4119, Statement of Michigan Income Tax Withheld for 2024-2026

Understanding the 2024 MI 1040 Tax Form

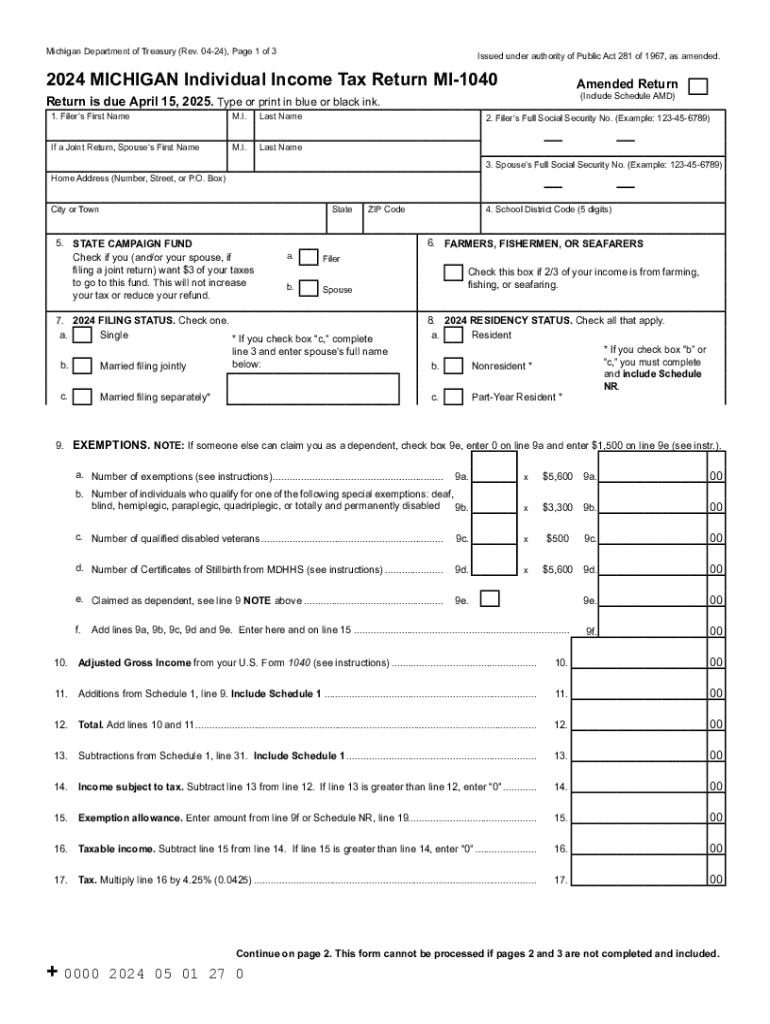

The 2024 MI 1040 is the Michigan Individual Income Tax form used by residents to report their income, calculate their tax liability, and determine any refunds or payments due. This form is essential for individuals earning income within the state, as it ensures compliance with Michigan tax laws. It is designed to capture various income sources, deductions, and credits applicable to Michigan taxpayers.

Key Elements of the 2024 MI 1040

The MI 1040 includes several critical sections that taxpayers must complete accurately. These sections typically encompass personal information, income details, adjustments, and tax calculations. Key elements include:

- Personal Information: Name, address, and Social Security number.

- Income Reporting: Wages, dividends, interest, and other income sources.

- Deductions and Credits: Standard or itemized deductions, along with any available tax credits.

- Tax Calculation: Total tax owed or refund due based on reported income and credits.

Steps to Complete the 2024 MI 1040

Filling out the MI 1040 involves several straightforward steps:

- Gather Required Documents: Collect W-2s, 1099s, and any other relevant income statements.

- Fill Out Personal Information: Enter your name, address, and Social Security number at the top of the form.

- Report Income: Complete the income section, listing all sources of income accurately.

- Claim Deductions and Credits: Identify and apply any deductions or credits for which you qualify.

- Calculate Tax Liability: Follow the instructions to compute your total tax owed or refund due.

- Sign and Date the Form: Ensure you sign the form before submitting it to validate your submission.

