Michigan Individual Income Tax Return MI 1040 2023

What is the Michigan Individual Income Tax Return MI 1040

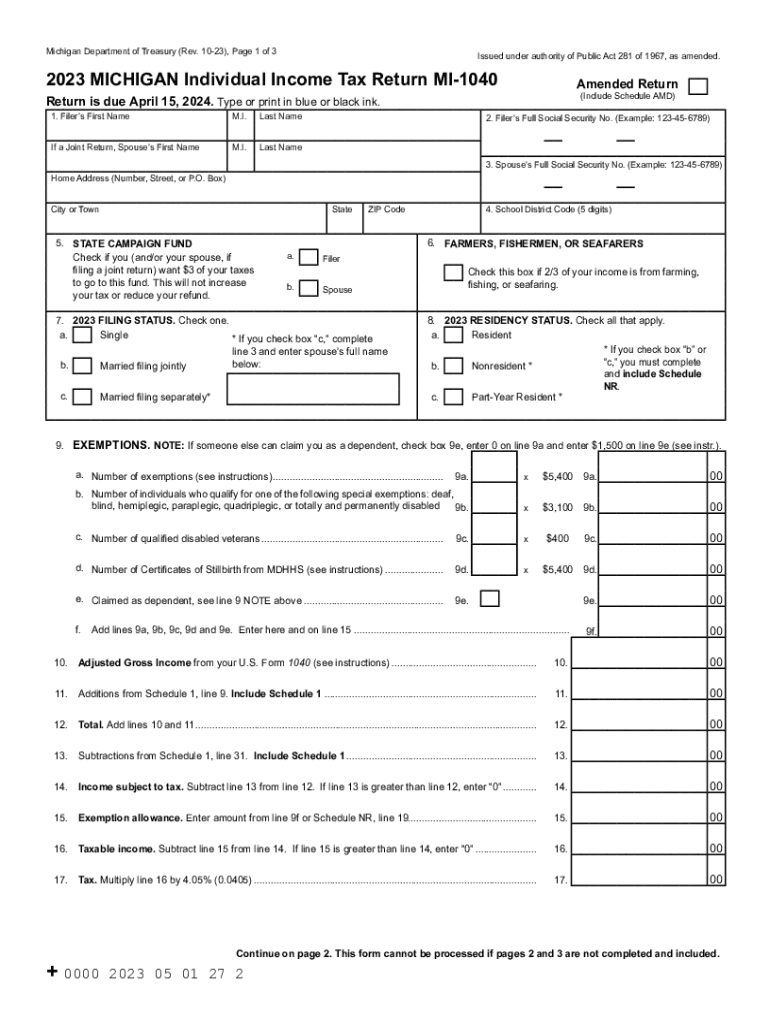

The Michigan Individual Income Tax Return, commonly referred to as MI 1040, is the official form used by residents of Michigan to report their annual income and calculate their state income tax liability. This form is essential for individuals and households to comply with state tax laws and fulfill their tax obligations. The MI 1040 includes sections for reporting various types of income, deductions, and credits that may apply to individual taxpayers. Understanding this form is crucial for accurate tax filing and ensuring compliance with Michigan's tax regulations.

Steps to Complete the Michigan Individual Income Tax Return MI 1040

Completing the MI 1040 involves several key steps to ensure accuracy and compliance. First, gather all necessary documents, including W-2 forms, 1099 forms, and any other income statements. Next, begin filling out the form by entering personal information, such as your name, address, and Social Security number. Then, report your total income, including wages, interest, and dividends. After calculating your total income, apply any deductions and credits you qualify for, which may reduce your taxable income. Finally, review all entries for accuracy before submitting the form either electronically or by mail.

Required Documents for the Michigan Individual Income Tax Return MI 1040

To successfully complete the MI 1040, certain documents are required. These typically include:

- W-2 forms from employers

- 1099 forms for other income sources

- Records of any deductions, such as mortgage interest or student loan interest

- Proof of tax credits, if applicable

- Any other documentation that supports income or deductions claimed

Having these documents ready will facilitate a smoother filing process and help ensure that all income and deductions are accurately reported.

Filing Deadlines / Important Dates for the Michigan Individual Income Tax Return MI 1040

Filing deadlines are critical for compliance with state tax regulations. For the 2024 tax year, the deadline to file the MI 1040 is typically April 15. However, if this date falls on a weekend or holiday, the deadline may be extended. It is important to stay informed about any changes in deadlines or extensions that may be announced by the Michigan Department of Treasury. Additionally, taxpayers should be aware of any specific dates for estimated tax payments, which are usually due quarterly.

Form Submission Methods for the Michigan Individual Income Tax Return MI 1040

Taxpayers have several options for submitting the MI 1040 form. The form can be filed electronically through approved e-filing software, which is often the quickest method and allows for faster processing. Alternatively, taxpayers may choose to print and mail their completed forms to the appropriate state tax office. In-person submissions are also possible at designated locations, although this option may vary by year and location. Each submission method has its own advantages, so it is important to choose the one that best fits your needs.

Key Elements of the Michigan Individual Income Tax Return MI 1040

The MI 1040 consists of several key elements that taxpayers must understand to complete the form accurately. These include personal information sections, income reporting lines, deduction and credit calculations, and signature areas. Additionally, the form may include schedules for reporting specific types of income or deductions, such as business income or capital gains. Familiarity with these elements helps ensure that all required information is provided and that the form is filled out correctly.

Quick guide on how to complete michigan individual income tax return mi 1040

Effortlessly Prepare Michigan Individual Income Tax Return MI 1040 on Any Device

Virtual document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed papers, allowing you to access the necessary form and securely save it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents swiftly without any delays. Handle Michigan Individual Income Tax Return MI 1040 on any device with the airSlate SignNow Android or iOS applications and simplify your document-based processes today.

The Easiest Way to Edit and eSign Michigan Individual Income Tax Return MI 1040 with Ease

- Locate Michigan Individual Income Tax Return MI 1040 and then select Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of your documents or obscure sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Generate your signature using the Sign tool, which takes only seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and then click the Done button to save your modifications.

- Decide how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form navigation, or mistakes that require printing new copies. airSlate SignNow manages all your document management needs in just a few clicks from any device you prefer. Update and eSign Michigan Individual Income Tax Return MI 1040 and ensure flawless communication at every step of the form creation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct michigan individual income tax return mi 1040

Create this form in 5 minutes!

How to create an eSignature for the michigan individual income tax return mi 1040

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 5092 Michigan 2024, and why is it important?

Form 5092 Michigan 2024 is a crucial document required for various administrative processes in Michigan. It helps businesses ensure compliance with state regulations and proper documentation. Understanding its requirements can streamline operations and prevent potential legal issues.

-

How can airSlate SignNow assist with completing Form 5092 Michigan 2024?

airSlate SignNow simplifies the process of completing Form 5092 Michigan 2024 by providing intuitive tools for document creation and eSigning. You can upload your form, fill it out, and get it signed securely. This saves time and enhances efficiency compared to traditional methods.

-

What are the pricing options available for using airSlate SignNow for Form 5092 Michigan 2024?

airSlate SignNow offers flexible pricing plans tailored to different business needs, starting with a free trial to test its features. For those specifically needing to manage Form 5092 Michigan 2024, affordable monthly subscriptions are available that include unlimited document signing and email support.

-

Is airSlate SignNow compliant with Michigan's regulations for Form 5092 Michigan 2024?

Yes, airSlate SignNow complies with Michigan's regulations regarding electronic signatures and document management. This ensures that your Form 5092 Michigan 2024 will be legally binding and valid. Using our platform adds a layer of security and compliance to your document handling.

-

What features does airSlate SignNow offer for managing Form 5092 Michigan 2024?

airSlate SignNow provides several robust features for managing Form 5092 Michigan 2024, including customizable templates, bulk sending options, and real-time tracking. These tools enhance collaboration and make it easy to manage multiple signatures efficiently. Users also benefit from integration capabilities to streamline their workflow.

-

Can I integrate airSlate SignNow with other software for further efficiency with Form 5092 Michigan 2024?

Absolutely! airSlate SignNow offers seamless integrations with numerous CRM and document management platforms. This connectivity allows businesses to automate processes related to Form 5092 Michigan 2024, reducing manual entry and increasing overall efficiency.

-

What are the benefits of using airSlate SignNow over other platforms for Form 5092 Michigan 2024?

airSlate SignNow stands out due to its user-friendly interface, affordability, and robust features dedicated to electronic signatures and document management. Unlike many other platforms, it specifically supports Form 5092 Michigan 2024, making it a tailored solution for businesses operating in Michigan.

Get more for Michigan Individual Income Tax Return MI 1040

- Oregon dmv order your own record form

- Dmv state driver refund form

- 735 387 application for tow or recovery vehicle business certificate form

- 150 101 157 form or soa rev

- Fillable order your own record x form

- 735 6776 farm endorsement application form

- Form 735 7266 state of oregon

- Meur reports oregon form

Find out other Michigan Individual Income Tax Return MI 1040

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple

- eSignature Montana Direct Deposit Enrollment Form Easy

- How To Electronic signature Nevada Acknowledgement Letter

- Electronic signature New Jersey Acknowledgement Letter Free

- Can I eSignature Oregon Direct Deposit Enrollment Form

- Electronic signature Colorado Attorney Approval Later

- How To Electronic signature Alabama Unlimited Power of Attorney

- Electronic signature Arizona Unlimited Power of Attorney Easy

- Can I Electronic signature California Retainer Agreement Template

- How Can I Electronic signature Missouri Unlimited Power of Attorney

- Electronic signature Montana Unlimited Power of Attorney Secure

- Electronic signature Missouri Unlimited Power of Attorney Fast

- Electronic signature Ohio Unlimited Power of Attorney Easy

- How Can I Electronic signature Oklahoma Unlimited Power of Attorney