Mi 1040 Form 2016

What is the Mi 1040 Form

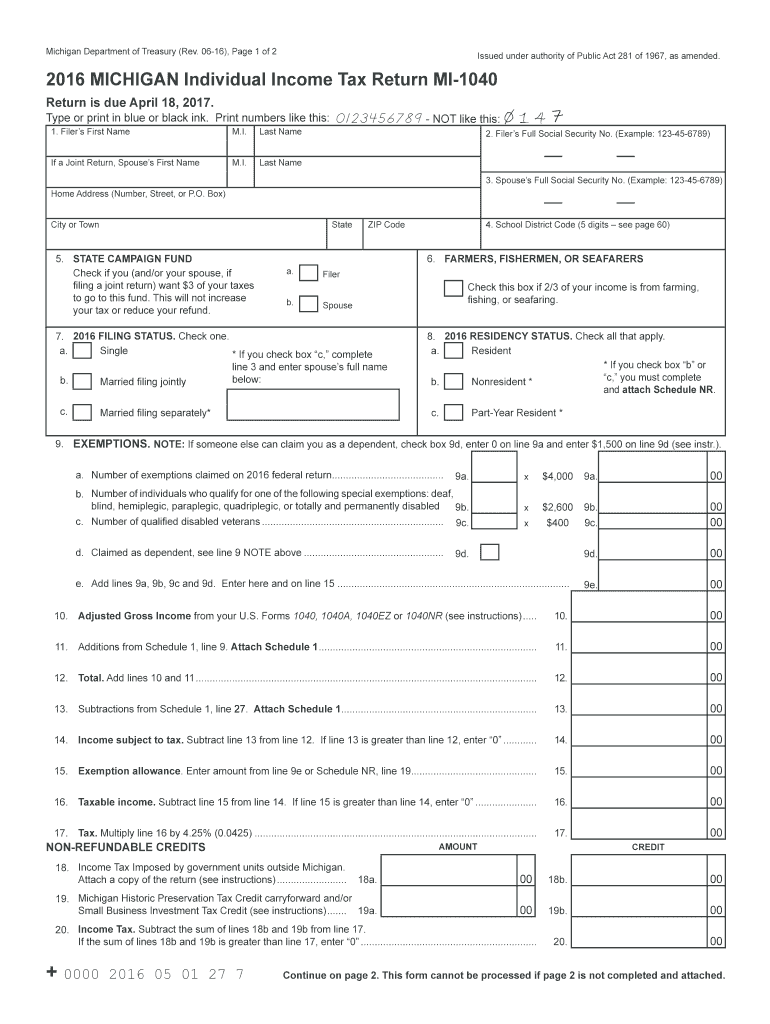

The Mi 1040 Form is a state-specific income tax return used by residents of Michigan to report their income and calculate their state tax liability. This form is essential for individuals and families who earn income in Michigan, allowing them to comply with state tax regulations. The Mi 1040 Form captures various sources of income, deductions, and credits, ensuring taxpayers pay the correct amount of tax owed to the state.

Steps to complete the Mi 1040 Form

Completing the Mi 1040 Form involves several key steps to ensure accuracy and compliance. First, gather all necessary documents, such as W-2s, 1099s, and any receipts for deductions. Next, fill out personal information, including your name, address, and Social Security number. Then, report your total income, followed by any adjustments or deductions you qualify for. After calculating your tax liability, review the form for any errors before signing and dating it. Finally, submit the completed form to the Michigan Department of Treasury by the specified deadline.

Legal use of the Mi 1040 Form

The Mi 1040 Form is legally binding and must be completed accurately to reflect your financial situation. Misrepresentation or failure to file can lead to penalties or legal repercussions. It is crucial to understand the legal requirements surrounding the form, including the need for proper signatures and the implications of electronic filing. Compliance with state tax laws ensures that taxpayers fulfill their obligations and avoid potential audits or fines.

Filing Deadlines / Important Dates

Filing deadlines for the Mi 1040 Form typically align with federal tax deadlines, which are usually April 15 each year. However, it is essential to check for any specific extensions or changes that may apply. Taxpayers should also be aware of deadlines for estimated tax payments if applicable. Staying informed about these dates helps individuals avoid late fees and ensures timely compliance with state tax obligations.

Required Documents

To complete the Mi 1040 Form accurately, certain documents are required. Taxpayers should gather their W-2 forms from employers, 1099 forms for other income sources, and documentation for any deductions or credits claimed. This may include receipts for medical expenses, property tax statements, and proof of charitable contributions. Having these documents ready simplifies the process and reduces the likelihood of errors.

Form Submission Methods (Online / Mail / In-Person)

The Mi 1040 Form can be submitted through various methods, providing flexibility for taxpayers. Individuals may file online using approved e-filing services, which often streamline the process and provide immediate confirmation of submission. Alternatively, the form can be mailed to the Michigan Department of Treasury, ensuring it is postmarked by the filing deadline. For those who prefer a personal touch, in-person submission at designated tax offices is also an option.

Examples of using the Mi 1040 Form

There are numerous scenarios in which taxpayers utilize the Mi 1040 Form. For instance, individuals with full-time employment will report their wages and any applicable deductions. Self-employed individuals may use the form to report business income and expenses. Additionally, retirees may need to report pension income and Social Security benefits. Each situation requires careful attention to detail to ensure the form accurately reflects the taxpayer's financial circumstances.

Quick guide on how to complete mi 1040 2016 form

Complete Mi 1040 Form effortlessly on any device

Managing documents online has gained popularity among organizations and individuals. It offers a perfect eco-friendly option compared to conventional printed and signed paperwork, as you can locate the necessary form and securely archive it online. airSlate SignNow provides you with all the resources you require to create, modify, and eSign your documents swiftly without delays. Handle Mi 1040 Form on any platform with airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to modify and eSign Mi 1040 Form easily

- Locate Mi 1040 Form and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight important sections of the documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign feature, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you want to send your form, whether by email, SMS, invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow fulfills your needs in document management in just a few clicks from any device of your choice. Edit and eSign Mi 1040 Form and ensure exceptional communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct mi 1040 2016 form

Create this form in 5 minutes!

How to create an eSignature for the mi 1040 2016 form

How to generate an electronic signature for your Mi 1040 2016 Form online

How to make an eSignature for the Mi 1040 2016 Form in Chrome

How to generate an electronic signature for putting it on the Mi 1040 2016 Form in Gmail

How to make an eSignature for the Mi 1040 2016 Form right from your mobile device

How to generate an eSignature for the Mi 1040 2016 Form on iOS

How to create an eSignature for the Mi 1040 2016 Form on Android devices

People also ask

-

What is the Mi 1040 Form and why do I need it?

The Mi 1040 Form is the Michigan Individual Income Tax Return used by residents to report their income and calculate their tax liability. You need this form to ensure compliance with state tax laws and to accurately reflect your taxable income. Completing the Mi 1040 Form correctly can help you avoid penalties and ensure you receive any refund you may be entitled to.

-

How can airSlate SignNow help me with my Mi 1040 Form?

airSlate SignNow provides a seamless solution for electronically signing and sending your Mi 1040 Form. With our easy-to-use platform, you can securely eSign your tax documents and share them with tax professionals or submit them directly to the state. This streamlines the filing process and enhances efficiency.

-

Is airSlate SignNow cost-effective for filing my Mi 1040 Form?

Yes, airSlate SignNow offers a cost-effective solution for managing your Mi 1040 Form. Our pricing plans are designed to fit various budgets, allowing individuals and businesses to access eSignature services without breaking the bank. With our affordable options, you can save time and money on document management.

-

What features does airSlate SignNow offer for the Mi 1040 Form?

airSlate SignNow includes features like customizable templates, a secure signing process, and document tracking for your Mi 1040 Form. These features enhance the user experience, ensuring that you can fill out and submit your tax forms efficiently. Additionally, you can integrate with other applications for a more streamlined workflow.

-

Can I integrate airSlate SignNow with tax preparation software for my Mi 1040 Form?

Absolutely! airSlate SignNow integrates seamlessly with popular tax preparation software, making it easy to manage your Mi 1040 Form alongside your other tax documents. This integration allows for a smooth workflow where you can eSign and send your forms directly from your preferred tax software.

-

What are the benefits of using airSlate SignNow for my Mi 1040 Form?

Using airSlate SignNow for your Mi 1040 Form brings numerous benefits, including enhanced security, ease of use, and time savings. You can securely send and receive signed documents, reducing the risk of errors and delays in filing your tax return. Plus, our platform simplifies the entire process, making tax season less stressful.

-

Is my information secure when using airSlate SignNow for the Mi 1040 Form?

Yes, your information is secure with airSlate SignNow when handling the Mi 1040 Form. We utilize industry-standard encryption and security protocols to protect your sensitive data throughout the signing process. You can trust that your personal and financial information remains confidential.

Get more for Mi 1040 Form

Find out other Mi 1040 Form

- Electronic signature Texas Lease Renewal Fast

- How Can I Electronic signature Colorado Notice of Intent to Vacate

- eSignature Delaware Employee Compliance Survey Later

- eSignature Kansas Employee Compliance Survey Myself

- Can I Electronic signature Colorado Bill of Sale Immovable Property

- How Can I Electronic signature West Virginia Vacation Rental Short Term Lease Agreement

- How Do I Electronic signature New Hampshire Bill of Sale Immovable Property

- Electronic signature North Dakota Bill of Sale Immovable Property Myself

- Can I Electronic signature Oregon Bill of Sale Immovable Property

- How To Electronic signature West Virginia Bill of Sale Immovable Property

- Electronic signature Delaware Equipment Sales Agreement Fast

- Help Me With Electronic signature Louisiana Assignment of Mortgage

- Can I Electronic signature Minnesota Assignment of Mortgage

- Electronic signature West Virginia Sales Receipt Template Free

- Electronic signature Colorado Sales Invoice Template Computer

- Electronic signature New Hampshire Sales Invoice Template Computer

- Electronic signature Tennessee Introduction Letter Free

- How To eSignature Michigan Disclosure Notice

- How To Electronic signature Ohio Product Defect Notice

- Electronic signature California Customer Complaint Form Online