Filing Deadlines and Important Dates

Timely filing of the MI 1040 is crucial to avoid penalties. The standard deadline for submitting the 2024 MI 1040 is typically April 15, 2025. However, if this date falls on a weekend or holiday, the deadline may be adjusted. Taxpayers should also be aware of any extensions that may apply and the implications of late submissions.

Form Submission Methods

Taxpayers have multiple options for submitting the 2024 MI 1040. These methods include:

- Online Filing: Many taxpayers prefer electronic filing through tax software, which can streamline the process and reduce errors.

- Mail: Completed forms can be mailed to the appropriate Michigan Department of Treasury address.

- In-Person: Some individuals may choose to file in person at designated tax offices, especially for assistance with complex situations.

Eligibility Criteria for the 2024 MI 1040

To file the 2024 MI 1040, taxpayers must meet specific eligibility criteria. Generally, individuals who are residents of Michigan and have earned income during the tax year are required to file. Additionally, those who qualify for certain credits or deductions may also need to submit the form to claim their benefits. Understanding these criteria helps ensure compliance and maximizes potential refunds.

Create this form in 5 minutes or less

Find and fill out the correct 4119 statement of michigan income tax withheld for

Create this form in 5 minutes!

How to create an eSignature for the 4119 statement of michigan income tax withheld for

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2024 mi 1040 form and why is it important?

The 2024 mi 1040 form is the Michigan individual income tax return that residents must file to report their income and calculate their tax liability. It is important because it ensures compliance with state tax laws and helps individuals claim any eligible deductions or credits. Filing the 2024 mi 1040 accurately can also prevent penalties and interest on unpaid taxes.

-

How can airSlate SignNow help with the 2024 mi 1040 filing process?

airSlate SignNow streamlines the 2024 mi 1040 filing process by allowing users to easily send, sign, and manage their tax documents electronically. With its user-friendly interface, you can quickly gather signatures and ensure all necessary forms are completed accurately. This efficiency can save you time and reduce the stress associated with tax season.

-

What features does airSlate SignNow offer for managing the 2024 mi 1040?

airSlate SignNow offers features such as document templates, real-time tracking, and secure cloud storage, which are essential for managing the 2024 mi 1040. These features help users organize their tax documents and ensure they are readily accessible when needed. Additionally, the platform provides a seamless signing experience, making it easier to finalize your tax return.

-

Is airSlate SignNow cost-effective for filing the 2024 mi 1040?

Yes, airSlate SignNow is a cost-effective solution for filing the 2024 mi 1040, offering various pricing plans to suit different needs. By reducing the time spent on document management and eSigning, users can save money on administrative costs. The platform's affordability makes it an attractive option for both individuals and businesses.

-

Can I integrate airSlate SignNow with other tax software for the 2024 mi 1040?

Absolutely! airSlate SignNow can be integrated with various tax software solutions, enhancing your ability to manage the 2024 mi 1040 efficiently. This integration allows for seamless data transfer and ensures that all your tax documents are in one place. By using airSlate SignNow alongside your preferred tax software, you can simplify your filing process.

-

What are the benefits of using airSlate SignNow for the 2024 mi 1040?

Using airSlate SignNow for the 2024 mi 1040 offers numerous benefits, including enhanced security, ease of use, and faster turnaround times for document signing. The platform ensures that your sensitive tax information is protected while providing a straightforward way to manage your forms. These advantages can lead to a smoother and more efficient tax filing experience.

-

How does airSlate SignNow ensure the security of my 2024 mi 1040 documents?

airSlate SignNow prioritizes the security of your 2024 mi 1040 documents by employing advanced encryption and secure cloud storage. This means that your sensitive information is protected from unauthorized access. Additionally, the platform complies with industry standards to ensure that your data remains confidential throughout the signing process.

Get more for 4119, Statement Of Michigan Income Tax Withheld For

- Pllc notices and resolutions alaska form

- Sample transmittal letter alaska form

- New resident guide alaska form

- Satisfaction release or cancellation of deed of trust by corporation alaska form

- Alaska trust form

- Partial release of property from deed of trust for corporation alaska form

- Alaska partial 497295176 form

- Small claims handbook form

Find out other 4119, Statement Of Michigan Income Tax Withheld For

- How Do I Electronic signature Iowa Construction Document

- How Can I Electronic signature South Carolina Charity PDF

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT