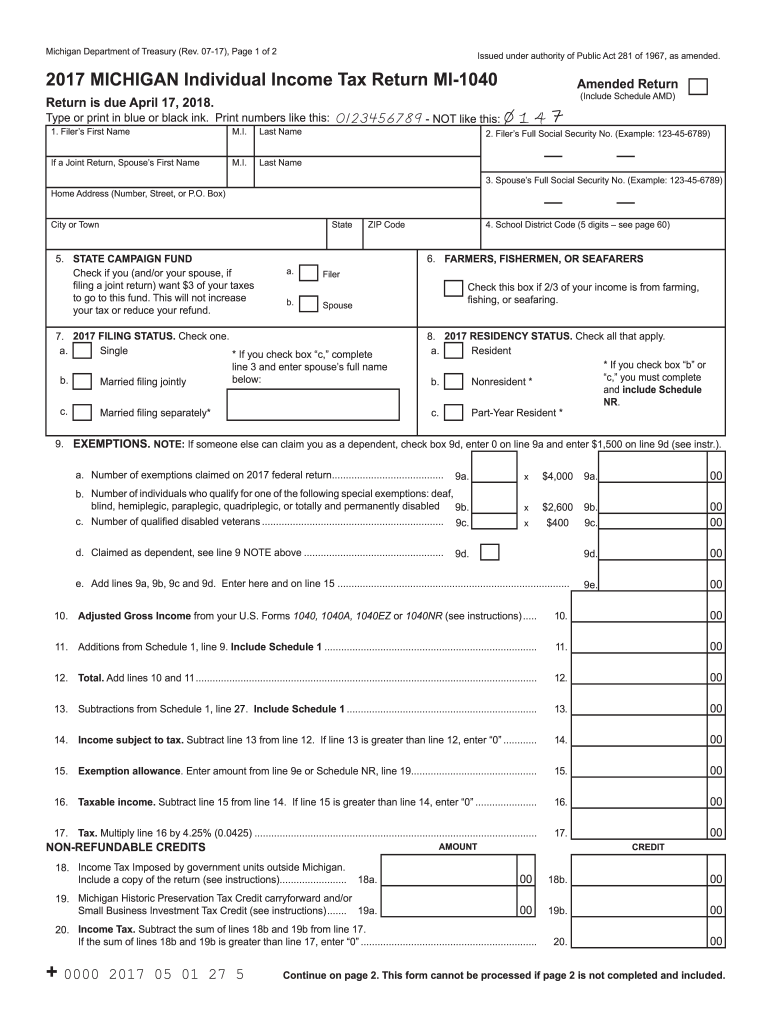

The Michigan 1040 Form is the state's individual income tax return used by residents to report their income and calculate their tax liability. This form is essential for individuals earning income in Michigan, as it allows them to determine the amount of state tax owed or any potential refund due. The Michigan 1040 Form is specifically designed to accommodate various income types, including wages, self-employment income, and investment earnings.

How to obtain the Michigan 1040 Form

The Michigan 1040 Form can be obtained through several convenient methods. Residents may download the form directly from the Michigan Department of Treasury website, where it is available in a printable format. Additionally, physical copies can be requested at local tax offices or public libraries. Many tax preparation services also provide access to the form as part of their services, ensuring that individuals can easily acquire the necessary documentation for filing their state taxes.

Steps to complete the Michigan 1040 Form

Completing the Michigan 1040 Form involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation, including W-2 forms, 1099s, and other income statements. Next, fill out the form by entering personal information, such as your name, address, and Social Security number. Then, report your income and any deductions or credits you may qualify for. Finally, review the completed form for accuracy before submitting it either online or via mail.

Legal use of the Michigan 1040 Form

The Michigan 1040 Form is legally recognized for filing state income taxes, provided it is completed accurately and submitted by the deadline. To ensure its legal validity, taxpayers must adhere to the regulations set forth by the Michigan Department of Treasury. This includes providing truthful information and maintaining records of all submitted documents. Failure to comply with these legal requirements may result in penalties or audits.

Filing Deadlines / Important Dates

Filing deadlines for the Michigan 1040 Form typically align with federal tax deadlines. Generally, the form must be submitted by April 15 of each year for the previous tax year. If the deadline falls on a weekend or holiday, it is extended to the next business day. Taxpayers should also be aware of any extensions they may file, which can provide additional time to submit their forms, but must still pay any taxes owed by the original deadline to avoid penalties.

Required Documents

To accurately complete the Michigan 1040 Form, several documents are required. These include, but are not limited to:

- W-2 forms from employers

- 1099 forms for other income sources

- Records of any deductions or credits claimed

- Proof of residency in Michigan

- Any prior year tax returns, if applicable

Having these documents on hand will facilitate a smoother filing process and help ensure that all income and deductions are accurately reported.

Quick guide on how to complete mi 1040 2017 2019 form

Effortlessly Prepare Michigan 1040 Form on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-conscious substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents rapidly without any holdups. Manage Michigan 1040 Form on any device with the airSlate SignNow applications available for Android and iOS, and enhance any document-centric workflow today.

How to Modify and eSign Michigan 1040 Form without Difficulties

- Find Michigan 1040 Form then click Get Form to commence.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills your document management needs with just a few clicks from any device of your choice. Modify and eSign Michigan 1040 Form and guarantee excellent communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct mi 1040 2017 2019 form

Create this form in 5 minutes!

How to create an eSignature for the mi 1040 2017 2019 form

How to generate an eSignature for your Mi 1040 2017 2019 Form online

How to generate an electronic signature for your Mi 1040 2017 2019 Form in Chrome

How to make an eSignature for signing the Mi 1040 2017 2019 Form in Gmail

How to generate an electronic signature for the Mi 1040 2017 2019 Form from your smart phone

How to make an electronic signature for the Mi 1040 2017 2019 Form on iOS devices

How to make an electronic signature for the Mi 1040 2017 2019 Form on Android

People also ask

-

What are printable Michigan tax forms available through airSlate SignNow?

Printable Michigan tax forms through airSlate SignNow include all necessary state tax documents, such as individual income tax returns, business tax forms, and various schedules. These forms can be easily accessed, filled out, and printed from our platform, ensuring that you have everything you need for tax season.

-

How can I access printable Michigan tax forms using airSlate SignNow?

To access printable Michigan tax forms, simply sign up for an airSlate SignNow account. Once logged in, you can navigate to the tax forms section to find and download the required forms in a printable format, ready for your needs.

-

Are there any costs associated with obtaining printable Michigan tax forms via airSlate SignNow?

AirSlate SignNow offers a cost-effective solution with various pricing plans. Basic access to printable Michigan tax forms is included in your subscription, allowing you to save money on paperwork while still complying with state filing requirements.

-

Can I electronically sign printable Michigan tax forms on airSlate SignNow?

Yes, airSlate SignNow enables users to electronically sign printable Michigan tax forms directly within the platform. This not only simplifies the signing process but also ensures that your documents are legally binding and secure.

-

What features do printable Michigan tax forms include on airSlate SignNow?

The printable Michigan tax forms on airSlate SignNow come equipped with an intuitive interface, form-filling capabilities, and eSigning features. Additionally, you can save your progress, allowing you to complete your forms at your convenience.

-

How can airSlate SignNow benefit my business in managing printable Michigan tax forms?

By using airSlate SignNow, your business can streamline its tax document management through easy access to printable Michigan tax forms. This efficiency can lead to quicker processing times, reduced errors, and a smoother overall tax preparation experience.

-

Is it possible to integrate other tools with airSlate SignNow while using printable Michigan tax forms?

Absolutely! AirSlate SignNow offers integrations with various tools and platforms, helping you manage your workflow while dealing with printable Michigan tax forms. Whether it's accounting software or other business applications, our platform can seamlessly connect with your existing systems.

Get more for Michigan 1040 Form

- Tractor checklist template form

- Fishing smarts recording form regular sized text heinemann

- Printable running record sheet form

- Operator restraint system for new holland form

- Operator daily checks on telehandlers form

- Vanessas butterfly printable form

- How to surrender indian passport form

- Appointment confirmation form

Find out other Michigan 1040 Form

- eSign Oklahoma Doctors Arbitration Agreement Online

- eSign Oklahoma Doctors Forbearance Agreement Online

- eSign Oregon Doctors LLC Operating Agreement Mobile

- eSign Hawaii Education Claim Myself

- eSign Hawaii Education Claim Simple

- eSign Hawaii Education Contract Simple

- eSign Hawaii Education NDA Later

- How To eSign Hawaii Education NDA

- How Do I eSign Hawaii Education NDA

- eSign Hawaii Education Arbitration Agreement Fast

- eSign Minnesota Construction Purchase Order Template Safe

- Can I eSign South Dakota Doctors Contract

- eSign Mississippi Construction Rental Application Mobile

- How To eSign Missouri Construction Contract

- eSign Missouri Construction Rental Lease Agreement Easy

- How To eSign Washington Doctors Confidentiality Agreement

- Help Me With eSign Kansas Education LLC Operating Agreement

- Help Me With eSign West Virginia Doctors Lease Agreement Template

- eSign Wyoming Doctors Living Will Mobile

- eSign Wyoming Doctors Quitclaim Deed Free